Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

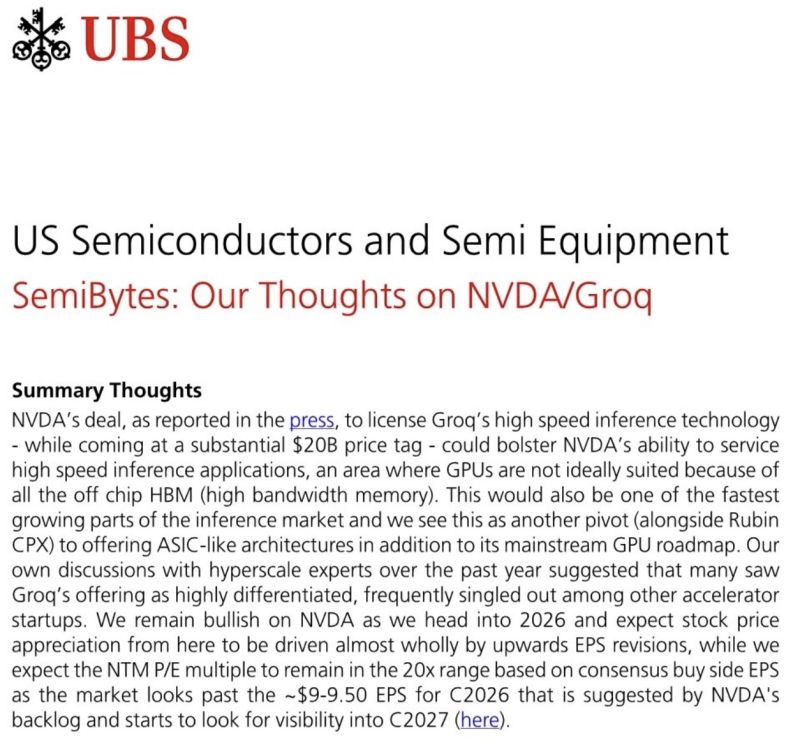

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

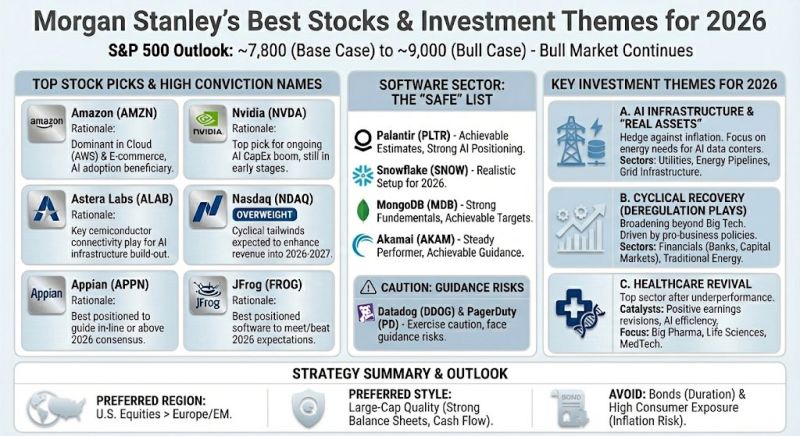

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

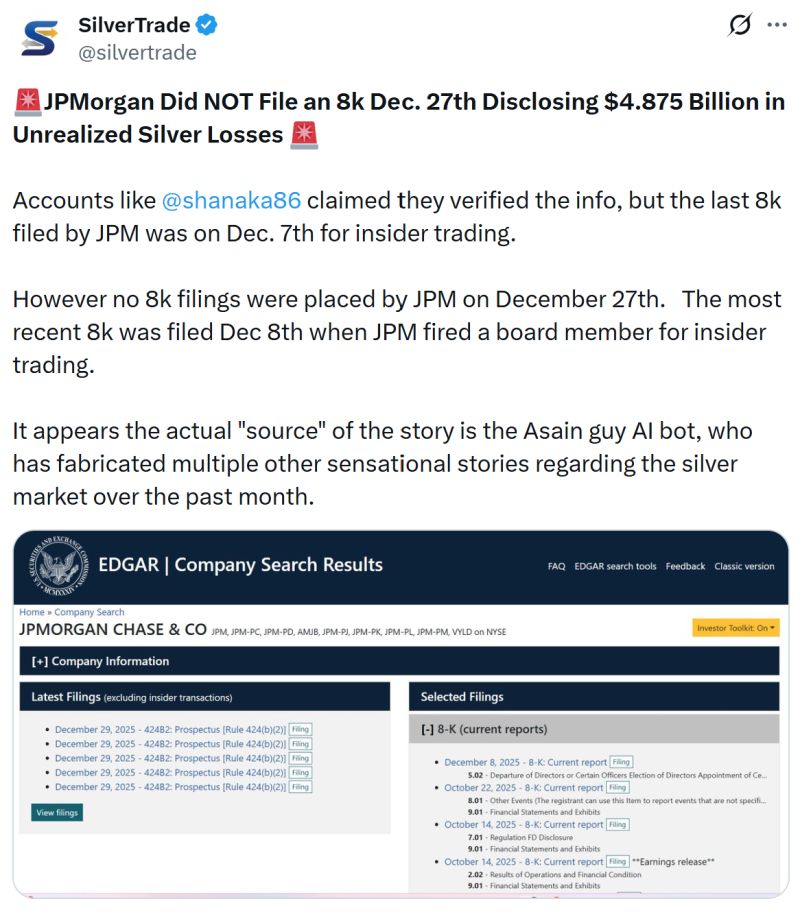

Beware about current rumours circulating on X today about silver squeeze hitting mega banks...

Nothing has been verified yet

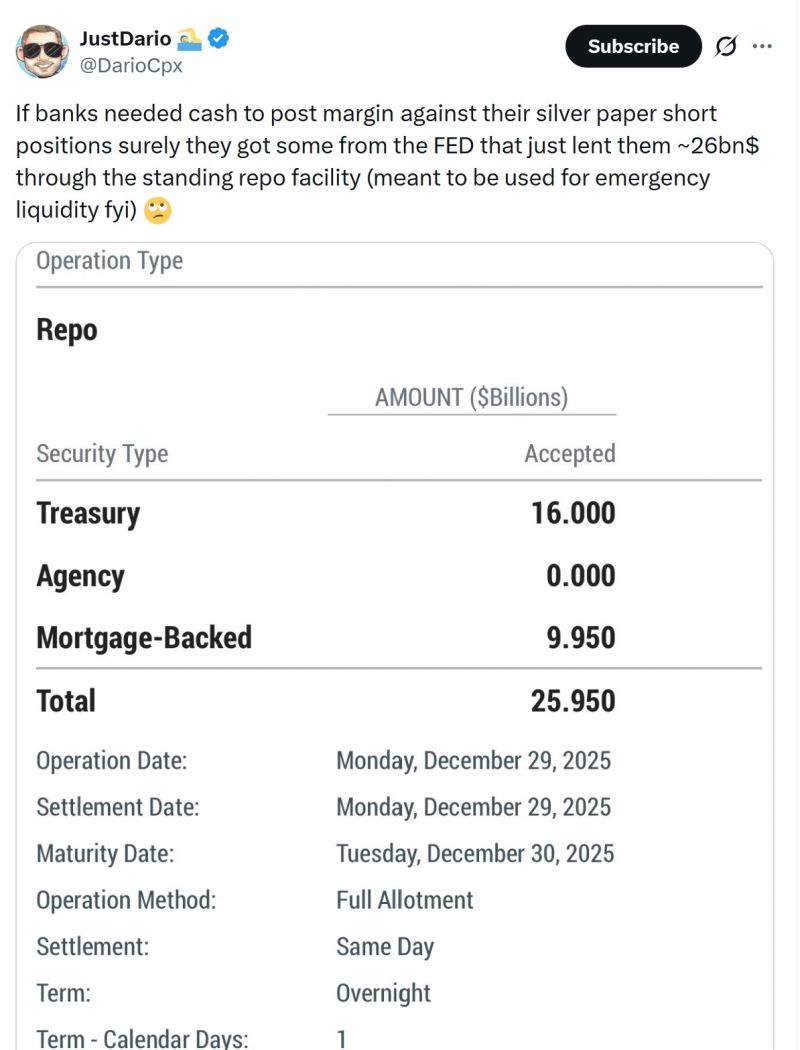

Fed to the rescue of banks again ???

REPO $26B on Monday 8:30 am

David Lee on X came in with his analysis on the price action of silver over the last week. He might have a point:

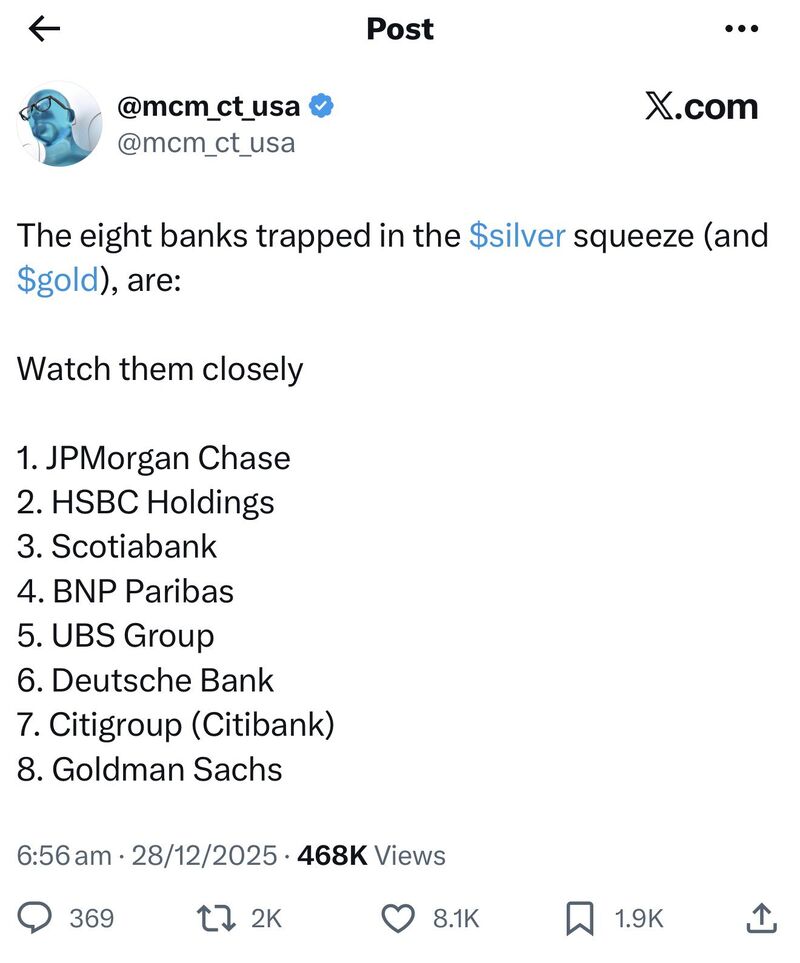

1. Physical silver is not available for December contract delivery 2. Big Banks were buying what physical is still available forcing price up 3. One Big Bank got caught in wrong position and unable to meet margin requirement, its short positions were liquidated forcing price shot up on Friday and Monday Asian trading 4. After the short covering has completed in early Asian trading on Monday morning, price got push down 5. Buyers come back to buy on the dip, cutting the price drop 6. Unless Big Banks can get enough physical to fulfill their delivery commitment, the demand will stay strong 7. With 4 trading days left of December, the next few days will see significant volatility and a chance of more bad news for Big Banks Below is a list by @mcm_ct_usa of Big Banks which might be "trapped in a Silver (and gold) squeeze" ‼️ >>> THIS IS UNVERIFIED INFORMATION. AS MOST OF US, I DO NOT KNOW WHO OWNS WHAT !!! (but it seems that the market has its doubts as big banks are currently getting sold)

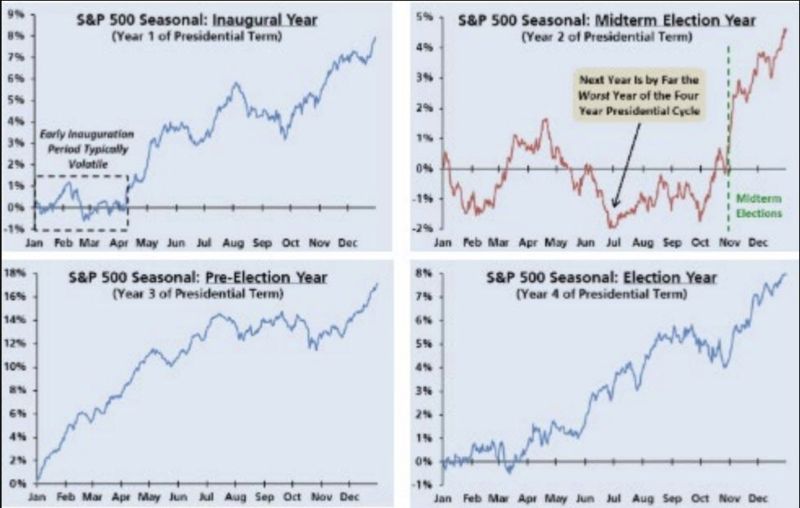

The midterm election year is without question the worst year in the four-year election cycle.

Source: Connor Bates

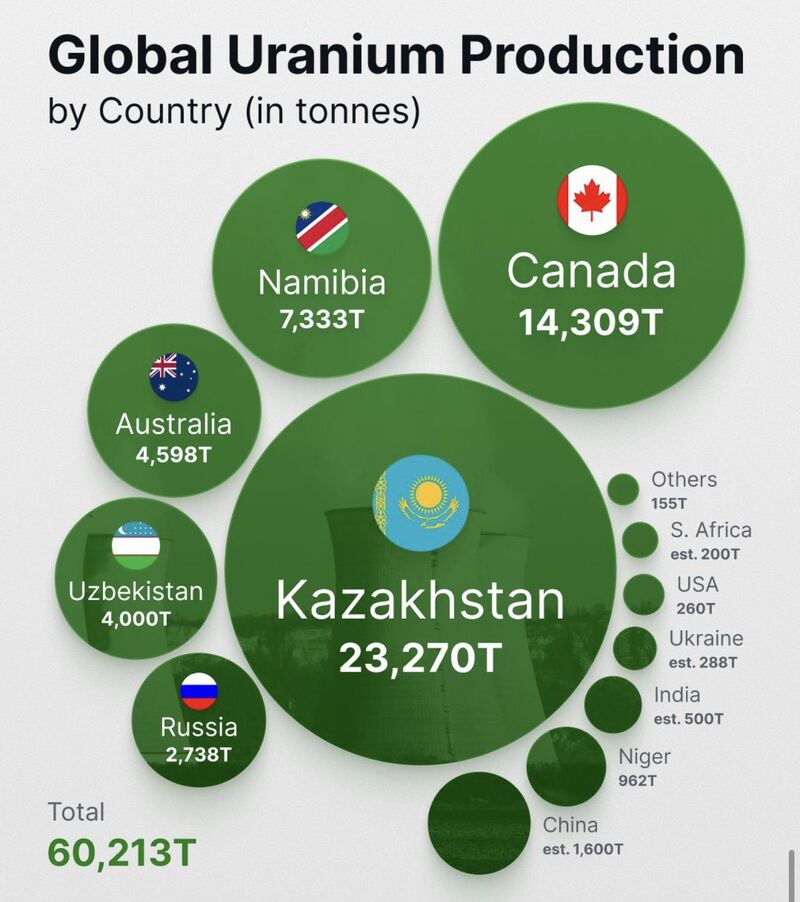

⚛️ THE "URANIUM SQUEEZE": DATA CENTERS VS. SUPPLY CHAINS.

If you think the energy transition is just about solar panels and wind turbines, you’re missing the biggest structural shift in the market right now. Uranium is no longer just a commodity. It is becoming a top-tier strategic asset. 🛡️ Here is why the "Nuclear Renaissance" is reaching a boiling point: 1️⃣ The AI Power Hunger 🤖 Large language models don't just need data; they need uninterrupted, carbon-free baseload power. * Tech giants (Amazon, Google, Microsoft) are pivotting to nuclear to power their massive AI data centers. Unlike renewables, nuclear provides the 24/7 "always-on" energy that AI requires to function. 2️⃣ Extreme Supply Concentration 🇰🇿 The global supply map is shockingly narrow. Kazakhstan dominates the market, producing ~40% of the world’s uranium. Canada and Namibia form the critical "second tier" for Western energy security. In a world of geopolitical tension, depending on a single region for 40% of your fuel is a massive risk. 3️⃣ The Looming Deficit 📉 The math doesn't add up. We are seeing record reactor restarts and new builds globally. Primary mine production is lagging behind actual reactor requirements. Secondary supplies (stockpiles) are thinning out fast. The Bottom Line: As we move toward a high-tech, low-carbon future, the demand for "reliable green power" is skyrocketing—but the "fuel" for that power is controlled by just a handful of players. In a tight, concentrated market, security of supply is the only thing that matters. Source: Jack Prandelli on X

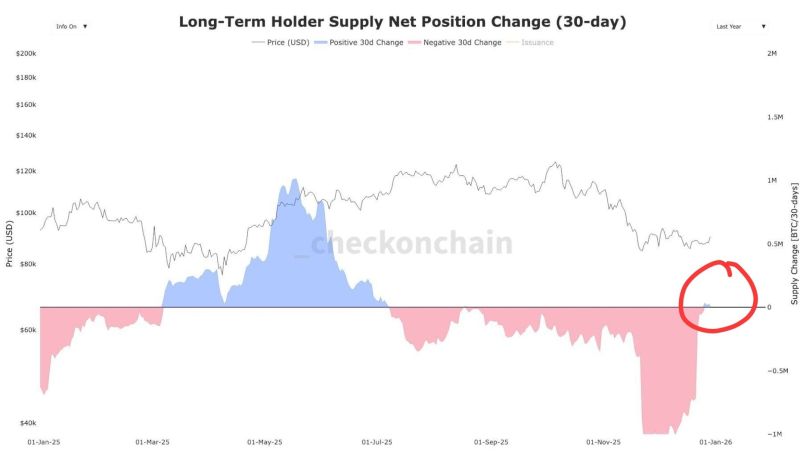

We got a pulse... Long term bitcoin holders have started accumulating

Source: MAGS 🔑⛏️🚒 @Crypto_Mags

Investing with intelligence

Our latest research, commentary and market outlooks