Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

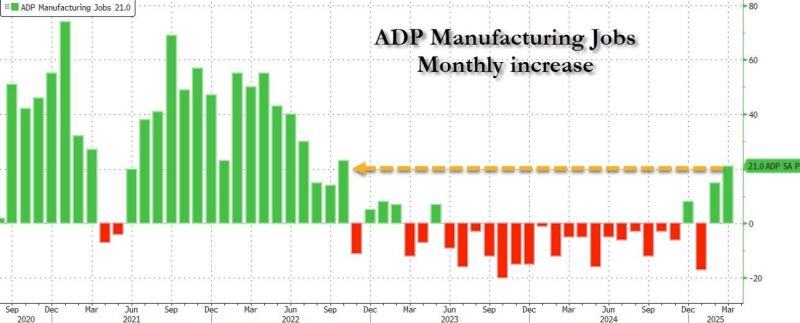

Is Trump's plan to reshore manufacturing already working?

This is the biggest increase in manufacturing jobs since October 22, which was followed by a 2 year manufacturing recession. Source: Bloomberg, www.zerohedge.com

The Magnificent 7 is officially in bear market territory 🐻

Source: Koyfin

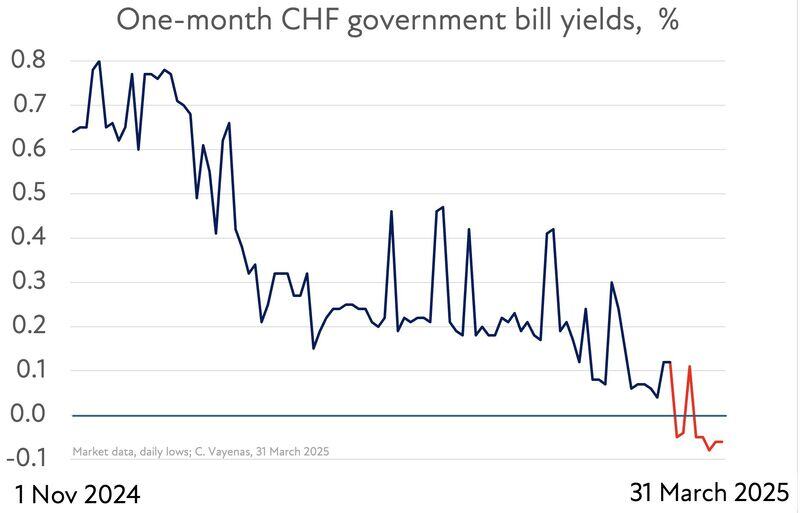

Negative interest rates have made a return in Switzerland, as noted by Costa Vayenas

Specifically, the one-month CHF government bill yield indicates a scenario where holders of Swiss francs are willing to pay the borrower instead of receiving interest. Source: C. Vayenas

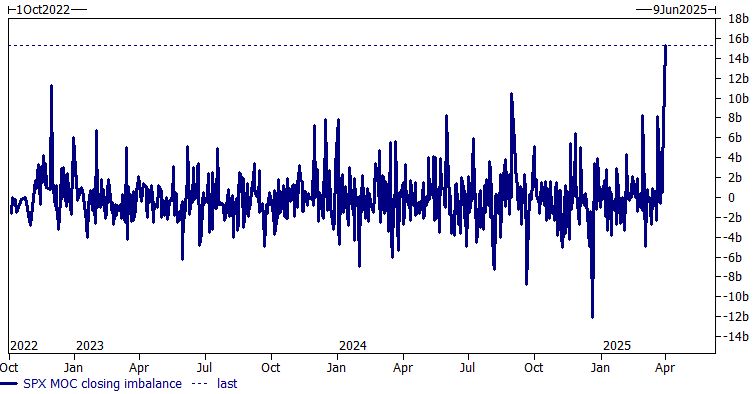

The SP500 clawed back earlier losses on Monday to end the session higher after briefly touching six-month low.

However, the tape wasn't all that bullish despite the big reversal. Indeed, Tech completed a top relative to $SPY while defensive stocks completed a bottom. Not the kind of risk appetite you want to see on a rally. Source: Steven Strazza

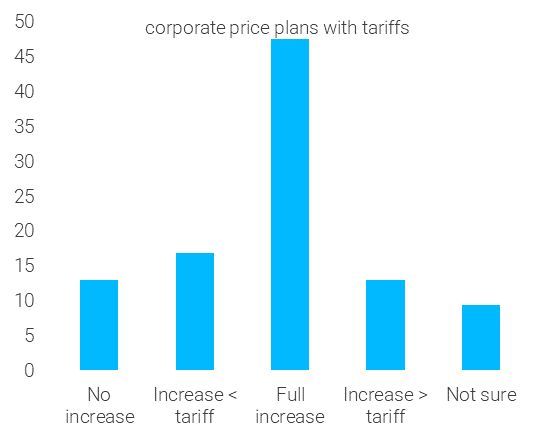

Richmond Fed asked companies how the plan to respond to tariffs.

Strong majority plan to raise prices... Source: Dario Perkins @darioperkins on X

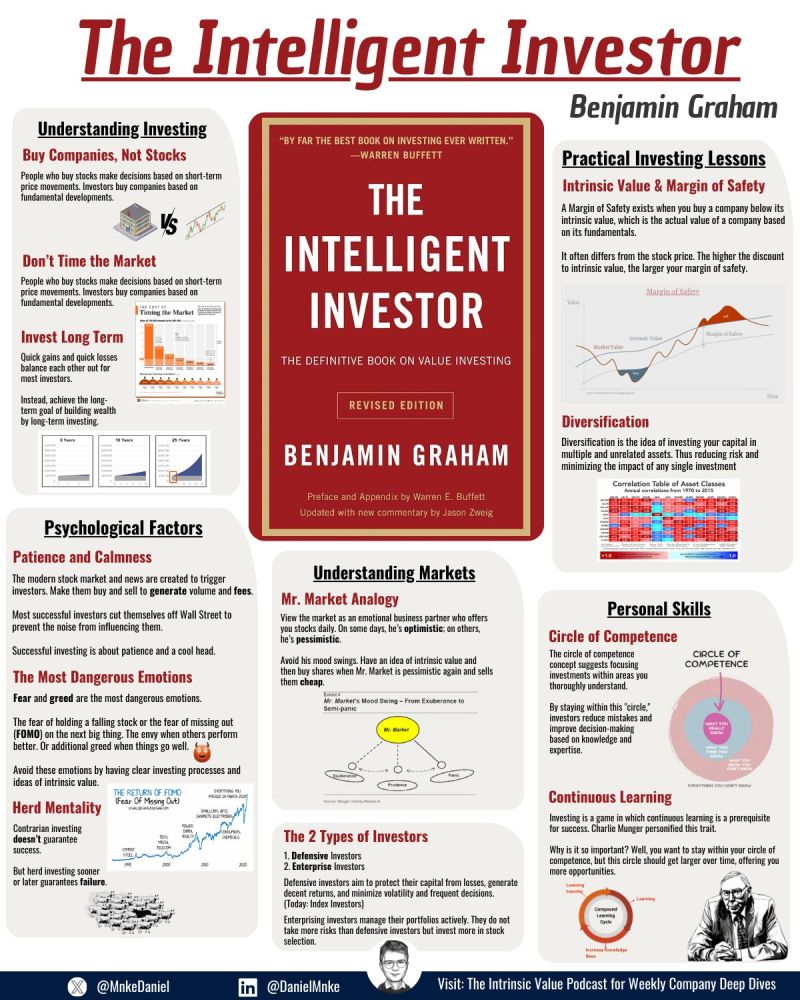

One-Pager on The Intelligent Investor:

Source: Daniel @MnkeDaniel

Investing with intelligence

Our latest research, commentary and market outlooks