Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Who will be right?

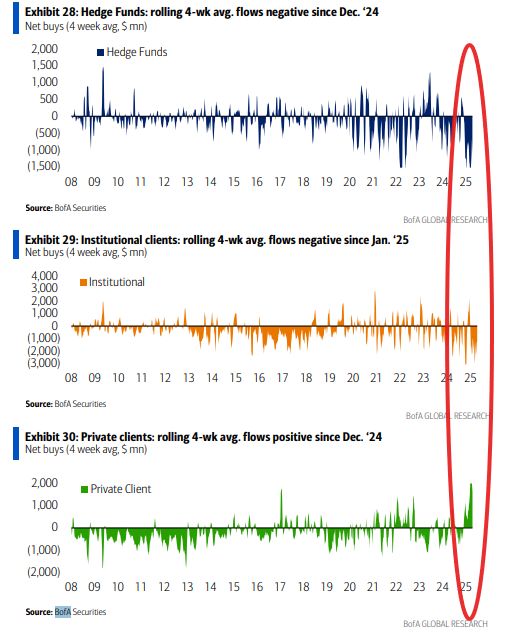

BoA hedge fund clients around record low (to 2008) 4-wk net buying flows. Institutions also have been big sellers, while retail at record highs. Neil Sethi @neilksethi

🔴 XAI AND PALANTIR PARTNER TO ACCELERATE AI IN FINANCIAL SERVICES

▶️ xAI has partnered with Palantir to drive AI adoption in the financial services sector, focusing on developing AI-driven solutions for businesses. The partnership, unveiled on May 6, extends an earlier collaboration with TWG Global. The collaboration aims to implement AI to enhance growth and operational efficiency, especially in the financial sector, by using "modular AI agents" tailored to specific business needs. AI’s integration at the C-suite level is key to its success, according to both companies, as they seek to unlock AI’s full potential in financial operations. Source: PYMNTS thru Mario Nawfal

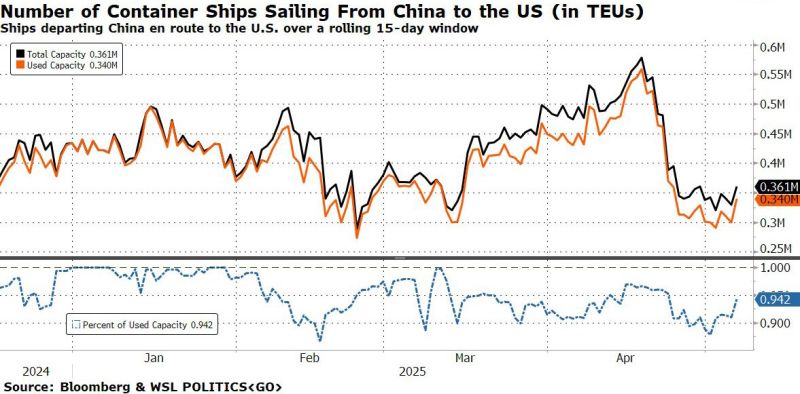

Ships sailing from China to US hits 2 week high.

But Long Beach was supposed to be a ghost port... @zerohedge

Rising smoke is coming out from Bundestag (image courtesy from HolgerZ on X))

German Lawmakers back CDU/CSU's Merz in 2nd Bundestag vote w/325 votes out of 630 lawmakers. ✔️ Friedrich Merz was elected as Germany’s chancellor in a second-round parliamentary vote on Tuesday, after failing to secure the necessary support earlier in the day. ✔️Merz needed at least 316 of the 630 members of parliament to vote in his favor. He received 325 votes. ✔️The German Dax stock market index pared losses after the result of the second vote

Investing with intelligence

Our latest research, commentary and market outlooks