Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

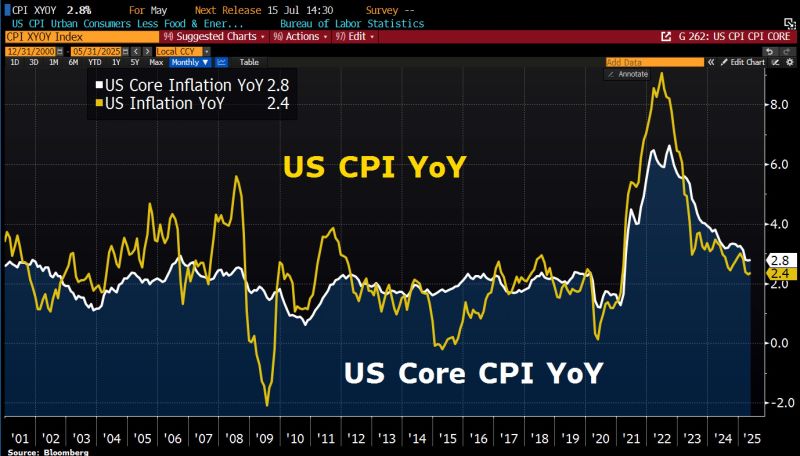

May US inflation slightly cooler than expected. Core CPI rose by 2.8% YoY, just below forecast of 2.9%, while headline inflation at 2.4%, matching expectations.

Both figures remain above Fed's 2% target, but Trump’s tariffs have not yet significantly impacted overall inflation. Source: HolgerZ, Bloomberg

OPENAI STRIKES UNPRECEDENTED CLOUD DEAL WITH $GOOGL -- REDUCES DEPENDENCY ON $MSFT 👀

OpenAI will use Google Cloud to meet its growing compute needs, marking a move to diversify beyond Microsoft. The deal, finalized in May, also ties into its Stargate data center project. – Reuters

A group led by British engineer Rolls-Royce has won UK government backing for its bid to build the country’s first small modular nuclear reactors.

The consortium has been selected as the preferred bidder out of four developers shortlisted last year. The selection marks a step forward for the technology in the UK, although SMRs are not likely to be up and running in Britain until the 2030s. It comes as the government announced £11.5bn of new state funding on Tuesday for a new large-scale power plant, Sizewell C in Suffolk. The government said it would pledge £2.5bn for SMRs over the current spending review period. The Rolls-Royce consortium was among four bidders shortlisted last year, including US-owned rivals Holtec Britain and GE Hitachi, and Canadian-owned Westinghouse Electric. The latter had dropped out earlier this year. SMR is a catch-all term for relatively small nuclear power plants using different technologies, parts of which can be built off-site. Proponents say their size and modular construction mean it should be possible to build them with fewer of the delays and cost blowouts that have dogged larger models. However, critics caution that there is so far no certainty that the purported benefits will materialise. Source: FT ➡️ https://lnkd.in/eF8Zp_xj

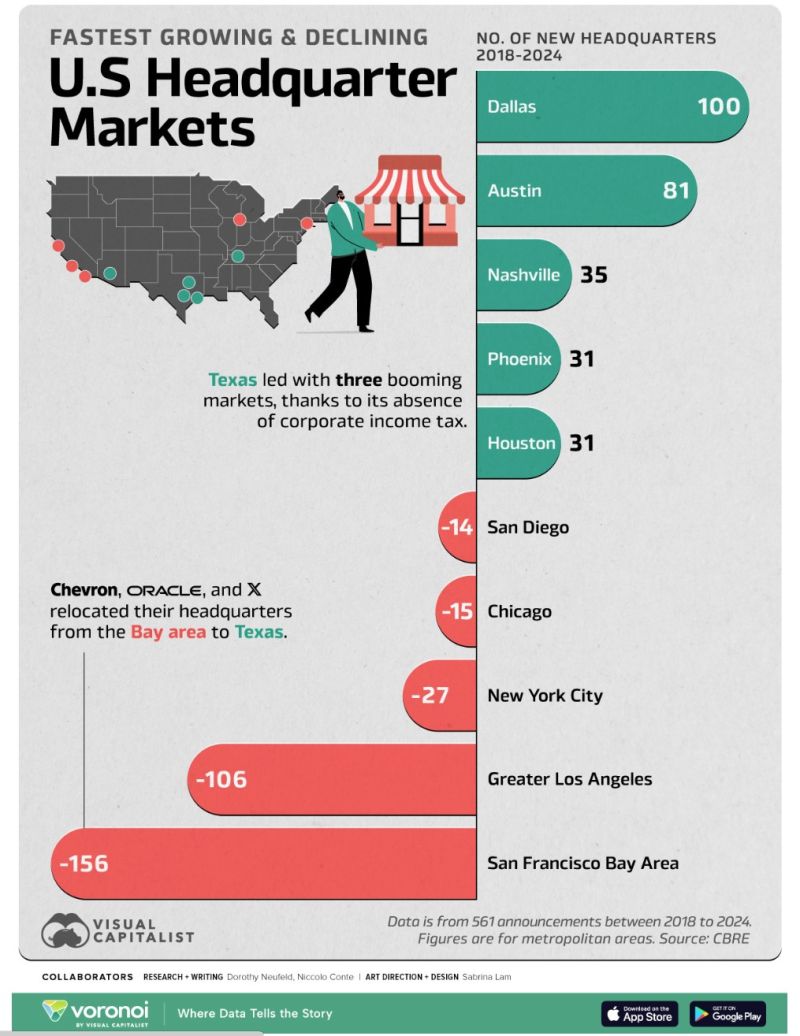

This graphic - courtesy of Visual Capitalist - shows the fastest growing—and shrinking—headquarter markets in America, based on data from CBRE.

Owing to its pro-business policies and lower cost of living, Texas is attracting scores of corporate headquarters, particularly from California. As a result, states are losing billions in tax revenues as the corporate landscape shifts south. As the country’s best state for doing business, Texas is home to three of the top five markets nationally. Fueling this migration are its growing talent pool, the absence of corporate and personal income tax, and its lack of red tape. The state is notable in its diverse business landscape attracting Chevron, Charles Schwab, and SpaceX to relocate headquarters since 2018. Additionally, companies are expanding their presence in the state. Goldman Sachs, for instance, plans to grow its headcount in Dallas to 5,000—up from 970 in 2016. By contrast, California is experiencing a corporate exodus. With homes at least 50% more expensive than in Texas, along with the fifth-highest tax burden in the country, the state has lost at least 275 headquarters since 2018. The San Francisco Bay Area stands as the hardest hit market, in a market facing one of the highest office vacancy rates in the nation. Source: Visual Capitalist, Voronoi

What do you notice on the picture below?

Source: Michel A.Arouet

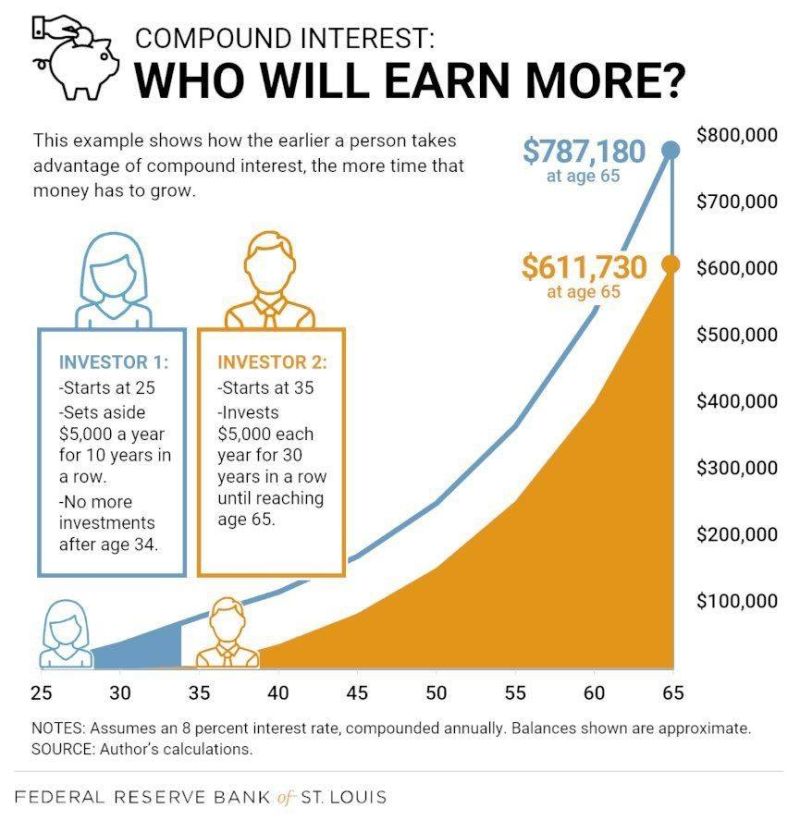

The Importance of Starting Your Investing Journey As Early As Possible

Source: Dividend Growth Investor

Bloomberg reports that US Treasury Secretary Scott Bessent is a possible contender to succeed Fed Chair Powell.

Last week, Trump said his pick for the next Fed Chair is “coming out very soon.” Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks