Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

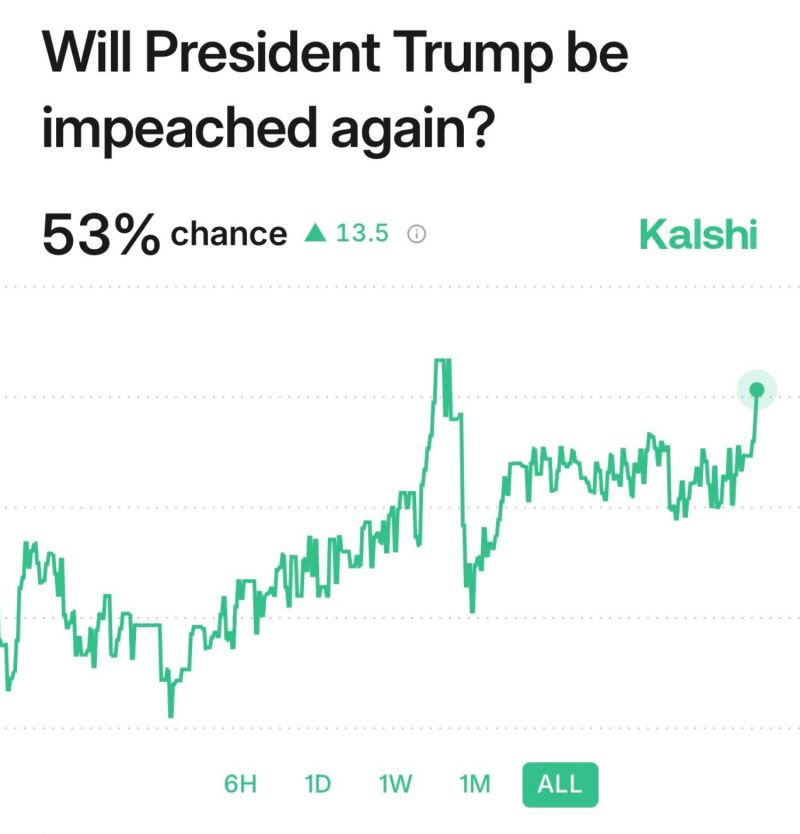

The betting odds of Trump getting impeached again are back to all time highs following the Epstein List news today.

According to the WSJ, The Justice Department told President Trump in May that his name is among many in the Epstein files. Source: Kalshi, SpencerHakimian

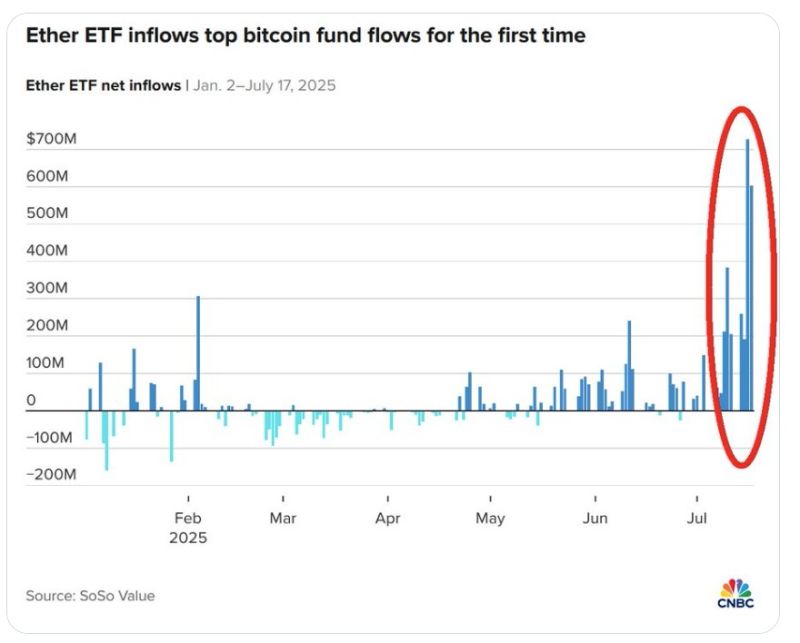

Ether ETFs saw $534 million in inflows on Tuesday, the 4th largest on record.

BlackRock alone bought $426 million. That’s now 13 straight days of inflows, totaling over $4 BILLION. Investors including Wall Street are going ALL IN on cryptos. Source: Global Markets Investor

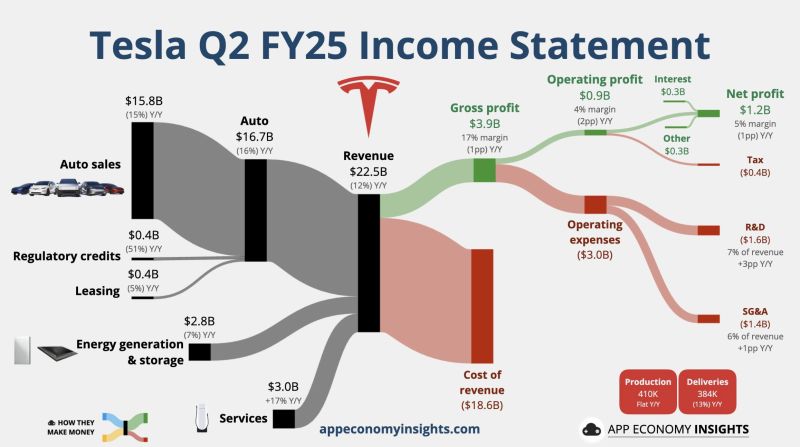

Tesla just posted a double miss for Q2:

~EPS: $0.40 vs $0.42 est ~REV: $22.50B vs $22.79B est Still, the stock $TSLA was up +1% in after-hours trading Here are the details: • Revenue -12% Y/Y to $22.5B ($0.4B beat). • Gross margin 17% (-1pp Y/Y). • Operating margin 4% (-2pp Y/Y). • Capex +5% Y/Y to $2.4B. • Free cash flow -89% Y/Y to $0.1B. • Non-GAAP EPS $0.40 (in-line). Source: App Economy Insights

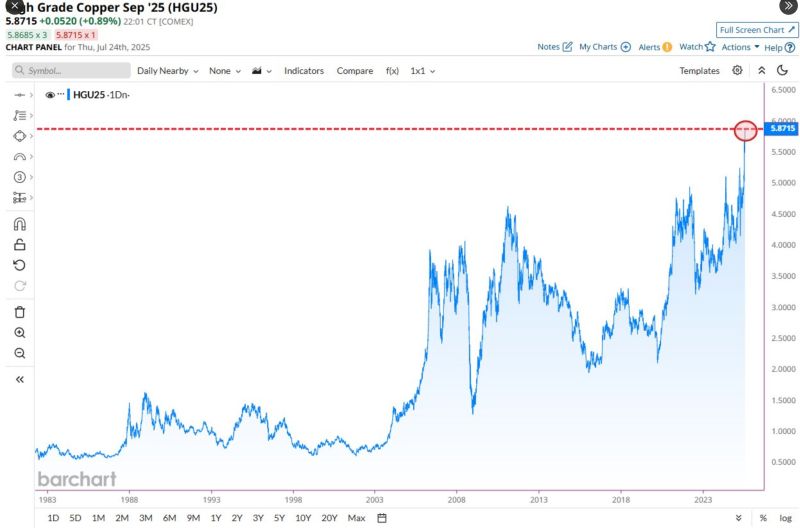

Copper soars to highest closing price in history 📈📈

Source: Barchart

The US president will spend about an hour at the central bank, as he looks to pressure its chair Jay Powell to cut interest rates more aggressively.

Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks