Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

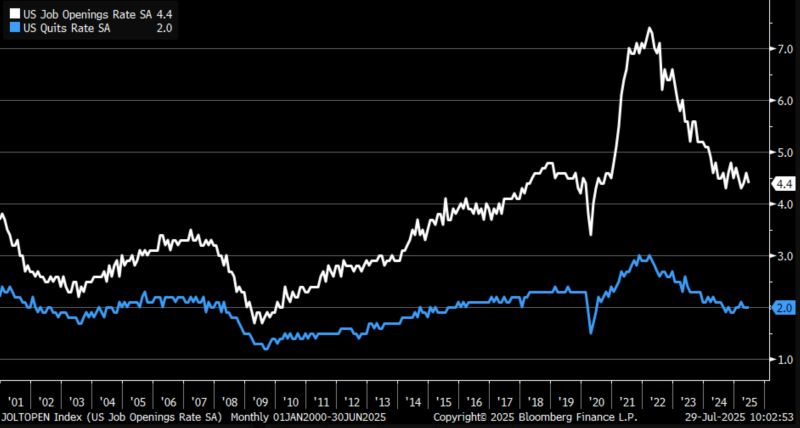

June JOLTS job openings rate (white) down to 4.4% vs. 4.6% prior ... quits rate (blue) unchanged at 2%

Source: Bloomberg, Kevin Gordon

The IMF has upgraded its global growth forecast amid signs that Donald Trump’s trade war will do less damage to the world economy than initially feared, helped by a weaker US dollar

Source: FT

It is hard to see gold and other store of values as a bad long-term investment with Money Supply exploding all across the world!

Source: Andrea Lisi

It's a race to the first major fib extension.

Who's tagging it first? $SPY | $QQQ

Europe is heading for the next humiliation. If Nvidia continues its triumphal march, the chip manufacturer could soon be worth more than the 50 largest comps in the Eurozone.

$NVDA hits a new all-time high yesterday. Nvidia is now valued at $4.3 Trillion Source: HolgerZ, Bloomberg

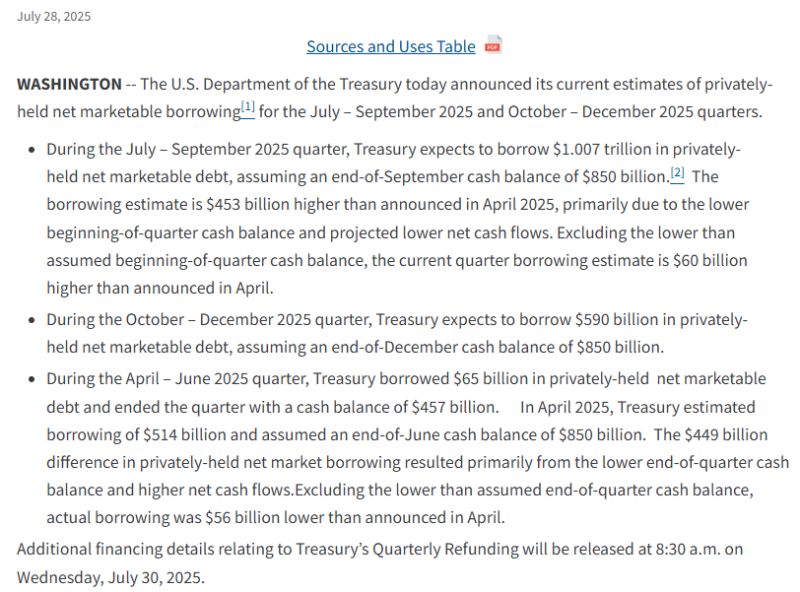

LIQUIDITY ALERT >>> The Treasury released their borrowing estimates.

$1.6T in net new debt issuance over the next two quarters. About $500B of it is the TGA refill. Source: Lyn Alden

The EU has admitted it doesn’t have the power to deliver on a promise to invest $600 billion in the United States economy, only hours after making the pledge at landmark trade talks in Scotland.

That’s because the cash would come entirely from private sector investment over which Brussels has no authority, two EU officials said The deal included a pledge to invest an extra $600 billion of EU money into the U.S. over the coming years. “It is not something that the EU as a public authority can guarantee. It is something which is based on the intentions of the private companies,” said one of the senior Commission officials. The Commission has not said it will introduce any incentives to ensure the private sector meets that $600 billion target, nor given a precise timeframe for the investment. However, the first official said that the $600 billion figure was "based on detailed discussions with different business associations and companies in order to see what their investment intentions are." Source: Politico

Investing with intelligence

Our latest research, commentary and market outlooks