Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

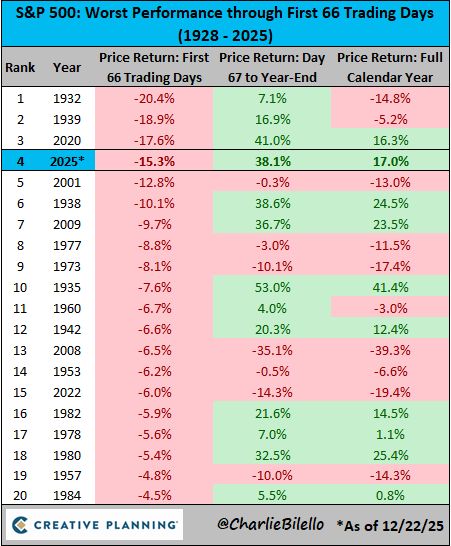

One of the greatest market comebacks in history

On April 8, the S&P 500 was down over 15% on the year, its 4th worst start to a year ever. But after a 38% rally, it's now up 17% on the year, hitting 37 all-time highs along the way. Source: Charlie Bilello

If you adjust the price of bitcoin for inflation using 2020 dollars, BTC never crossed $100k

Source: Alex Thorn @intangiblecoins

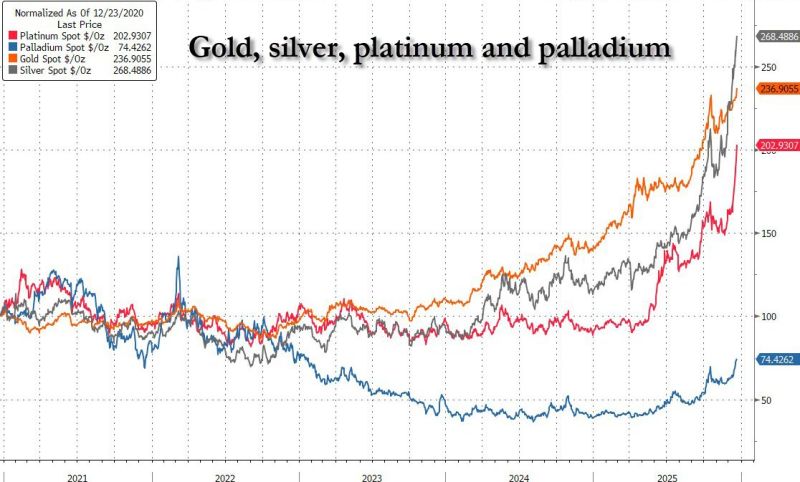

BREAKING: Gold trades above $4,500 for the first time in history.

Source: Trend Spider

Market manipulation on Bitcoin

GOLD - new ATH SILVER - new ATH S&P 500 - near ATH NASDAQ - near ATH DOW - new ATH While Bitcoin is down -28% from its peak, having the worst Q4 in the last 7 years without any negative news, FUD, or scandal. There is no explanation for this except pure market manipulation. Source: Bull Theory @BullTheoryio

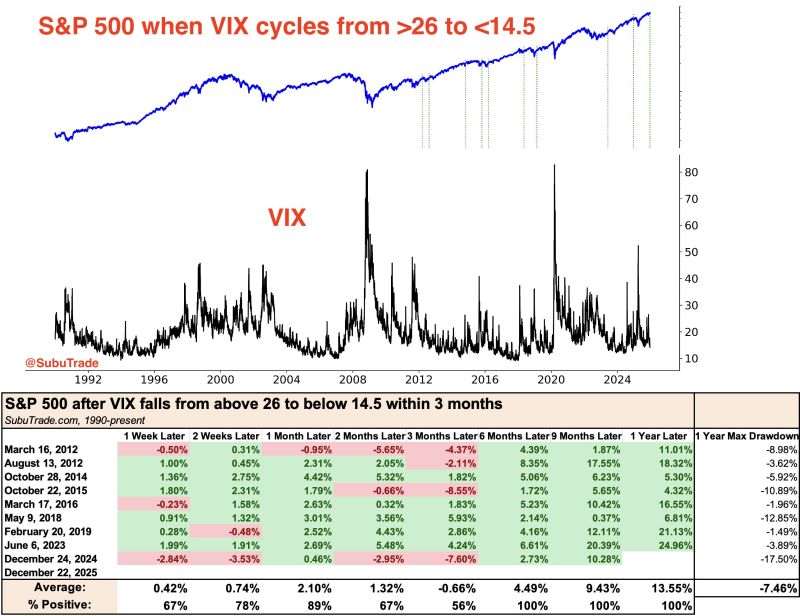

$VIX dropped to 14 today, down from 26 just a month ago

Is volatility "too low"? In each of the last 8 times this happened, $SPX was higher a month later. Source: Subu Trade

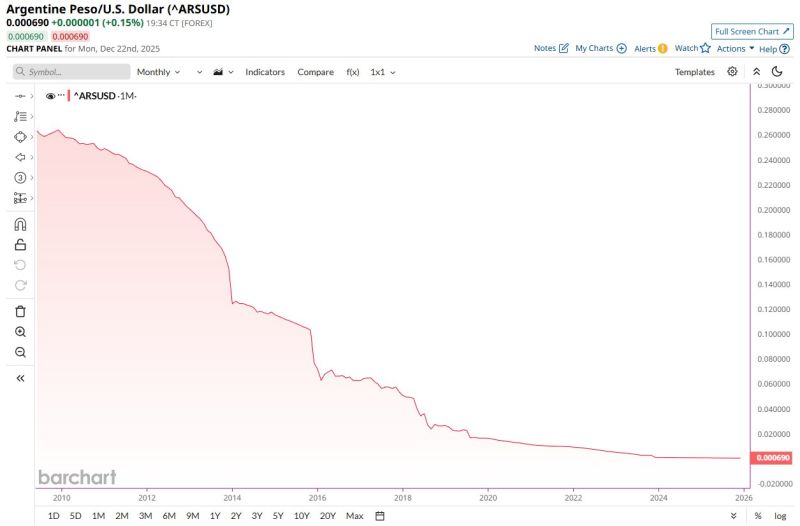

BREAKING 🚨: Argentina

Argentina's Peso has now collapsed 99.8% against the U.S. Dollar since 2009 📉📉 Source: Barchart

"Macro hedge funds are enjoying their best year since at least 2008…"

Per the @FT thru Mo EL Elrian: "An index from data provider HFR tracking the returns of such funds — which aim to profit from economic trends by trading equities, bonds and commodities — was up 16 per cent at the end of November”

Investing with intelligence

Our latest research, commentary and market outlooks