Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The 10 best airlines in the world for the year 2025.

Here is the top 10 as illustrated, which corresponds exactly to Skytrax's official ranking for 2025. Source: @Nicolas T.

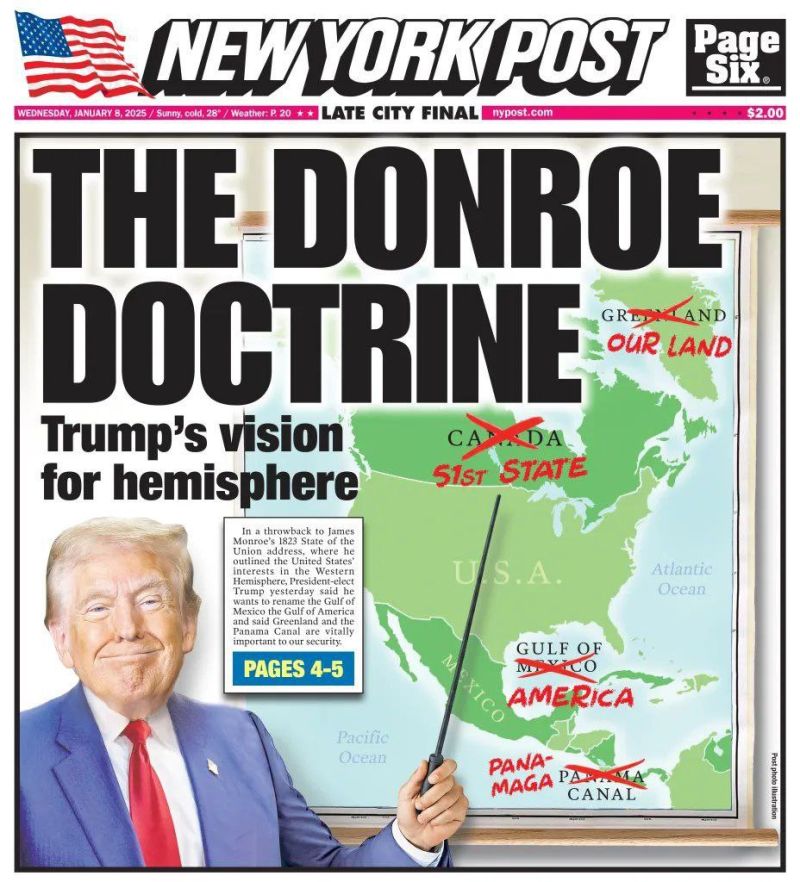

The Donroe doctrine explained

In geopolitical terms, the concept of the Western Hemisphere vs. the Eastern Hemisphere is a framework that divides the world into two distinct spheres of influence. Historically, this served to separate the "New World" (the Americas) from the "Old World" (Europe, Asia, and Africa). Under President Trump’s 2nd administration, this concept has been revitalized through a policy often referred to as the "Trump Corollary" to the Monroe Doctrine. This strategy shifts the focus of U.S. foreign policy away from global commitments in the East (like NATO or the Indo-Pacific) to assert absolute "preeminence" in the West. 1. The Hemispheric Divide The Eastern Hemisphere: Often framed by this administration as a region of "civilizational erasure" and competition. Trump’s strategy suggests that Eastern powers—specifically China and Russia—should stay out of American affairs, while the U.S. simultaneously reduces its traditional role as the "policeman" of Europe and the Middle East. The Western Hemisphere: Framed as the US "neighborhood" or "home turf." The goal is to create a "fortress" in the Americas where the U.S. exercises unchallenged control over security, trade, and resources. 2. The Monroe Doctrine: Colonial vs. Defensive The Monroe Doctrine (1823) originally stated that any intervention by European powers in the politics of the Americas was a potentially hostile act against the U.S. and notably to prevent European monarchs from recolonizing newly independent Latin American nations. Critics argue the doctrine was always a "colonial" tool because it didn't grant Latin American nations true sovereignty; it simply replaced European masters with American ones. 3. The "Trump Corollary" (Monroe 2.0 or Donroe doctrine) The 2025 National Security Strategy (NSS) explicitly introduced the Trump Corollary. It links the 19th-century doctrine to modern "America First" goals in several ways: - Resource and Asset Control: The U.S. now claims the right to deny "non-hemispheric competitors" (China) the ability to own "strategically vital assets" in the Americas, such as ports, mines, or 5G networks. - Militarized Border & Migration: The Western Hemisphere is prioritized as the "main line of defense." Trump has used this framework to justify military operations in the Caribbean and near the Mexican border to stop migration and drug trafficking, treating these as "invasions." - Regime Change & Sovereignty: The recent 2026 military action in Venezuela to remove Nicolás Maduro is the most direct application of this doctrine. It sends the message that the U.S. will manage the affairs of the hemisphere and will not tolerate "hostile" regimes aligned with Eastern powers. - Territorial Expansion: Informal discussions about Greenland or "annexing" parts of Canada are viewed by some as an extreme, modern extension of the "the Monroe Doctrine.

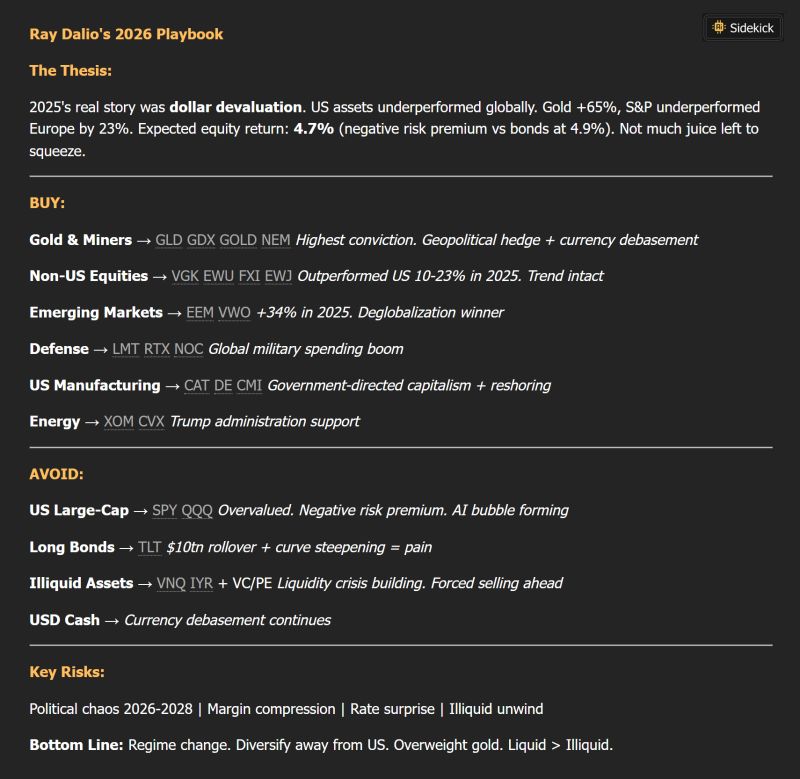

The founder of the world's largest hedge fund just dropped his roadmap for 2026.

We ran it through Sidekick to break down the key takeaways and where he’s positioning as markets shift. Here’s the breakdown: Source: TrendSpider @TrendSpider

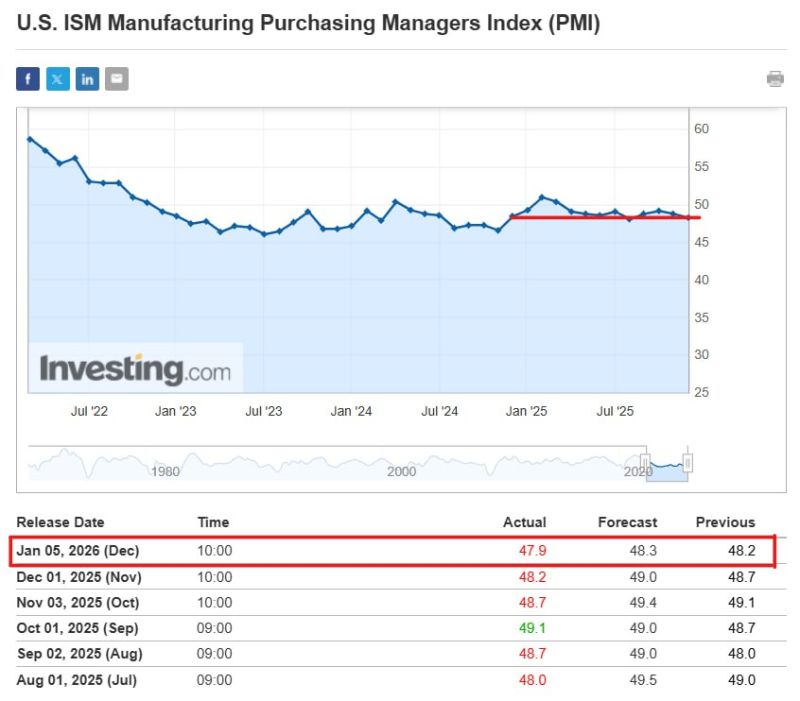

In case you missed it... US ISM Manufacturing PMI came in at a 14 month low of 47.9. while the expectation was 48.4.

The ISM Manufacturing is still trending lower, which means the US economy is still struggling. Source: www.investing.com, Bull Theory

Uranium, $URA extends it’s rally, gaining +5% The bull market is broadening

Source: Hedgeye

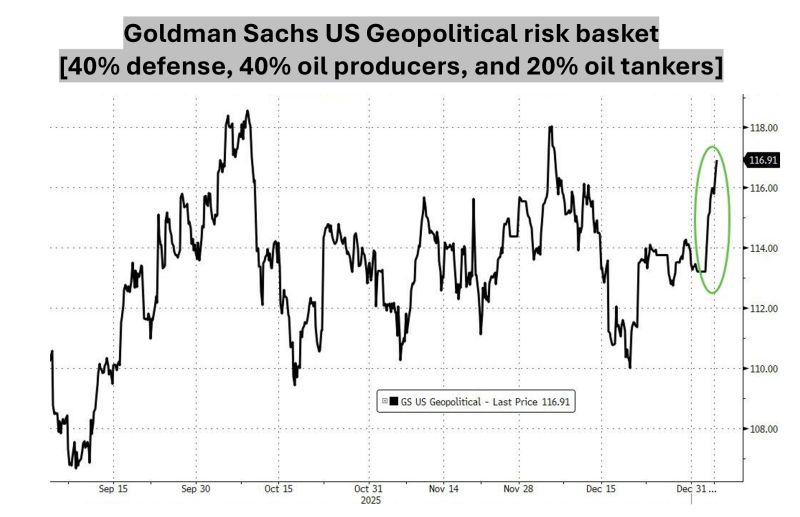

How to go long geopolitical risk...

Goldman's US Geopolitical Risk basket (composed of US-listed equities that are sensitive to geopolitical risk, diversified across 40% defense, 40% oil producers, and 20% oil tankers) has surged to start 2026... Source: zerohedge, Bloomberg

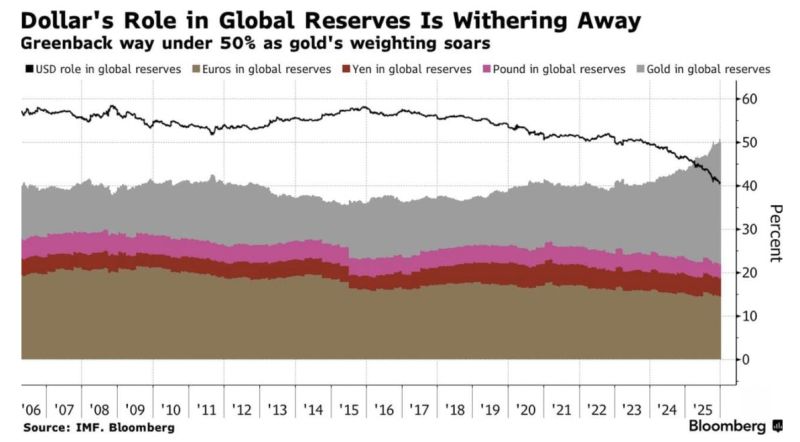

Gold has overtaken the U.S. Dollar as the largest Global Reserve Asset 🚨🚨🚨

(of course performance helped) Source: Barchart, Bloomberg

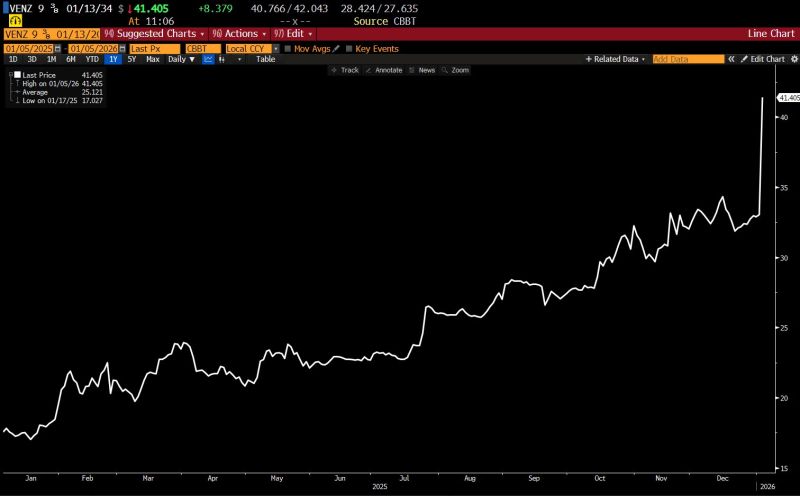

Bonds - not oil - were the play... Venezuela debt has doubled in the last 6 months.

Source: The Long View @HayekAndKeynes

Investing with intelligence

Our latest research, commentary and market outlooks