Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Japan’s 30y govt bond yield jumped 10bps to 3.50%, its highest level since at least the 1990s.

The move comes amid growing speculation that PM Sanae Takaichi may dissolve parliament as early as next month, following reports in local media. Source: Bloomberg, HolgerZ

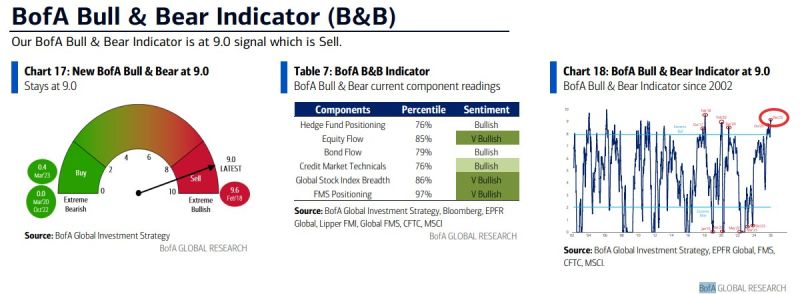

BofA Bull & Bear Indicator (B&B)

The revamped BofA Bull & Bear Indicator is now at 9.0, exceeding the 8.9 on Oct 1st which was “an extreme bullish level last seen in Feb’18 & Feb’20,” and remaining above the “contrarian sell signal” level. “[Outflows from tech stocks & EM debt [were] offset by very strong global equity breadth (98% of country indices above 200dma), super-low BofA Global FMS cash positions (record low 3.3%), hedge funds adding to S&P 500 longs via futures; new revamped B&B Indicator 8.5 on Dec 17th, 8.8 on Dec 24th, 9.0 on Dec 31st [and Jan 7th]” Source: BofA through Neil Sethi

Fed Chair Powell says he’s under criminal investigation, won’t bow to Trump intimidation

Jerome Powell just dropped a bombshell. Federal prosecutors are officially investigating the Fed Chairman over a $2.5 billion renovation project. But according to Powell, this isn't about construction costs. It’s about independence. Here is what you need to know: The Charges: Grand jury subpoenas have been served regarding the $2.5B HQ renovation and Powell’s related testimony to Congress. The Conflict: Powell explicitly linked the probe to President Trump’s frustration over interest rate decisions. The Stakes: This isn't just a legal battle; it’s a fight for the soul of the central bank. Powell warns that if political pressure wins, evidence-based policy loses. The Market Reaction: Stock futures are already sliding as investors digest the news. Gold, Silver and Cryptos are up. The dollar is slightly down Why this matters for every professional: Central bank independence is the bedrock of global financial stability. If monetary policy becomes a political tool, the rules of the game change for everyone—from Wall Street to Main Street. Powell’s message is clear: Is the Fed driven by data or intimidation? The outcome of this investigation won't just impact Powell’s career—it will redefine the future of the Fed independence.

"US flip from exceptionalism to expansionism is best case for a contrarian US dollar long" (BofA Hartnett)

Source: TME

THE MINERALS MAP THAT RUNS THE WORLD

Who controls the supply? By Jack Prandelli

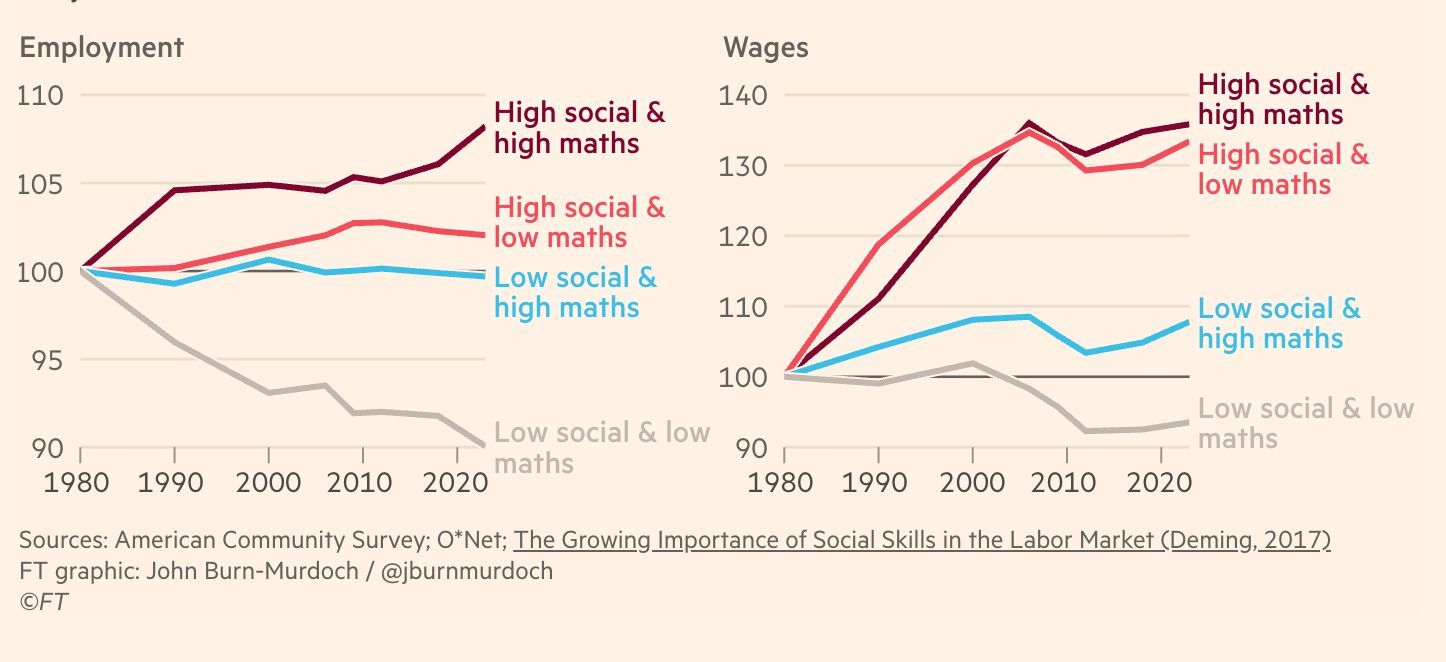

A fascinating chart that shows how important social skills really are.

High social skills + High maths skills = holy grail Source: nxthompson @nxthompson, FT

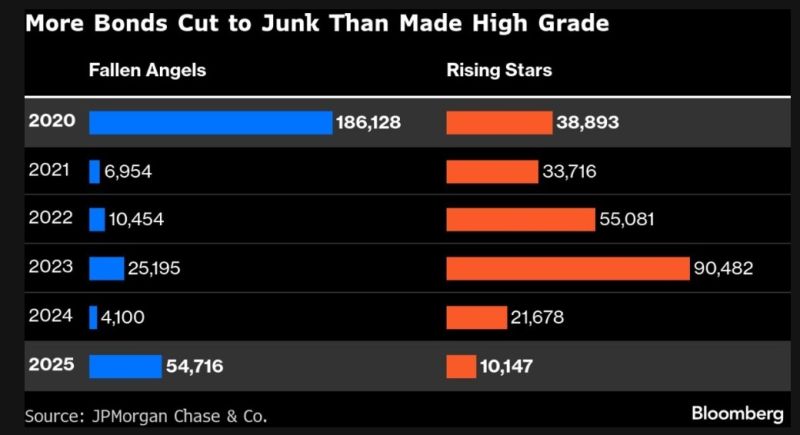

More Bonds Are Teetering on the Brink of Junk

JPMorgan doesn’t anticipate market turmoil anytime soon. Demand from investors is still strong, and earnings will probably be relatively strong in the coming weeks, leaving spreads relatively rangebound. But there are still risks in credit. About $55 billion of US corporate bonds migrated from investment-grade to junk status in 2025, becoming “fallen angels,” according to JPMorgan. That far exceeds last year’s $10 billion of “rising stars,” or firms elevated to high-grade. And the trend is set to continue, the strategists say. Source: Bloomberg, Tracy Shuchart (𝒞𝒽𝒾 ) @chigrl

Investing with intelligence

Our latest research, commentary and market outlooks