Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Should we fear bearish engulfing patterns on the S&P 500?

Fundstrat: " $SPX and equities are overbought. So a bit of consolidation is expected. But we believe the risk/reward for stocks remains favorable. And we think stocks will likely be higher 2 weeks from now." Source: Seth Golden @SethCL

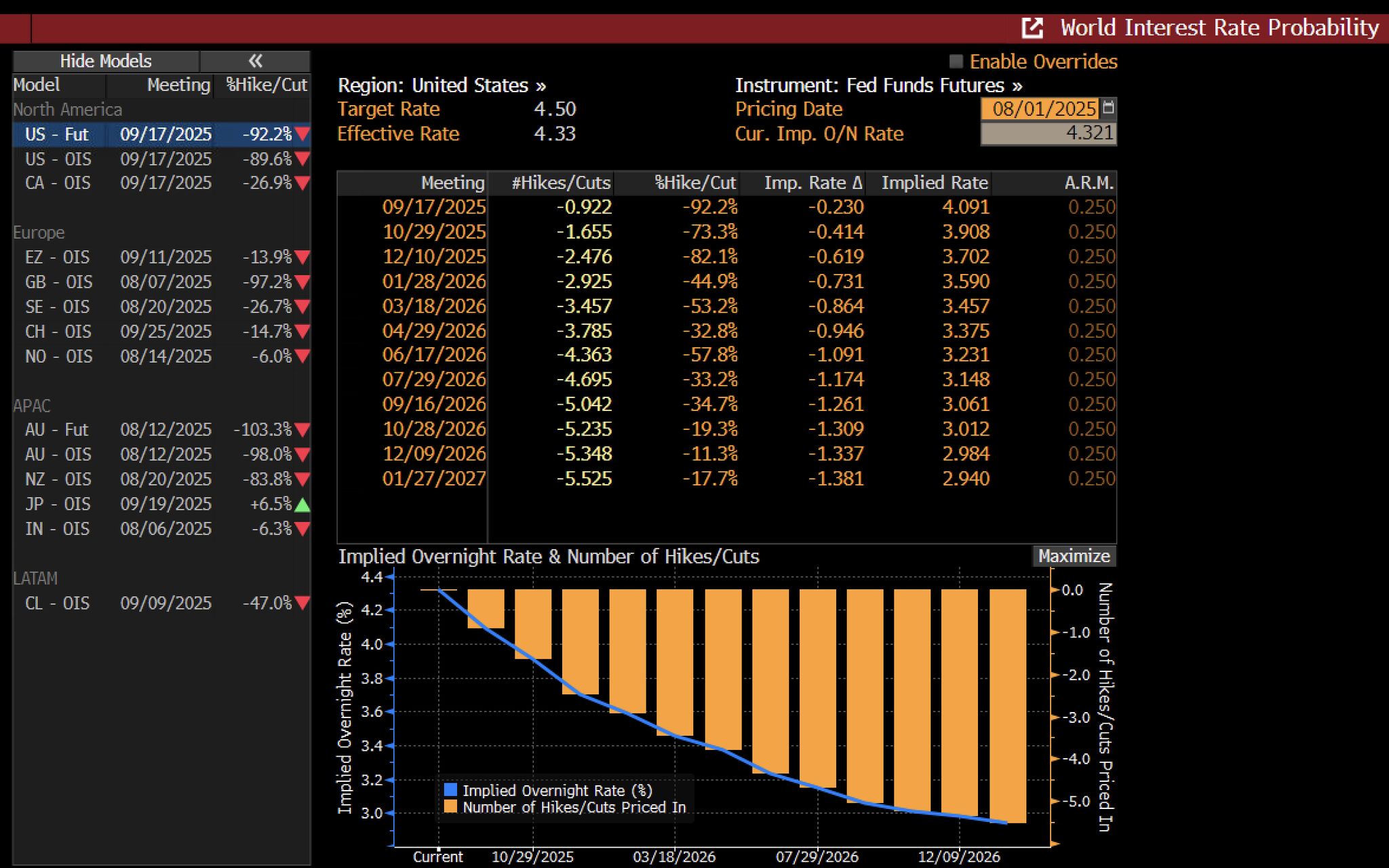

Market expectations for Fed rate cuts have shifted sharply lower after weaker-than-expected US jobs data.

Investors are now pricing in 62bps of rate cuts for the rest of the year, up from ~35bps before the report. The probability of a rate cut at Sep17 meeting has jumped to 92%. Source: Holger Zschaepitz @Schuldensuehner

The german stockmarket’s brief comeback (as a percentage of world's market cap) appears to be over – at least for now.

The surge in US big tech stocks, the underperformance of German equities, and a weakening Euro have pushed Germany’s share of global stock market capitalization down to 2.2%, from 2.4% in May. Source: HolgerZ, Bloomberg

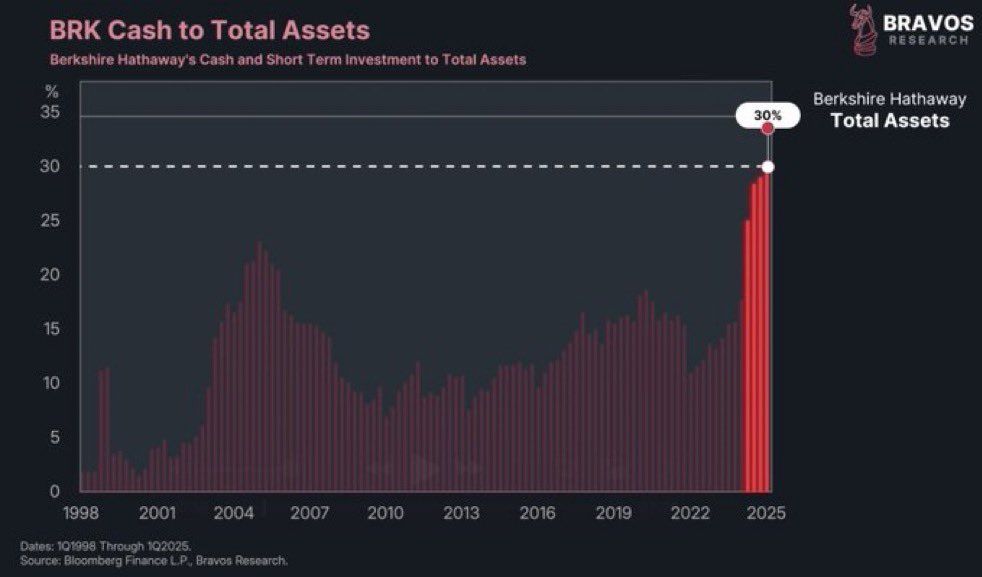

Berkshire Hathaway’s cash position is now 30% of their total assets, the most in history.

Source: Barchart

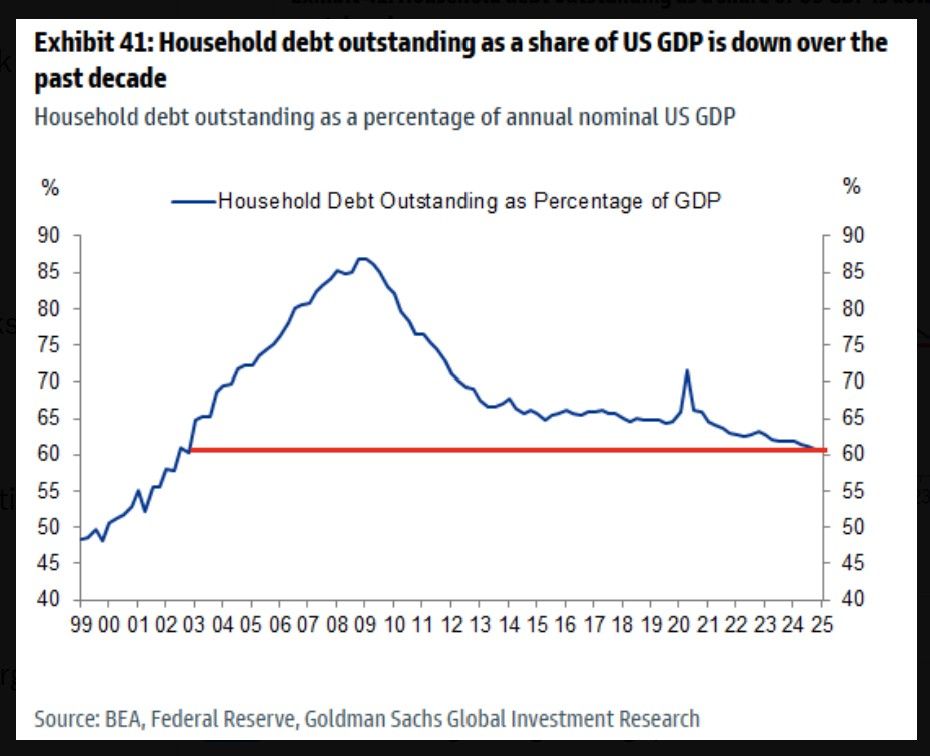

In the us, leverage is with the government, and less with companies and households.

