Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

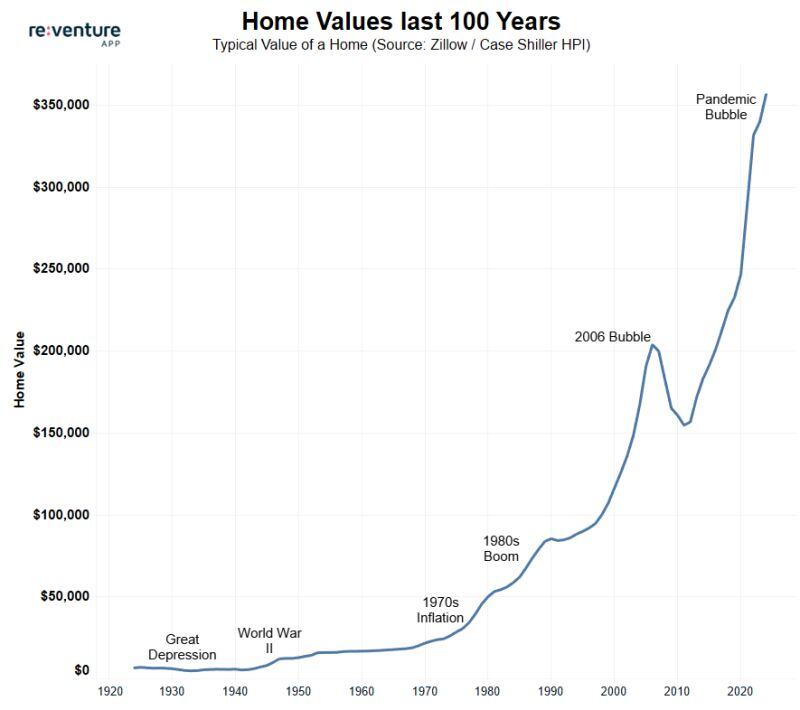

The value of a home in America since 1924.

Real estate is one way to protect your wealth against money debasement Source chart: re-venture

Morgan Stanley is leaving the Net-Zero Banking Alliance, the lender said on Thursday.

👉 Morgan Stanley (NYSE: MS) has become the latest financial giant to abandon the Net-Zero Banking Alliance, a UN-backed coalition aimed at aligning banks’ financing activities with global net-zero emissions targets. The move follows recent exits by Citigroup (NYSE: C) and Bank of America (NYSE: BAC), and earlier departures by Goldman Sachs Group (NYSE: GS) and Wells Fargo (NYSE: WFC), marking a significant retreat from collective climate commitments by some of the world’s largest banks. 👉 These high-profile defections, driven by intensifying political and market pressures, cast doubt on the ability of voluntary financial coalitions to sustain ambitious climate action in a polarized environment. 👉 Launched in 2021, the NZBA aimed to transform the financial sector’s role in combating climate change. As part of the broader Glasgow Financial Alliance for Net Zero, it united over 140 banks across 44 countries, with members committing to reduce greenhouse gas emissions linked to their financing activities and to achieve net-zero emissions by 2050. 👉 NZBA members pledged to set interim 2030 emissions targets for high-impact sectors, including energy, transportation, and heavy industry, aligning their portfolios with the 1.5°C warming limit set by the Paris Agreement.. Source: Bloomberg, thedeepdive.ca

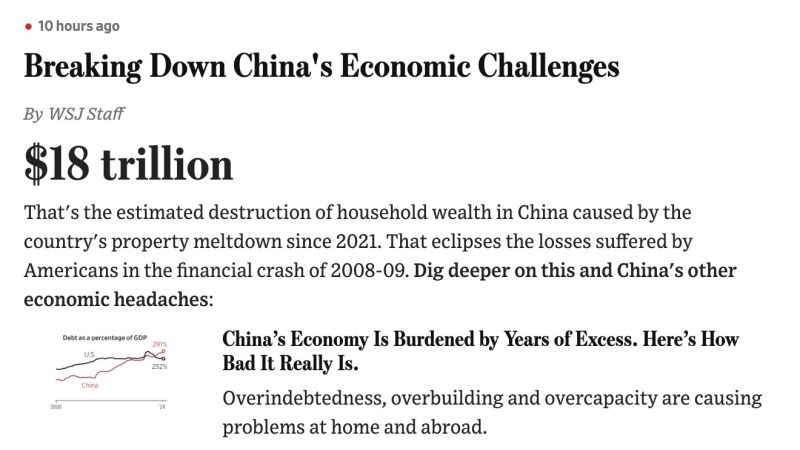

BREAKING 🚨: China

The Chinese Property Market has seen a total loss of $18 Trillion over the past 3 years, surpassing the losses suffered by the U.S. during the Global Financial Crisis. Source: Barchart

Global Macro: Diverging trends for 2025 real GDP growth

🚨 US: While the US economy maintains relatively high growth, a slight deceleration is expected in 2025, influenced by factors like market adjustments and global economic shifts. 🚨 Europe: The Euro Area is set for continued growth, with projections pointing to a steady increase in GDP, particularly in France and Germany. 🚨 China and India: Both countries have been driving global growth, but their expansion is expected to slow down. China’s growth could be further affected by the potential impact of Trump's tariff increases, which may challenge the economy in 2025. Source: Genuine Impact, Goldman Sachs

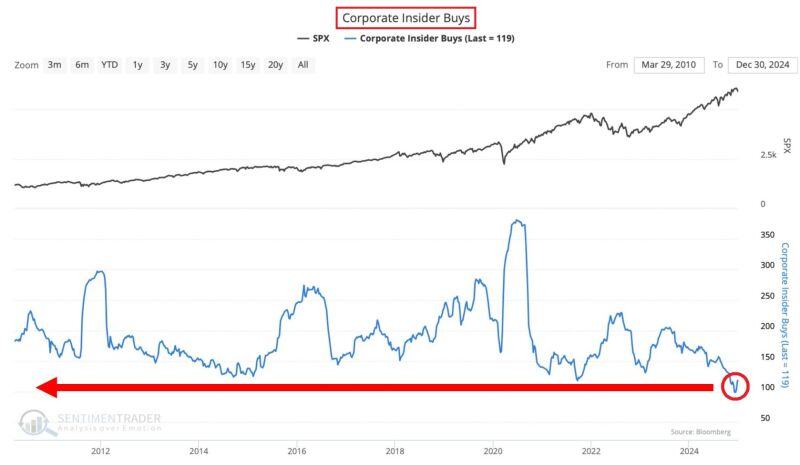

US CORPORATE INSIDERS BUYING HAS RARELY BEEN SO LOW

US executives' buys of their companies stocks dropped to near the lowest on record. This coincides with insiders selling the most stocks ever. Are they saying that stocks are expensive? Source: Sentimentrader and Bloomberg data thru Global Markets Investor

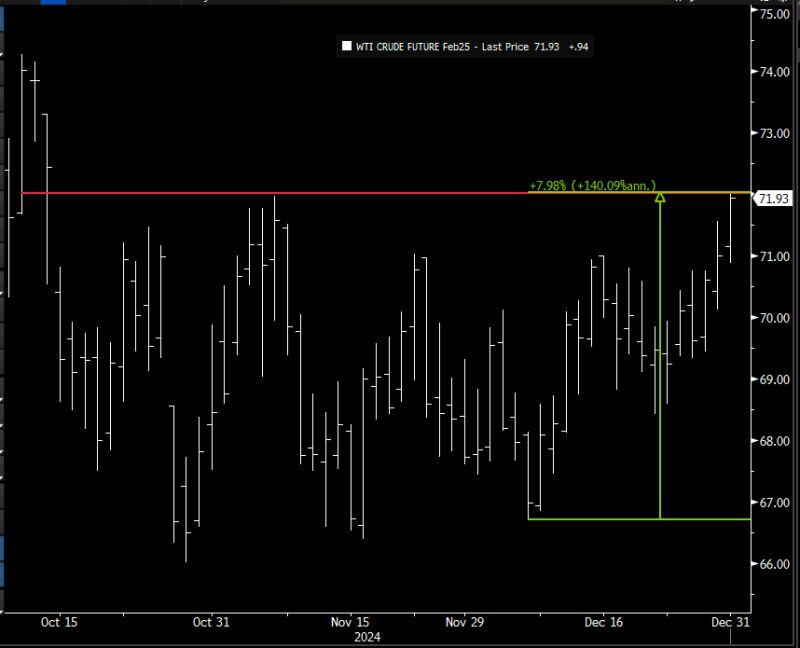

An unexpected behavior by oil...

As the red line shows, WTI is at its highest price since October. The green annotation shows that it has increased by 8% in the last few weeks. The rise of oil prices took place despite Trump win (and the subsequent "Drill, baby drill") and Scott Bessent being nominated Treasury Secretary nominee (and says the US should add 3 million barrels/day of production). So why isn't crude oil slumping and now on the verge of breaking out? Source: James Bianco, Bloomberg

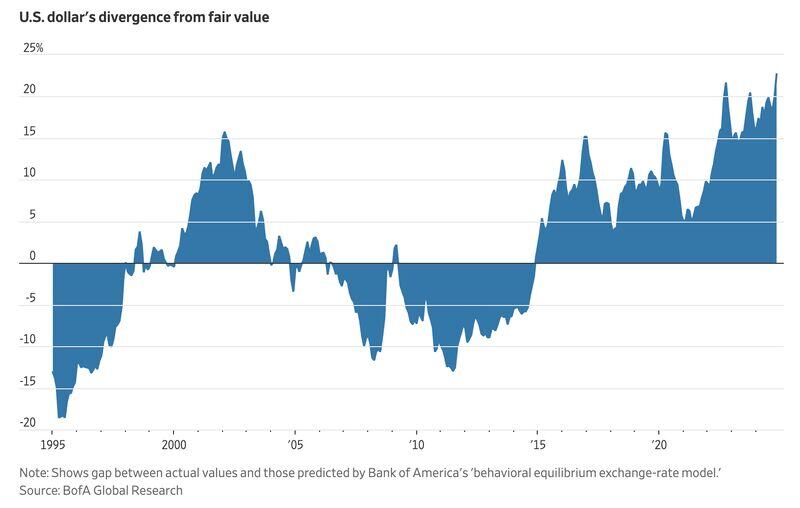

USDollar is now the most overvalued in history according to Bank of America.

Bank of America uses a "behavioral equilibrium exchange model (BEER)", an economic concept used to estimate the equilibrium exchange rate of a currency based on fundamental macroeconomic factors and behavioral relationships. BEER models derive the equilibrium exchange rate from observable economic fundamentals such as Terms of trade, Productivity differentials, Net foreign assets, Interest rate differentials and Trade balances Source: Barchart

A new risk seems to be rising as we start 2025: terrorism on US soil

• NEW ORLEANS TERROR ATTACK: At least 10 people were killed and 35 injured when a driver rammed a pickup truck into a crowd during New Year’s celebrations on Bourbon Street in New Orleans early on Wednesday morning. The FBI is investigating it as an “act of terrorism.” • TESLA CYBERTRUCK EXPLOSION OUTSIDE TRUMP LAS VEGAS HOTEL: Government officials told ABC News that the Tesla Cybertruck explosion on Wednesday outside the Trump Las Vegas hotel in Nevada is being investigated as a "possible act of terror." Source: CNN, ABC, Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks