Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

This looks like a very strong trend

Japanese 10-year government bond yield hit 2.07%, the highest since the 1990s. Gold prices hit a record $4,440, rising +68% year-to-date. Finally, silver prices surpassed $66 per ounce for the first time in history, now up +134% year-to-date. When will it end? Source: Global Markets Investor

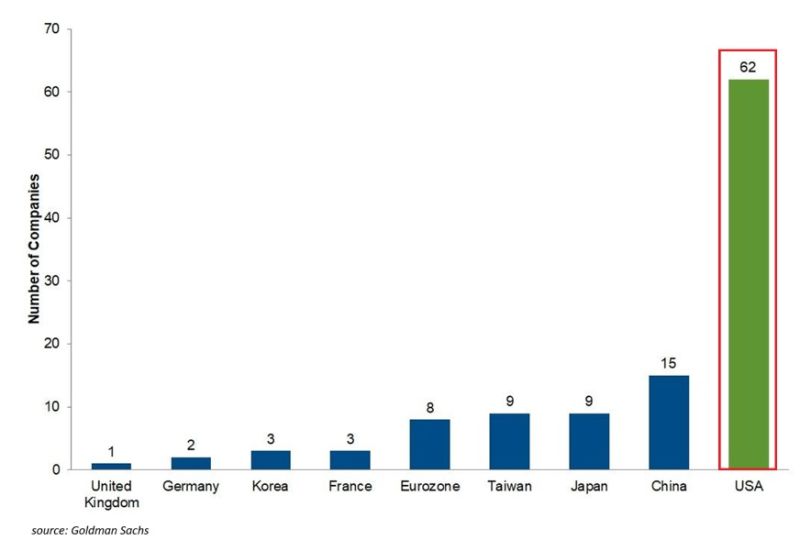

The US is innovating at an unprecedented rate 🚀

We talk about global competition, but the data tells a much more lopsided story. Check these numbers: 1. The Profit Gap The US has 62 technology companies netting over $1B in annual profit. China? Only 15. That’s a 4x lead over the world’s second-largest economy. 2. The Global Comparison The US has 21 more elite tech firms than China, Japan, Taiwan, and the Eurozone combined. Read that again. One country is out-scaling entire continents. 3. The Leaderboard Of the world’s 10 largest companies, 8 are US tech firms. Of the world’s 10 most innovative companies, 8 are US-based. "Dominance" is no longer the right word. We are witnessing a level of industrial concentration we’ve never seen before. The US isn’t just participating in the future. It’s architecting it. Is the gap between the US and the rest of the world becoming unbridgeable? Source: The Kobeissi Letter

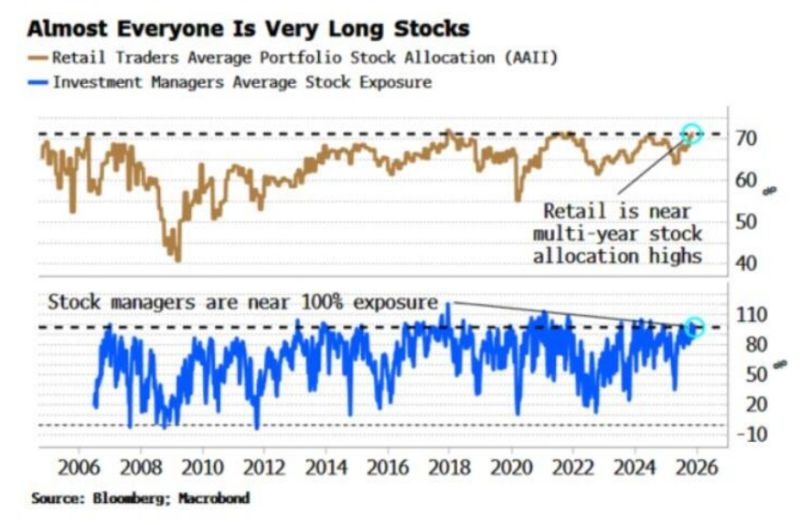

Risk appetite is through the roof.

Stock market investment is at 20+ year highs. Meanwhile, retail asset allocation to stocks is up to ~70%, near the highest in 20 years, according to the AAII survey. This is in-line with the highs seen during the 2021 meme stock frenzy. To put this into perspective, stock allocations were just ~55% during 2020 and fell to ~40% at the 2008 low. At the same time, average stock exposure among investment managers is up to nearly ~100%, one of the highest readings over the last 20 years. This has risen ~65 percentage points since the April low. Source: The Kobeissi Letter, Bloomberg

In case you missed it...

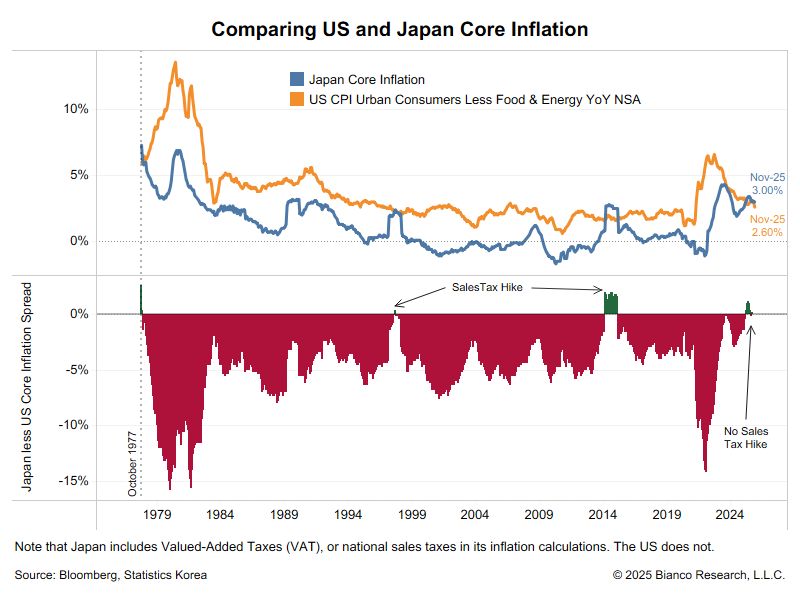

*JAPAN NOV. CORE CPI RISES 3.0% Y/Y; EST. +3.0% *US NOV. CORE CPI RISES 2.6% Y/Y; EST. +3.0% This is the first time since 1977 that Japan has a higher inflation rate than the US. (Japan includes taxes in its inflation measure. The US does not.) Source: Jim Bianco

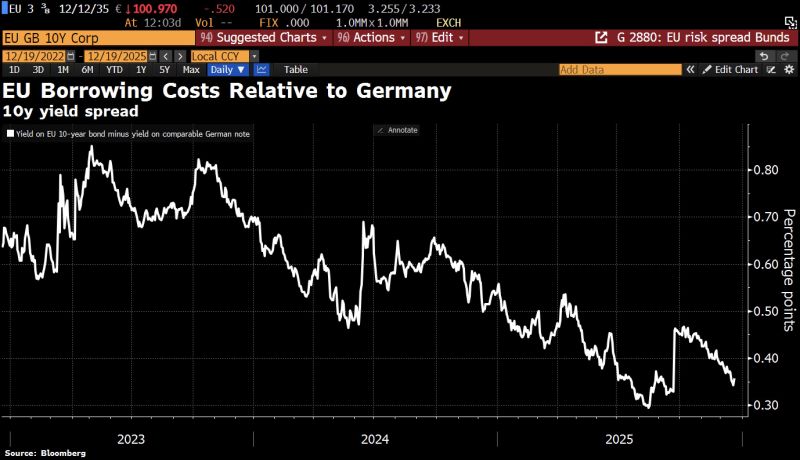

Interesting view by HolgerZ on X

"Chancellor Friedrich Merz has now suffered a setback in foreign policy as well. He was unable to push through the Mercosur trade deal – an agreement that matters greatly for Germany’s economy – and the plan to support Ukraine’s debt relies on the issuance of joint EU debt. As a result, Germany is slowly losing one of its last competitive advantages: its superior credit rating. The risk premium on EU bonds relative to German Bunds has narrowed sharply in recent weeks". Source: HolgerZ, Bloomberg

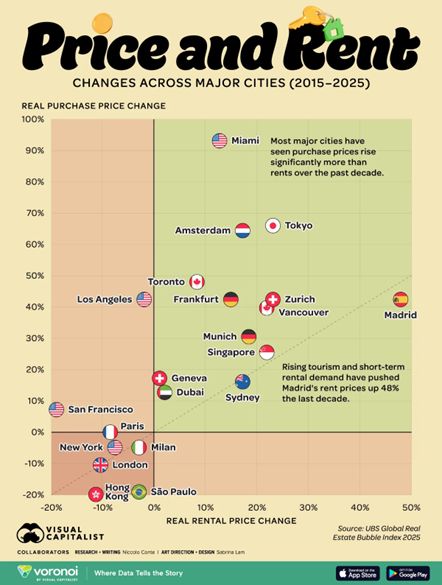

The global real estate map has been completely rewritten in the last 10 years. 🌍🏠

The gap between buying and renting isn't just growing—it’s exploding. The latest data from the UBS Global Real Estate Bubble Index (2015–2025) reveals a massive divergence. If you’re an investor, homeowner, or renter, you need to see these numbers: 🚀 The Rocket Ship: Miami Miami is in a league of its own. Real home prices have skyrocketed by 93.1%. Compare that to a modest 12.7% rent increase. The "Magic City" is officially the world's capital for capital appreciation. 🇪🇸 The Rental Crisis: Madrid While most of the world watches home prices, Madrid is seeing a rental surge like no other. Home Prices: +42.4% Rent Prices: +48.0% This is the steepest rental hike of any major global city, fueled by a massive tourism rebound and a booming short-term rental market. 📉 The Cooling Giants: London & Milan Not every "safe haven" stayed safe. London: Prices and rents have both dropped 10.5% since 2015. Between Brexit's shadow and a significant millionaire exodus, the luster is fading. Milan: A quiet decline, with property values down 4.9% and rents down 3%. 🥨 The Stability Zone: Zurich & Munich German-speaking hubs remain engines of growth. Both saw double-digit increases across the board: Zurich: +42.4% (Home) | +23.1% (Rent) Source: Visual Capitalist, Voronoi, UBS

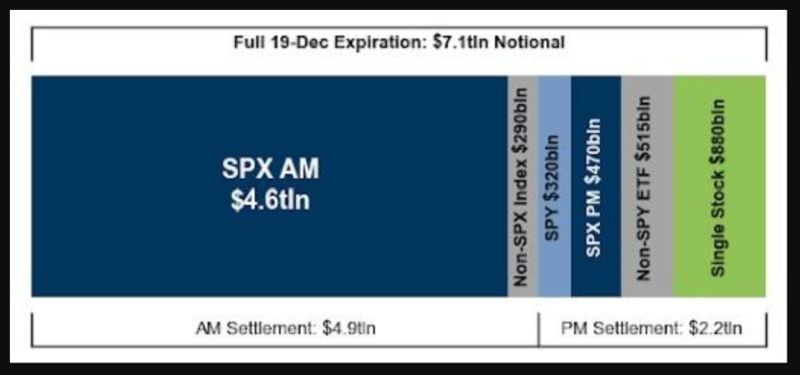

Today is the largest options expiration in history...

Goldman's options guru John Marshall estimates that this December options expiration will be the largest ever with over $7.1 trillion of notional options exposure expiring, including $5.0 trillion of SPX options and $880 billion notional of single stock options. Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks