Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

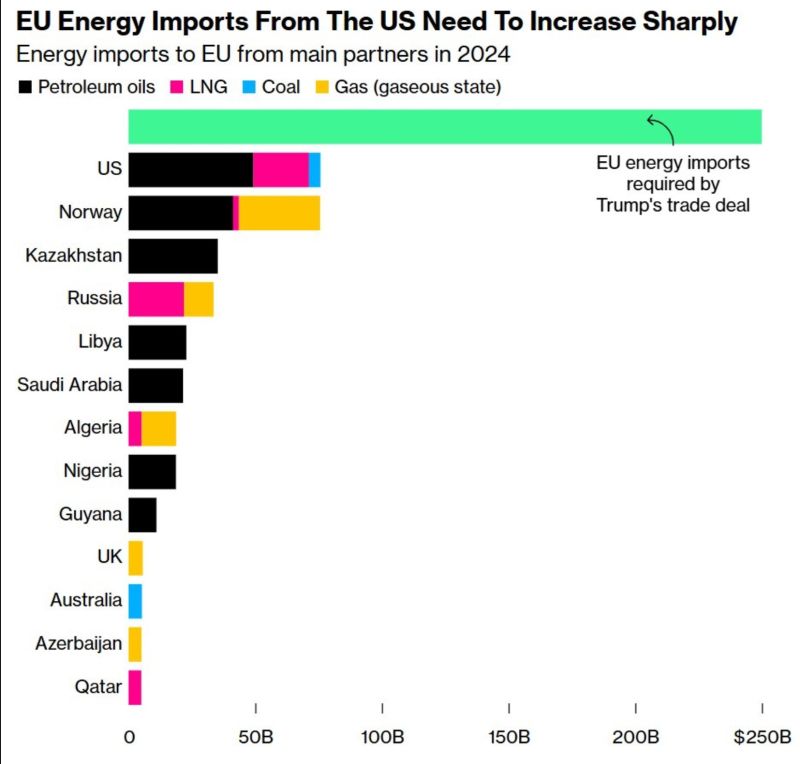

EU trade deal with Trump sparks backlash in Europe: The new trade agreement w/the US is drawing criticism across Europe.

German Chancellor Friedrich Merz said, "I'm not satisfied with this result in the sense of calling it 'good.' But considering where negotiations started with the US, achieving more just wasn't realistic." French Prime Minister François Bayrou went further, calling the EU’s acceptance of the deal a “dark day” and a sign of submission. The EU is the US’s largest trading partner, with a trade surplus of ~$250bn. Critics argue the asymmetrical deal reflects the true balance of power – and that a region which lags economically and relies on US security shouldn't be surprised when it's forced to make concessions. Source: Yahoo Finance, HolgerZ

From TACO (Trump Always Chickens Out) to WACO (World Always Chickens Out)

The world has "chickened out" against Trump, per FT. "America’s trading partners have largely failed to retaliate against Donald Trump’s sweeping tariffs, allowing a president taunted for “always chickening out” to raise nearly $50bn in extra customs revenues at little cost. Four months since Trump fired the opening salvo of his trade war, only China and Canada have dared to hit back at Washington imposing a minimum 10 per cent global tariff, 50 per cent levies on steel and aluminium, and 25 per cent on autos. At the same time US revenues from customs duties hit a record high of $64bn in the second quarter — $47bn more than over the same period last year, according to data published by the US Treasury on Friday".

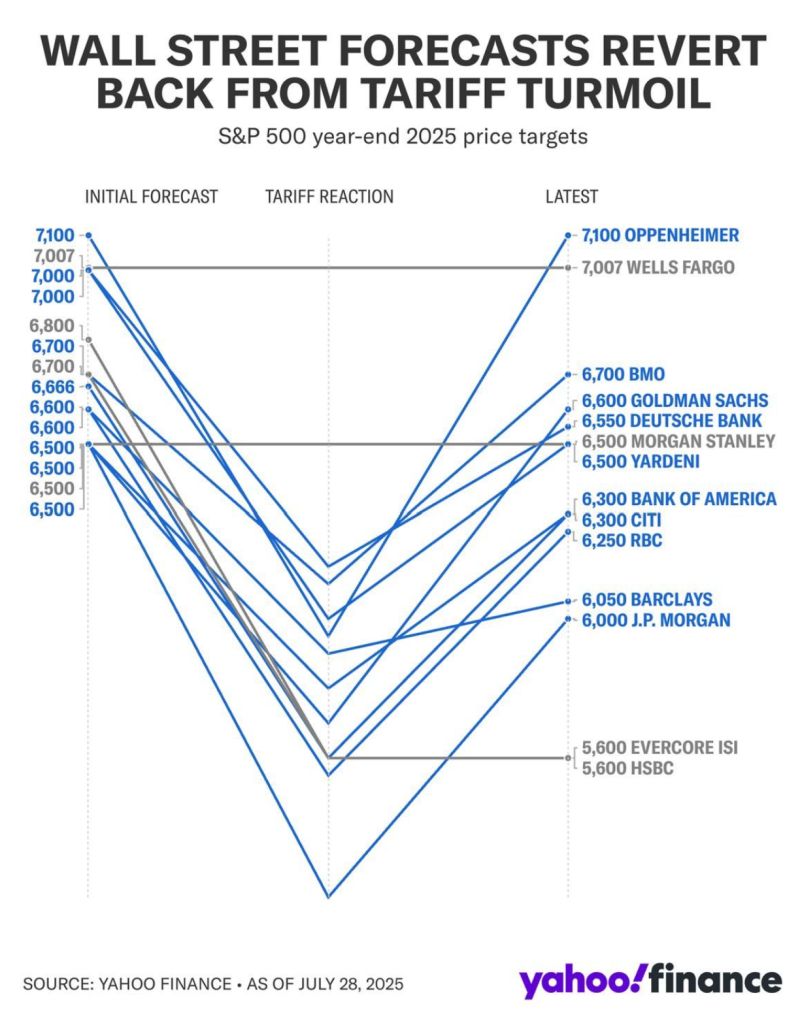

THIS IS WHY YOU NEVER FOLLOW WALL STREET PRICE TARGETS BLINDLY

Source: Gurgavin, Yahoo Finance

The Euro suffered its steepest one-day drop against the dollar since May on Monday, as Germany and France voiced fears that the long-awaited EU-US trade deal would hurt the European economy.

The single currency was down more than 1 per cent against the dollar and weakened by 0.8 per cent against the pound, following the announcement on Sunday that the US would impose 15 per cent tariffs on most imports from the EU. The agreement, hailed by European Commission president Ursula von der Leyen as “the biggest trade deal ever” and covering nearly 44 per cent of global GDP, averted a possible transatlantic trade war. But German chancellor Friedrich Merz said on Monday that the tariffs would cause “considerable damage” to his country’s economy, Europe and the US itself. “Not only will there be a higher inflation rate, but it will also affect transatlantic trade overall,” he said. “This result cannot satisfy us. But it was the best result achievable in a given situation.” French Prime Minister François Bayrou said the trade deal marked a “dark day”, adding that the EU had “resigned itself into submission”. Source: FT

‼️For many foreign nationals, a new visa fee will increase the cost of traveling to the United States by $250 ⚠️

➡️ The “visa integrity fee,” included in the sweeping policy legislation that President Donald Trump signed into law this month, will require visitors traveling on a non-immigrant visa to pay an additional $250. ➡️ This group includes leisure and business travelers as well as international students from a wide range of countries such as India, China, Mexico, Brazil, South Africa and the Philippines. ➡️ Applicants must pay this amount on top of other visa fees that often total nearly $200. The Department of Homeland Security can adjust the fee based on inflation, starting in October. The bill does not specify when the fee will go into effect. In a statement, DHS said the new law “provides the necessary policies and resources to restore integrity in our nation’s immigration system. The visa integrity fee requires cross-agency coordination before implementation.” Source: The Washington Post

Bitcoin $BTC price will go up if there are more buyers, says Citi - couldn't agree more...

"A bitcoin is worth what the next person will pay for it," the FT journalist, Bryce Elder, writes. "The same can be said of a lot of assets." Spot on! This is correct and accurate reporting indeed. And that's how investors need to think about markets, whether it's Bitcoin (BTC), shares of Apple (AAPL), or the direction of Gold.

The most important week of us earnings season is here.

Over 37% of $QQQ reports earnings this week. Enjoy the show 🍿 $MSFT | $AAPL | $AMZN | $META Source. BofA, Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks