Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it... In Germany, inflation slowed more than expected at the end of last year.

Consumer prices rose 1.8% in Dec YoY, below the 2.1% forecast. The slowdown was driven mainly by falling energy prices and a sharp easing in food inflation, which dropped to just 0.8%. Core inflation also declined to 2.4%, although service inflation remains stubbornly high at 3.5%. Source: HolgerZ, Bloomberg

Saudi Arabia has removed all restrictions for foreigners to buy local stocks.

The decision allows non-residents to invest directly in the main market effective Feb. 1.

Nvidia CEO said yesterday that the “Memory Bottleneck is Severe”

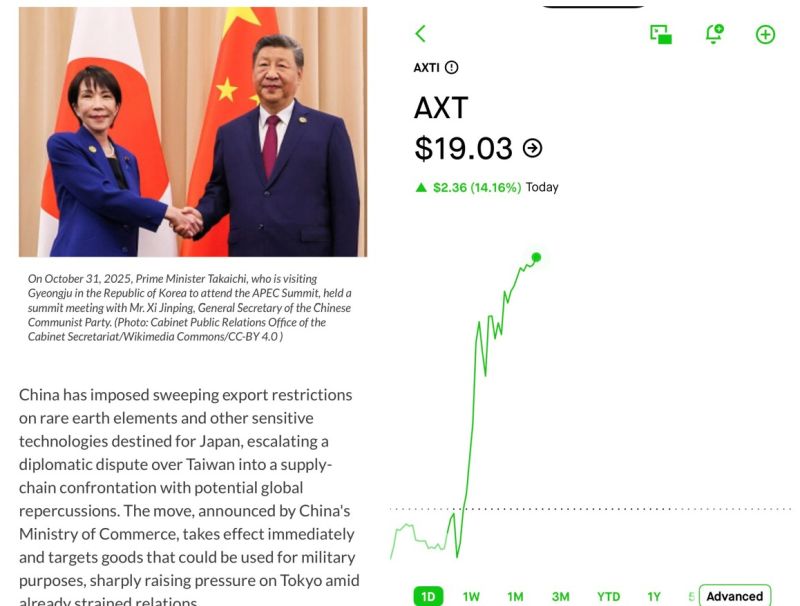

SK Hynix ($330B) $MU ($355B) Samsung ($595B). Wait and see the look on everyone’s face when they find out the entire AI buildout will be bottlenecked by the tiny $AXTI ($1B) after the China’s new export controls. Source: Serenity @aleabitoreddit

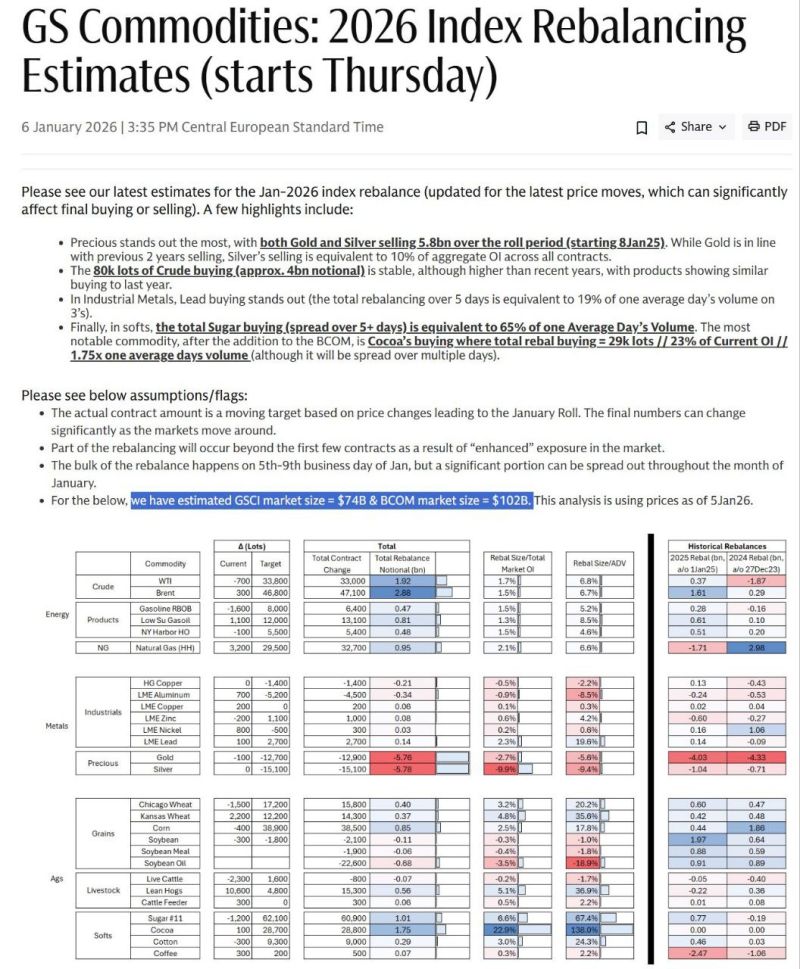

As highlighted by Lia the Trader @Liathetrader on X BEWARE $SILVER holders ‼️

The 2026 commodity index rebalancing (BCOM & GSCI) kicks off this week, forcing big adjustments in holdings. Precious metals stand out with massive estimated outflows—over $6.8B in gold and $6.8B in silver selling pressure. Silver's weight in BCOM drops sharply from ~9.6% to ~1.45%, triggering passive funds to dump futures. This could create short-term downward pressure on silver prices starting Thursday (Jan 8-14 roll period). Silver is trading around $78/oz today after huge 2025 gains (~150%), making it a prime rebalancing target. Expect volatility—analysts warn of potential dips, but fundamentals (industrial demand, deficits) remain bullish long-term.

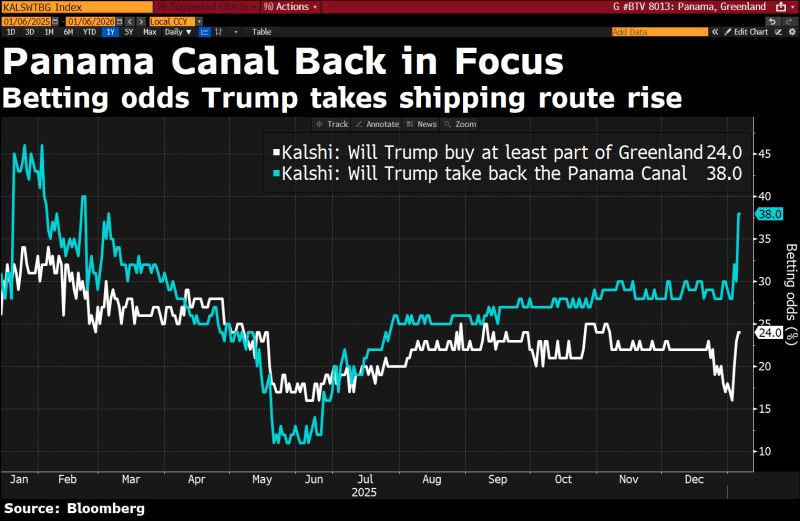

Traders are betting that the Panama Canal will be the next target of the Trump administration, given the market's dawning understanding of the "Donroe Doctrine:"

Source: h/t @bloombergtv's @DRBCurtis Lisa Abramowicz Bloomberg

30,000,000 to 50,000,000 barrels. 🛢️

That is the scale of the move Donald Trump just announced. The US is officially escalating its push into the Venezuelan oil sector. Here is the breakdown of what is happening right now: 🚀 The Move: A US flotilla is already inbound to Venezuelan waters. The goal? To load up to $3B worth of "stranded" crude and bring it directly to US docks. ⚖️ The Control: Trump has stated this money will be controlled by the White House to "benefit the people of Venezuela and the United States." Energy Secretary Chris Wright is already on the move to execute. 🏗️ The Crisis: Venezuela’s infrastructure is at a breaking point. Without this "relief," analysts predict a total production collapse. Storage is full. The pumps are stopping. 📉 The Market: Brent and WTI are already reacting, sliding as the world braces for the "Donroe Doctrine." The Big Debate: Is this a strategic masterstroke to stabilize a collapsing neighbor and secure US energy interests? Or, as Yale’s Jeffrey Sonnenfeld suggests, is it an "imperialistic" move in a world already facing an oil glut? One thing is certain: The "wait and see" approach to Venezuela is officially over. We are watching a real-time restructuring of global energy flows. The meeting between the Energy Secretary and Chevron executives in Miami today will likely set the tone for the next decade of South American energy. Your turn: Is this the right move for US energy security, or does it set a dangerous precedent? 👇 Let’s discuss in the comments. Source: FT

All of the World’s Silver Reserves by Country, in One Visualisation:

• Peru alone holds roughly 22% of the World’s known Silver reserves. • Mexico dominates global Silver production, but its reserve base is much smaller than several peers. Source: Silver Gold News @SilverGold_News

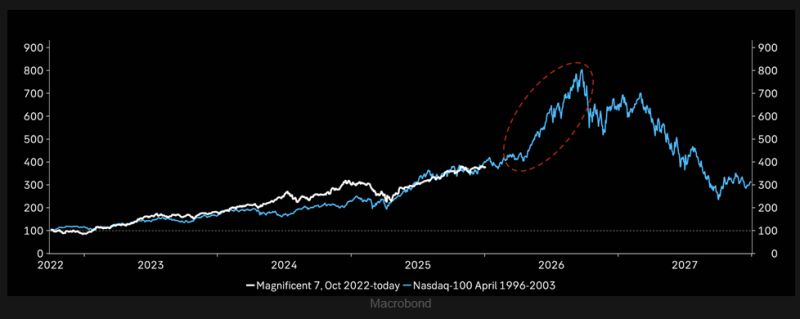

Is the mania with us in the room right now?

Last time around... Nasdaq jumped 100% last six months ahead of peak, this is the tricky part. Source: Macrobond, TME

Investing with intelligence

Our latest research, commentary and market outlooks