Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

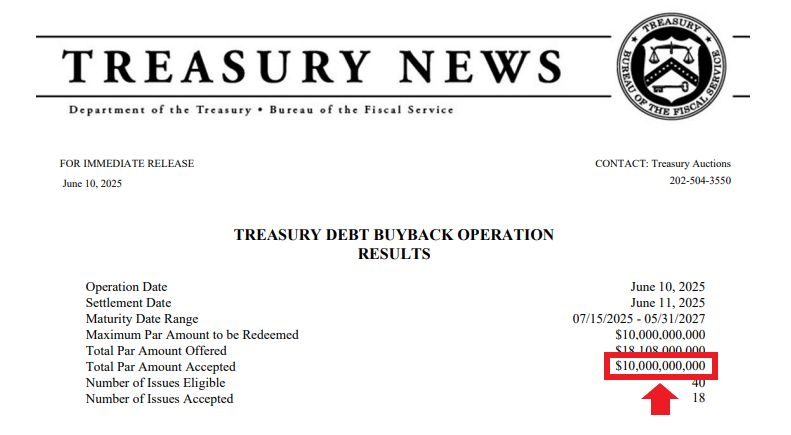

BREAKING 🚨: United States Treasury - THEY DID IT AGAIN! Japan 2.0 ???

U.S. Treasury just bought back another $10 Billion of its own debt, matching the largest Treasury buyback in history (and that was from last week)! Source: Barchart

CBOE Volatility Index $VIX falls to lowest level since February

No Fear Left in the Market Source: Barchart

nuclear energy stocks are on fire 🔥

🟢 Oklo ($OKLO) shares surged 29% on Wednesday after the company was named the intended awardee for a Department of Defense project to deliver clean energy to Eielson Air Force Base in Alaska. The Defense Logistics Agency Energy issued a Notice of Intent to Award (NOITA), designating Oklo as the preferred provider following a competitive evaluation process. Under the proposed agreement, Oklo will design, build, own, and operate an Aurora powerhouse—a microreactor that provides both electricity and heat—at the remote military base. ➡️ Oklo Inc. is an advanced nuclear technology company headquartered in Santa Clara, California, founded in 2013 by Jacob DeWitte and Caroline Cochran, both MIT graduates. The company focuses on designing and deploying compact fast reactors, aiming to provide clean, safe, and affordable energy at a global scale. Oklo’s flagship product is the Aurora powerhouse, a small, liquid metal-cooled fast reactor designed to generate between 15 and 75 megawatts of electrical power (MWe). This reactor can operate for up to 10 years without refueling and is intended for off-grid applications such as data centers, artificial intelligence infrastructure, remote communities, industrial sites, and military bases.

🟥 Crude Oil is now back above its 100 day moving average for the first time in more than 2 months.

‼️ Oil prices edged higher on Thursday to their highest in more than two months, after U.S. President Donald Trump said U.S. personnel were being moved out of the Middle East, which raised fear that escalating tensions with Iran could disrupt supply. ➡️ Trump on Wednesday said U.S. personnel were being moved out of the Middle East because “it could be a dangerous place,” adding that the United States would not allow Iran to have a nuclear weapon. ⚠️ Reuters reported earlier on Wednesday that the U.S. is preparing a partial evacuation of its Iraqi embassy and will allow military dependents to leave locations around the Middle East due to heightened security risks in the region, according to U.S. and Iraqi sources.

On the back of lower than expected CPI (May) numbers, President Trump calls for the Fed to cut interest rates by "one full point." (i.e 4 rate cuts)

Source: Stocktwits

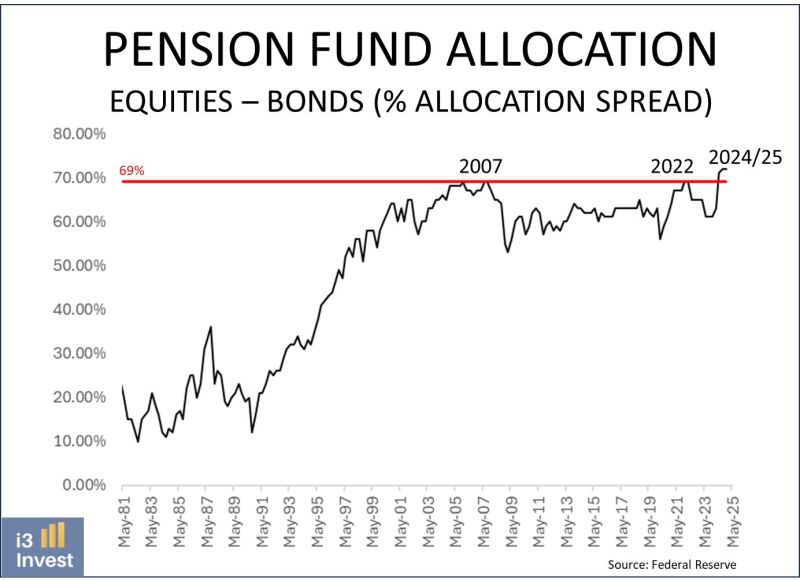

US pension fund allocation to equities relative to bonds is at an all-time high.

U.S. pension funds represent approximately 20% of the total U.S. financial markets. Source: Guilherme Tavares @i3_invest

Investing with intelligence

Our latest research, commentary and market outlooks