Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

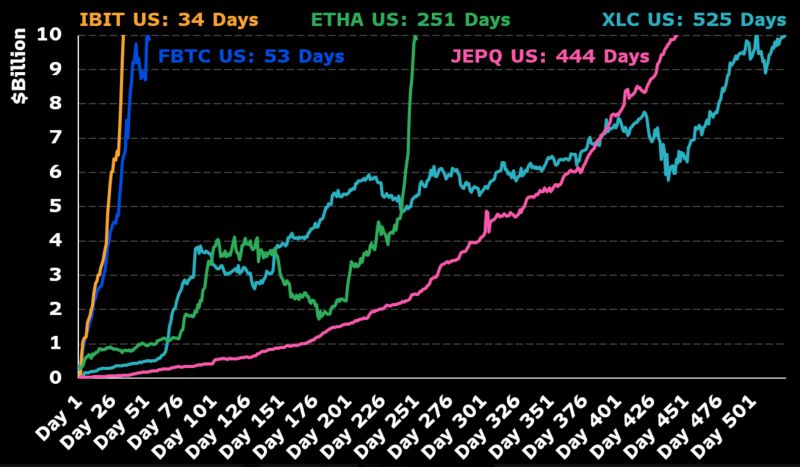

LOOK OUT: $ETHA iShares ethereum Trust ETF just hit $10b in one year flat, the 3rd fastest ETF to hit that mark in history after (you guessed it) two bitcoin ETFs $IBIT & $FBTC.

Amazingly it went from $5b to $10b in just 10 days. The ETF is Top 5 in flows for the last month and the week Source: Bloomberg, Eric Balchunas

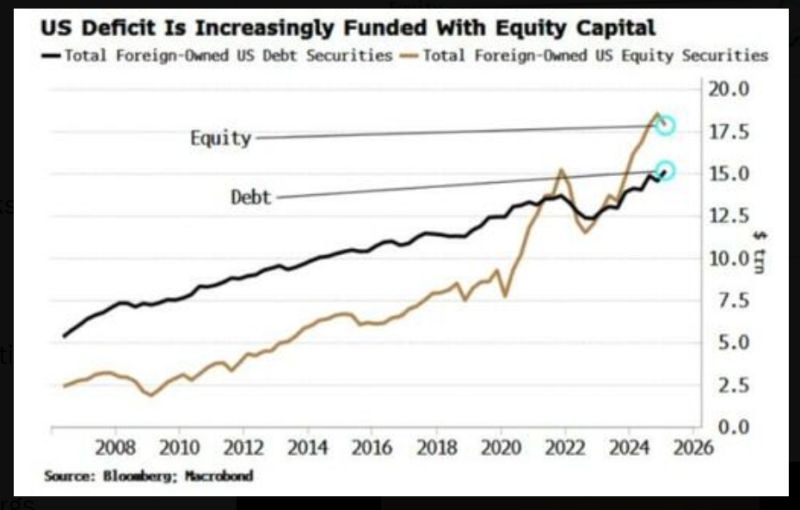

Foreign Investors now own $2.5 Trillion more in U.S. Stocks than U.S. Debt, the widest gap ever

Source. Barchart, BofA

BREAKING >>> Trump spars with Powell over renovation costs during Fed visit, but says not ‘necessary’ to fire chairman

Trump: It looks like it’s about $3.1 billion Powell: I’m not aware of that. Trump: It just came out Powell: You just added in a third building Trump: It’s a building that’s being built Powell: It was built five years ago. Source: @SpencerHakimian

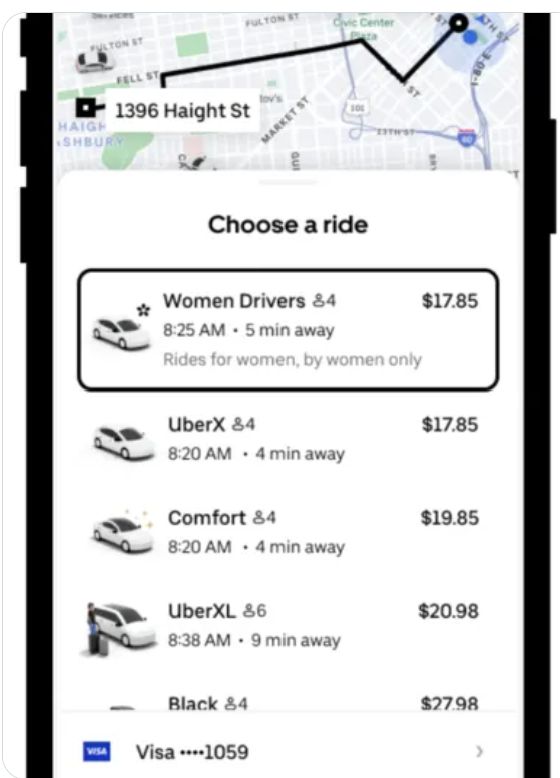

UBER TO LET WOMEN AVOID MALE DRIVERS IN NEW SAFETY PILOT

Starting next month, Uber will allow women drivers and riders to opt for same-gender pairings in Los Angeles, San Francisco, and Detroit. VP Camiel Irving: “It’s about giving women more choice, more control, and more comfort." The move follows similar tests in countries like France, Germany, and Argentina, and comes amid long-standing safety concerns on ride-hailing platforms. Source: CNBC thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks