Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

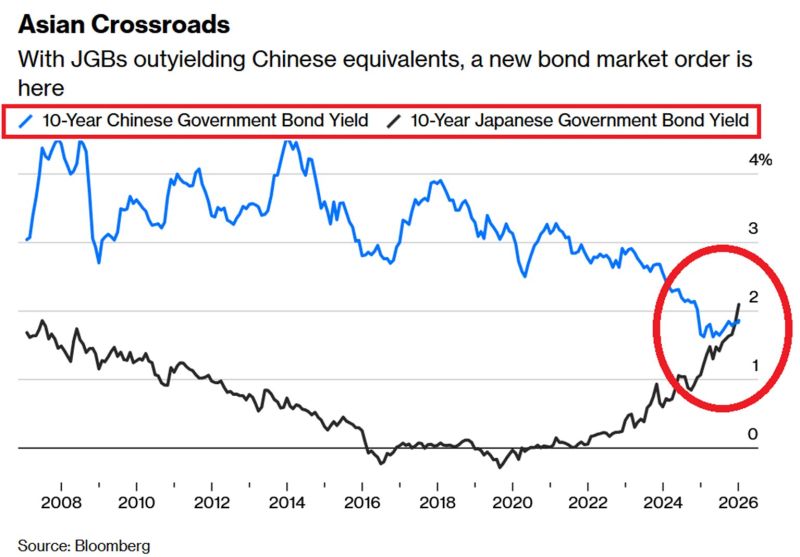

🚨 A HISTORIC REVERSAL IN ASIA. 🚨

For 15+ years, one rule dominated the macro landscape: Chinese yields stay higher than Japanese yields. China was the growth engine; Japan was the land of "Lower for Longer." That world just ended. 🌏 For the first time in decades, Japanese 10-year yields have officially overtaken China’s. We are witnessing a total regime shift in real-time. 📈 The Great Divergence: By the Numbers JAPAN: 10-year JGB yields have skyrocketed from -0.28% (2019) to 2.10%—a level not seen since 1999. CHINA: 10-year yields have plummeted from 3.05% to 1.86%, hovering near record lows. Why is this happening? It’s a tale of two opposite crises: 🇯🇵 In Japan: The BoJ is hiking to 30-year highs. Prime Minister Takaichi is pushing a record FY2026 budget with massive military spending. Fiscal expansion + Rate hikes = A bond market under siege. 🇨🇳 In China: The real estate downturn is biting hard. Deflation risks are mounting, and the central bank is forced to keep easing just to keep the lights on. The "Lose-Lose" Trap for JGB Investors 🪤 If you're holding Japanese bonds, where is the exit? Scenario A (Growth Re-accelerates): The BoJ is forced to hike faster than anyone expects. Bond prices tank. 📉 Scenario B (Growth Slows): JGBs underperform higher-yielding peers like US Treasuries. Investors flee for better returns elsewhere. ⚠️ The Contagion Risk This isn't just a Japan problem. This is a Carry Trade Nightmare. For years, traders borrowed "cheap" Yen at 0% to bet on global assets. Now, the cost of that debt is exploding. If the Yen strengthens and yields keep climbing, the "unwind" could send shockwaves through global markets. The era of free money in Japan is officially dead. Is your portfolio prepared for a world where Japan is no longer the "anchor" of low rates? 💬👇 Source: Global Markets Investor

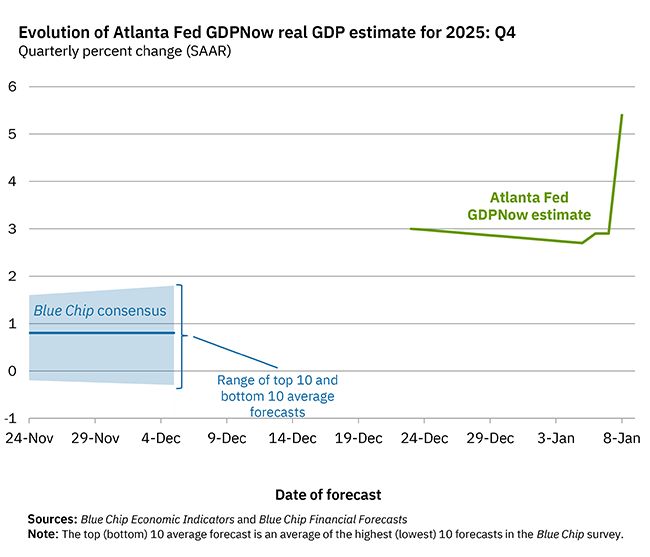

On January 8, the Atlanta Fed GDPNow model nowcast of real GDP growth in Q4 2025 is +5.4% from 2.7% previously.

That's a significant move upward. Yes you read it correctly +5.4% !!!! Real personal consumption expenditures growth increased from 2.4% to 3.0%. Net exports increased from -0.30% to 1.97%. Colling inflation, higher production, and higher GDP growth all seem very promising for the US economy. What comes next is $350B tax cut, Fed balance sheet expansion and maybe more Fed rate cuts... Source: Truflation, AtlantaFed

VIX seasonality is about to kick in right here...

Source: Equity clock, The Market Ear

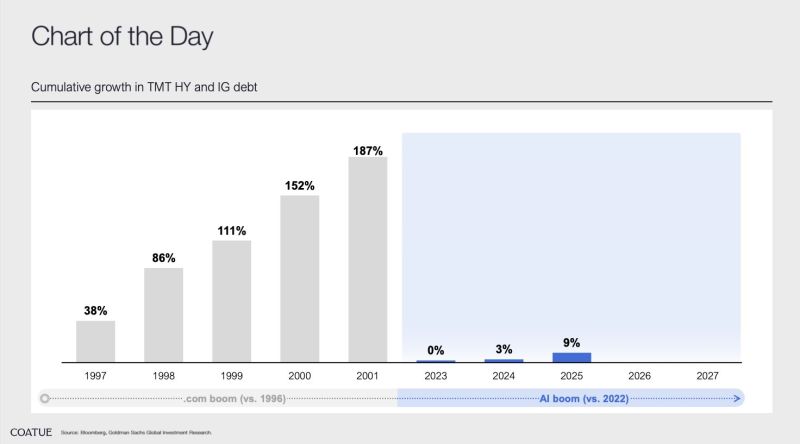

The dot-com boom ran on debt. The AI boom runs on balance sheets.

That difference matters. Source: Goldman Sachs, COATUE

The defense squeeze

European aero and defense index, SXPARO, has surged by some 13% YTD. The squeeze has been absolutely huge since the start of the week, with RSI now trading at 80! Source: The Market Ear, LSEG Workspace

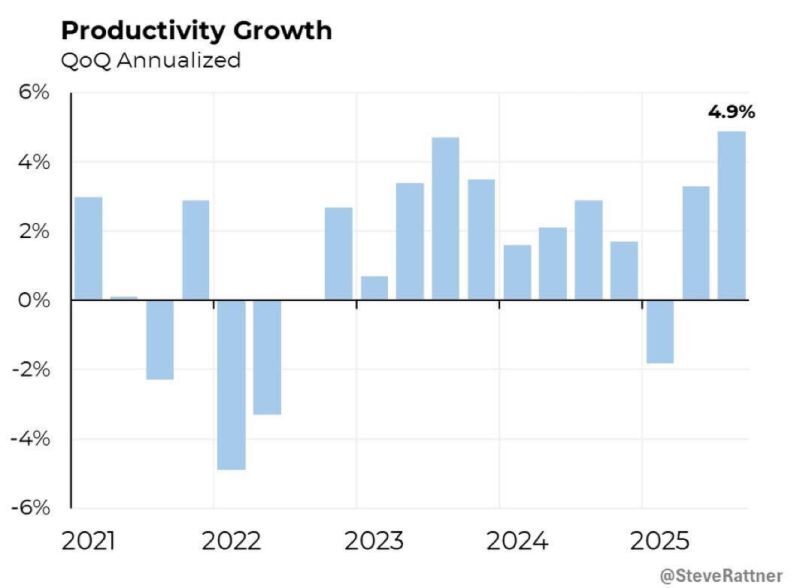

Is this the Goldilocks economy? 📈

US Bureau of Labor Statistics (BLS) released yesterday preliminary Productivity and Costs data for Q3 2025 (July-September) and it’s a masterclass in efficiency. U.S. productivity just surged +4.9%—the strongest reading we’ve seen in nearly 6 years. The number is sharply above 3.3% consensus expectation, and higher than the previous 4.2% (revised up for Q2). But here is the real kicker: While output is soaring, labor costs actually fell -1.9%. In the world of economics, this is the Holy Grail. 🏆 The breakdown: Productivity: Jumped from ~3.3% ➡️ 4.9% Labor Costs: Flipped from +1% ➡️ -1.9% Indeed, Hourly compensation increased with figures varying around +4-5%. But Unit labor costs (compensation adjusted for productivity gains) declined or rose modestly, reflecting that productivity growth outpaced wage gains. Why does this matter to you? It means we are seeing massive growth without the inflationary "tax." This indicates accelerating economic efficiency, often driven by technology, innovation, or better processes. This is probably why the Atlanta Fed just hiked its Q4 GDP forecast to a staggering +5.4%. The Productivity and Costs report measures how efficiently the economy produces goods and services. This robust productivity growth is positive for the economy, as it helps contain wage-driven inflationary pressures and supports potential Fed rate cuts without overheating. This is bullish for markets, the economy, and risk assets. Source: Quantus Insights, Truflation

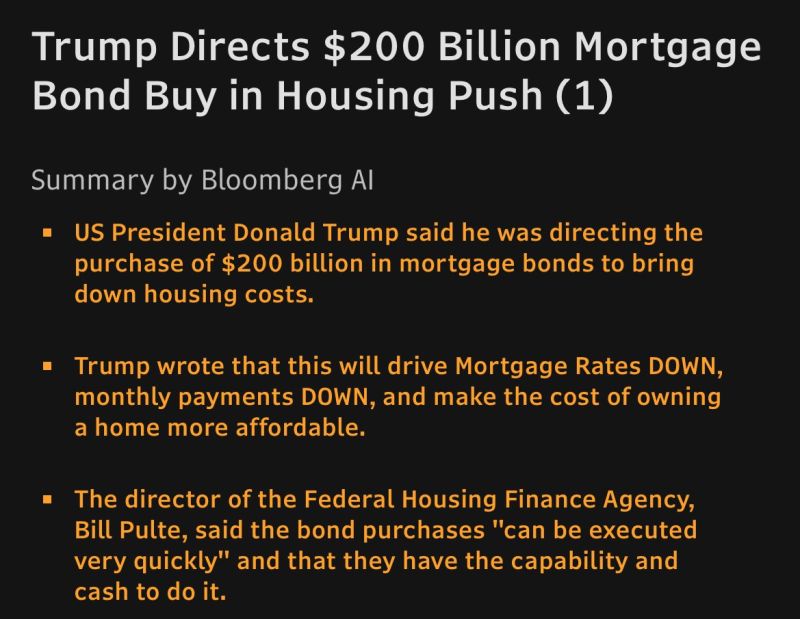

Is Trump launching his own QE? Buying MBS via Fannie and Freddie…

Source: Bloomberg, Geiger Capital

In case you missed it…

"German manufacturing orders for November surprised sharply to the upside, with the year-on-year figure rising +10.5%, versus expectations of +2.9%. Outside of the post-Covid rebound, this marks the strongest increase in almost 15 years. The data were boosted by large orders linked to government rearmament plans, but even stripping out such lumpy items, there has been a clear and gradual improvement in underlying momentum over recent months“ (Jim Reid, Deutsche Bank) Source: DB through Daniel D. Eckert @Tiefseher on X

Investing with intelligence

Our latest research, commentary and market outlooks