Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

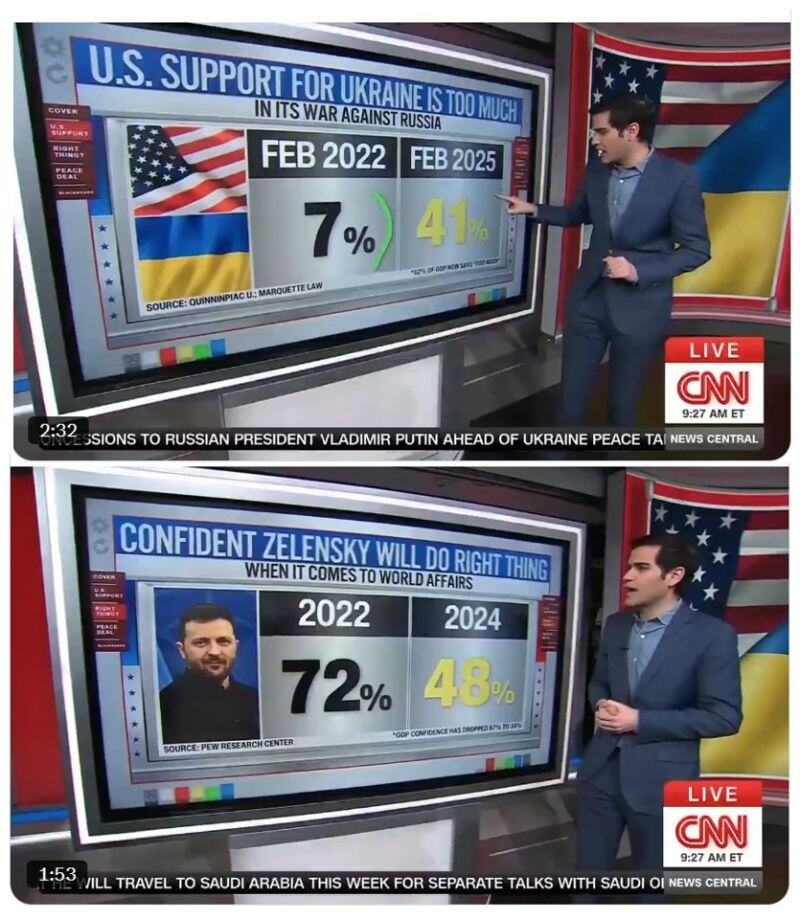

It seems that US opinion on Ukraine spending and Zelensky is starting to turn.

These numbers are from CNN which is definitely NOT pro-Trump. 👉 More people now think the U.S. is helping Ukraine too much—up from 7% to 41%. 👉On top of that, trust in Zelensky fell from 72% to under 48%

You can add Prague to the list of countries around the world making new highs.

There are more and more countries making new highs, not fewer. A broadening bull market is a positive development. Source: J-C Parets

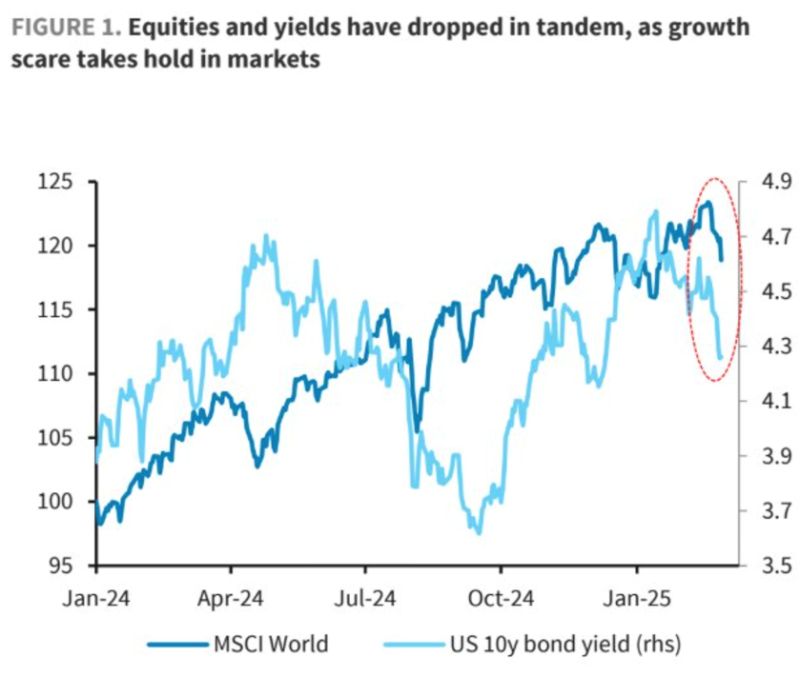

We have seen some positive correlation between bond yields and stocks recently.

Adding long-dated US Treasuries as a portfolio hedge now makes more sense. Source: Bloomberg, Barclays

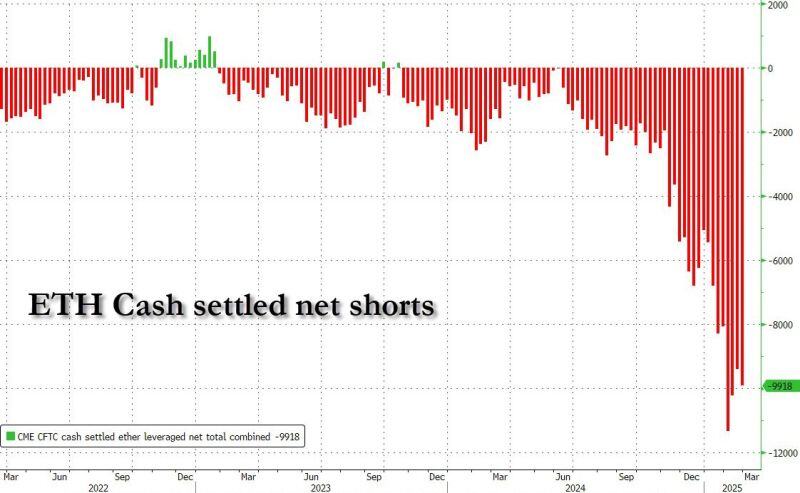

JUST IN: Over $330,000,000,000 added to the cryptocurrency market in the past 4 hours.

Source: www.zerohedge.com

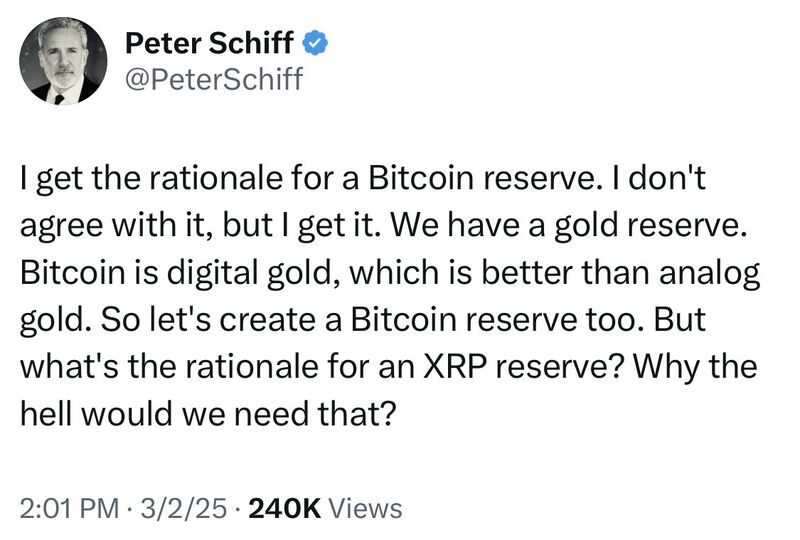

The idea of XRP, SOLANA and CARDANO in a strategic U.S. reserve is so retarded that even Peter Schiff is becoming a Bitcoin maximalist.

Source: The ₿itcoin Therapist @TheBTCTherapist

Updated technical chart on bitcoin by J-C Parets.

👉 102 level is the big one. 155 is next. 242 after that. Source: J-C Parets

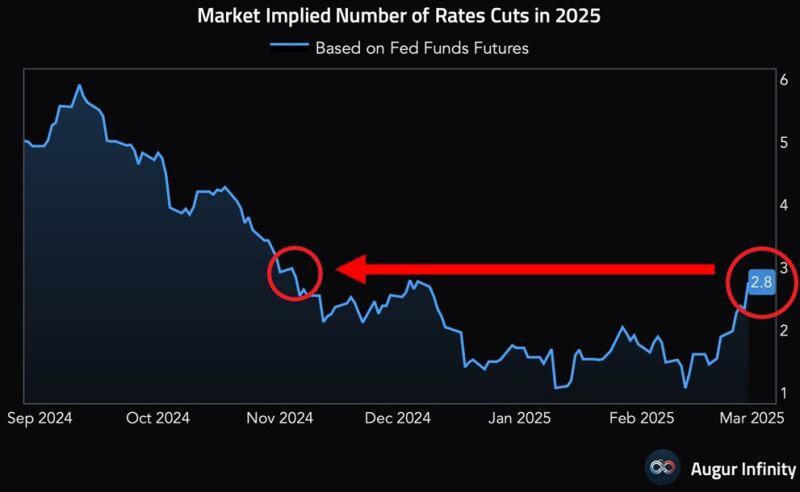

⚠️Markets are RAPIDLY shifting again:

The market is pricing in almost 3 Fed rate cuts in 2025, the highest since November. This is up from just 1 reduction expected just 2 weeks ago. This comes as US economic data has deteriorated sharply, and Treasury yields have dropped. Source: Global Markets Investor, Augur Infinity

Investing with intelligence

Our latest research, commentary and market outlooks