Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

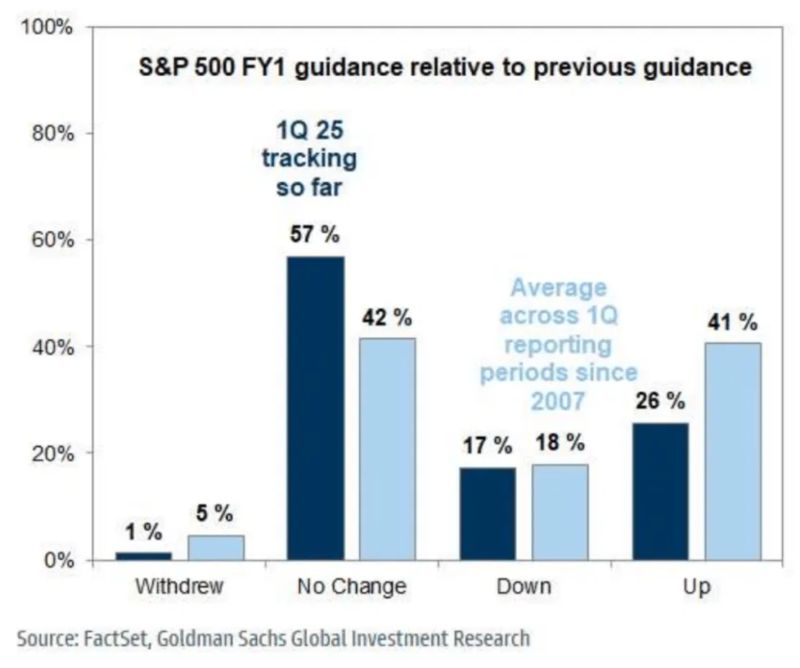

So far very few US earnings downgrades...

Source: GS, Ronnie Stoeferle @RonStoeferle

U.S. rejects Japan's exemption from "reciprocal" tariffs - Kyodo

▶️ The United States has refused Japan's full exemption from not only a 10 percent "reciprocal" tariff but a country-specific tariff in recent negotiations, sources close to the matter said Monday. ▶️ U.S. officials including Treasury Secretary Scott Bessent told Japan's top negotiator Ryosei Akazawa in their meeting in Washington last week that the administration of President Donald Trump intends to put only a cut in the 14 percent country-specific tariff, suspended through early July, on the negotiating table, the sources said. ▶️ The U.S. side stressed in the second round of the negotiations that it will only consider extending the 90-day suspension or lowering the 14 percent tariff depending on the progress of their talks, according to the sources.

The recent outperformance of european vs. US equities in context

Source: Michel A.Arouet, @Augur Infinity

German benchmark index Dax slips, as Merz falls short of majority in initial German parliament vote.

Friedrich Merz failed to be elected German chancellor Tuesday, after he fell short of securing a majority in a shock first-round parliamentary vote. Merz needed at least 316 votes to become chancellor and only 310 members of parliament voted in his favor. Germany’s Bundestag has a total of 630 members. The result marks an unanticipated setback for Merz who was widely expected to secure the necessary votes and be officially sworn in later in the day. After the result of the vote was announced the parliamentary session was halted to allow for discussion of next steps. The German Dax stock market index extended losses to trade around 1.4% lower by 10:07 a.m. London time. A second vote needs to take place within 14 days, according to the German constitution, with an absolute majority needed once again. There are also protocols in place in case the second vote also fails to elect a chancellor. Source: CNBC, Bloomberg, HolgerZ

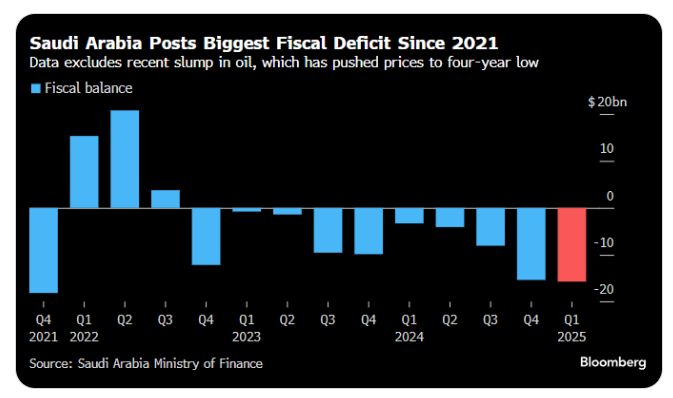

Saudiarabia posted a $16 bn budget deficit in the first 3 months of 2025

That's already well over half of the $27 bn the government had budgeted for the entire year. Oil averaged $75 in the first quarter of 2025 -- it's now near $60 Source: Ziad Daoud @ZiadMDaoud, Bloomberg

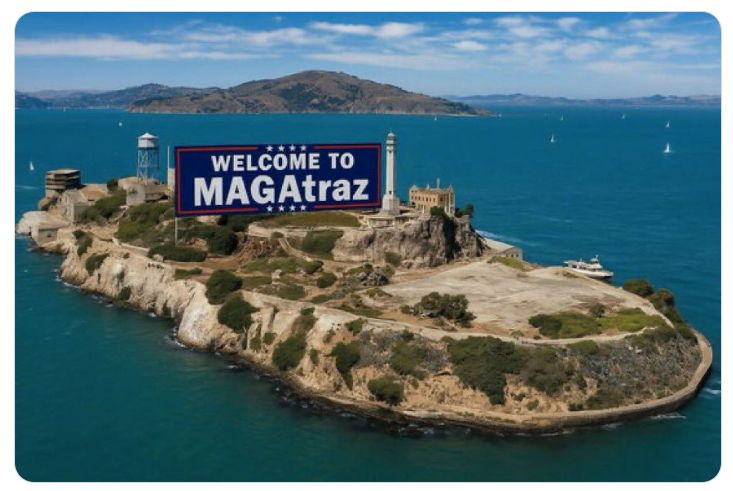

Grand opening coming soon! Trump orders reopening of Alcatraz prison for ‘most ruthless offenders’

▶️ Trump orders reopening of Alcatraz prison for ‘most ruthless offenders’ Plan to expand and reuse long-shuttered penitentiary off San Francisco described as ‘not serious’ by Nancy Pelosi ▶️ Donald Trump has said he is directing the administration to reopen and expand Alcatraz, the notorious former prison on an island off San Francisco that has been closed for more than 60 years. ▶️ California Democrats called the idea “absurd on its face” and part of the US president’s strategy of political distraction. Other officials pointed to the closure of the prison complex in 1963, known for its brutal conditions, due to operational expense and the high number of (unsuccessful) escape attempts. ▶️ “Alcatraz closed as a federal penitentiary more than 60 years ago. It is now a very popular national park and major tourist attraction. The president’s proposal is not a serious one,” the California Democratic congresswomen and former House speaker Nancy Pelosi said. ▶️ In a post on his Truth Social site on Sunday evening, Trump wrote: “For too long, America has been plagued by vicious, violent, and repeat Criminal Offenders, the dregs of society, who will never contribute anything other than Misery and Suffering. When we were a more serious Nation, in times past, we did not hesitate to lock up the most dangerous criminals, and keep them far away from anyone they could harm. That’s the way it’s supposed to be.” Source: Gunther Eagleman™ on X, The Guardian

India has proposed zero-for-zero tariffs on U.S. auto parts and steel, according to Bloomberg

Amid continued trade talks with Washington, India has reportedly proposed to charge zero tariffs on steel, auto components and pharmaceuticals from the US on a reciprocal basis. According to a report by Bloomberg quoting people familiar with the development, the reciprocal tariffs have been offered up to a certain quantity of imports from the US. Beyond the set limit, imported industrial goods would attract the regular level of duties, the sources said. The offer was reportedly made by trade officials from the Indian side who visited Washington in late April to expedite negotiations on a bilateral trade deal. A deal is expected to be closed by autumn this year, the report quoted the sources as saying.

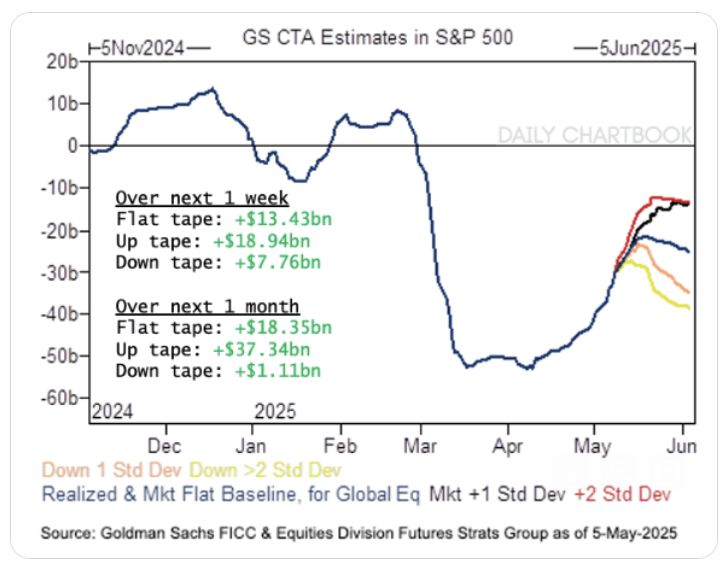

According to Goldman Sachs, CTAs are projected to buy US stocks in EVERY SINGLE SCENARIO over the next week and month.

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks