Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING >>>

U.S. President Donald Trump on Tuesday stateside announced that he had completed a “massive Deal” with Japan, that involves “reciprocal” tariffs of 15% on the country’s exports to the U.S. Nikkei 225 index is up more than 3pct on the news! In a post on Truth Social, Trump also said that Japan will invest $550 billion dollars into the United States, adding that the U.S. will “receive 90% of the Profits.” Trump also said that Japan will “open their Country to Trade including Cars and Trucks, Rice and certain other Agricultural Products, and other things.“ The U.S. president added that the deal would also create “Hundreds of Thousands of Jobs.” Source: CNBC

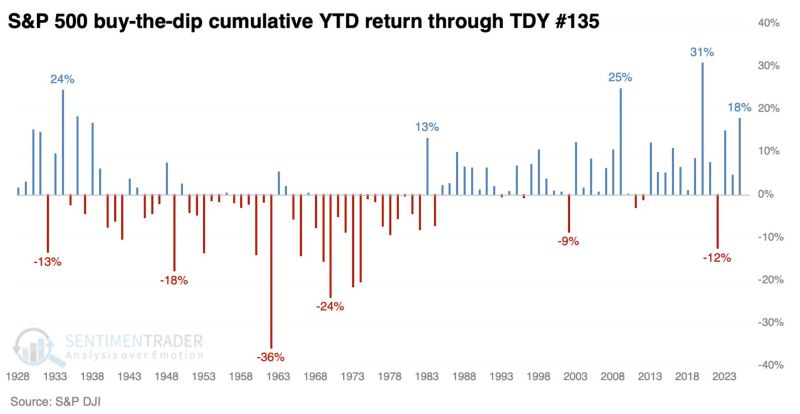

'Buy the Dip' mentality remains strong.

So far this year, the cumulative gain by buying a down day in the S&P 500 and holding it only for the next session is +18% ... tied for the fourth-highest since 1948 Source: Kevin Gordon @KevRGordon

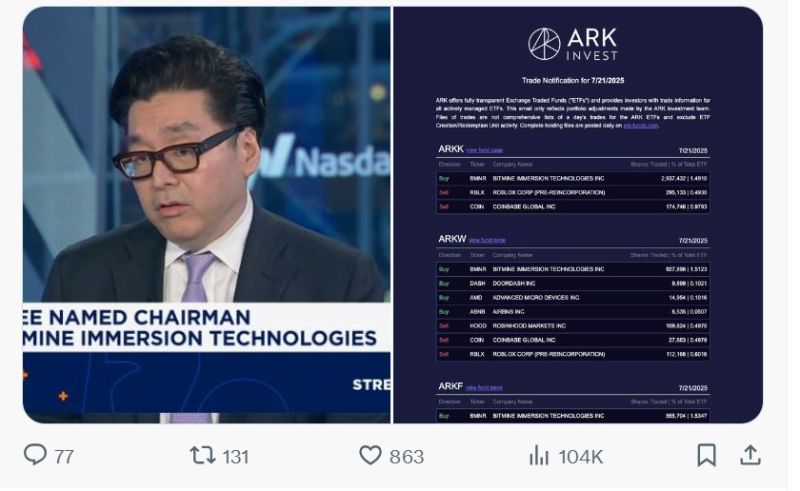

Cathie Wood and Ark Invest bought 4,421,034 shares of Tom Lee's new Ethereum Treasury Company $BMNR

Source: Evan

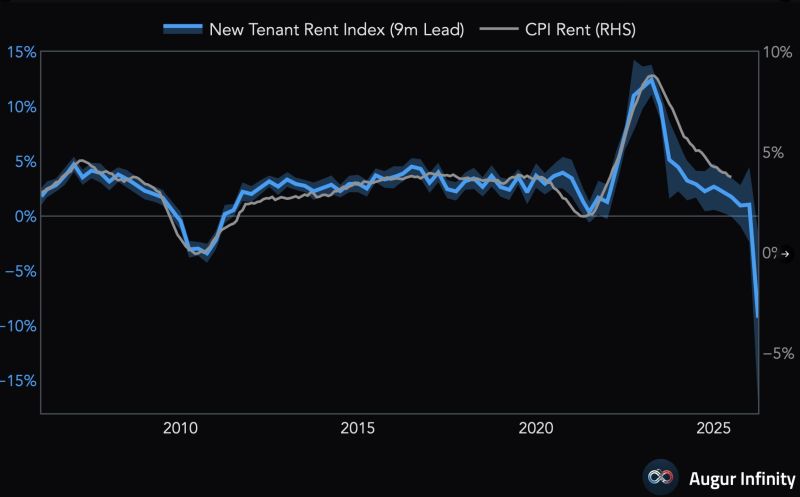

The New Tenant Rent Index, which leads CPI Rent, declined by an unprecedented -9.3% Y/Y in Q2 (with a confidence interval of -17.1% to -1.5%).

Caution should be applied when interpreting these numbers as the series tends to experience very large revisions. In fact, all the negative readings in prior releases were subsequently revised away. However, it is probable to assume that disinflation in shelter CPI, which is ~30% of the Core CPI bucket, will help offset rising inflation concerns as a result of tariffs ✅ Source: Augur Infinity, Bloomberg

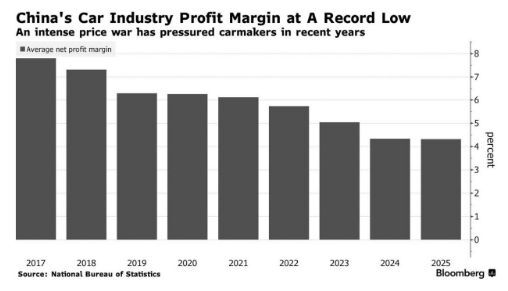

China's Car Industry Profit Margin has fallen to an all-time low

Source: Barchart

NVIDIA CEO: “I’D STUDY PHYSICS, NOT SOFTWARE” IF I WERE 20 TODAY Jensen says if he were graduating college in 2025, he’d skip coding bootcamps and major in physical sciences like physics or chemistry.

During a trip to Beijing on Wednesday, Huang was asked by a journalist: “If you are a 22-year-old version of Jensen [who] just graduated today in 2025 but with the same ambition, what would you focus on?” To that, the Nvidia CEO said: “For the young, 20-year-old Jensen, that’s graduated now, he probably would have chosen ... more of the physical sciences than the software sciences,” adding that he actually graduated two years early from college, at age 20. Why? Because the next frontier isn’t just chatbots - it’s hashtag#AI that understands gravity, inertia, friction, and cause and effect. He calls it Physical AI: robots that don’t just generate images or code, but grip, move, and predict real-world outcomes - like not crushing your coffee mug. “When you put that physical AI into a physical object called a robot, you get robotics." And yes, he said this in Beijing, while leading the first $4 trillion company in history. Source: CNBC thru Mario Nawfal on X

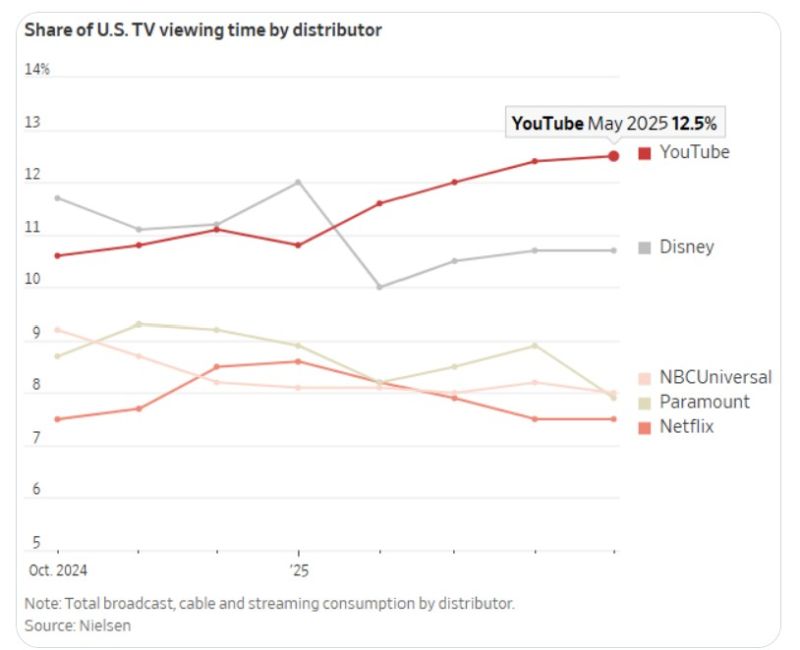

YouTube now owns 12.5% of all U.S. TV viewing time - more than any other distributor.

1B+ hours are watched daily on YouTube, surpassing Disney across broadcast, cable, and streaming. No studios. No soundstages. No scripts. Just total living room dominance. $GOOGL Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks