Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

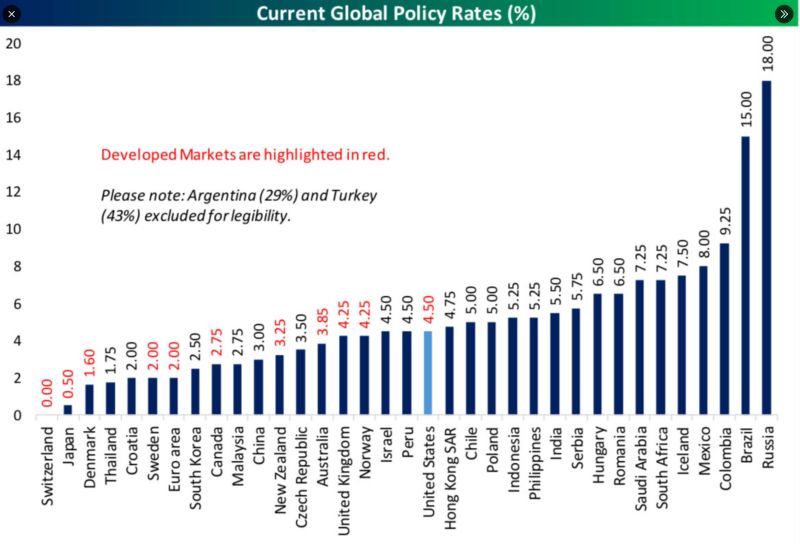

The US has the highest central bank rate of any developed market.

Here’s a detailed look at current global policy rates: Source: bespokeinvest

Retail investors are winning big this year – meme stocks are back.

The Goldman Sachs Meme Stock Index, which tracks some of the market’s most shorted names, is up 39% – a full 30 percentage points ahead of the S&P 500. Even the Goldman Sachs Retail Favorites Index, packed with stocks popular among small investors, has outperformed the broader market. Source: Bloomberg, HolgerZ

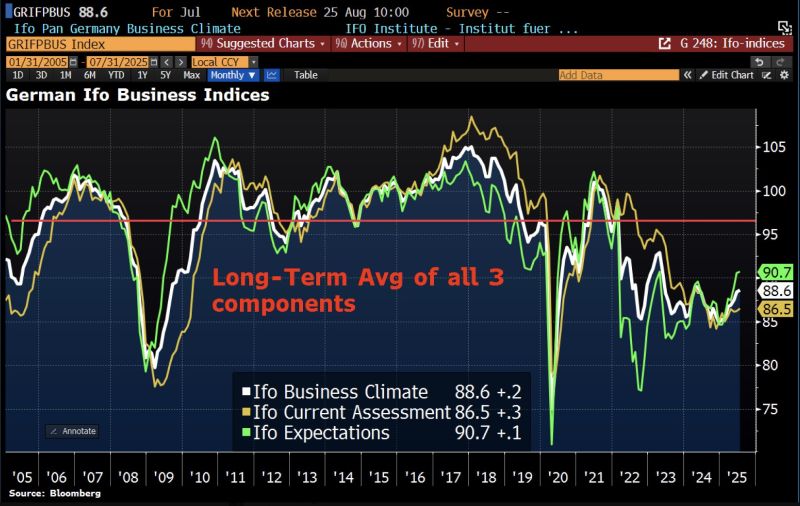

In Germany, the latest Ifo Business Climate Index suggests the economy is holding up surprisingly well despite rising tariffs.

The index edged up from 88.4 in June to 88.6 in July – slightly below expectations (89.0). This marks the 7th consecutive monthly improvement, this month driven mainly by better assessments of current business conditions. However, underlying growth remains weak. According to Capital Economics, the survey results remain consistent w/a GDP contraction based on long-term historical patterns. That said, the Ifo has not been a reliable predictor of GDP in recent years. Source: Bloomberg, HolgerZ

TRUMP HITS LOWEST APPROVAL OF SECOND TERM AT 37%

Six months in and the honeymoon's over. Independents crashed from 45% to 29% - that's the real story here. Republicans still at 89% (cult-like loyalty intact). Democrats at 2% (shocking absolutely nobody). The independent collapse matters most. They decide elections, and they're abandoning ship at record pace... Source: Gallup Poll, @AFpost thru Mario Nawfal

German business activity continued to grow marginally in July, though at a slightly slower pace than in June.

The German flash composite PMI fell to 50.3 points in July, down from 50.4 in June and below the 50.7 forecast in a Reuters poll. Source: Bloomberg, HolgerZ

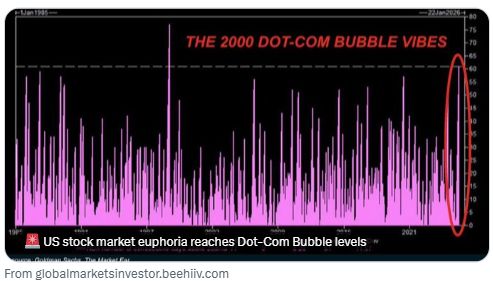

Us equities markets very EXTREMELY expensive: The Shiller P/E ratio on the S&P 500 is now at 38.8x, the highest since the 2000 Dot-Com Bubble burst.

The Shiller P/E ratio is higher than it has been 96% of the time in history. Source: Global Markets

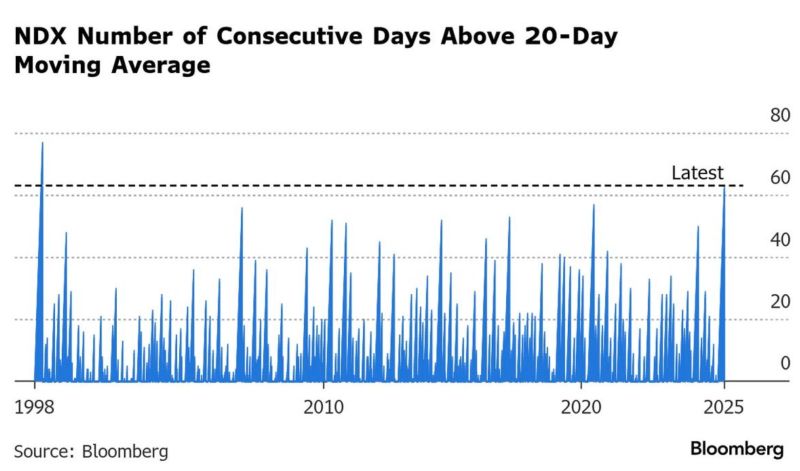

Nasdaq posted its 63rd consecutive day above its 20-day moving average, the longest streak since the dot com bubble.

Source: zerohedge, Bloomberg

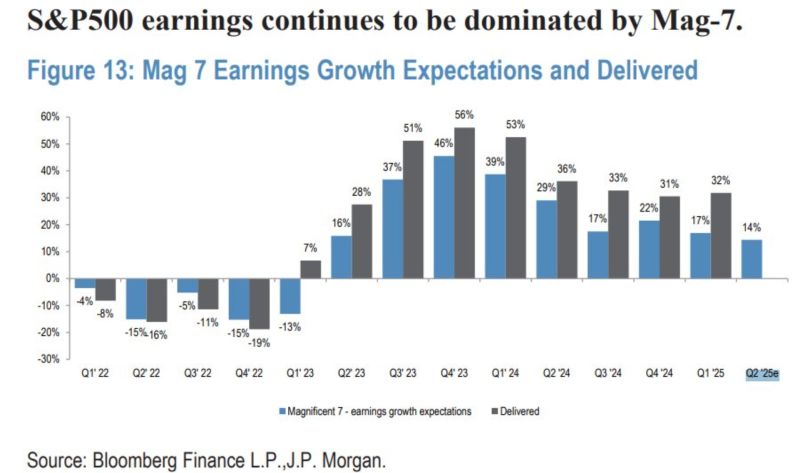

The Mag 7 has consistently blown the doors off EPS estimates

Mag 7 EPS growth is expected to hit 14% this quarter Source: Mike Zaccardi, CFA, CMT, MBA, JP Morgan, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks