Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

According to Reuters (via an FT report), Anthropic is laying groundwork for an IPO as early as 2026.

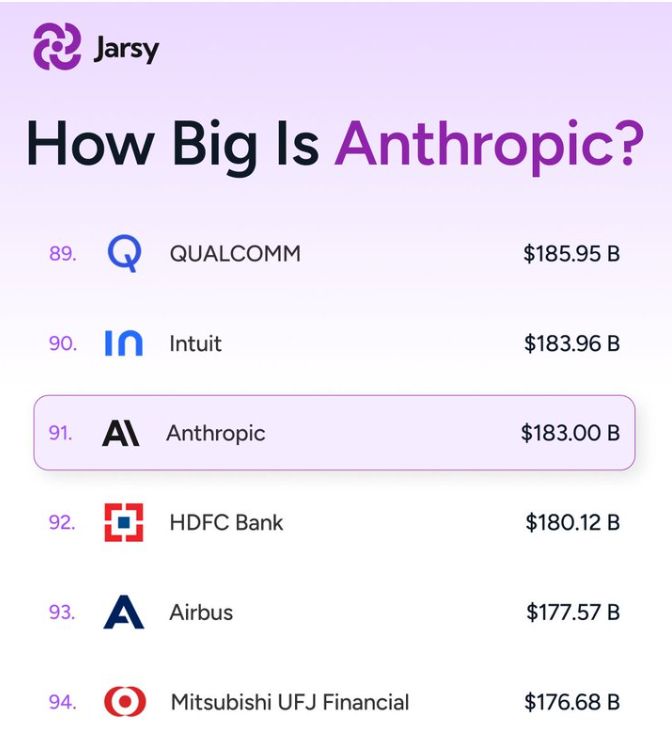

They’re also reportedly in talks for a private funding round that could value the company north of $300B — a huge step up from their most recently disclosed ~$183B post-money valuation. If Anthropic were public today and you simply treated that ~$183B as its market cap, here’s the fun part: 📈 It would land around the low-90s globally by market cap — roughly #91 — just ahead of Airbus (≈$181B). For context, that neighborhood looks like: Blackstone ≈ $186B HDFC Bank ≈ $180B (Anthropic) ≈ $183B Airbus ≈ $178B Source : Reuters, FT

The K-shaped economy is not just about the US

Indeed, the German economy is increasingly K-shaped: stock markets are rising, while consumer confidence is in free fall. Source: HolgerZ, Bloomberg

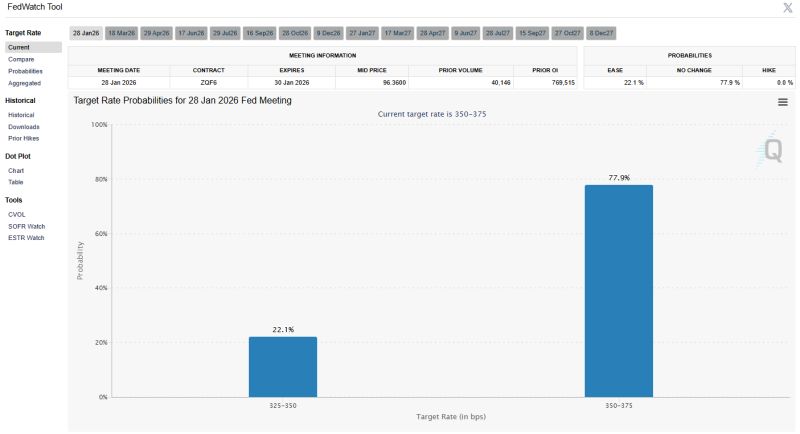

The odds of a January rate cut have fallen to just 22% 🚨

Source: Barchart @Barchart

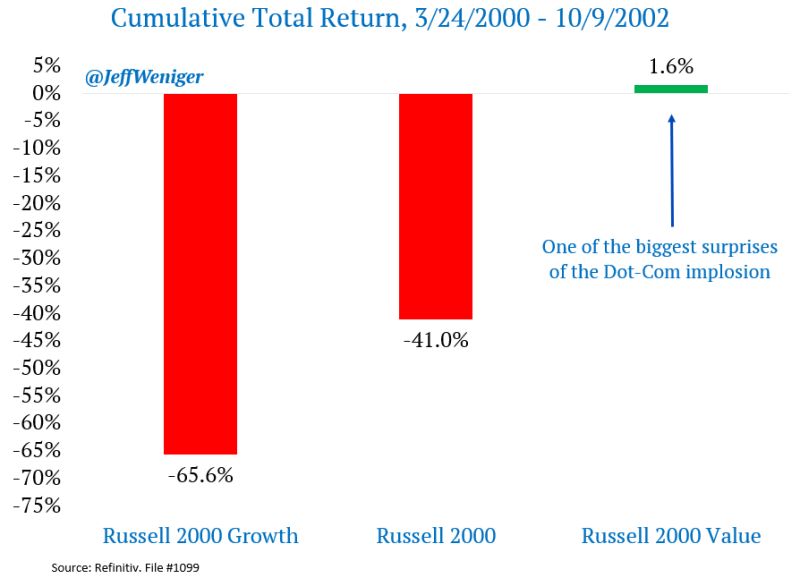

The day the AI bubble implodes, let's keep this in mind

Yes it happened Source: Jeff Weniger

The most important Supreme Court decision you haven’t heard about is coming in January ⚖️

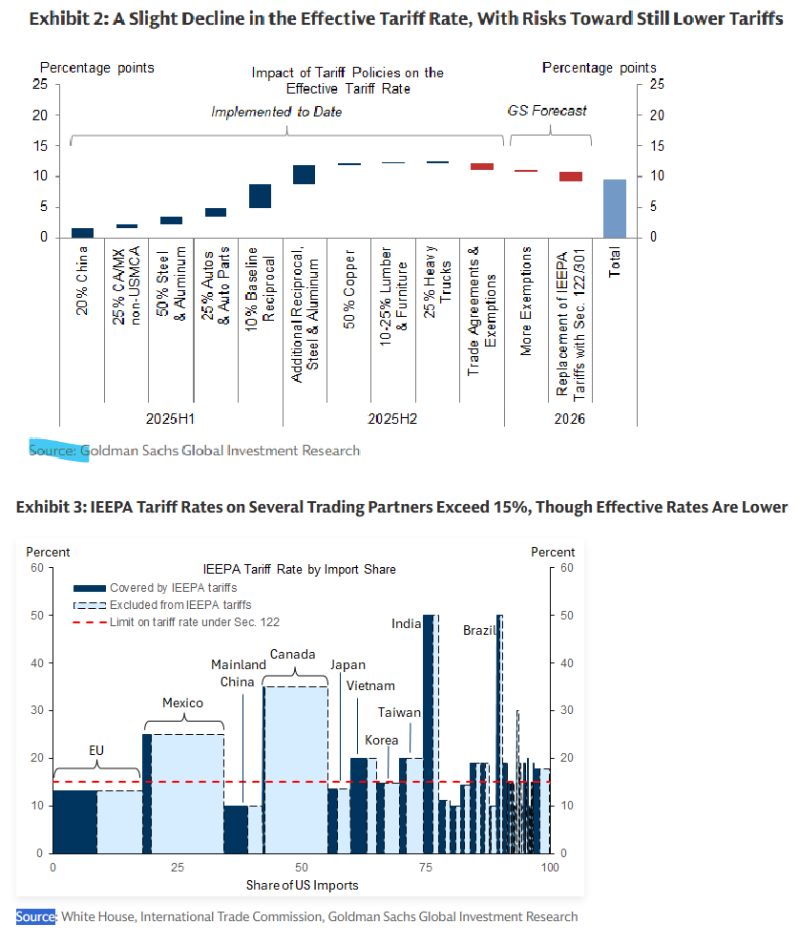

And it could trigger a massive downside risk to current tariff rates. 📉 Goldman’s latest insight suggests the "tariff era" as we know it is about to hit a major legal wall. Here is the breakdown: The Core Issue: The Supreme Court is currently reviewing the IEEPA (International Emergency Economic Powers Act). This is the "emergency" authority used to hike tariffs this year. The Likely Verdict: Oral arguments suggest a majority of Justices believe the administration exceeded its authority. What happens next? 1. The "Big Reset": If the court rules against all IEEPA tariffs, it wipes out 7.5 percentage points of the 11.4pp increase we’ve seen this year. That is a massive shift for global trade. 2. The "Specific" Limit: The court might allow tariffs for specific emergencies, but kill the idea of broad "reciprocal" tariffs. The Bottom Line: The risk to tariff rates is firmly to the downside. Even if the administration pivots to "Section 122" as a backup, rates would likely be capped at 15%. The result? A potential 1.6pp drop in the effective tariff rate almost overnight. So keep an eye on the SCOTUS docket. But let's also keep in mind that Trump administration have already prepared to retaliate. Tariffs are more about the HOW they will be implemented rather than the IF Source: Neil Sheti, Goldman

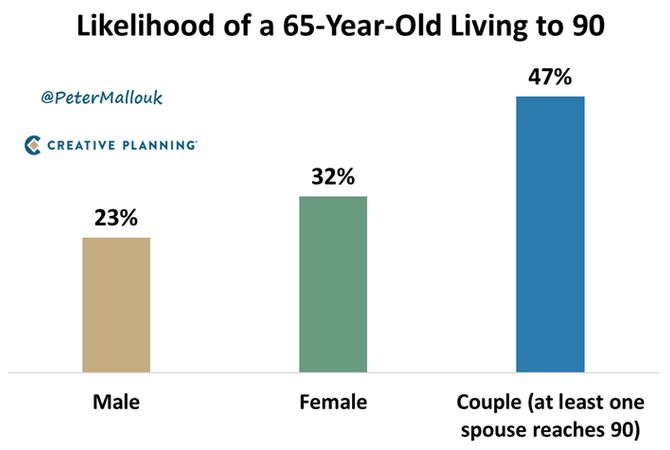

Think you need to go ultra-conservative with your investments at retirement?

Think again! A 65-year-old married couple has a 47% chance that at least one spouse will live to age 90. Your portfolio should be prepared to last several decades into retirement. Source: Peter Mallouk

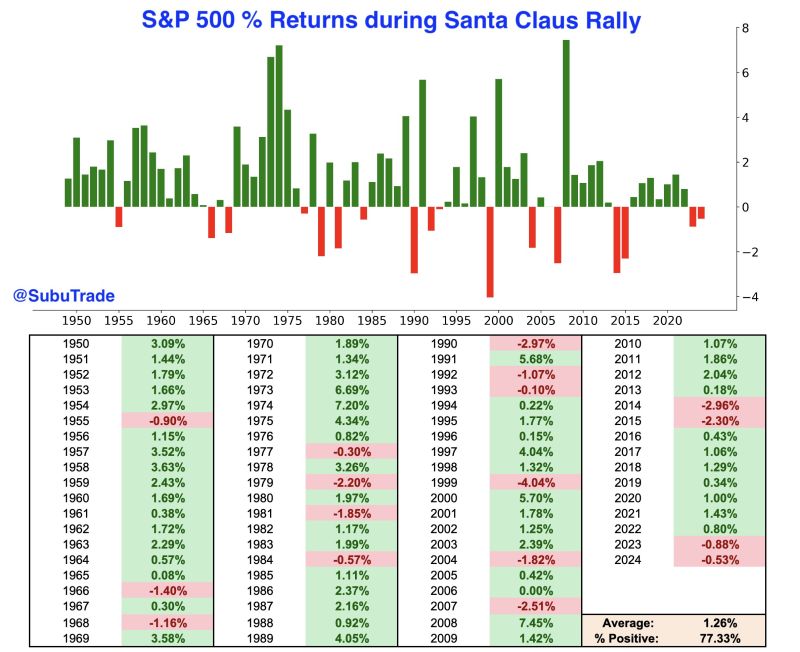

The 'official' Santa Claus Rally begins on December 24

It covers the last 5 trading days of December + the first 2 of January. $SPX was up 77% of the time. The last 2 were negative, but there has never been a third straight down Santa Claus Rally. Source: Subu Trade @SubuTrade

Investing with intelligence

Our latest research, commentary and market outlooks