Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

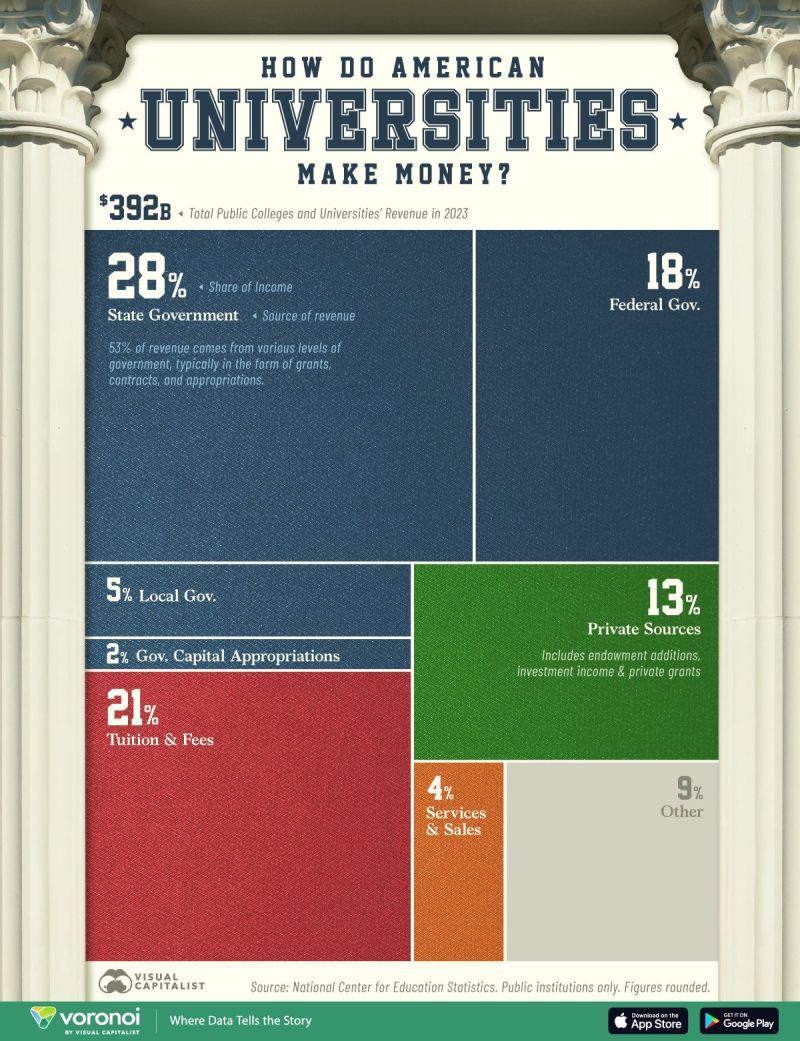

How do US universities make money?

Source: Markets & Mayhem @Mayhem4Markets, Voronoi

‼️The S&P 500 is trading at a MASSIVE technical level:

The S&P 500 has recovered some losses and broken above its 50-day moving average for the first time since February. However, it is still trading below its key 200-day moving average, a level smart money is watching. Will progress on US-China tariffs help the market break key resistance levels? Source: Bloomberg, Global Markets Investor

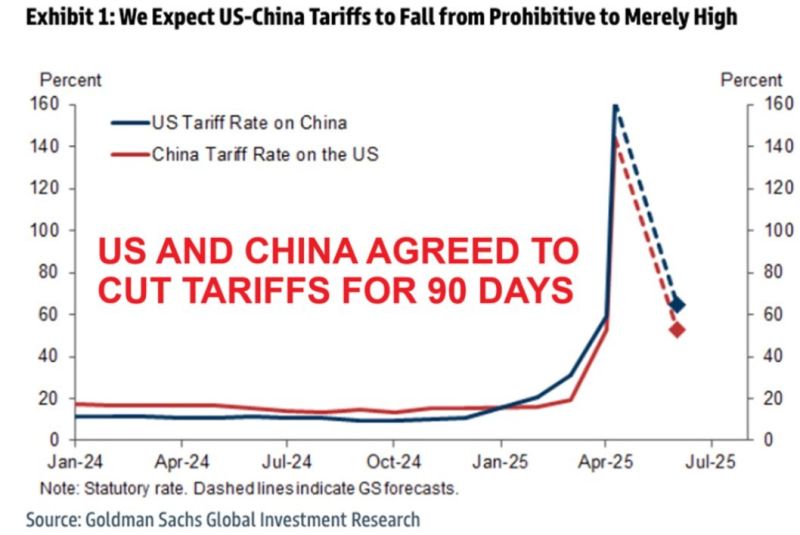

🔴 BREAKING: US and China agreed to LOWER tariffs on each other for 90 days until further agreement is reached.

▶️ US cuts tariffs on Chinese goods to 30% from 145% (a base 10% plus 20% fentanyl duty) from May 14th. ▶️ China cuts tariffs on American goods to 10% from 125%. ▶️ Reductions DO NOT include sectoral duties imposed on all US trading partners, and the tariffs applied on China during the first Trump administration remain in place. Treasury Secretary Scott Bessent said that neither side wants to decouple. As a reminder, in 2018, both sides also agreed to pause, but the US backed away from that, which led to more than 18 months of further tariffs and talks. It is a short-term relief at least. But just one headline may reverse everything again. Stay tuned. Source: Global Markets Investor

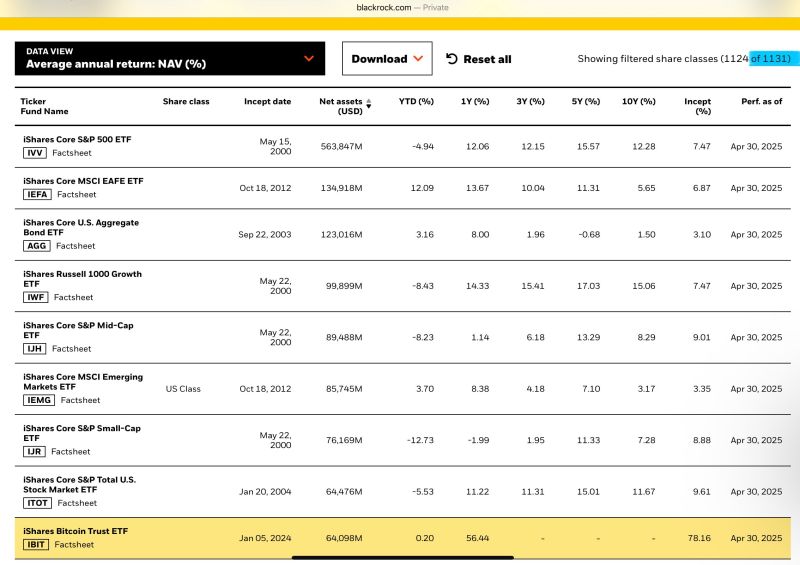

BlackRock, the world's largest asset manager with $11.6 Trillion in assets under management, has 1,131 funds.

BlackRock's BITCOIN ETF, $IBIT, is #9 of all funds after 16 months 👇 Source: HODL15Capital 🇺🇸 @HODL15Capital

Britons are being urged to stay home today between 11 a.m. and 3 p.m. because the temperature is set to reach... 24 to 26 degrees.

Isn't it too much?

US-China Trade (temporary) deal summarized

(see below table by Mike Zaccardi, CFA, CMT, MBA. 👉 As highlighted by a CNBC article >>> The new U.S.-China deal to temporarily cut tariffs is better than expected, providing near-term relief for investors. Under the deal, so-called reciprocal tariffs will drop from over 100% to 10% on both sides. The Trump administration will keep 20% fentanyl-related tariffs on China in place, meaning America’s total duties on Chinese imports will stand at 30% while the 90-day pause is effective. 👉 In a note to clients on Monday, Tai Hui, chief market strategist for Asia Pacific at JPMorgan Asset Management, said the deal unveiled in Geneva was better than anticipated, but uncertainty remained. “The magnitude of this tariff reduction is larger than expected,” he said, although he noted that it would be difficult for Beijing and Washington to reach a more concrete trade arrangement in just three months. “The 90-day period may not be sufficient for the two sides to reach a detailed agreement, but it keeps the pressure on the negotiation process,” Hui said. “We are still waiting for further details on other terms of this agreement, for example, whether China would relax on rare earth export restrictions.” Source: CNBC

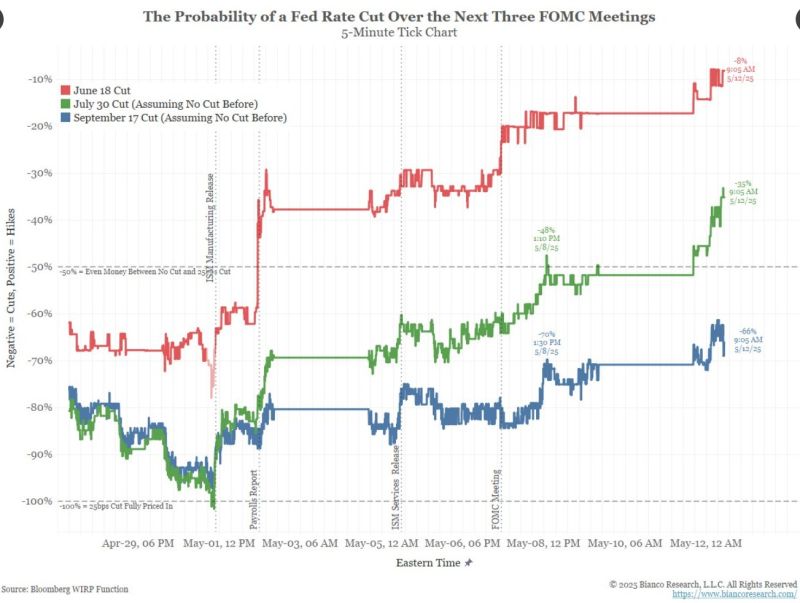

The number of Fed rate cuts continue to be revised downwards:

* June 18 (red) now 8% (92% no move) * July 30 (green) now 35% (65% no move) No cut is priced until September 17. And even that cut (blue) is disappearing. It was more than 100% ~10 days ago and is now 66% (34% no move) and continuing to fall. Source: Jim Bianco @biancoresearch

Investing with intelligence

Our latest research, commentary and market outlooks