Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump has announced that India will be subjected to tariffs of 25% on imports to the US

Donald Trump has announced the US will levy 25 per cent tariffs on imports from India and also impose an unspecified penalty. In a post on his Truth Social platform on Wednesday, the US president said Indian tariffs were “among the highest in the World”, adding that New Delhi had “the most strenuous and obnoxious non-monetary Trade Barriers of any Country”. India had “always bought a vast majority of their military equipment from Russia” and was Moscow’s biggest purchaser of energy at a time when the Ukraine war was still raging, Trump said. “ALL THINGS NOT GOOD!” he wrote. “INDIA WILL THEREFORE BE PAYING A TARIFF OF 25%, PLUS A PENALTY FOR THE ABOVE, STARTING ON AUGUST FIRST.” The US president had said on Tuesday he would be imposing sanctions on Russia, including “secondary tariffs” on its energy customers, if Moscow did not halt the war in Ukraine within 10 days. Trump has also been pushing countries to boost purchases of US energy and military equipment. The EU said it would buy more American weapons as part of a trade deal with the US struck over the weekend. In a separate post on Wednesday, Trump added: “WE HAVE A MASSIVE TRADE DEFICIT WITH INDIA!!!” The US had a $45.7bn goods trade deficit with India in 2024.

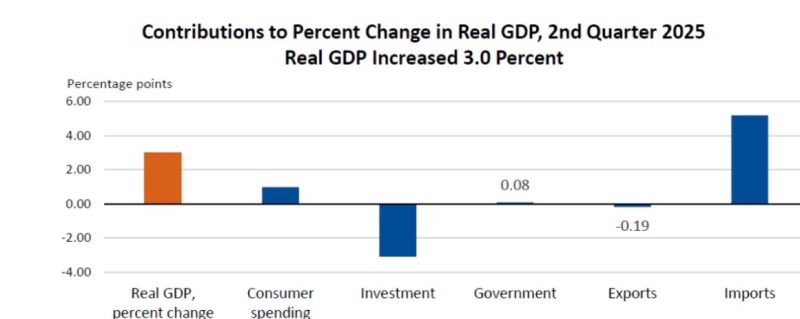

US real GDP beat expectations (+3.0pct vs. +2.3pct according to consensus) but “Growth” is misleading.

Q2 real GDP +3.0% was inflated by a +5.6% boost from COLLAPSING imports (a subtraction in GDP math). Real economy: Investment -2.1% Exports -0.19% Consumer spending only +0.8% So ‘real economy’ is not collapsing but looks soft Source: The Coastal Journal

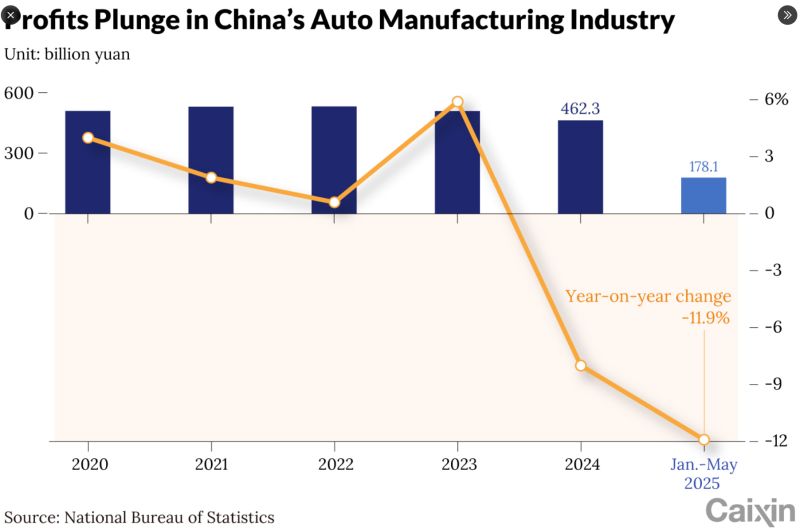

China's auto industryis a massive below-cost, state subsidized statecraft masking as trade

This is Beijing trying to put the world's auto producers out of business even as domestic carmakers teeter on the verge of collapse, but are propped up by state money. Source: zerohedge, Caixin

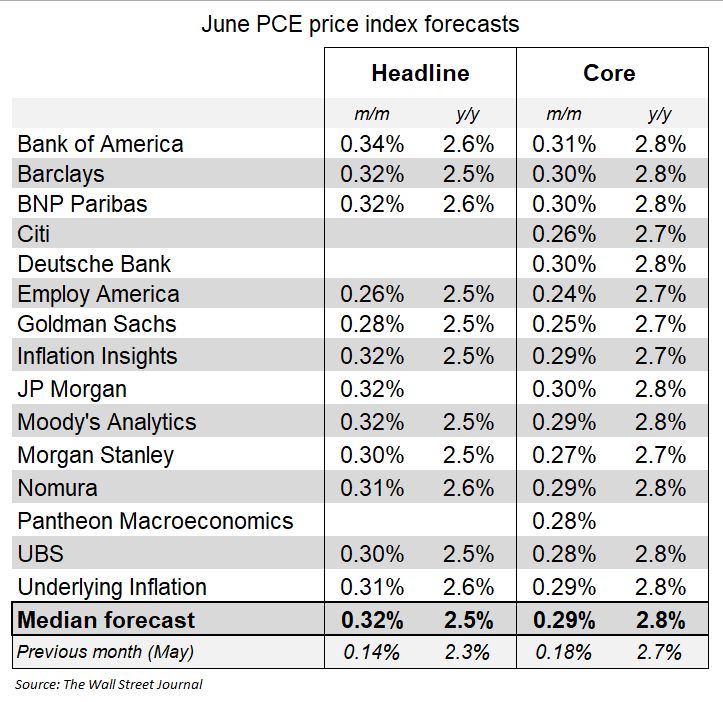

Economists who translate the CPI and PPI into the PCE expect monthly core inflation firmed in June. BEA reports this on Thursday.

Core PCE estimate: +0.29% (highest since February), which would push the year-over-year to 2.8% Headline PCE: +0.32% (y/y rises to 2.5%) Source: Nick Timiraos @NickTimiraos

Foreign Investors now own 18% of U.S. Equities, the most in history.

Source: barchart

U.S. Dollar Index $DXY now on a 4-day winning streak and is at its highest level in more than 1 month 📈📈

Source: barchart

Investing with intelligence

Our latest research, commentary and market outlooks