Indeed, household debt outstanding as a share of US GDP is down over the past decade. Lowest since 2002. Source: BofA

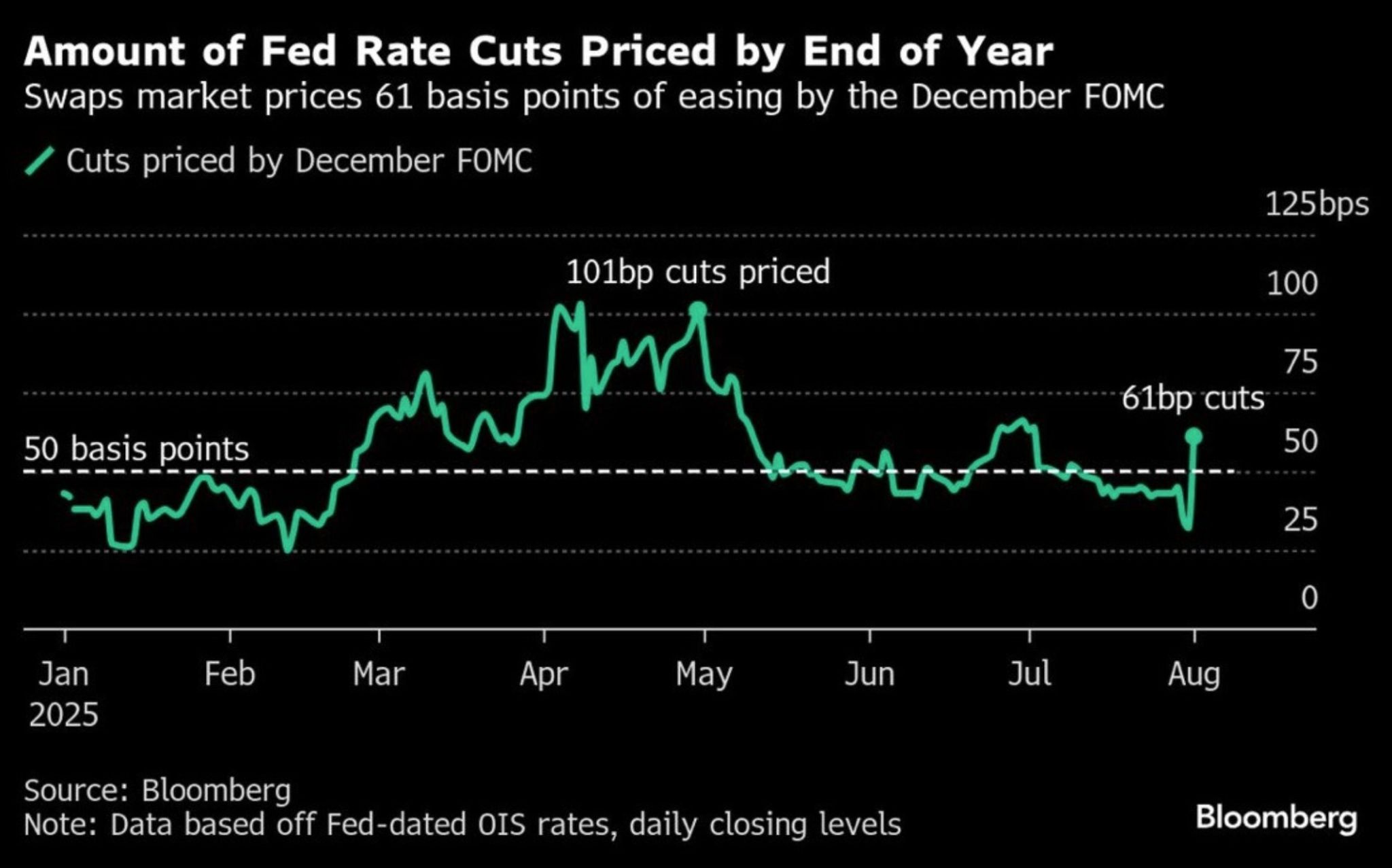

Market expectations for rate cuts this year have been quite volatile

We could gain more clarity on this at the upcoming Jackson Hole Symposium (August 21-23), or soon thereafter. Source: Bloomberg. Mo El Erian

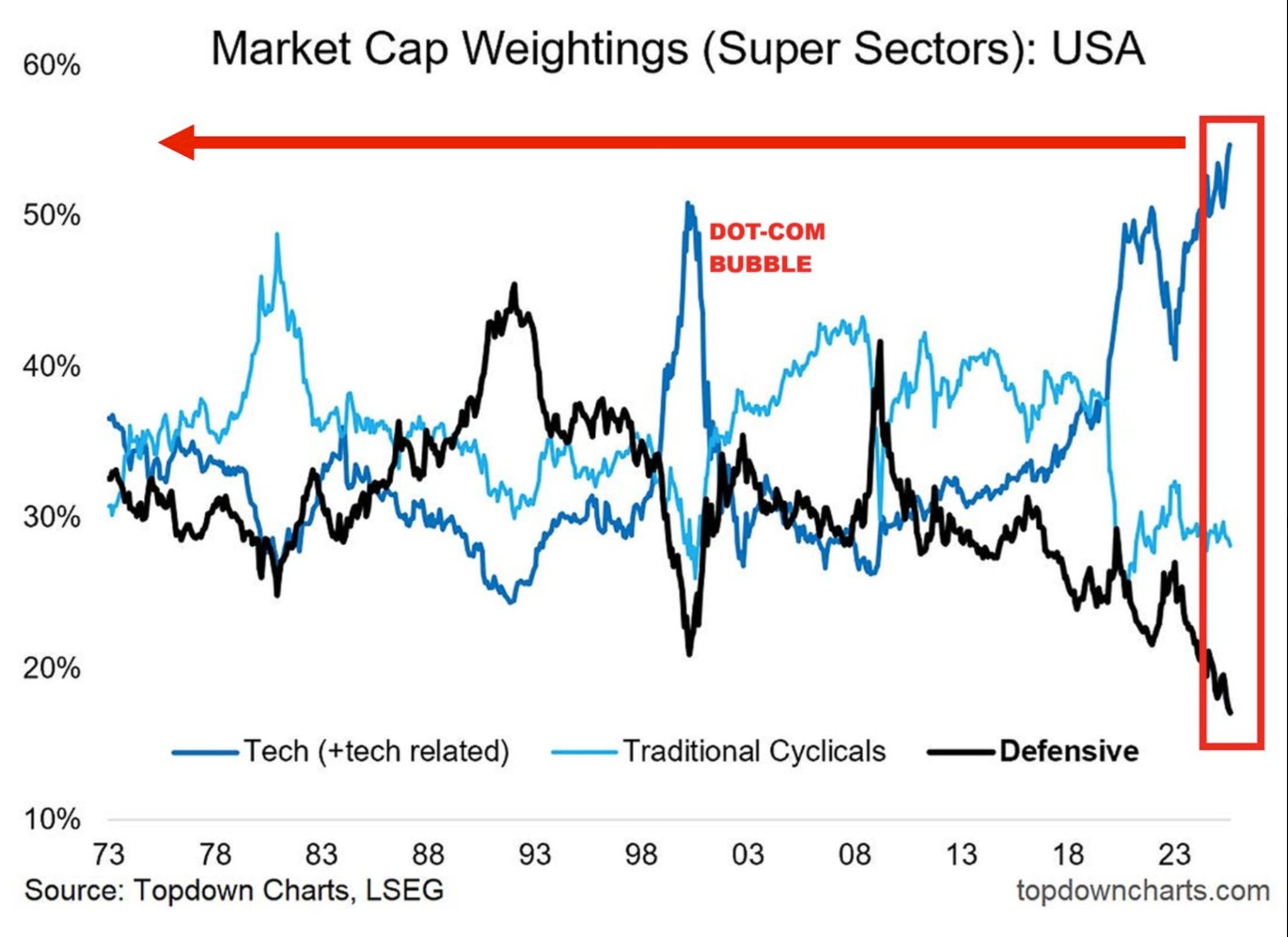

It is all about tech...

US technology and tech-related stocks now account for ~55% of the US stock market, the highest share EVER. It has exceeded the 2000 Dot-Com Bubble levels by ~5 percentage points. By comparison, defensive stocks now reflect ~18% of the market. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks