Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It is important to be able to say "NO".

The difference between successful people and really successful people is that really successful people say no to almost everything" - Warren Buffet

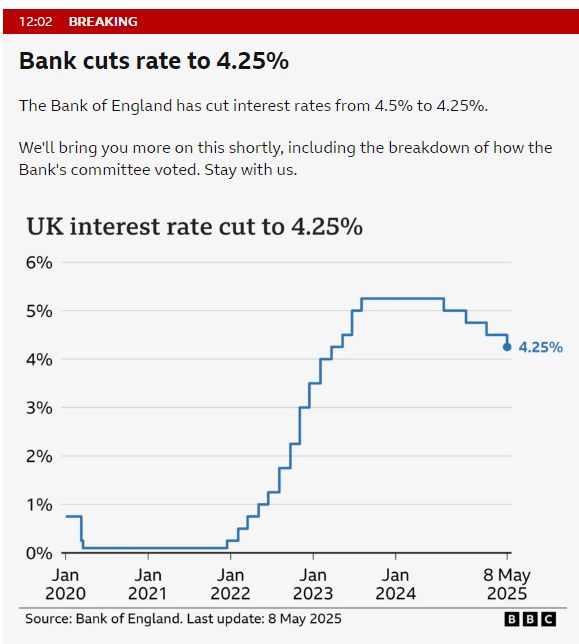

As expected, BoE cut rates by 25bps! (5-4 vote).

It came as Donald Trump hinted a UK-US trade pact was imminent. Some MIXED SIGNALS - Two members (Swati Dhingra and Alan Taylor) preferred to reduce Bank Rate by 0.5 percentage points, to 4%. Two members (Catherine L Mann and Huw Pill) preferred to leave Bank Rate unchanged, at 4.5%.

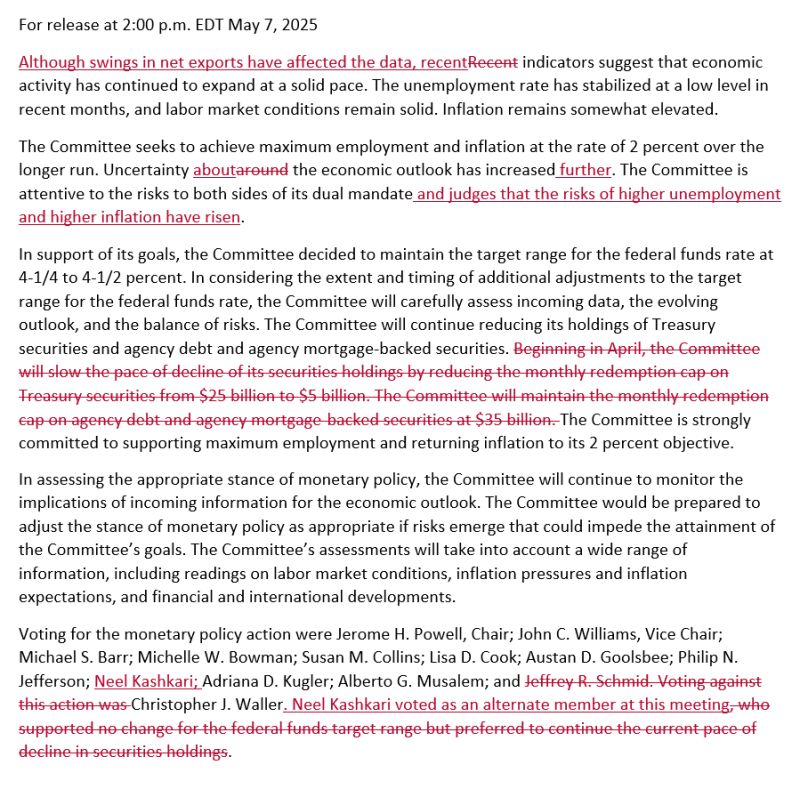

Fed leaves rates unchanged, as expected

“The committee … judges that the risks of higher unemployment and higher inflation have risen.” Powell is facing the worst outcome for a Fed President... The Federal Reserve's dual mandate is to promote two main economic goals: maximum employment and price stability... and uncertainty is on both sides How will President Trump react to this? ECB is cutting rates. PBOC as well as they see a disinflationary shock coming. Meanwhile, the Fed stays put. He is not going to like this...

Trump says he’d rescind global chip curbs amid ai restrictions debate -- bullish for $nvda 🤩

▶️ Nvidia shares rose on Wednesday on a report that the Trump administration plans to revise a set of chip trade restrictions called the “AI diffusion” rule. ▶️ The rule, which was proposed in the last days of the Biden administration, organizes countries into three different tiers, all of which have different restrictions on whether advanced AI chips like those made by Nvidia, AMD, and Intel can be shipped to the country without a license. ▶️ The Trump administration plans to rescind the rule, Bloomberg reported on Wednesday. The chip restrictions were scheduled to take effect on May 15. ▶️ Nvidia had no comment on the reported move by the Trump administration. ▶️ Chipmakers including Nvidia and AMD have been against the rule. AMD CEO Lisa Su told CNBC on Wednesday that the U.S. should strike a balance between restricting access to chips for national security and providing access, which will boost the American chip industry. Nvidia CEO Jensen Huang said earlier this week that being locked out of the Chinese AI market would be a “tremendous loss.” 🔴 However, this is more about Middle East than China. Indeed, the changes are taking shape as Trump readies for a trip to the Middle East, where a number of nations including Saudi Arabia and the UAE have bristled at restrictions on their ability to acquire AI chips. Source: Shay Boloor, CNBC

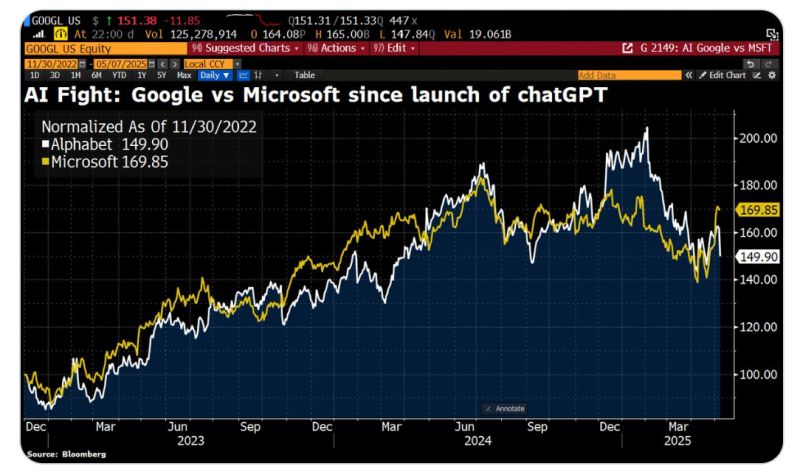

Alphabet shares tumble >7% on vibes.

Alphabet could be the next Eastman Kodak. Apple executive Eddy Cue revealed that the iPhone maker is exploring adding AI-powered search to its browser, after search activity in Safari declined for the first time ever in April. Apple is now considering alternatives to Google—including OpenAI, Perplexity, and Anthropic. "Today could mark a historic turning point in sentiment toward Alphabet," says Melius’s Reitzes. Source: HolgerZ, Bloomberg

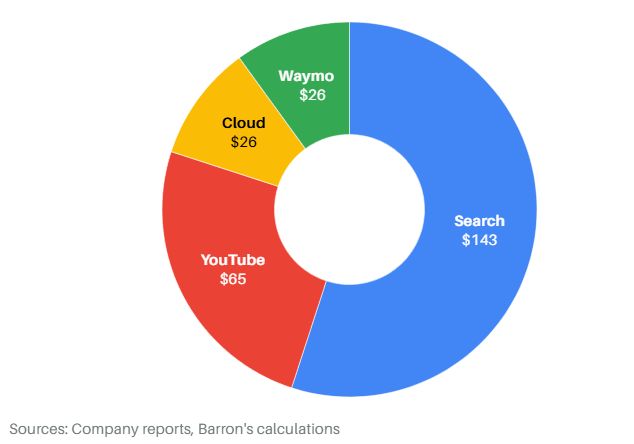

Alphabet is worth $260 per share according to Barron's ! This is 75% higher than current price ‼️

See below the key takeaways from their article "What an Alphabet Breakup Would Mean for Shareholders 👉 https://lnkd.in/eBx4EZiE As mentioned above, they end up with a "breakup value / sum of the parts" of $260. Even if they take off 50% of the Search value, they end up with $182 per share, or 20% HIGHER than the current price! Here's how they calculated it 👇 ➡️ Google Search: 17x EBITDA for 2025 The valuation would be $1.76T or $143/share. ➡️ YouTube:" 22x EBITDA for 2025 The valuation would be $800B or $65/share. ➡️ Google Cloud: 16x EBITDA for 2025 The valuation would be $320 billion or $26/share. ➡️ Waymo: Valuing Waymo is more complex. Uber is valued at $150B, while Tesla exceeds $1T (as of October 2024) The valuation would be 325B or $26/share. $GOOGL Source: Patient Investor on X

Donald Trump plans to announce a new trade pact with the UK on Thursday, in what could make Britain the first country to ease tariff tensions with the US

➡️ https://lnkd.in/eG8ABj8f Trump said in a post on his Truth Social platform on Wednesday that a “Big News Conference” was coming “concerning a MAJOR TRADE DEAL WITH REPRESENTATIVES OF A BIG, AND HIGHLY RESPECTED, COUNTRY”. The expected UK-US deal is one of 17 agreements that the Trump administration has been aiming to sign with its major trading partners as it rows back on the sweeping tariffs on countries around the world announced on April 2. The US president has been under pressure to deliver some early deals to show investors that he is serious about de-escalating the trade tensions that have caused huge volatility in markets in recent weeks. But US officials have also insisted that a wide range of countries have made offers to Washington in the hope of clinching deals to put a lid on their trade disputes with Trump. The scope and details of the pact expected on Thursday with the UK was not clear, including whether further negotiations will be needed to finalise it, and how much relief from US tariffs Britain will get. The Financial Times reported on Tuesday that Washington and London were close to agreeing a trade pact that would offer lower-tariff quotas for British cars and steel exports, which were hit by 25 per cent levies by Trump earlier this year. Such tariff relief would help offset the impact of Trump’s “liberation day” levies on UK exports to the US — which were set at the baseline rate of 10 per cent last month. Source FT

The Gold/Silver Price Ratio is now trading at 102x, the highest level in history since the U.S.

Dollar came off the Gold Standard (excluding the Covid scare) Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks