Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

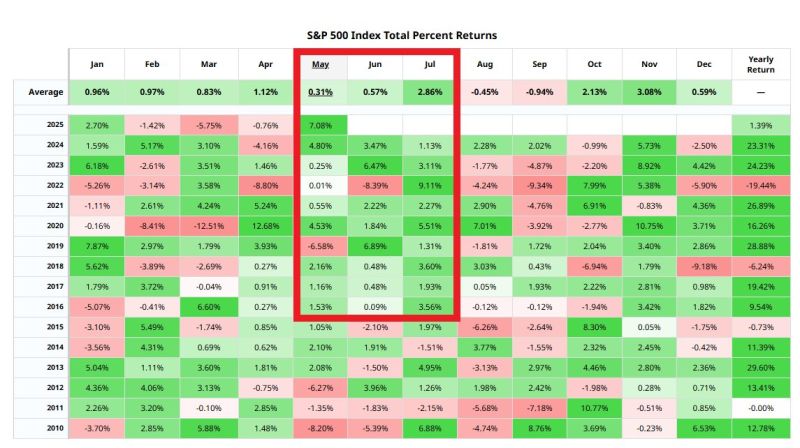

Since 2016, S&P 500 has only had 2 red months during the May-July period 📈📈📈

Source: barchart

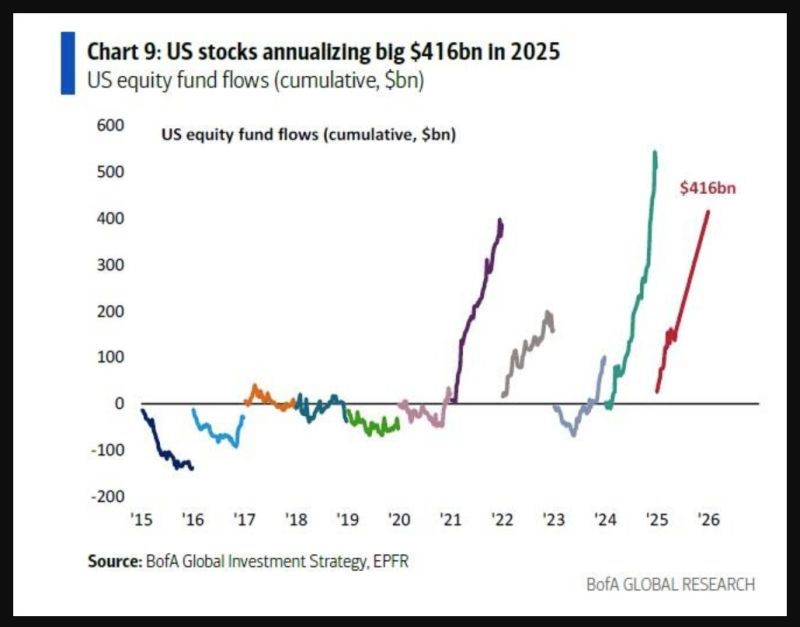

Yes, 2025 is likely to be a record year for EU equities funds inflows (according to BofA/EPFR, +$110bn inflow annualized, which will be the biggest since '15).

But despite all the US bashing, it could be a very strong year for US equities inflows as well. Indeed, US equities funds are on course for $416bn inflow, the 2nd biggest year ever... Source: BofA, EPFR

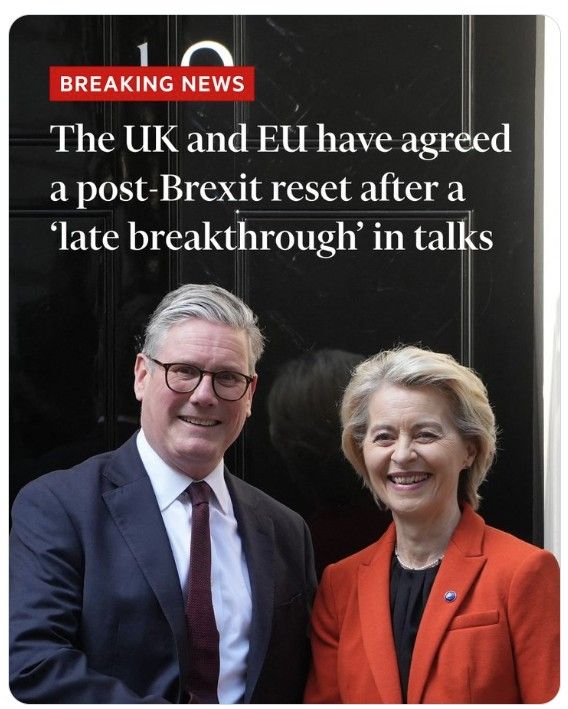

Breaking news:

The UK and EU have agreed a historic post-Brexit reset of ties ahead of a summit in London on Monday, officials said - link to FT article >>> https://lnkd.in/ea6m_PnK The UK and EU have agreed a historic post-Brexit reset of relations after a “late breakthrough” in overnight talks ahead of a summit in London on Monday, officials on both sides said. The UK agreed to open its fishing waters for 12 more years to EU boats — a move that will be condemned by the opposition Conservatives — according to Brussels officials. In return, UK Prime Minister Sir Keir Starmer has secured a veterinary deal that will remove much red tape for British farming and fisheries exports to its biggest market, in a much-sought economic prize of the “reset” talks. Three EU diplomats confirmed Brussels had dropped demands to link the duration of the agrifood deal to the one for fish, while British officials confirmed that a deal on the two issues had been done. Both sides were locked in intense haggling through the night over key details of their revamped relationship, including on fisheries and food trade, along with wording about a proposed youth mobility scheme. Source: FT

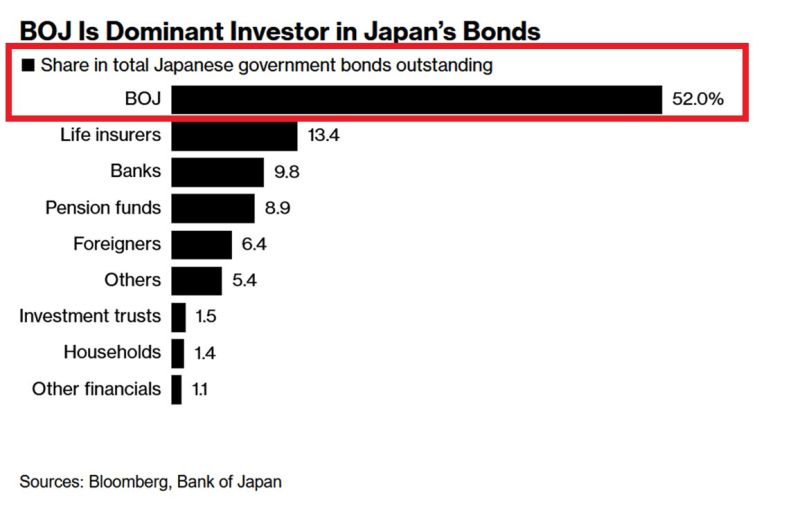

Is it the end game for US Treasuries?

The Bank of Japan owns a whopping 52% of its domestic government bond market. Since July, the BoJ has been gradually reducing the size of its holdings. The estimated value of Japan's government debt market is $7.8 TRILLION, world's 3rd largest. Source: Global Markets Investor, Bloomberg

Moody’s downgrade does NOT change much; they just aligned with S&P and Fitch.

What DOES matter is the fiscal and debt situation which remain major worries Source cartoon: Hedgeye

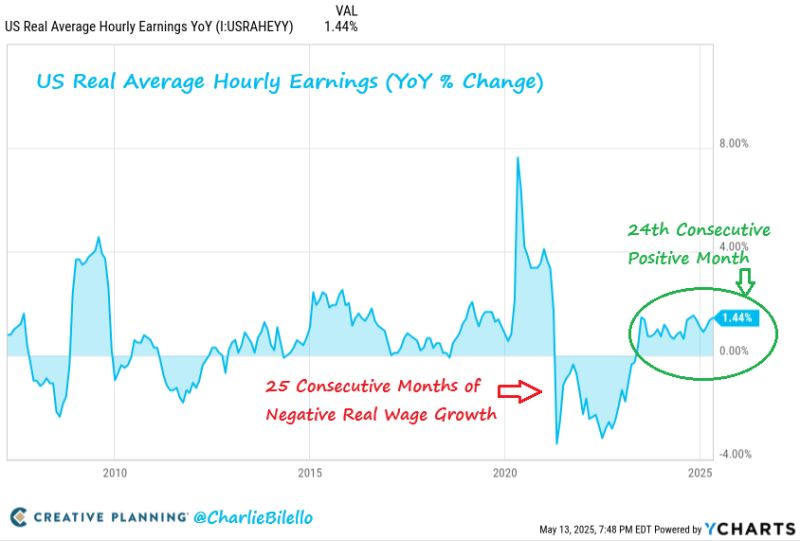

After a record 25 consecutive months of negative real wage growth, wages have now outpaced reported inflation on a YoY basis for 24 straight months.

This is a great sign for the American worker that hopefully continues. Source: Charlie Bilello

Retail sales rose 5.1% from a year earlier in April, MISSING analysts’ estimates of 5.5% growth, according to a Reuters poll

Sales had grown by 5.9% in the previous month. Industrial output grew 6.1% year on year in April, STRONGER than analysts’ expectations for a 5.5% rise, while slowing down from the 7.7% jump in March. Fixed-asset investment for the first four months this year, which includes property and infrastructure investment, expanded 4.0% from a year earlier. ➡️ As mentioned by Mo El Erian on X, the latest Chinese macro numbers illustrate a familiar pattern in the country’s economy: government measures often succeed in boosting industrial production, but tend to be less effective at stimulating household consumption Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks