Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

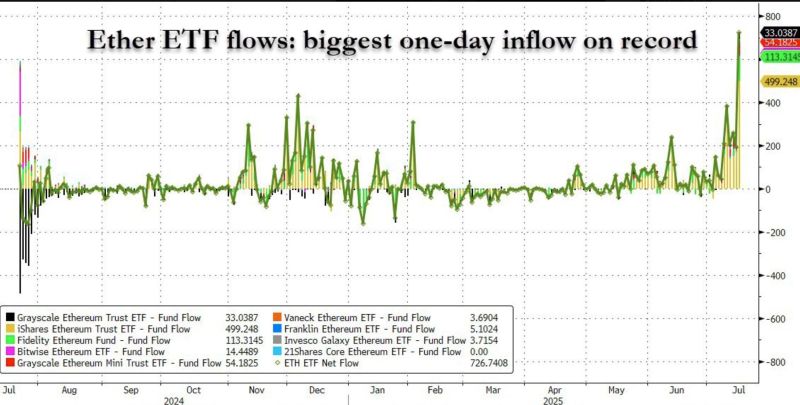

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

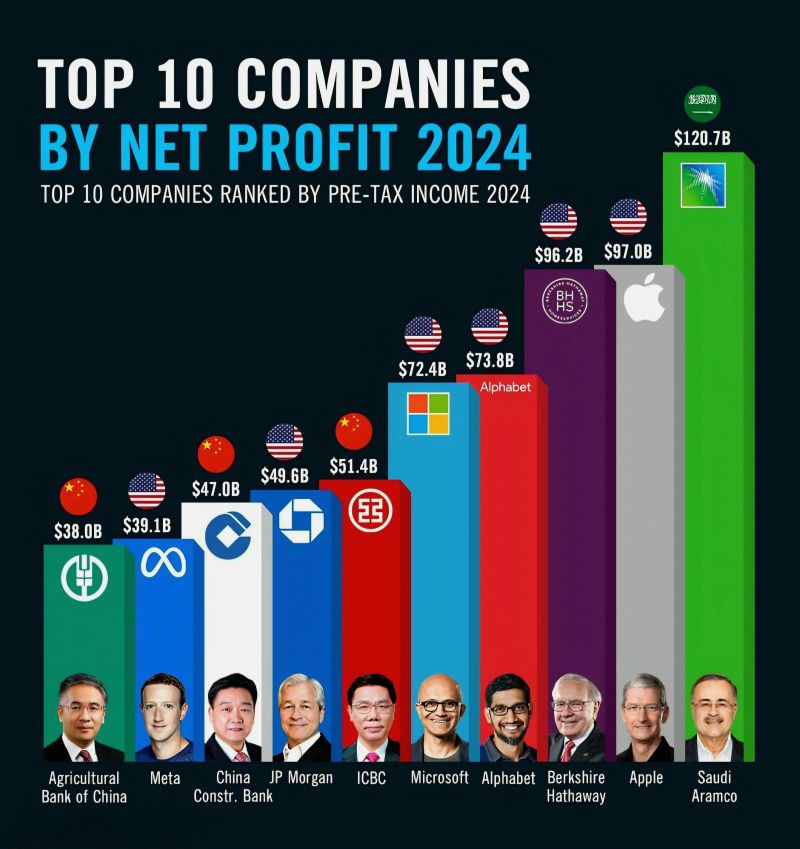

Top 10 Profitable Companies in 2024

1. Saudi Aramco: $120.7B 2. Apple: $97.0B 3. Berkshire Hathaway: $96.2B 4. Alphabet (Google): $73.8B 5. Microsoft: $72.4B 6. ICBC: $51.4B 7. JP Morgan Chase: $49.6B 8. China Construction Bank: $47.0B 9. Meta (Facebook): $39.1B 10. Agricultural Bank of China: $38.0B Source: Statista

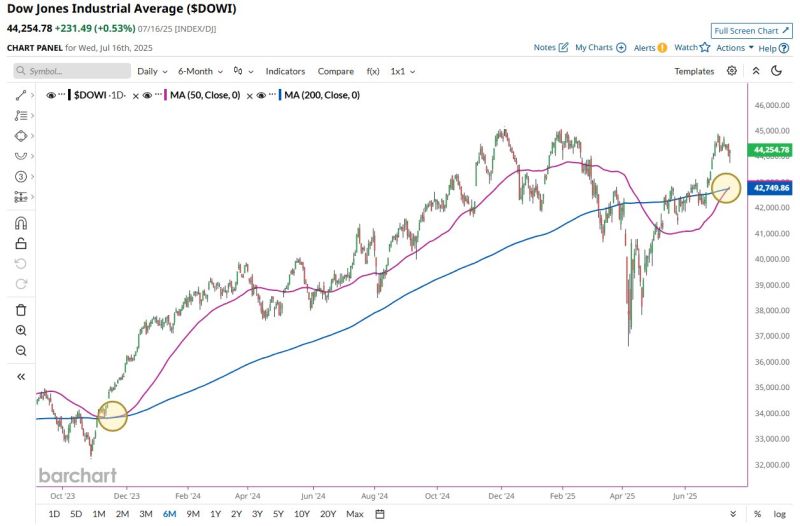

S&P 500 earnings have recently seen multiple sharp upward revisions.

This comes after 15 consecutive weeks of downside earnings revisions fueled by tariff fears. Overall, it seems that US corporations are actually coming out on the other side of these fears stronger. This is a tailwind for the stock market. Source: Bravos research

Investing with intelligence

Our latest research, commentary and market outlooks