Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

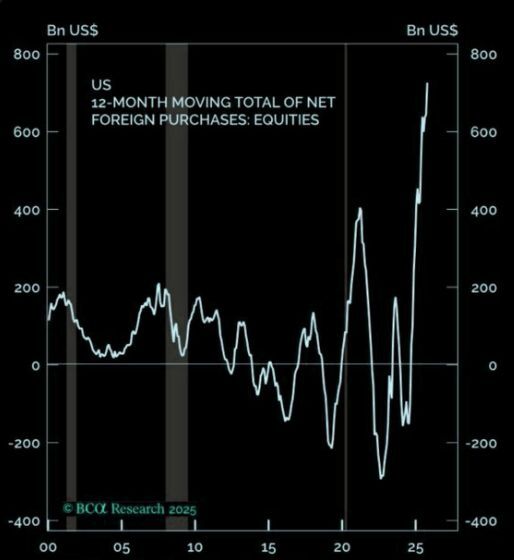

Foreigners net bought more than $700 Billion worth of U.S. Stocks over the last 12 months, the largest inflow this century 🚨👀📈

Source: Barchart

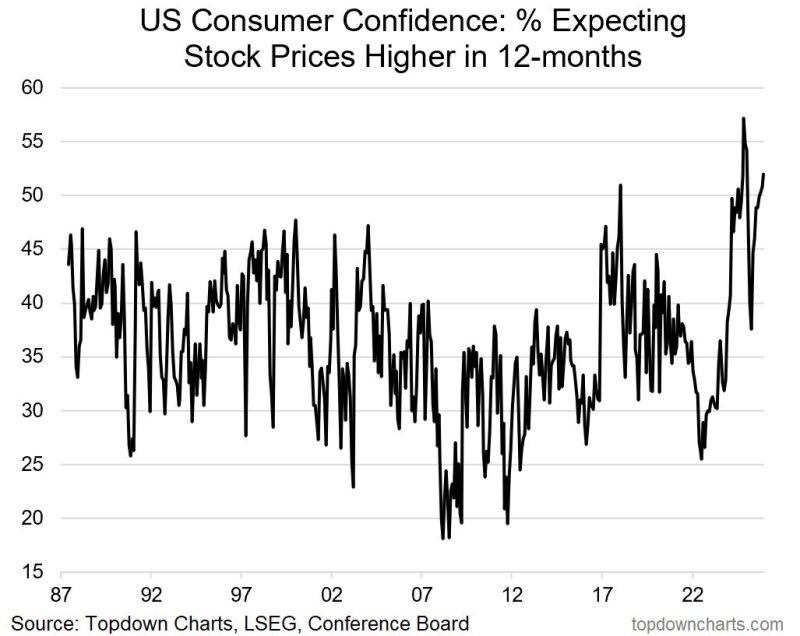

More than 50% of consumers expect higher stock prices over the next 12 months, one of the highest readings in history 🚨📈🤯

Source: Barchart

Chinese Households now have available cash totaling 160 TRILLION Yuan, the equivalent of more than $22 Trillion USD 🚨📈🤑🥳

Source: Barchart, Financial Times

Ayatollah Khamenei plans to flee to Moscow if Iran unrest intensifies

The report says the plan is limited to a tight inner circle with assets already positioned abroad and is modeled in part on Bashar al-Assad’s escape to Russia. It reflects growing concern over Khamenei’s health, his isolation during recent protests, and fears that economic strain and public anger could fracture loyalty inside the security apparatus. Source: Open Source Intel @Osint613

US oil stocks react to Venezuela:

1. Chevron, $CVX: +11% 2. Valero, $VLO: +11% 3. ConocoPhillips, $COP: +10% 4. Marathon, $MPC: +10% 5. Exxon Mobil, $XOM: +7% 6. Phillips 66, $PSX: +6% 7. Occidental Petroleum, $OXY: +4% 8. EOG Resources, $EOG: +4% 9. Devon Energy, $DVN: +4% 10. Kinder Morgan, $KMI: +3% These stocks have now added +$100 BILLION in market cap on the news President Maduro being captured by the US. US big oil has won again. Source: The Kobeissi Letter

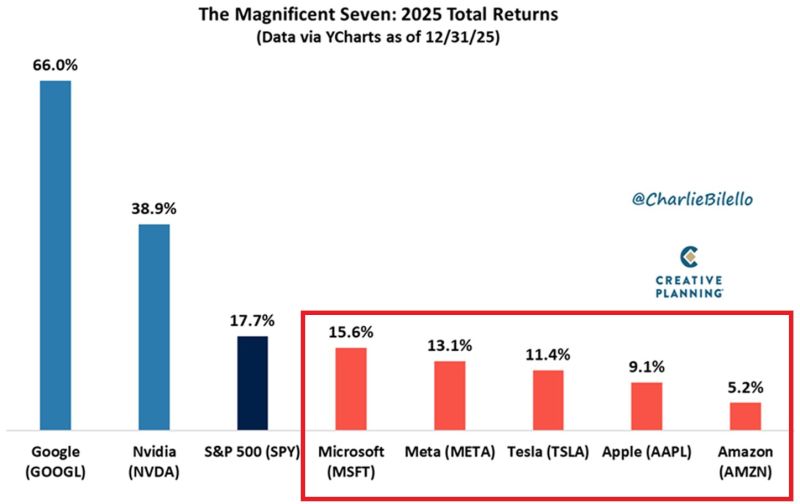

⚠️Most of the Magnificent 7 stocks actually LAGGED the S&P 500 in 2025.

Out of the 7 Magnificent stocks, only Google, $GOOGL, and NVIDIA, $NVDA, outperformed the broader US stock market index last year with +66% and +39% gains, respectively. This means Microsoft, Meta, Tesla, Apple, and Amazon finished 2025 below the S&P 500. The Magnificent 7 are not so magnificent anymore. Will this continue? What do you think? Source: @charliebilello, Global Markets Investor

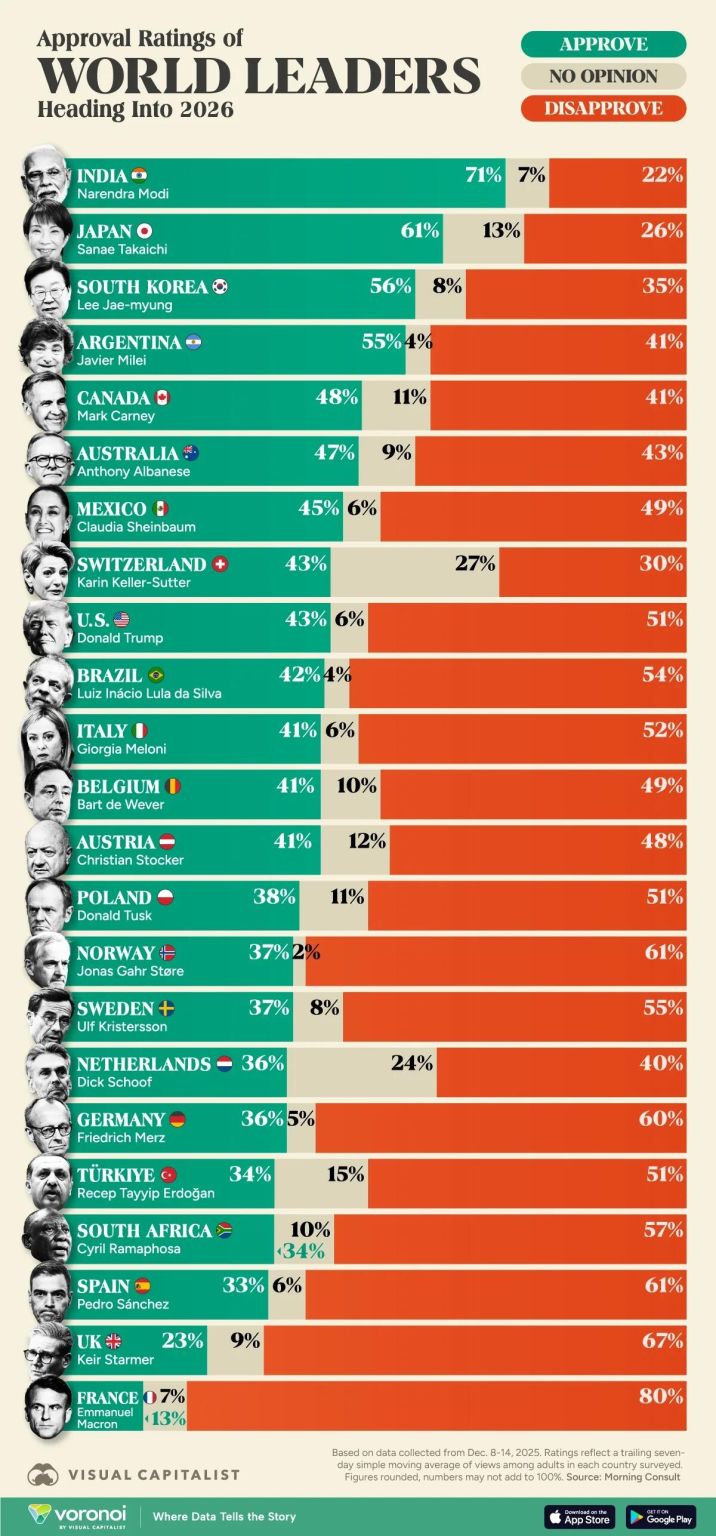

India’s Narendra Modi enters 2026 with a 71% approval rating. That's the highest among world leaders.

MACRON (13%) AND STARMER (23%) = PROFOUNDLY UNPOPULAR Source: Steve Hanke @steve_hanke Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks