Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Gold and Silver just hit a new all-time high as the US dollar weakened after Powell accused Trump of targeting the Fed.

Now the Fed’s independence is at risk, so investors are dumping dollar and buying metals for safety hedge. The precious metal bull run still shows no signs of stopping in 2026. Source: Bull Theory @BullTheoryio

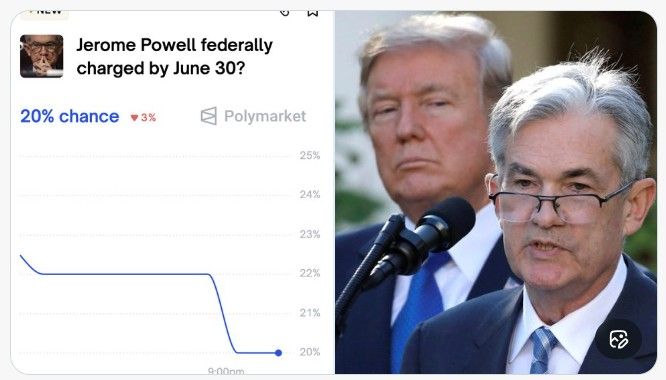

NEW POLYMARKET: JPow charged?

Will Trump follow through? Source : Polymarket

Powell has the highest approval rating of any “political leader” in the country.

Source: Joe Weisenthal @TheStalwart Gallup

Is the volatility index VIX set to spike?

Asset managers have aggressively increased their VIX futures shorts to the highest level since July 2024. In other words, funds are betting heavily on continued low stock market volatility. Such extreme short VIX positioning often leaves markets vulnerable to sharp volatility spikes if sentiment turns. A similar setup occurred in July-August 2024, when a sudden shift in risk appetite drove a nearly -10% market drop. Are we heading for a pullback? Source. Global Markets Investors

A fascinating chart that shows how important social skills really are.

High social skills + High maths skills = holy grail Source: nxthompson @nxthompson, FT

U.S. Dollar Index $DXY heating up, now above 99 for the first time in 1 month

Source: Barchart

📢 No Supreme court ruling on tariffs today.

The Supreme Court just kept the world guessing. 🏛️📉 Wall Street was holding its breath for a Friday ruling on the Trump administration’s broad tariffs. Instead? Silence. The Court released one unrelated opinion and adjourned, leaving the legality of billions in trade duties—and the fate of the U.S. fiscal deficit—hanging in the balance. Here is why this is the biggest "wait and see" in the market right now: ⚡ The $200 Billion Stakes At the heart of the case is the IEEPA (International Emergency Economic Powers Act). The Court has to decide: Legality: Can the President use emergency powers to bypass Congress and levy global tariffs? The Refund Bomb: If the tariffs are ruled illegal, will the U.S. have to pay back $150B–$200B to importers who already paid up? ⚖️ The "Mishmash" Theory Treasury Secretary Scott Bessent expects a "mishmash" ruling. The Court could grant limited powers or require only partial repayments. It’s rarely all-or-nothing at this level of government. 🔄 The "Workaround" Reality Even if the White House loses, don't expect a free-trade party. The "Plan B": The administration is already eyeing the 1962 Trade Act to keep tariffs at similar levels. The Impact: Analysts at Morgan Stanley see "significant room for nuance." The White House may pivot to a "lighter-touch" approach focused on affordability, but the tariffs aren't likely to vanish. 📉 The Economic Twist Despite the controversy, the data is defying the doomsayers: Inflation: Has remained surprisingly limited. Trade Deficit: October hit its lowest level since 2009. The Bottom Line: If the court blocks the tariffs, it’s a win for corporate earnings and input costs, but a massive headache for the national deficit and "onshoring" ambitions. Prediction markets only give a 28% chance that the tariffs are upheld exactly as they are.

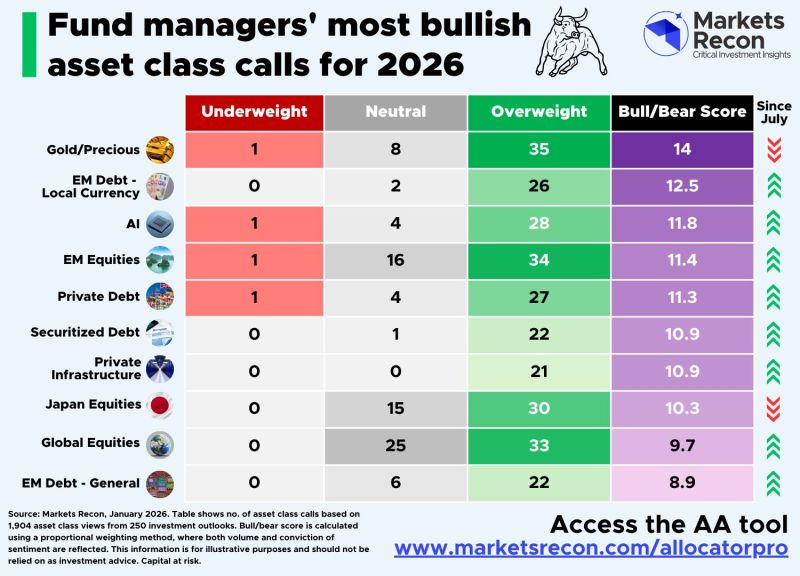

Where are fund managers most bullish for 2026? 🤔

Based on Markets Recon's review of ~250 asset manager outlooks for 2026, the most frequently mentioned overweight call was... GOLD 🥇 What else do asset managers like for 2026 portfolios? 📈 In Equities, it's AI 🤖, EM 🌍, and Japan 🇯🇵 stocks getting the most love. 📄 In Bonds, its EM Debt 🌎 and Securitised Debt 🧩. And in Private Markets, Infrastructure 🌉 is the most admired. Source: Stephen White, CAIA from Markets Recon

Investing with intelligence

Our latest research, commentary and market outlooks