Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

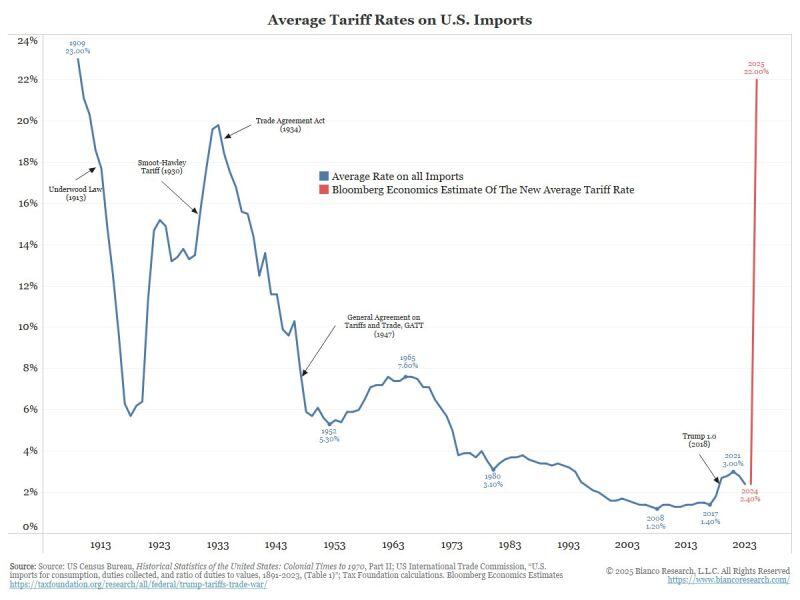

Bloomberg Economics estimates that the average tariff rate the US charges on around $3T of imported goods will now go up to 22%- the highest in a century

But remember, this is NOT a final number. Many things can happen. - China could negotiate a deal (or try to absorb the shock via more stimulus and weakening of the Yuan) - The EU could chose to retaliate - and the US escalates... - How will the rest of the world respond is very uncertain as well Expect a new high in the economic uncertainty index and lots of volatility ahead Source: chart: Bianco Research

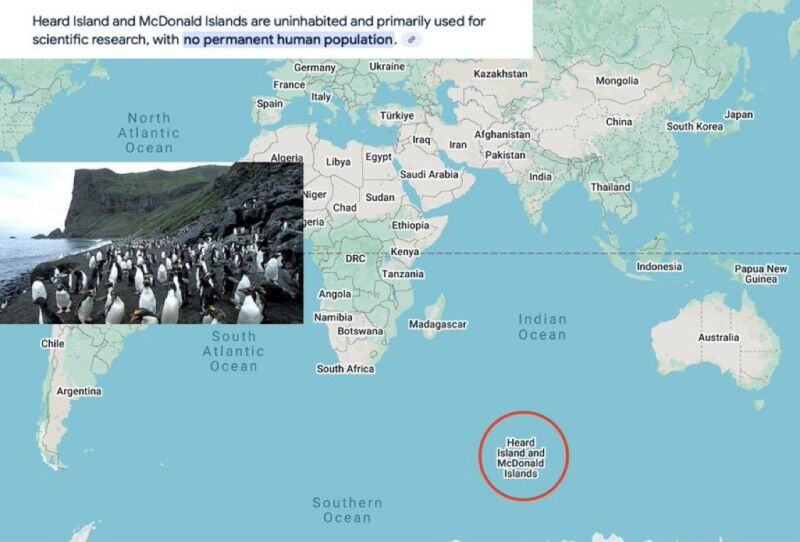

U.S. President Trump imposed a 10% tariff on Heard and McDonald Islands—uninhabited except for penguins.

Source: Clash Report @clashreport

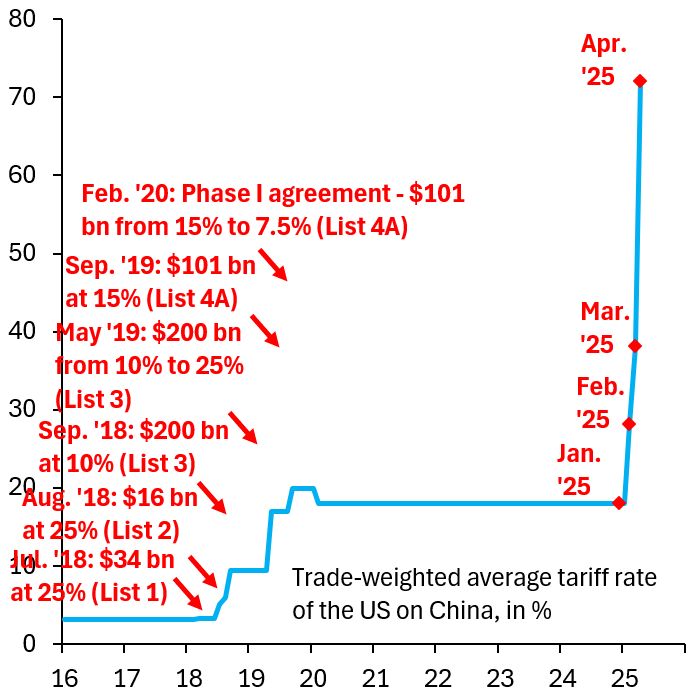

If the 34% tariff is on top of previous tariffs, China's average tariff rate is up 54 ppts this year, swamping what was done in President Trump's first term.

Question: How will China react? If China devalues the Yuan, that could trigger a major risk-off across the world... Source: Robin Brooks

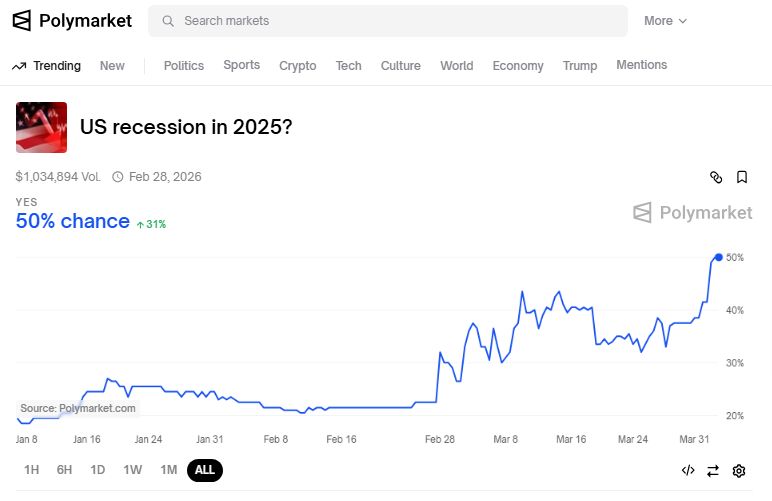

JUST IN 🚨:

The odds of a U.S. Recession occurring this year just soared to 50% on Polymarket 👀 Source: Barchart

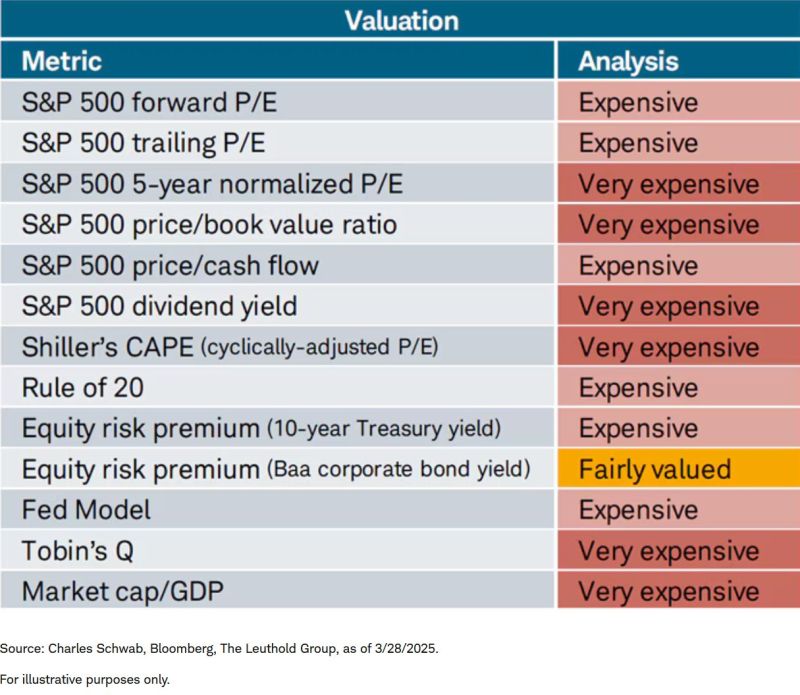

Despite the pullback, the S&P 500 is still NOT cheap:

As shown below, the US stock market is expensive or very expensive on 12 out of 13 valuation indicators, according to Charles Schwab analysis. Metrics like 5-year normalized P/E, P/B or Shiller's CAPE are still historically elevated despite the sell-off. Source: Charles Schwab, The Leuthold Group, Bloomberg thru Global Markets Investor

Physical gold craziness...

The big 3 vaults (Brinks, JPM, HSBC), are running out of space where to store the physical; the 3 alone hold more than 35 million oz of physical.

Investing with intelligence

Our latest research, commentary and market outlooks