Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

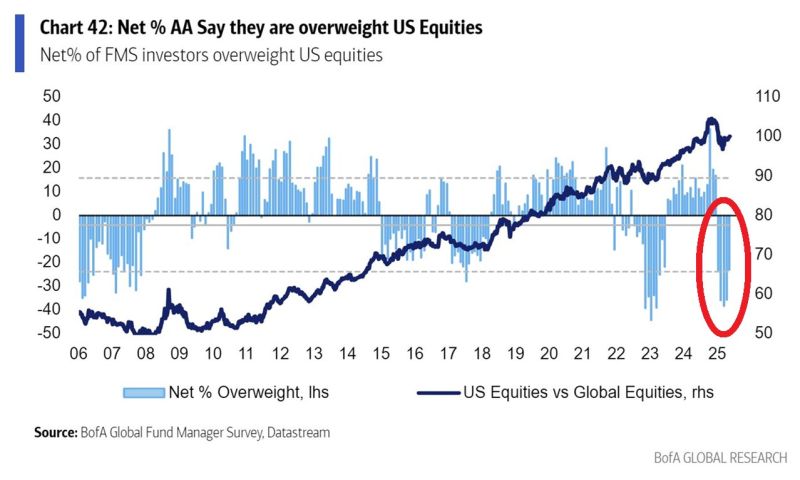

⚠️ Global fund managers are under invested in US stocks:

▶️ Professional investors have remained UNDERWEIGHT US equities versus global stocks for the 5th consecutive month. 👉 Meanwhile, the MSCI World Ex. USA index is up 17% year-to-date, beating the S&P 500 gain of 7%. Source: Global Markets Investor, BofA

Ether $ETH relative to bitcoin $BTC is breaking out after a multi-month consolidation.

Is this bearish for bitcoin? No. It just means that we might be at the beginning of the so-called "altcoin season" where other cryptos start to outperform bitcoin. But it does NOT mean that bitcoin is heading south. The new all-time highs in Coinbase, Robinhood and other crypto-related stocks and assets like Galaxy Digital are additional evidence that the crypto bull market might actually gathering speed. Source. J-C Parets NB: this is not an investment recommendation. Do your own research

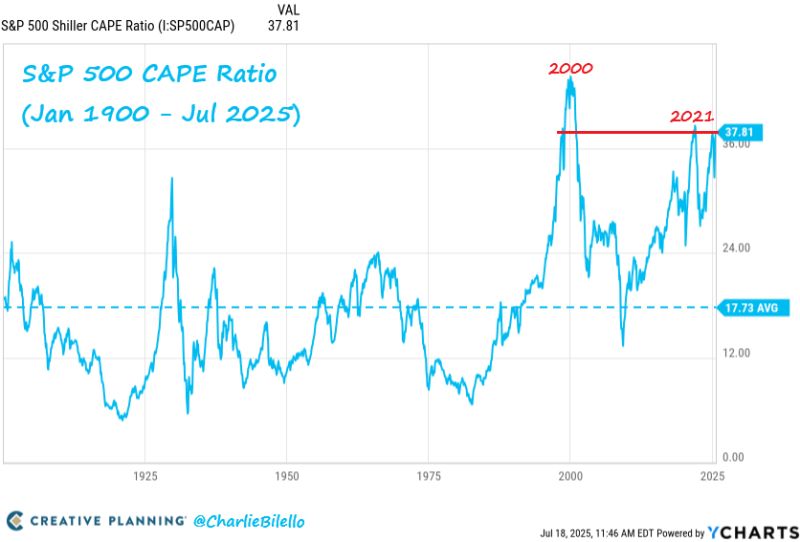

The SP500's CAPE Ratio is about to cross above 38 for the 3rd time in history, now higher than 98% of historical valuations. $SPX

Source: Charlie Bilello

Japan PM Ishiba Vows To 'Stay On' Despite Ruling Coalition Facing Major Loss; Exit Polls Show

The governing coalition of Prime Minister Shigeru Ishiba is likely to lose a majority in the smaller of Japan's two parliamentary houses in a key election Sunday, according to exit polls, worsening the country's political instability. Voters were deciding half of the 248 seats in the upper house, the less powerful of the two chambers in Japan's Diet. Ishiba has set the bar low, wanting a simple majority of 125 seats, which means his Liberal Democratic Party, or LDP, and its Buddhist-backed junior coalition partner Komeito need to win 50 to add to the 75 seats they already have. That would mean a big retreat from the 141 seats they had before the election. The LDP alone is projected to win from 32 to 35 seats, the fewest won by the party, which still is the No. 1 party in the parliament. Source: www.zerohedge.com

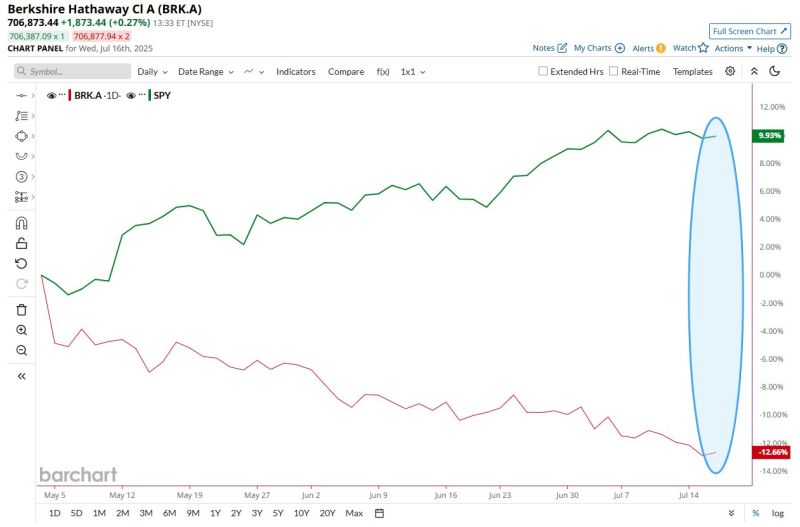

Berkshire Hathaway is now underperforming the S&P 500 by almost 23 percentage points since Warren Buffett announced his retirement 📉📉

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks