Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

New all-time high for $XOM!

The chart shows Exxon Mobil’s total return, including dividends This happened in a year where oil prices fell below $60, and Exxon Mobil raised its 2030 free cash flow targets by $35 billion Now imagine what happens if oil prices start rising again Source: Karel Mercx @KarelMercx

Time to be contrarian on bitcoin?

Interesting comment by Gert van Lagen @GertvanLagen on X: $BTC / GOLD is hitting the purple downtrend on RSI for 5th time in history. 🟠Occurrences: + Bear market bottom 2011 + Bear market bottom 2015 + Bear market bottom 2018 + Bear market bottom 2022 + Bear market bottom 2025 ? Each time a higher low on BTC/GOLD was printed 🟠

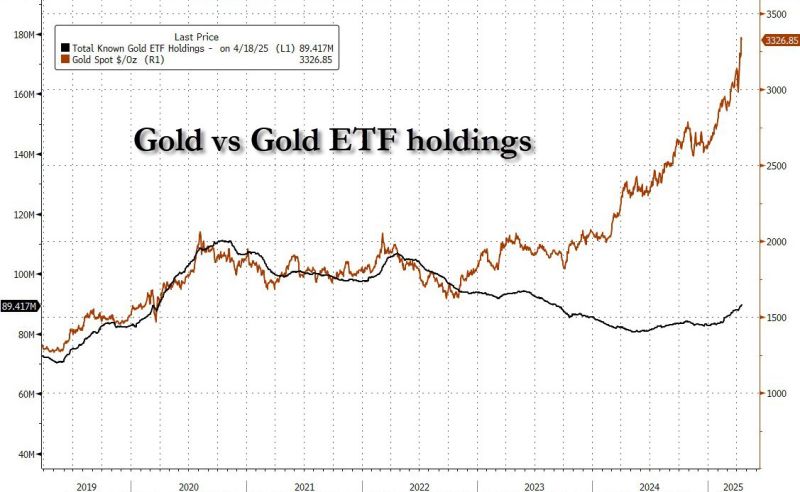

Gold just had its biggest ever ETF inflow at $8.0bn in the past week. There is just a "little" more to go for ETFs to catch up...

Source: zerohedge

Italy and Spain shake off ‘periphery’ tag as borrowing premiums hit 16-year low

For years, Italy and Spain were labeled the "risky periphery" of the Eurozone. Today? They are the new safe havens. Here is what’s happening in the markets right now (and why you should care): 1. The 16-Year Milestone 📉 Italian and Spanish borrowing costs have hit their lowest levels relative to Germany since 2009. The "risk gap" is evaporating. 2. The "Tale of Two Europes" ↔️ While the South is belt-tightening and growing, the traditional "safe" anchors are drifting: Spain: Set to be the world’s fastest-growing large advanced economy in 2025 (2.9% GDP growth). Italy: Winning over markets with fiscal discipline and a crackdown on tax evasion. France: Struggling with political turmoil and a budget deficit that has pushed its borrowing costs above Spain’s. 3. From "PIIGS" to "Prudent" 💎 Remember the Eurozone crisis? That memory is being replaced by a new reality. Fund managers like Vanguard and BNP Paribas are no longer seeing these as "distressed" assets. They are seeing them as core investments. 4. The Institutional Shift 🏦 The ultimate signal? Ultra-cautious central banks are now looking at Italian and Spanish debt for their foreign reserves. That is the highest stamp of approval a sovereign bond can get. The Lesson: Markets have long memories, but they aren't static. Resilience is built in the tough times. The "periphery" isn't the periphery anymore. It’s the engine. 🚀 Agree? Or is this just a temporary honeymoon phase for the South?

🚨The U.S. is sitting on nearly $1 TRILLION worth of hidden liquidity that could be unlocked without QE.

The U.S. is sitting on a $1 TRILLION "hidden" asset that almost nobody is talking about. 🤫 Forget QE. Forget interest rate cuts. There is a lever the Treasury could pull that would inject massive liquidity into the system without issuing a single new bond. Here is the "Invisible Math" that could change everything: 1. The Accounting Time Warp 🕰️ The U.S. Treasury owns 261.5 million ounces of gold. On the official books, it’s valued at just $42.22 per ounce—a price frozen in 1973. Official Book Value: ~$11 Billion Real Market Value (at ~$4,500/oz): ~$1.17 Trillion 2. The $1.1 Trillion Gap 🕳️ While most countries value their gold at market prices, the U.S. is sitting on a massive unrealized gain. This isn't just a fun fact—it’s a strategic bazooka. 3. Why this matters NOW ⚠️ With U.S. debt crossing $37 trillion and interest costs exploding, the government is running out of moves: Raising taxes? Politically impossible. Cutting spending? Unrealistic. More debt? Pushes yields into the danger zone. 4. The "Stealth Liquidity" Play 🚀 If the U.S. revalues that gold to market prices, it instantly creates over $1 trillion in balance sheet capacity. No bonds, no debt—just "unlocked" value. What happens to your portfolio? Gold: Skyrockets, as it’s the primary asset being repriced. Risk Assets: Follow suit as "stealth liquidity" enters the system. Bitcoin: Becomes the ultimate signal. Gold revaluation is an admission that fiat purchasing power has eroded. Bitcoin is the only major asset that sits entirely outside that system. Will the US decides to revalue their gold holdings in 2026??? 🧐 Source: Bull Theory on X

Investing with intelligence

Our latest research, commentary and market outlooks