Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

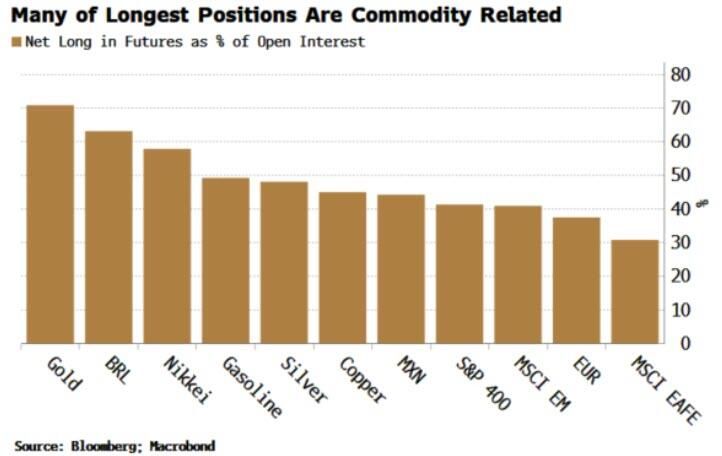

Speculators Are Moving Towards Commodities

Gold, gasoline, silver and copper have the largest net longs, along with emerging currencies related to resources, BRL and MXN. Chart below is in raw percentage terms, that is the net long position as a percentage of open interest. Source: zerohedge, Bloomberg, Macrobond

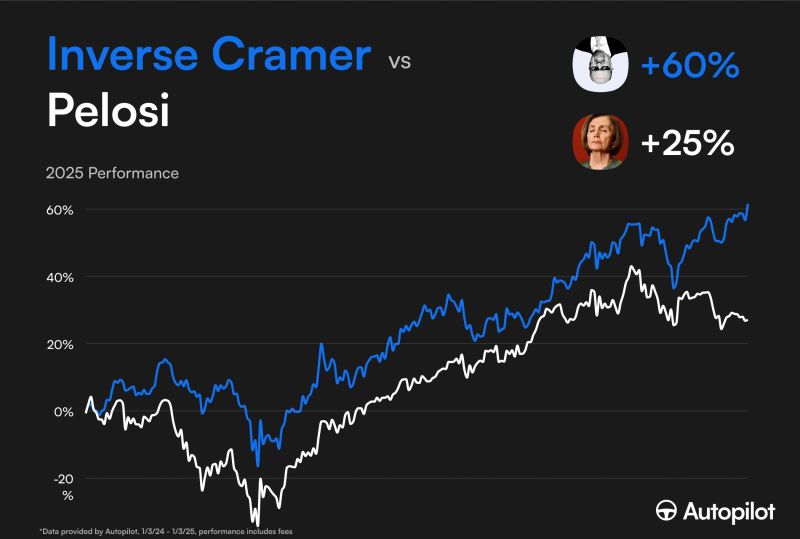

The Queen has been dethroned

Inverse Cramer officially beats out Pelosi for the top portfolio on Autopilot Source: Nancy Pelosi Stock Tracker ♟ @pelositracker

LME Copper surges to $13,000 for the first time to new record high

Source: www.investing.com

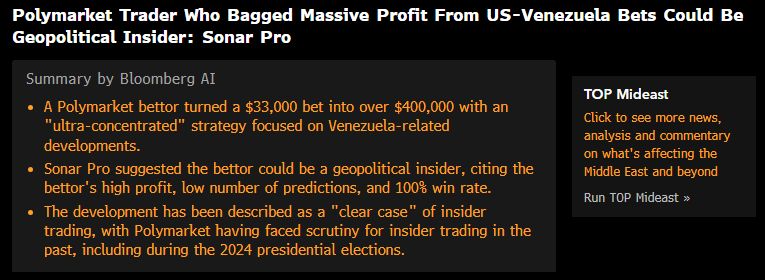

A new type of insider... the geopolitical insiders...

One of them bet $33k through Polymarkets on Venezuela-related developments and turned into $400k. It has been described as a "clear case" of insider trading. Source: Bloomberg

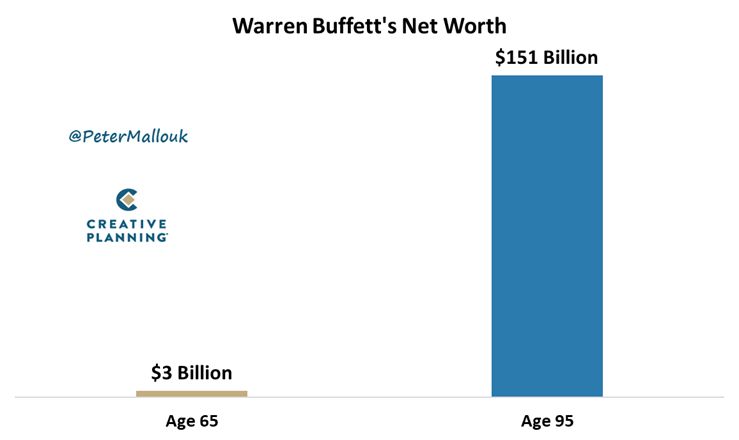

Here's THE MOST incredible stat from Warren Buffett’s tenure as CEO of Berkshire: 98% of his current net worth of $151 billion was generated AFTER he turned 65.

"My life has been a product of compound interest." - Warren Buffett Source: Peter Mallouk @PeterMallouk

Venezuela sovereign bond CUSIPs below

Source: Bloomberg (These are NOT investment recommendations)

Investing with intelligence

Our latest research, commentary and market outlooks