Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

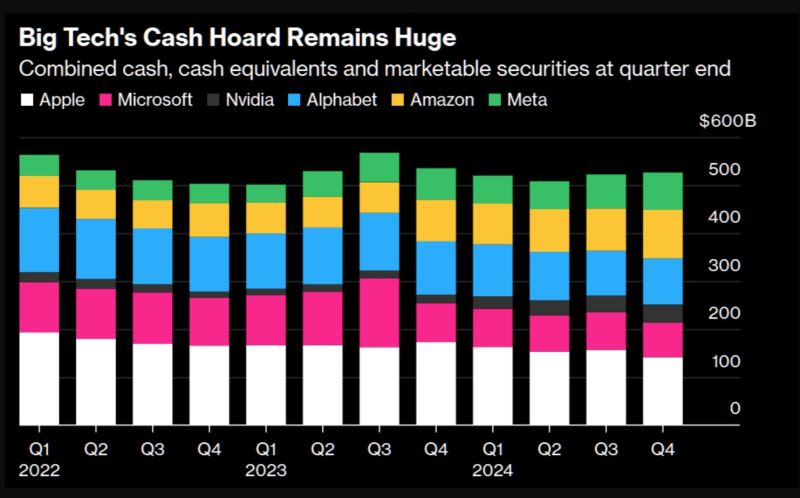

📢 The return of capital is back in focus

➡️ The Cap return story is more impressive now than ever. Companies managing to invest in growth AND return capital. Some even protecting the margin by lowering OPEX. Best of 2 worlds or even triple positive whammy. 1. Microsoft remained steady at $3.5 billion. 2. Meta ramped up to $13.4 billion (from $0 last quarter). 3. Google executed $15.1 billion in buybacks and raised its program to $70 billion. 4. And the standout: Apple repurchased $25 billion and authorized an additional $100 billion. Source: The Market Ear, Bloomberg

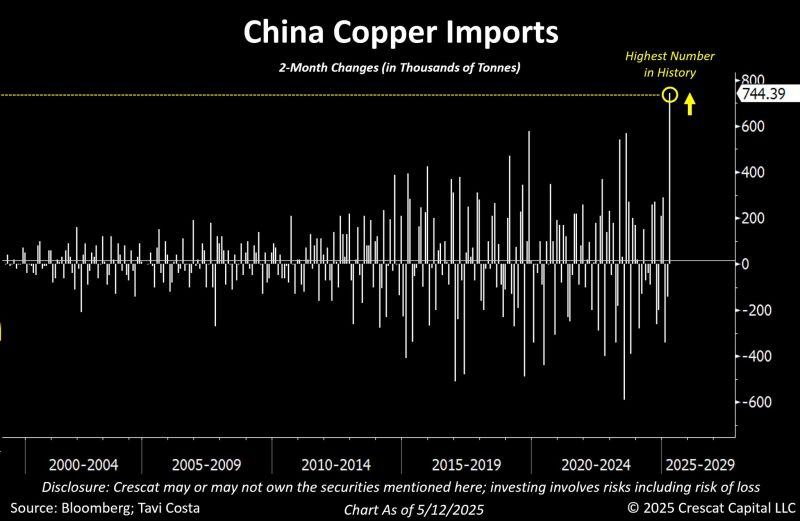

China has just reported its largest two-month copper imports in history.

The world remains firmly entrenched in a deglobalization trend. Even if we got a (temporary) US-China trade deal over the week-end, this foes not change the The push to secure strategic metals is just one manifestation of this broader shift unfolding in the markets. Source: Tavi Costa, Bloomberg

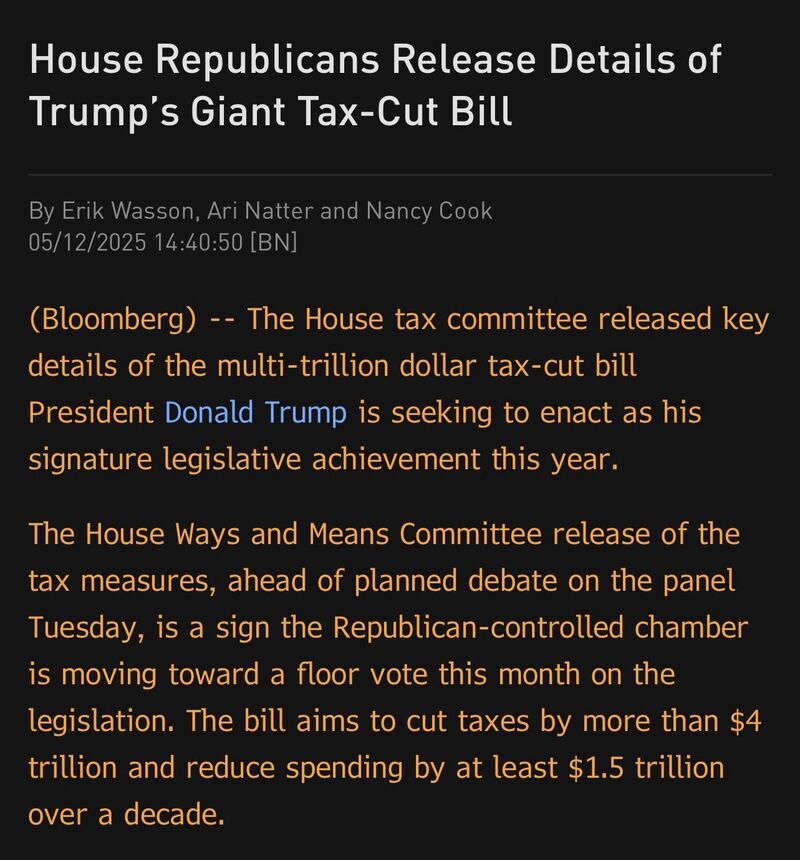

House tax proposal is out.

$4T in Tax Cuts $1.5T in Spending Cuts 👉 Another $2.5T added to the deficit. 🟢 Amazing for stocks, gold, and bitcoin. 🔴 Terrible for bonds Same old story as always. Source: Spencer Hakimian on X, Bloomberg

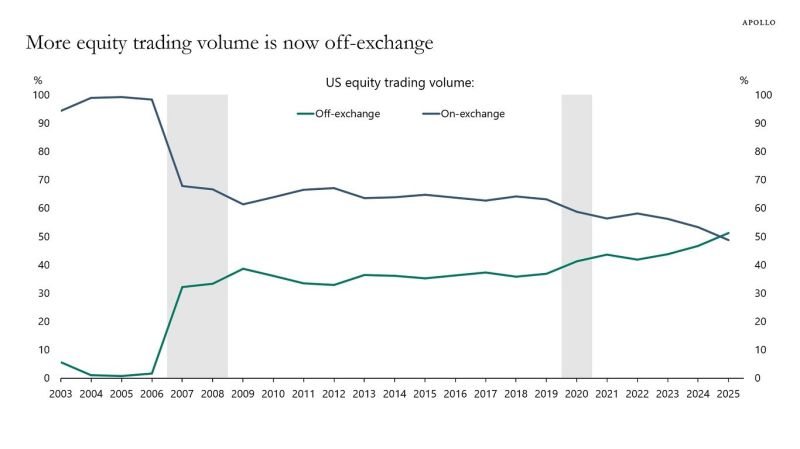

Dark pools are a bigger and bigger part of the stock market, now eclipsing volume at exchanges

Source: Markets & Mayhem, Apollo

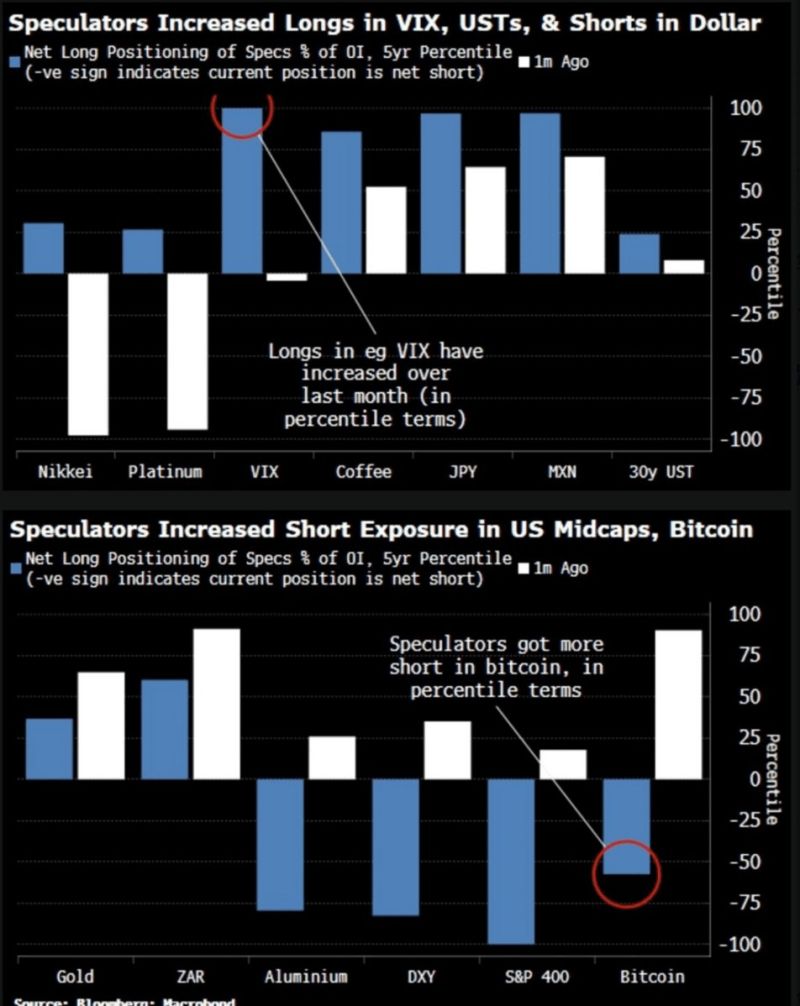

BREAKING: Hedge Funds

Hedge Funds were long volatility, short U.S. Dollar, short equities, and short Bitcoin $BTC before the U.S.-China trade agreement was announced... Source: Barchart, Bloomberg

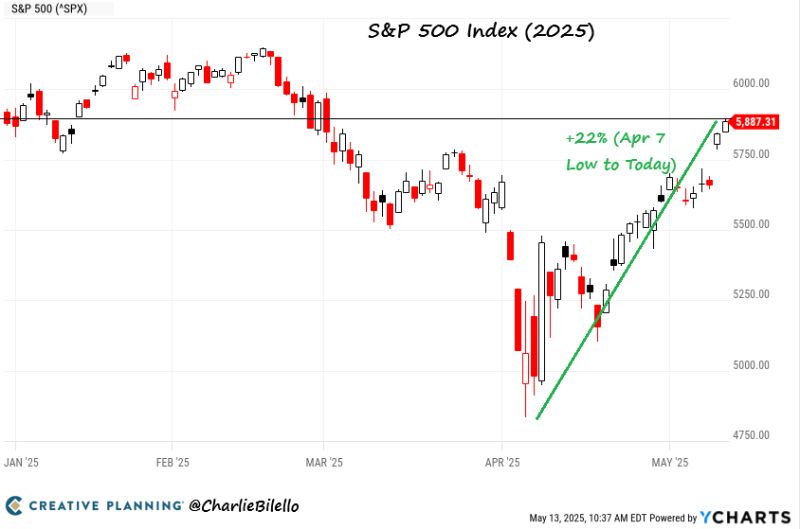

The S&P500 is flat on the year and less than 5% away from new all-time highs.

Congrats to those who stuck with their plan. Source: Ryan Detrick, CMT

US 30-Year Treasury Yield jumps to 4.89%, sitting near the highest levels of the last 18 years

Will the rise of bond yield start to hurt the equity market's recovery? What is the pain threshold? Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks