Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Thoughts on the Moody's Downgrade of the US sovereign credit rating (inspired by a tweet by Jim Bianco):

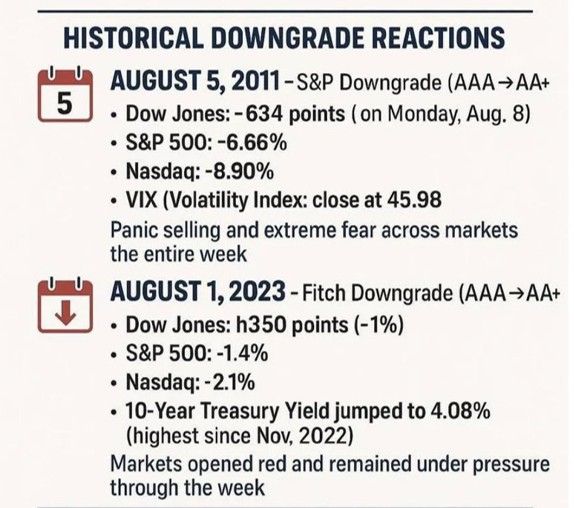

➡️ In August 2011, S&P first downgraded the US from AAA to AA+. Back then, many derivative contracts, loan agreements, investment directives, and similar documents prohibited the use of non-AAA securities. The fear was that a downgrade meant Treasuries were no longer eligible under these rules and would mean forced selling was to follow. ➡️ The 2011 downgrade left the US Split-Rated AAA (Moody's Aaa, Fitch AAA, S&P AA+). So, the US was still an AAA country and NOT in violation of these contracts. But everyone knew it was only a matter of time before the US lost its AAA status. So, in the years after 2011, those contracts were rewritten from "AAA securities" to "government securities," thereby excluding the credit rating qualification.

Welcome to panic-driven buying!

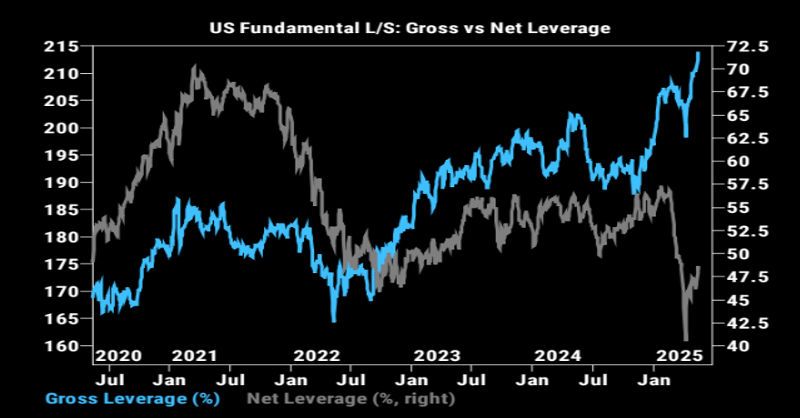

Going into this week: * Hedge funds just hit 100th percentile gross leverage * Biggest 6-week positioning jump since 2020. * Net buying at +2.5 SD (largest since Dec ’21) * Put protection near multi-year lows * "Offers wanted" floods GS desk This isn’t cautious buying—it’s panic-driven chase mode. Source: The Market Ear

Sometimes we need to be careful with magazine cover page.

Or use them as contrarian indicator?

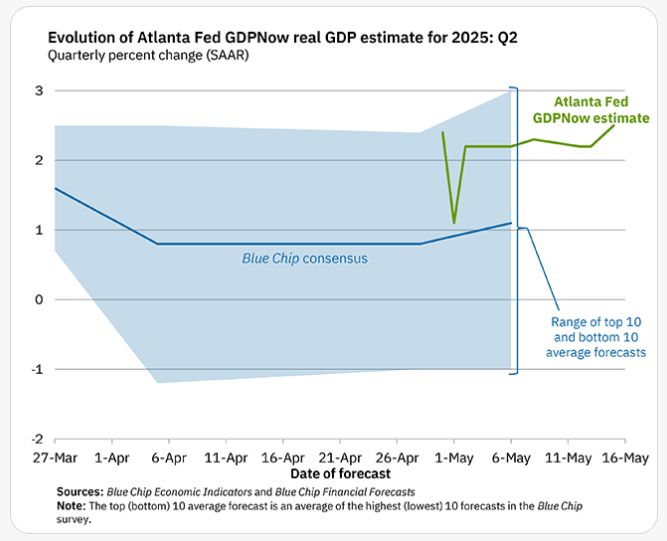

On May 15, the GDPNow model nowcast of real GDP growth in Q2 2025 is 2.5%

.

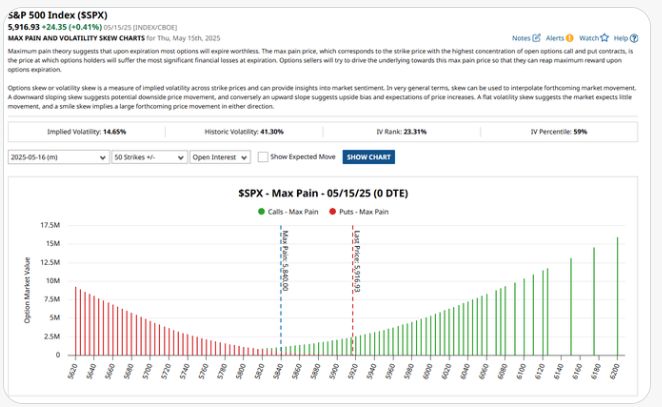

$1.2 Trillion of S&P 500 $SPX notional options exposure is set to expire on Friday with a max pain price currently sitting at 5,840

Source: Barchart

Global 30-Year Bond Yields from Europe to North America to Asia are all sending the same message

Source: Barchart

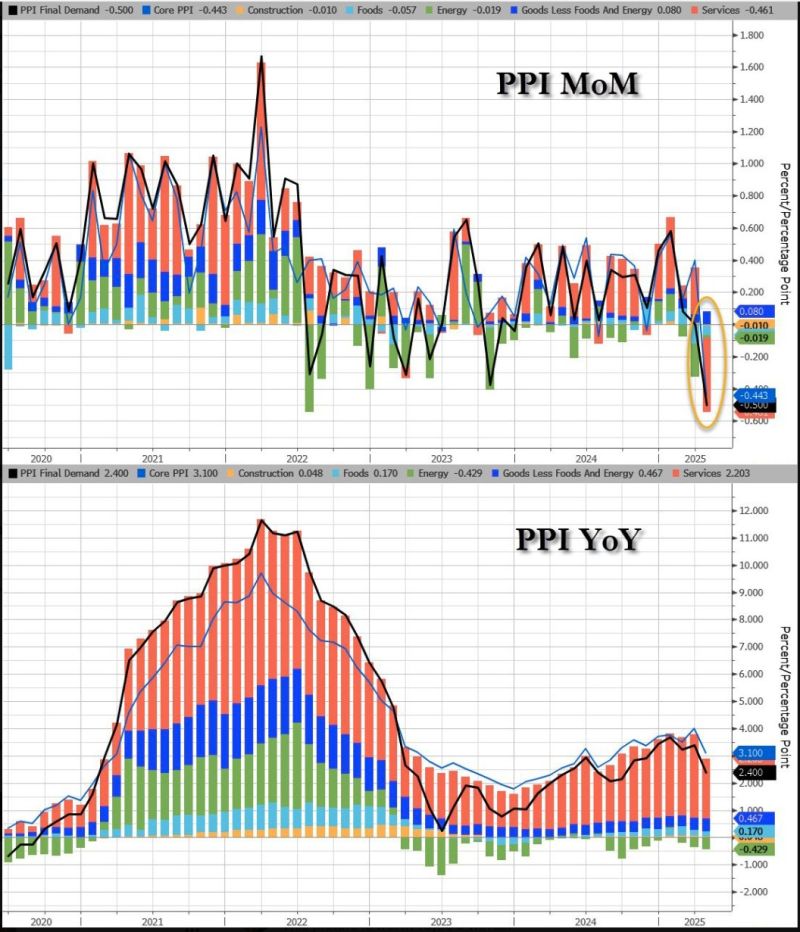

April PPI plunged largely due to collapse in company margins as a result of absorbing tariff increases

What does it mean for corporate margins going forward? Moreover, Fed chairman Powell told us companies would pass through tariffs. Is it going to be the case? Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks