Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

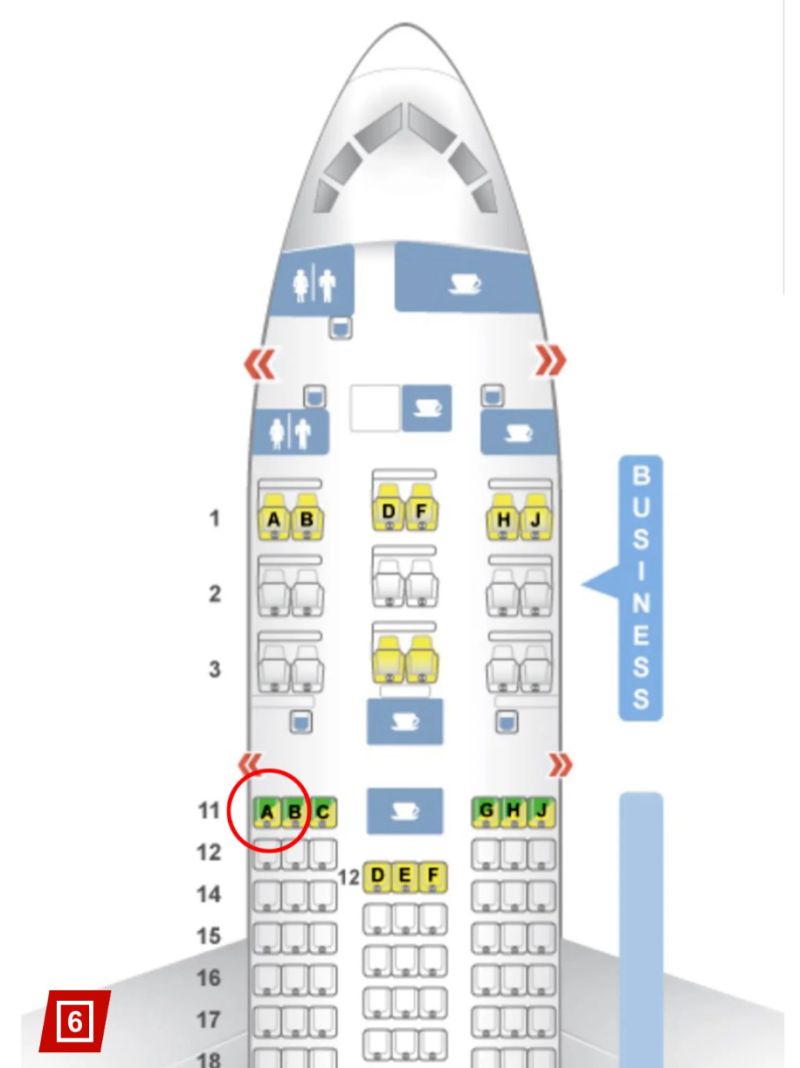

Seat 11a (or seats close to exit door) are going to be in high demand...

The lone survivor of the India crash who walked away was in seat 11a. According to his testimony when the plane hit ground it disintegrated & the exit door blew. He was in the emergency exit row & the door blowout likely saved him. His brother was killed on the same plane 🙁.RIP Source: market_sleuth on X

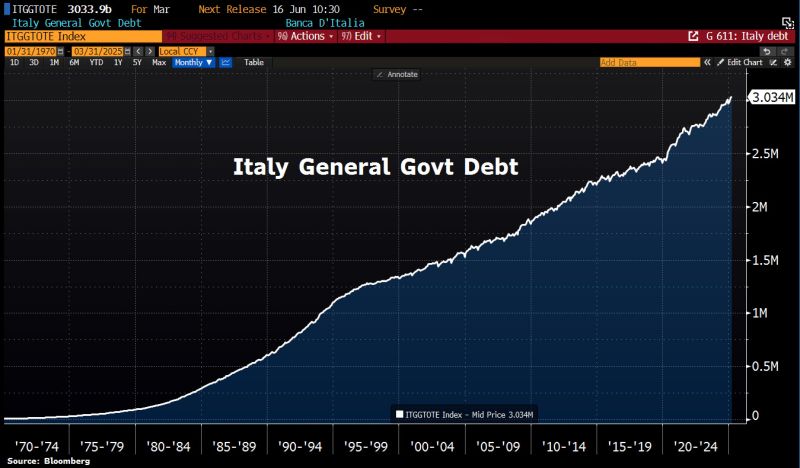

In case you missed it: Italy's total government debt has topped €3tn, for the 1st time ever.

Source: HolgerZ, Bloomberg

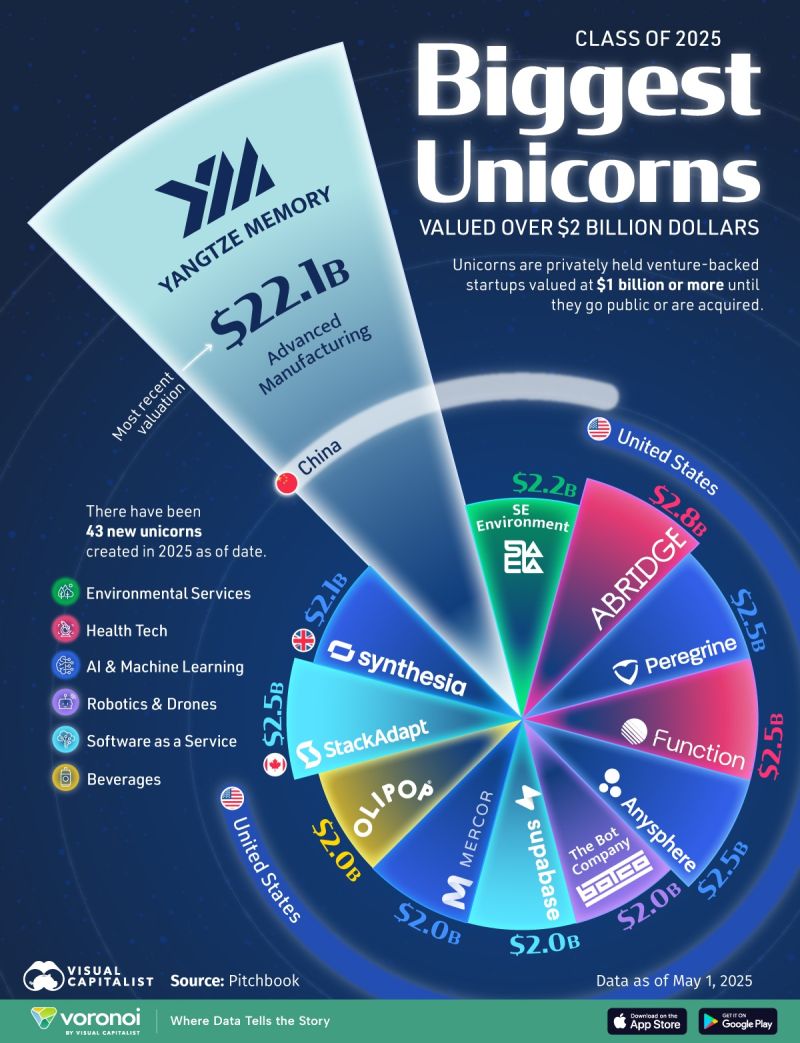

This graphic visualizes unicorns valued at $2 billion or more that became unicorns ($1 billion+ in valuation) in 2025.

Data comes from PitchBook, as of May 1, 2025. PitchBook defines unicorns as venture-backed companies valued at $1 billion or more after a funding round, until it goes public, gets acquired, or drops below that valuation. Yangtze Memory, a Chinese flash memory chip developer, is 2025’s biggest unicorn so far with a $22.1 billion valuation. The company became a unicorn, by PitchBook’s definition, in April 2025 after it secured a $222 million investment from Quanhong Investment. Even if a company’s internal or market valuation exceeds $1 billion, PitchBook’s definition requires a qualifying funding event for official unicorn status. Abridge, an American healthcare AI startup that summarizes clinician-patient conversations into documentation, is the second-most valuable unicorn in the class of 2025. AI-driven companies dominate the list of the biggest unicorns of 2025—such as Synthesia (AI video generation), AnySphere (AI programming assistants), and The Bot Company (AI agents)—and have attracted significant investment in recent years. There have been 43 new unicorns created in 2025, as of May. The largest share (65%) of new unicorns in 2025 are from North America, followed by Europe (23%). Currently, the most valuable unicorns in the world are ByteDance, the creator of TikTok, and Elon Musk’s SpaceX. Source: Visual Capitalist

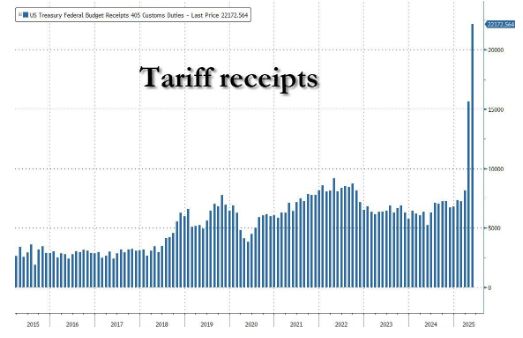

U.S. Tariff Revenue soared to $22.2 Billion during May, an all-time high 🚨🚨

Source: zerohedge

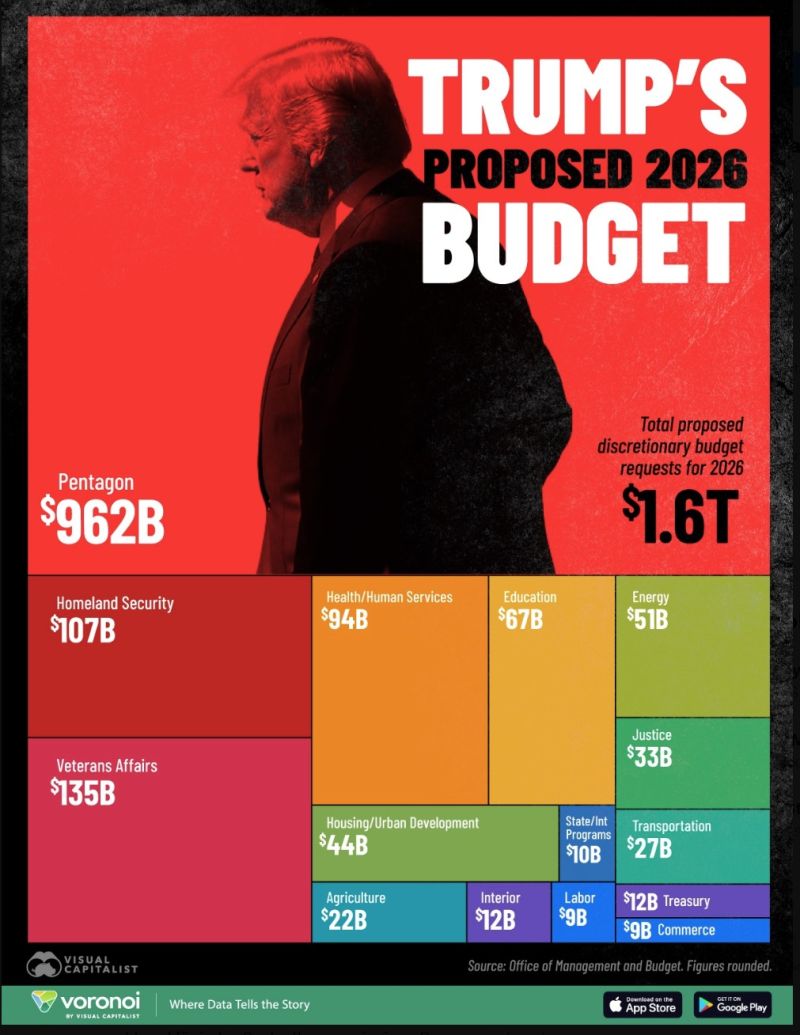

Visualizing Trump’s 2026 Budget Proposal 💰by Visual Capitalist and Voronoi App

From foreign aid to renewable energy programs, federal agencies are bracing for sweeping cuts. As Trump’s budget proposal slashes $163 billion from nondefense discretionary spending, it threatens to eliminate some programs entirely. Meanwhile, it boosts the Pentagon’s budget by 13%, raising it to $962 billion in 2026.As Trump’s budget proposal slashes $163 billion from nondefense discretionary spending, it threatens to eliminate some programs entirely. Meanwhile, it boosts the Pentagon’s budget by 13%, raising it to $962 billion in 2026. The Pentagon stands to gain an additional $114 billion—the largest budget increase by far. In particular, funding would be directed to building a “Golden Dome”, a multi-billion dollar missile shield that includes orbital sensors, satellites, and missiles on the ground. By the end of his term, Trump wants to spend $175 billion on its architecture.

A major breakout for palladium

Source: Graddhy - Commodities TA+Cycles

Investing with intelligence

Our latest research, commentary and market outlooks