Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

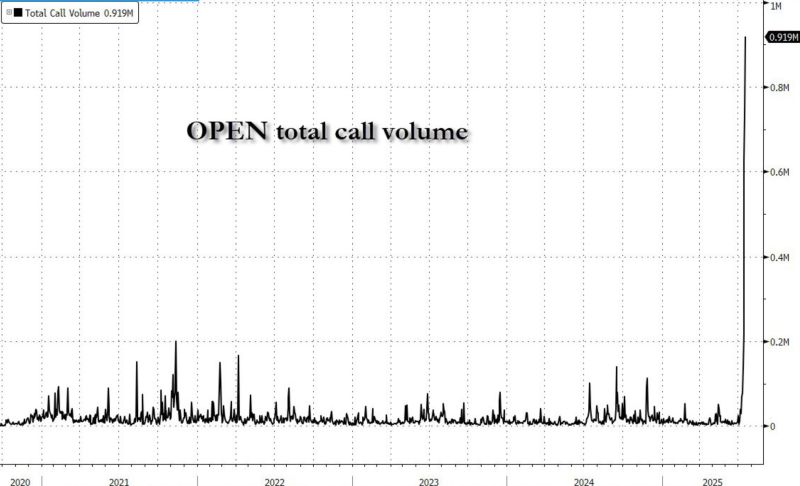

Opendoor is the market’s latest Meme Stock w/insane trading volumes.

Shares of the San Francisco-based tech group that focuses on the stagnant real estate sector have nearly tripled in value over the past week. The rally appears to have been sparked by a prominent investor discussing the stock on social media, which drew the attention of retail traders. The company has struggled since peaking at a $20.6bn valuation in February 2021, shortly after merging with the SPAC (special purpose acquisition company) Social Capital Hedosophia Holdings Corp II, led by Chamath Palihapitiya. That decline isn’t surprising: Opendoor’s core business is in the "instant buyer" market, where it aims to make home sales faster and bypass traditional realtor fees—an idea that has faced serious challenges in a cooling housing market. Yesterday was a roller-coaster, with the stock declining -40% in the last hour of trading after being up more than 67% intraday... Source: HolgerZ

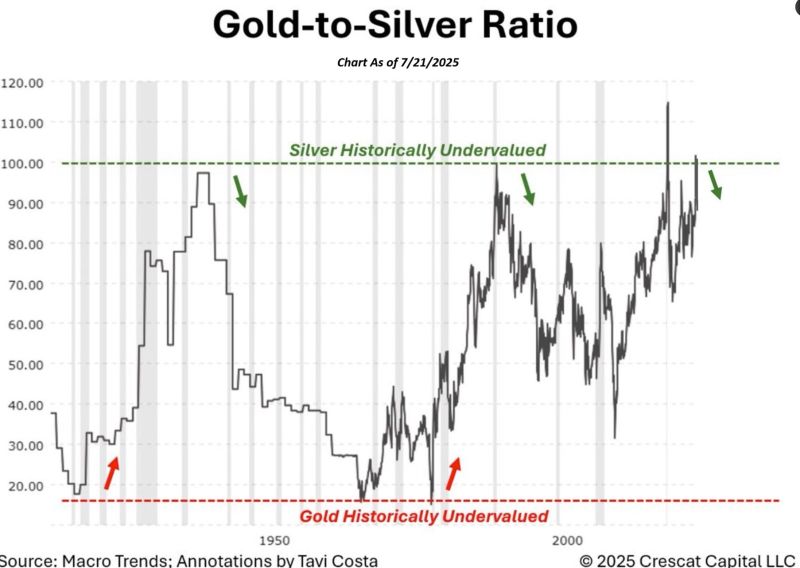

It's remarkable to see silver approaching $40/oz, yet still historically undervalued relative to gold.

Source: Tavi Costa

The biggest gamma squeeze in history ???

Source: zerohedge

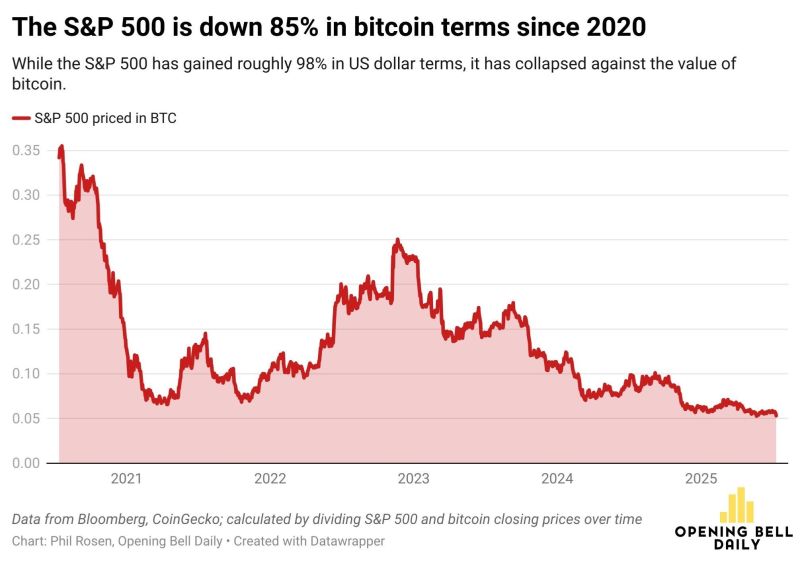

BREAKING: The S&P 500 is down 85% in Bitcoin terms since 2020.

Source: Bitcoin Archive @BTC_Archive

⚠️Corporate executives are EXTREMELY bearish:

11.1% of S&P 500 firms with the recent insider activity saw more buying than selling by corporate officers and directors, the LOWEST share EVER. 10 of the 11 sectors saw negative activity in all company sizes including large-cap. Source: Global Markets Investor

US Treasury Secretary Scott Bessent has called for an inquiry into the “entire Federal Reserve institution”

In the latest sign of how top Trump administration officials are cranking up pressure on the central bank. “What we need to do is examine the entire Federal Reserve institution and whether they have been successful,” Bessent told CNBC on Monday. Bessent’s comments come as Donald Trump and his lieutenants have sharply criticised the Fed and its chair Jay Powell for refraining to cut borrowing costs this year. Trump last week asked a group of Republican lawmakers whether he should sack Powell, but later clarified that he had no plans to do so unless he needed to “leave for fraud”. Trump’s government has also recently opened a new front in their campaign against the Fed, with the president’s budget director Russell Vought repeatedly alleging that a $2.5bn renovation of the central bank’s headquarters has been grossly mismanaged. Bessent amped up his criticism of the Fed on Monday, saying that if the Federal Aviation Administration had made as many mistakes, “then we would go back and look at why this has happened”. The Fed inspector general is reviewing the renovation of its headquarters, which involves an overhaul of two buildings that overlook the National Mall and is $700mn over budget. Powell has also written to senior senators to explain how the US central bank is reining in costs. Source: FT

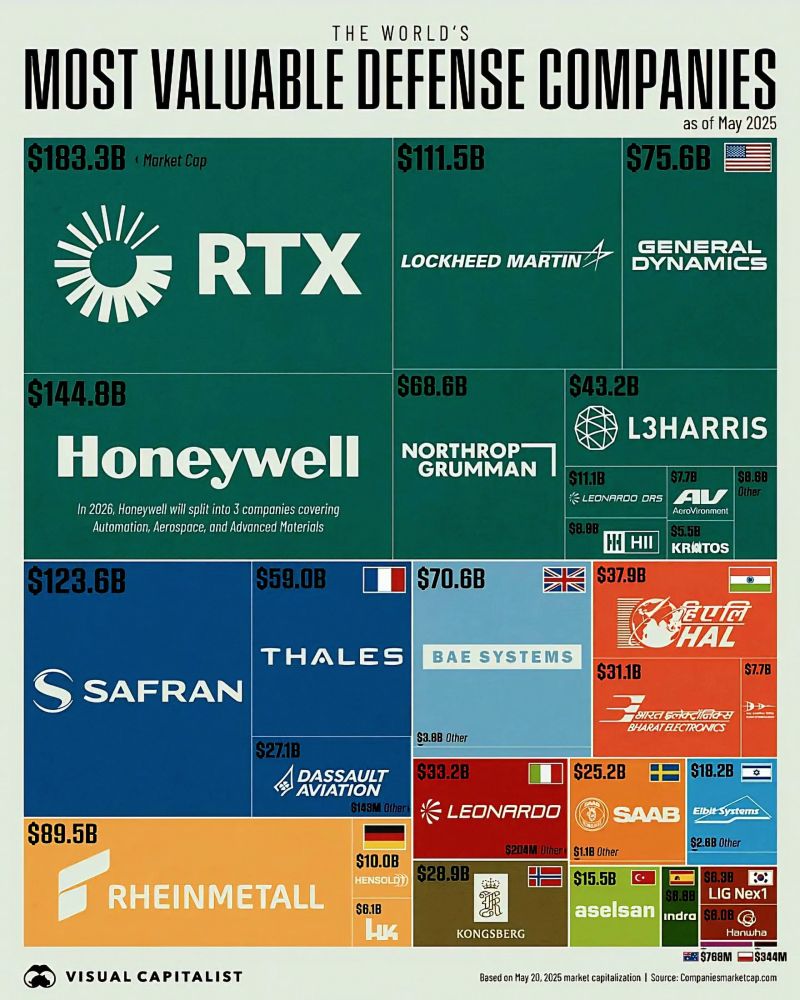

World's Most Valuable Defense Companies

Source: Global Statistics

Investing with intelligence

Our latest research, commentary and market outlooks