Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The French government has launched a criminal investigation into Elon Musk’s X over 'the alleged manipulation of its algorithm' and 'fraudulent' data extraction, the social media platform said

Source: FT

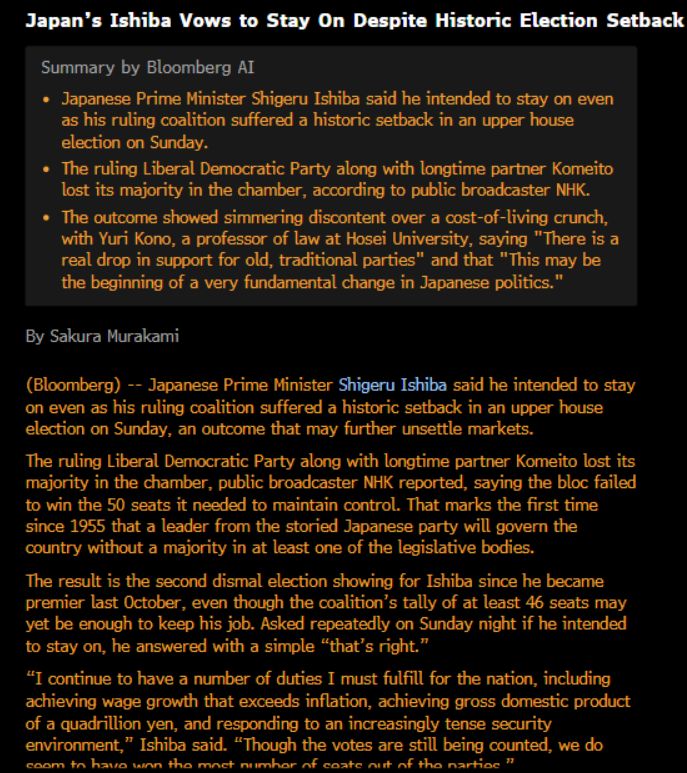

⚠️ Japan House of Councillors Election – Key Takeaways for Markets & Policy

▶️ Political Setback: PM Shigeru Ishiba’s LDP-led coalition failed to secure a majority, increasing political uncertainty and likely altering fiscal and monetary trajectories. ▶️ Market Impact: Greater opposition influence may push for looser monetary policy, pressuring the BOJ to delay rate hikes. This could weaken the Yen further (note that this is NOT market's first reaction as the yen is strengthening today) and push JGB yields higher ▶️Fiscal Concerns: Opposition-backed tax cuts and cash handouts could deepen Japan’s already high public debt burden, risking credit rating downgrades and higher borrowing costs. ▶️ Geopolitical Risks: A weakened coalition may delay or derail a U.S.-Japan trade agreement ahead of the August 1st deadline, worsening trade tensions. 👉Investor Outlook: Expect a more fragmented & uncertain policy landscape. This could mean higher JPY & JGB volatility during the Summer.

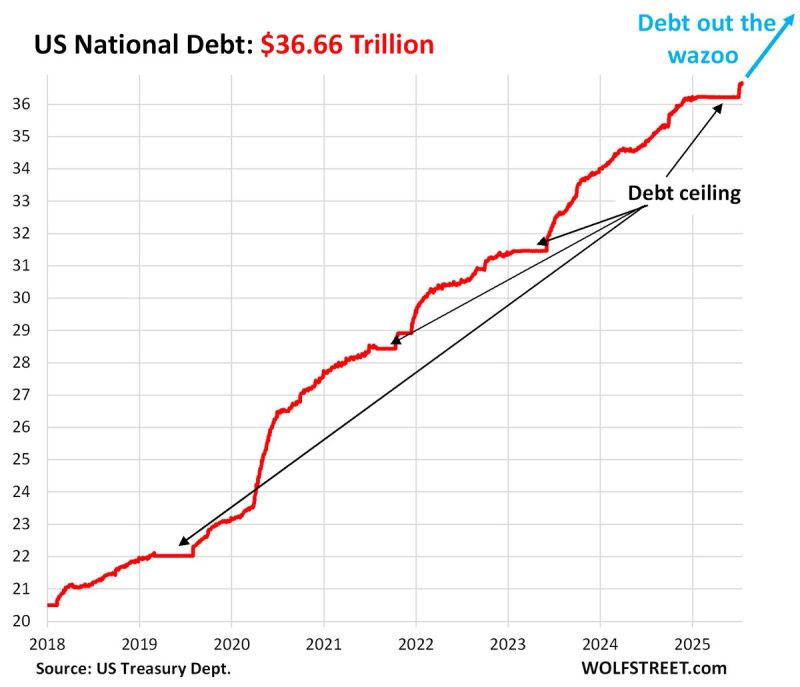

🔴 The US debt crisis is getting worse:

The US federal debt has hit $36.66 TRILLION, an all-time high. The public debt has skyrocketed $441 billion over the last 2 weeks after the statutory debt limit was extended. Over the last 2 years, the US debt has risen $5 TRILLION. Source: Global Markets Investor, Wolfstreet

London Stock Exchange Group is weighing whether to launch 24-hour trading as bourses race to extend access to stocks amid growing demand from small investors active outside normal business hours.

According to the FT ▶️ 🔴 The group is looking into the practicalities of increasing its trading hours, according to people familiar with the situation, from the technology required to regulatory implications. 🔴LSEG is “absolutely looking at it, whether it means 24-hour trading or extended trading”, one of the people said, adding that the exchange group was “having important commercial, policy and regulatory discussions” about the “ongoing topic”. 🔴 Pioneered in the US, longer trading windows have become a hot topic among exchange groups as they seek to modernise, spurred by the rise of younger investors who trade on their smartphones. 🔴 The 24-hour nature of cryptocurrency markets, where volumes are booming, has also led bourses to consider extending hours.

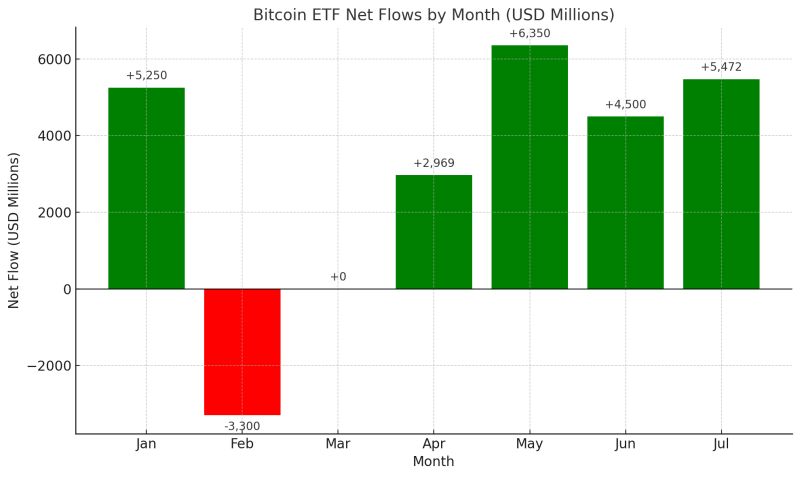

Bitcoin ETF Flows are still 2x the flows from MSTR and other Bitcoin Treasury companies.

If nothing changes, these together will generate $50 billion in new demand for BTC (without taking into account new bitcoin treasury companies being created, sovereign demand, new institutional demand, etc.) We now the supply variable in the equation. What we do NOT know is how much the whales will offload their bitcoin as the price keeps moving higher. But net net it looks like the supply-demand context remains rather favourable... Source chart: Fred Krueger

JP Morgan Chase & Co. has begun publishing research reports on leading private companies.

Marking a strategic shift as these firms wield growing influence over global markets, a source told Reuters on Friday. The bank's first note focuses on OpenAI, the ChatGPT creator that ignited Wall Street's AI frenzy with a valuation surpassing $27?billion. As IPO timelines stretch and private market valuations rival those of S&P 500 companies, institutional investors are seeking earlier insights into disruptors like SpaceX and TikTok parent ByteDance. In an internal memo, JPMorgan's head of global research, Hussein Malik, said the reports will provide structured analysis and market tracking but will exclude ratings and price targets. "Private companies are increasingly shaping industries, particularly in the new economy space," Malik wrote. The timing reflects explosive growth in private markets. North America alone hosts over 1,000 unicorn startups valued above $1?billion worth nearly $4 trillion collectively, according to PitchBook. Private capital markets, spanning venture and private equity, reached $18.7 trillion last year and are projected to hit $24 trillion by 2029. RTTNews, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks