Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

President Trump says he is banning dividends and buybacks for Defense companies.

📉 $LMT | $RTX | $NOC | $GD Source: Trend Spider

President Trump announces steps to ban large institutional investors from buying single-family homes.

"People live in homes, not corporations." Blackstone shares are tumbling. Source: Brew markets

LARGEST FED FUND FUTURES TRADE IN HISTORY 🚨

A bond trader just made the largest fed fund futures bet in history. The trade was a total of 200,000 contracts for January which amounts to a total risk of $8 million per basis point move. Source: Barchart @Barchart Bloomberg

Is it an "invasion" if the US captures a world leader, but doesn't stay to occupy the land? 🌎

On Polymarket, $10.5M is currently hanging on the definition of a single word. The drama unfolding right now in the prediction markets is a masterclass in Risk, Regulation, and the "Information Edge." 🧵 Here’s what’s happening: 1. The "Maduro Capture" Controversy US Special Forces extracted Nicolás Maduro from Caracas. Polymarket bettors who bet "YES" on an invasion thought they had hit the jackpot. But Polymarket says: Not so fast. The platform is refusing to settle the "Invasion" contract, arguing that a military raid isn't an "offensive to establish control over territory." 2. The $400k "Mystery Trader" While the crowd fights over definitions, one anonymous account is laughing all the way to the bank. Account created: Dec 26. Bets placed: Days before the raid. Outcome: Turned $32k into $400,000 by betting on Maduro’s removal when the market gave it only a 7% chance. Coincidence? Or the ultimate "information edge"? 🕵️♂️ 3. The Trust Gap in DeFi This highlights the massive hurdle for prediction markets. When the "Source of Truth" is subjective, the house becomes the judge, jury, and executioner. As one user (Skinner) put it: "Words are being redefined at will." The Big Takeaway: Prediction markets are the future of price discovery, but they are currently the "Wild West." Without clear definitions and insider trading protections, "betting on the news" is a dangerous game. Congress is already moving to ban insider trading on these platforms. The days of the "Mystery Trader" might be numbered. Source: FT

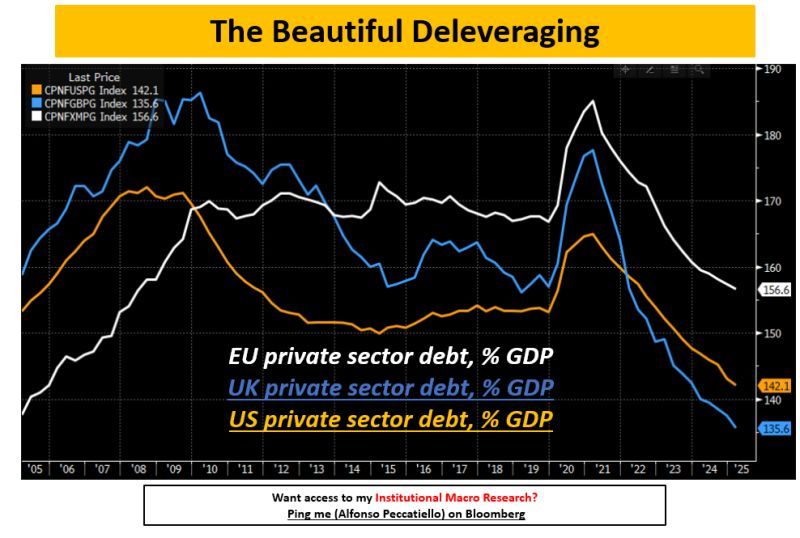

Stop worrying about the "debt mountain." You’re looking at the wrong mountain. 🏔️❌

High interest rates were supposed to "break" the economy by now. We all expected a collapse. So why are we still standing? It comes down to one massive shift that almost everyone is missing: The Great Private Sector De-leveraging. Here’s the breakdown: 1. Private Debt > Government Debt 🏦 Unlike the government, you and I can’t print money. If a household gets buried in debt, the pain is real and immediate. This is where economic "breaks" actually happen. 2. The 15-Year Cleanup 🧹 Since 2008, while we were focused on government deficits, the private sector (US, UK, EU) was quietly de-leveraging. Households and businesses have spent over a decade cleaning up their balance sheets. 3. The "Baton Pass" 🏃♂️💨 Governments took over the burden of money creation. Massive fiscal stimulus allowed the private sector to reduce its debt as a % of GDP. Essentially, the public sector took the hit so the private sector could heal. 4. The Result? Resilience. 💪 A lean private sector can handle 5% interest rates much better than an over-leveraged one. That’s why the "inevitable" crash hasn't arrived. The Big Question for 2026: How long can governments keep expanding deficits before they hit the wall of inflation and credibility? Can this "beautiful" de-leveraging continue forever? The baton has been passed... but is the runner running out of breath? 🏃♂️⛽ Source: Alfonso Peccatiello @ The Macro Compass - Institutional Macro

$1.5 TRILLION. 🚀 Donald Trump calls for 50% increase in US defence spending by 2027

Here is the breakdown of what this means for the US, the economy, and the defense industry: 1. The "Tariff-Fueled" Growth 💰 The President is pivotting away from traditional debt-funding. The plan? Use tariff revenue to bridge the gap from $901B to $1.5T. While skeptics point to CBO deficit warnings, the administration is betting big on trade levies to fund national security and even pay a "dividend" to the middle class. 2. A New Era for Defense Contractors 🛠️ The days of "business as usual" for the Big Defense are over. The President is demanding: - No more share buybacks or dividends if production speeds don't meet his standards. - Massive upfront investment in plants and equipment. - Executive pay tied to production, not short-term financial metrics. The message to giants like Raytheon is clear: Innovate or be sidelined. 3. "The Department of War" Mindset 🌎 With recent operations in the Atlantic and Venezuela—and Greenland back on the table—the military is being positioned as the primary tool for foreign policy. We are moving from a posture of deterrence to one of active assertion. The Bottom Line: We are witnessing a radical decoupling of defense spending from traditional fiscal constraints, fueled by a "Production First" mandate for the private sector. Is this the necessary evolution for "dangerous times," or a fiscal risk too far? Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks