Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

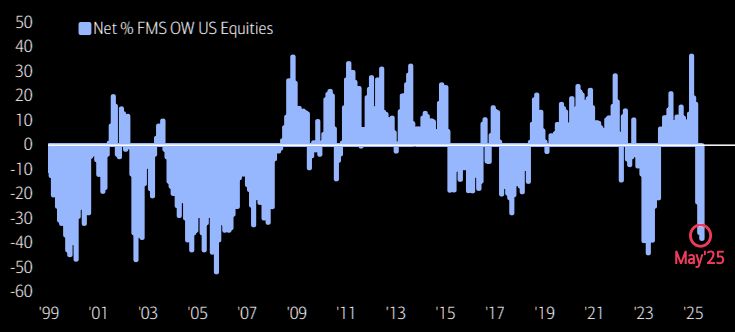

BREAKING 🚨: Fund Managers

Fund Managers have missed out on the recent stock surge after recently reducing their equity exposure to the lowest levels in 2 years 👀 Source: Barchart, BofA

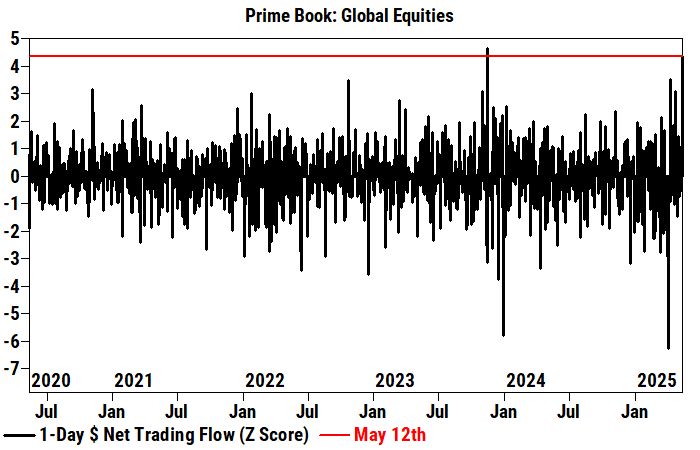

Hedge fund capitulated with second biggest short covering panic on record during Monday melt-up 🚀

On Monday, the Goldman Prime Brokerage Global equities book saw the second largest notional net buying in 5 years (+4.3 sigma), driven by short covers and to a lesser extent long buys (1.6 to 1). All regions were net bought, led by North America and to a lesser extent Europe (both led by short covers). Goldman HF Prime report shows that hedge funds net bought US equities at the fastest pace since Apr 9th (+4.0 sigma one-year), driven by short covers and long buys (1.5 to 1). Single Stocks / Macro Products were both net bought and made up 53% / 47% of the total notional net buying, led by short covers / long buys, respectively. Source: Goldman, zerohedge

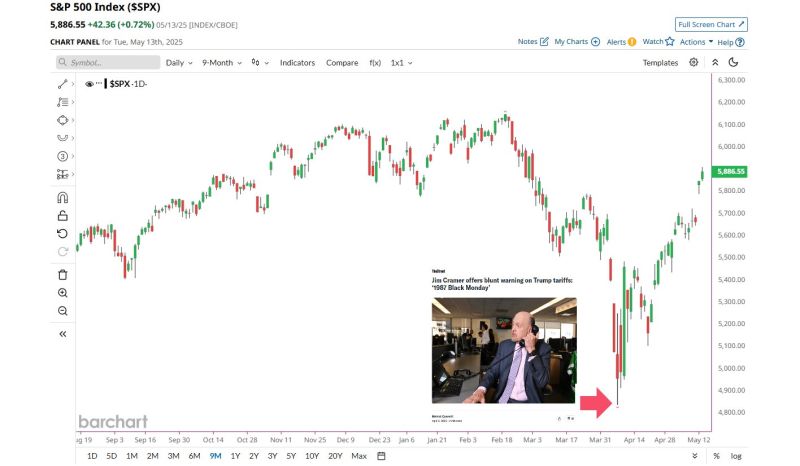

Jim Cramer Remains Undefeated His "Black Monday" warning occurred at the EXACT time that the Stock Market bottomed.

S&P 500 is now in a bull market Source: Barchart

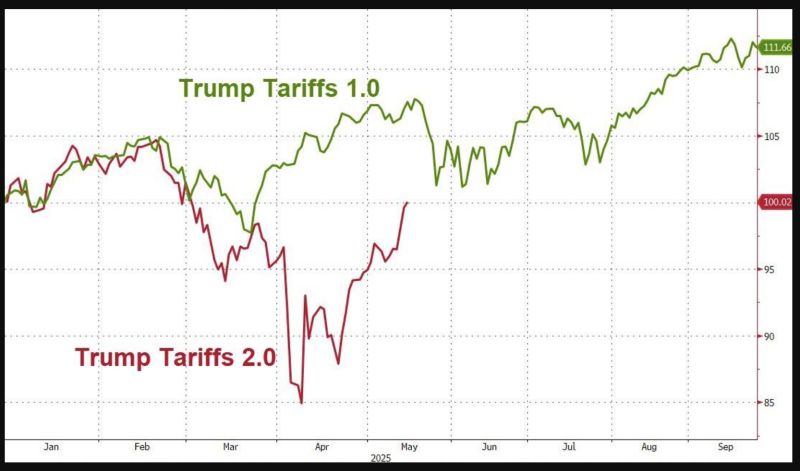

"History does not repeat itself but often rhymes" - Mark Twain

On the back of lower than expected inflation CPI report yesterday, the S&P 500 joined the Nasdaq 100 in the green year-to-date, erasing all of the April pullback. The S&P 500 Trump Tariffs 2.0 line is catching up with the Trump Tariffs 1.0 one... Source: zerohedge

Yesterday, NVIDIA announced a strategic partnership with HUMAIN, a subsidiary of Saudi Arabia’s Public Investment Fund (PIF), to advance AI and digital infrastructure.

The key components of this partnership include: 👉 AI Factories and Infrastructure: NVIDIA and HUMAIN will develop hyperscale AI data centers with a projected capacity of up to 500 megawatts, powered by several hundred thousand of NVIDIA’s advanced GPUs over the next five years. The initial phase involves deploying an 18,000 NVIDIA GB300 Grace Blackwell AI supercomputer with NVIDIA InfiniBand networking. 👉 NVIDIA Omniverse Platform: HUMAIN will implement NVIDIA’s Omniverse platform as a multi-tenant system to create digital twins, enhancing efficiency and safety in sectors like manufacturing, logistics, and energy. This supports Saudi Arabia’s Industry 4.0 goals.

🔵 Here are the key takeaways from President Donald Trump's "lavender carpet" visit to Saudi Arabia yesterday:

✔️ Economic Deals and Investments: Trump secured a $600 billion investment commitment from Saudi Arabia into the U.S. economy, focusing on sectors like AI, energy, infrastructure, and defense. This included a $142 billion arms deal, described as the largest defense cooperation agreement in U.S. history, covering air and missile defense, maritime security, and more. Additional deals involved U.S. companies like Google, Oracle, and Boeing, with Saudi investments in AI data centers and energy infrastructure. ✔️Lifting Sanctions on Syria: Trump announced the lifting of U.S. sanctions on Syria, in place since 1979, to support the country’s reconstruction under its new leadership following the fall of Bashar al-Assad. This decision was made at the request of Saudi Crown Prince MBS and was celebrated in Syria as a step toward economic recovery. Trump also planned a brief meeting with Syria’s new president, Ahmed al-Sharaa, in Riyadh.

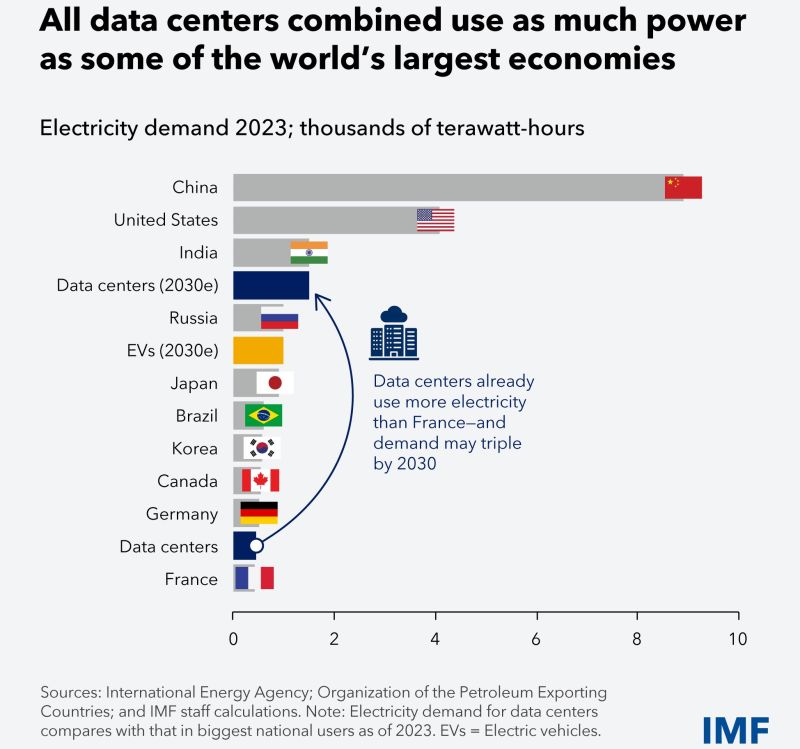

All data centers combined use as mich power as some of the world's largest econnomies

Source: IMF

Recession Cancelled?

McDonald's $MCD to hire 375,000 workers this summer 🚨🚨🚨 Source: Barchart, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks