Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Another enormous climb in the Taiwanese dollar today, up almost 8% over the last two sessions against the USD, by far the biggest two-day increase on record.

▶️ So what's going on? The Taiwanese dollar (TWD) has been surging due to a combination of economic, trade, and market factors in 2025: ✔️ Easing Trade Tensions: Speculation about reduced U.S.-China trade tensions, particularly following indications that China is open to trade talks with the U.S., has boosted optimism for Taiwan’s export-driven economy. ✔️ Strong Economic Growth: Taiwan’s GDP grew at an annualized rate of 9.67% in Q1 2025, with annual growth of 5.37%, surpassing forecasts. A ✔️ Tech Sector Strength: Strong U.S. tech earnings, particularly from companies like Microsoft and Meta, have signaled sustained demand for AI and semiconductors, where Taiwan plays a critical role through companies like TSMC. This has driven foreign capital inflows and supported TWD appreciation.

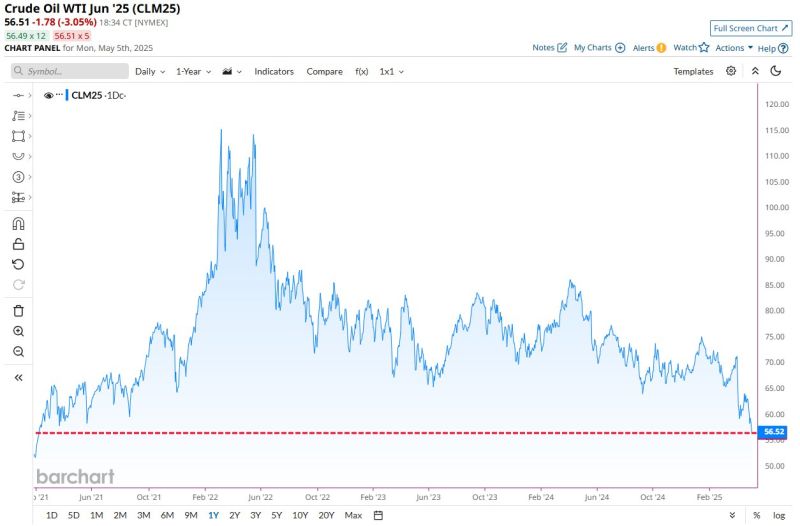

🔴 BREAKING 🚨: Crude Oil is on track for its lowest closing price since February 2021 📉📉

➡️ U.S. crude oil prices fall more than 4% after OPEC+ agrees to surge production in June ➡️ The eight producers in the group, led by Saudi Arabia, agreed on Saturday to increase output by another 411,000 barrels per day in June. The decision comes a month after OPEC+ surprised the market by agreeing to surge production in May by the same amount. ➡️ The June production hike is nearly triple the 140,000 bpd that Goldman Sachs had originally forecast. OPEC+ is bringing more than 800,000 bpd of additional supply to the market over the course of two months. Source: Barchart, CNBC

The Warren Buffet Way..

Since 1964, Berkshire Hathaway has delivered a staggering return of over 5,500,000% That’s 5.5 million percent… To put it in perspective: a $10,000 investment back then would be worth $550 million today Source: Stocktwits @Stocktwits

Warren Buffet's portfolio as of 31st of March 2025

Source: Investywise

🔴 EU airlines saying they’re going to start buying Chinese planes instead of American planes…

▶️ The boss of Ryanair has threatened to cancel orders with American aircraft maker Boeing and buy from Chinese manufacturers instead if Donald Trump’s trade tariffs push up costs. ▶️ In a letter to top US lawmakers, Michael O’Leary criticised Washington’s trade war with Beijing and warned that a “material” impact on the price of aircraft could prompt his company to take its business elsewhere. ▶️ The Irishman said Ryanair could even turn to state-owned Commercial Aircraft Corporation of China (Comac), a threat sure to anger Mr Trump, who has made isolating China a key aim of his trade war. ▶️ Ryanair, the largest carrier in Europe, is currently waiting on the delivery of 29 Boeing 737 Max 200 planes, out of a total order of 210. It has also ordered 150 Max 10 jets, the largest in the 737 family, for delivery from 2027 with the option of another 150 afterwards. Source: Yahoo Finance

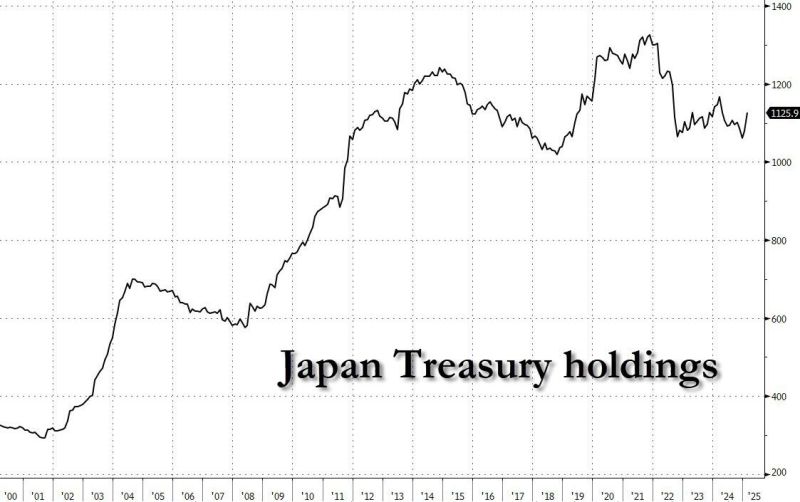

Did Japan's finance minister threaten liquidation of US Treasuries?

Addressing a question on a Tokyo TV program on Friday, Japan Financial Minister Kato said the country's $1.1 trillion in Treasury holdings - the highest of any foreign creditor - could be a "negotiation card" in its trade talks with Washington but "whether or not we use that card is a different decision." In other words, Japan is threatening to sell some/all of its $1.1 trillion in bonds if tariffs are imposed. NLI Research Institute said just minutes after the TV remarks, "Katsunobu Kato’s comments on US Treasuries could be interpreted as dangerously provoking the US government." He added that for the US, unstable long-term rates are a concern, and having Japan continue to hold US Treasuries is beneficial, while maintaining fiscal soundness and the dollar’s status as the reserve currency are important issues that would have positive effects in the medium to long term. Translation: chaos in the US would be painful, but it would be catastrophic for Japan. Source: www.zerohedge.com

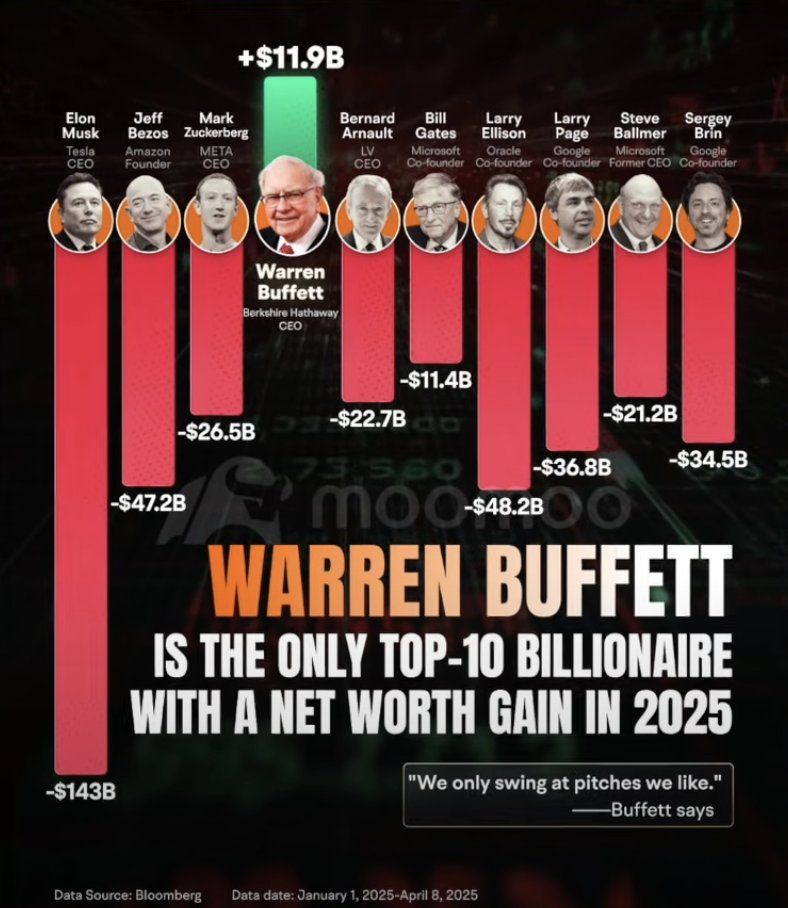

Only Warren Buffett is getting richer right now.

Source: Dividendology

Investing with intelligence

Our latest research, commentary and market outlooks