Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Is D.O.G.E going global ???

➡️ “What Europe needs is a DOGE,” Deutsche Telekom CEO Tim Höttges told an audience at the Mobile World Congress in Barcelona. ➡️ Höttges made a renewed call for Europe to cut down on barriers to market consolidation in Europe’s telecoms industry and consider charging U.S. tech giants to use mobile carriers’ networks. ➡️Elon Musk’s Department of Government Efficiency has looked to slash spending at federal government agencies, making huge job cuts at various different departments. https://lnkd.in/eJDZc4DS

It seems that the market didn't like this chart at all

(ISM Manufacturing New orders & Price Paid) Source: Bloomberg, RBC

‼️ Alert: Unconfirmed reports that President Trump will announce that the US is leaving NATO in his joint address to US Congress tomorrow!

Source: US Homeland Security News @defense_civil25 on X

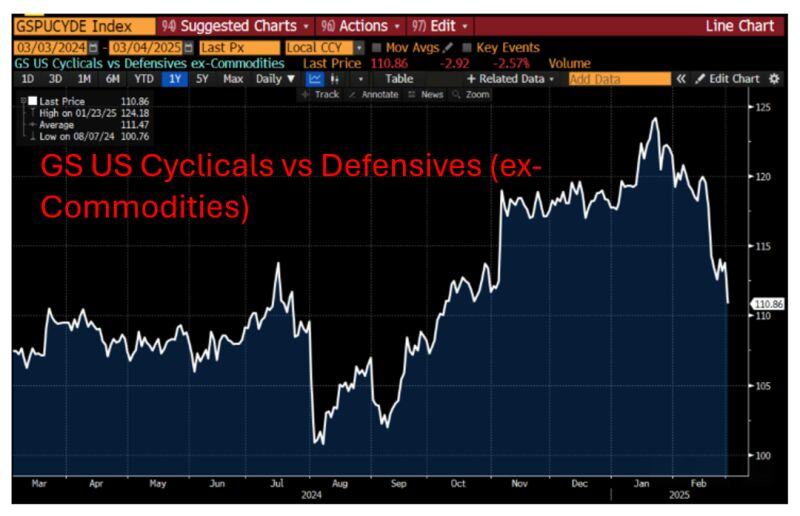

A clear message from the market:

Cyclicals vs defensives peaked in late January, with underperformance accelerating in mid-February. If you add to this the inverted 3m-10y yield curve, the odds of recession are on the rise. Source: Bloomberg, RBC

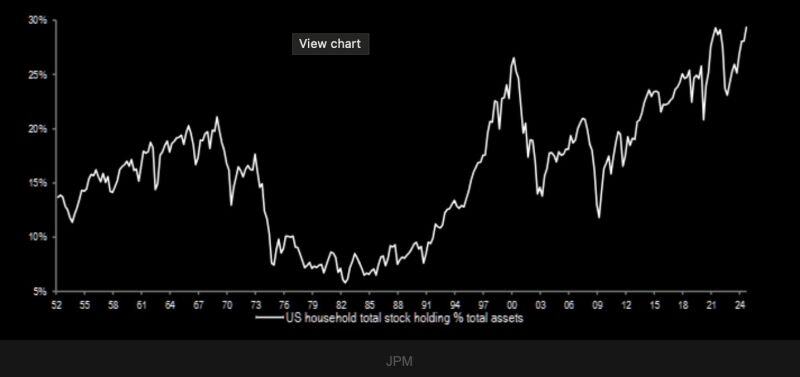

U.S. households now have the biggest allocation to stocks in history

Source: Win Smart, CFA @WinfieldSmart

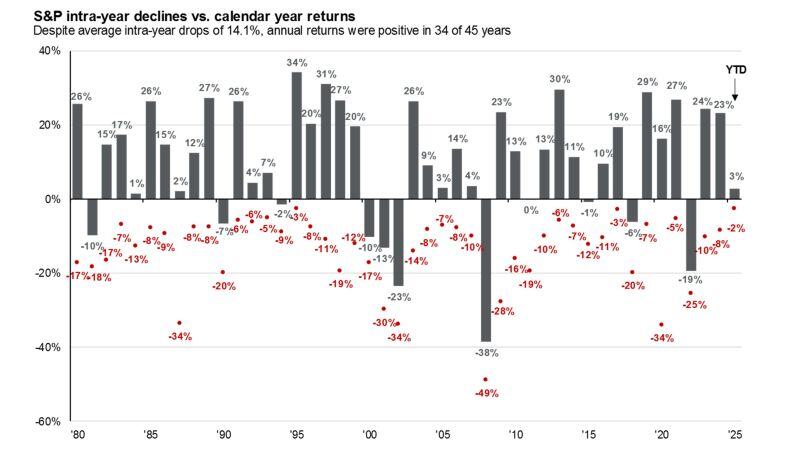

Remember: The average $SPX intra-year drawdown is 14.1%

Source: Bloomberg, Mike Zaccardi, CFA, CMT, MBA

"Be Greedy When Others Are Fearful"

One of Warren Buffett’s most famous quotes is to “be greedy when others are fearful.” Unfortunately, many anxious investors can’t stomach losses in the stock market, causing them to go to “all cash” at exactly the wrong times. Take large declines, for example. Since WW2, the S&P 500 has fallen more than 15% in nine different quarters. Following every single instance, the index was higher a year later with an average one-year gain of 25.1%. Similarly, the S&P 500 has had two-quarter drops of 20%+ just eight times, and over the next year, the index was up by at least 17% with gains every single time. source : bespoke

Investing with intelligence

Our latest research, commentary and market outlooks