Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

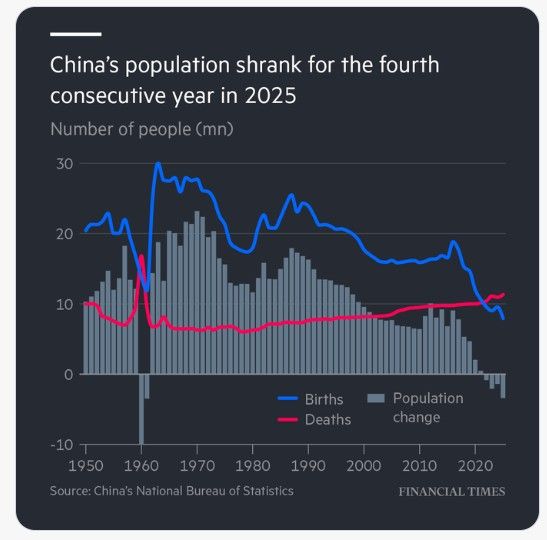

China last year registered the lowest number of births since records began

This marks the fourth consecutive year of population decline as policymakers grapple with a demographic crisis. Source: FT

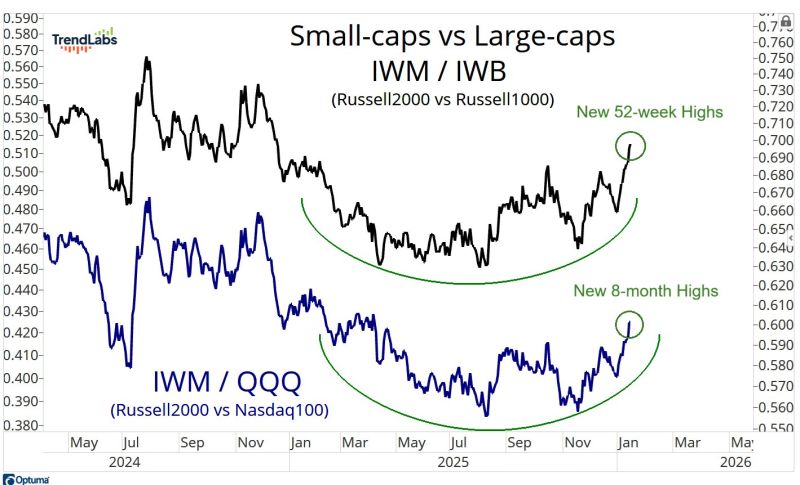

There are more stocks on the NYSE in uptrends right now than an any other point since 2024. Is so much winning a bad thing for investors?

Source: J.C. Parets @JC_ParetsX

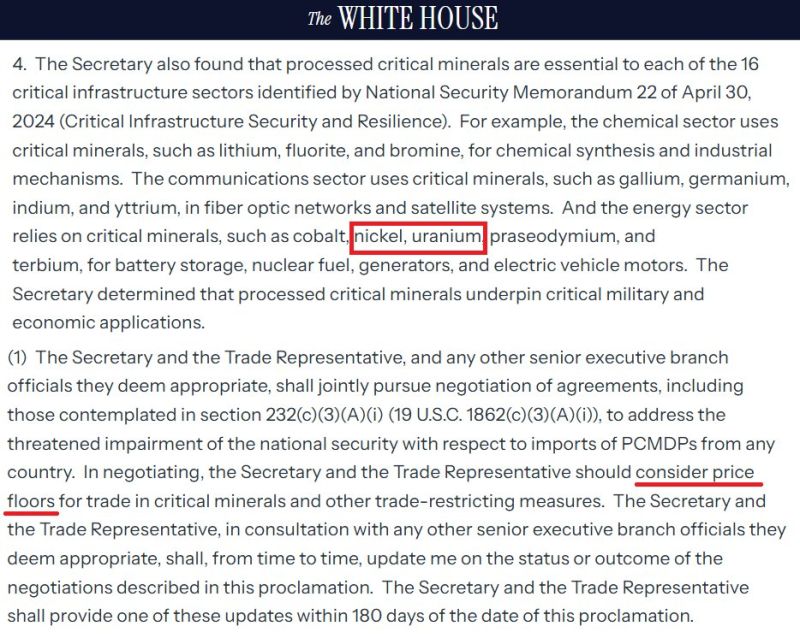

From Ghost Industry to National Priority

This White House statement on critical minerals explicitly listed uranium as a critical mineral, and it looks like they’re actually considering a price floor guarantee. The US used to be a powerhouse in uranium, but the industry is basically a ghost of its former self now. The government seems to be stepping up and back producers with some real institutional support. Things like strategic stockpiling or a price floor could be a massive game-changer. Between the skyrocketing power demand and energy security needs, support seems to be coming. Source: JH @CRUDEOIL231

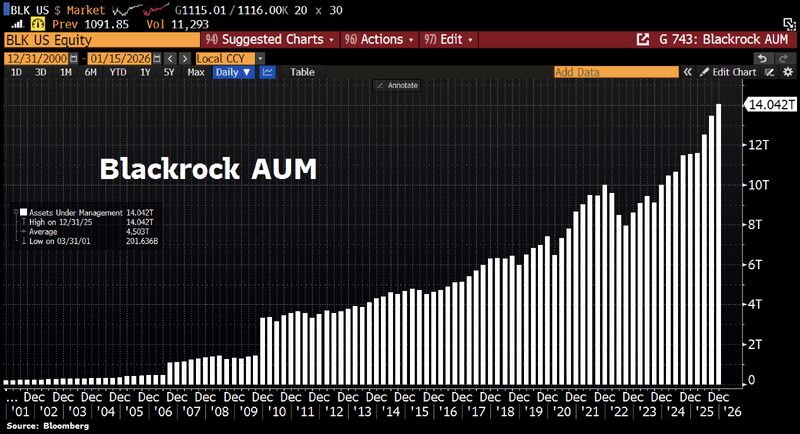

BlackRock is eating the world. Total assets under management hit a record $14 TRILLION after the firm pulled in $342bn of client money in Q4 alone.

Source: HolgerZ, Bloomberg

$7.8 Trillion is now sitting in Money Market Funds, a new all-time high

Source: Barchart

Taiwan will invest $ 250 billion in U.S. chipmaking under new trade deal

The U.S. and Taiwan have reached a trade agreement to build chips and chip factories on American soil, the Department of Commerce announced Thursday. As part of the agreement, Taiwanese chip and technology companies will invest at least $250 billion in production capacity in the U.S., and the Taiwanese government will guarantee $250 billion in credit for these companies. In exchange, the U.S. will limit “reciprocal” tariffs on Taiwan to 15%, down from 20%, and commit to zero reciprocal tariffs on generic pharmaceuticals, their ingredients, aircraft components and some natural resources. Source: CNBC

European Troop Commitments to Greenland

Number of European troops (by country) sent to Greenland to boost security... No, this is not a joke...

Investing with intelligence

Our latest research, commentary and market outlooks