Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

An era came to a close in Europe on the first day of 2025 >>>

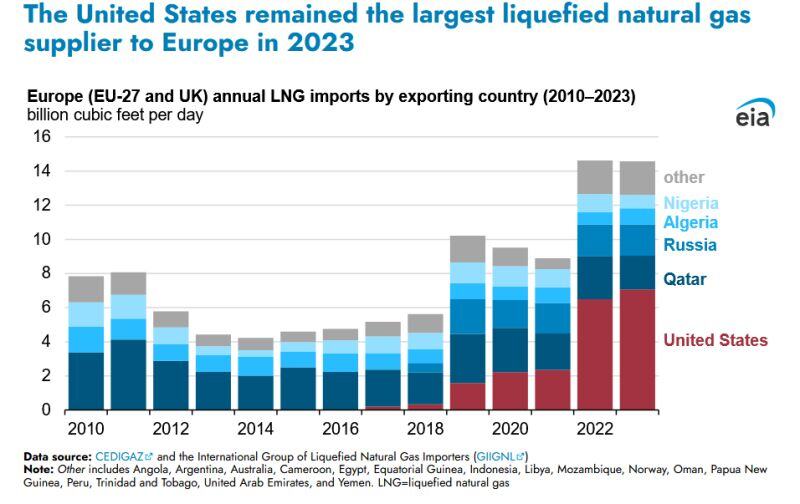

Russian gas exports via Soviet-era pipelines running through Ukraine came to a halt on New Year's Day, marking the end of five decades of Moscow's dominance over Europe's energy markets, as well as cheap gas that kept Germany's economy humming. The gas had kept flowing despite nearly three years of war, but Russia's gas firm Gazprom said it had stopped at 0500 GMT after Ukraine refused to renew a transit agreement. European natural gas prices have been rising all year and closed 2024 more than doubling from their February lows. There is a risk they will only keep rising now. The European Commission said the EU had prepared for the cut-off. Indeed, the EU has slashed its dependence on Russian energy since the start of the war in Ukraine by buying more piped gas from Norway and LNG from Qatar and the United States. "The European gas infrastructure is flexible enough to provide gas of non-Russian origin," a spokesperson for the Commission said. "It has been reinforced with significant new LNG (liquefied natural gas) import capacities since 2022." The biggest beneficiary of said LNG imports is, of course, the US which has seen its LNG exports to Europe soar since the Ukraine war and since the US blew up the Nordstream pipeline, making (expensive) US sourced LNG one of the few realistic alternatives for Europe. In other words, Europe has gone from relying entirely on cheap Russian gas to relying entirely on expensive US LNG. Source: zerohedge

Europe has gone from relying entirely on cheap Russian gas to relying entirely on expensive US LNG

Source: zerohedge

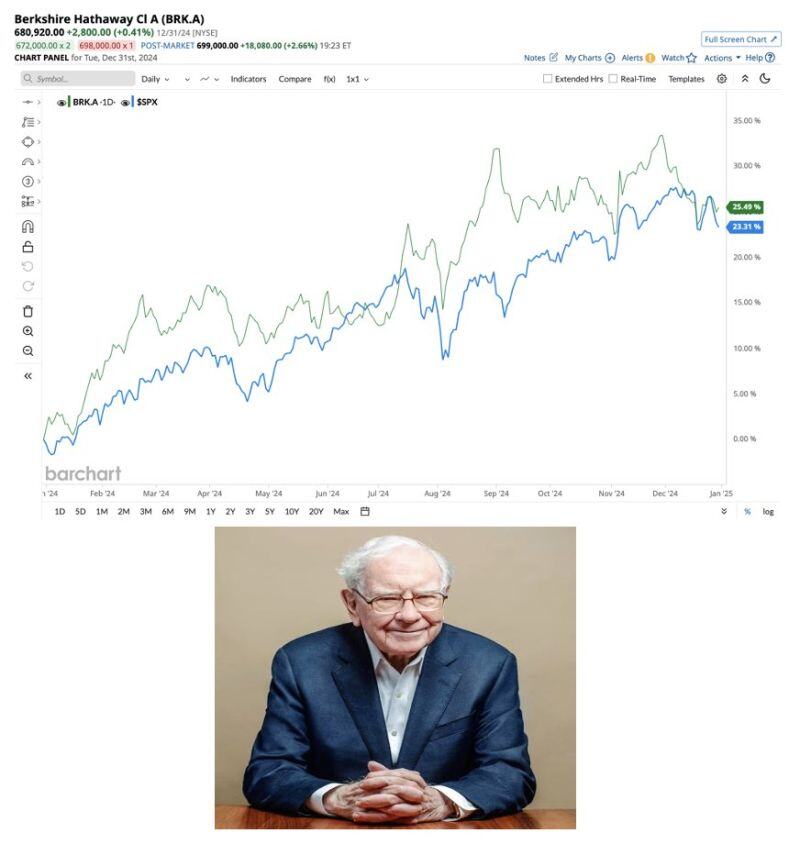

Warren Buffett did it again! Berkshire Hathaway outperformed the S&P 500 in 2024.

Source: Barchart

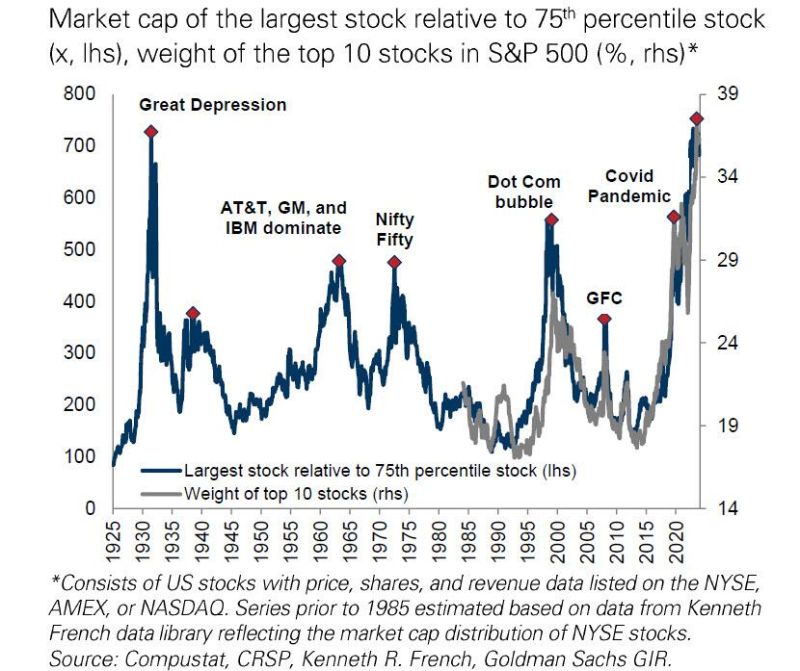

The last time just 10 stocks accounted for 38% of total market cap was just before the Great Depression

Source: Goldman, zerohedge

MicroStrategy $MSTR now down 47% since hitting an all-time high 6 weeks ago

Source: Barchart

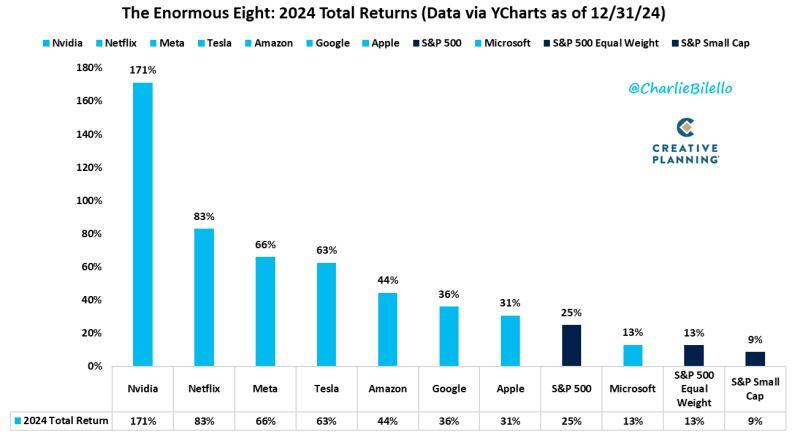

The Enormous Eight: 2024 Returns

Nvidia $NVDA: +171% Netflix $NFLX: +83% $META: +66% Tesla $TSLA: +63% Amazon $AMZN: +44% Google $GOOGL: +36% Apple $AAPL: +31% -S&P 500 $SPY: +25% Microsoft $MSFT: +13% -S&P Equal Weight $RSP: +13% -S&P SmallCap $IJR: +9% Source: Charlie Bilello

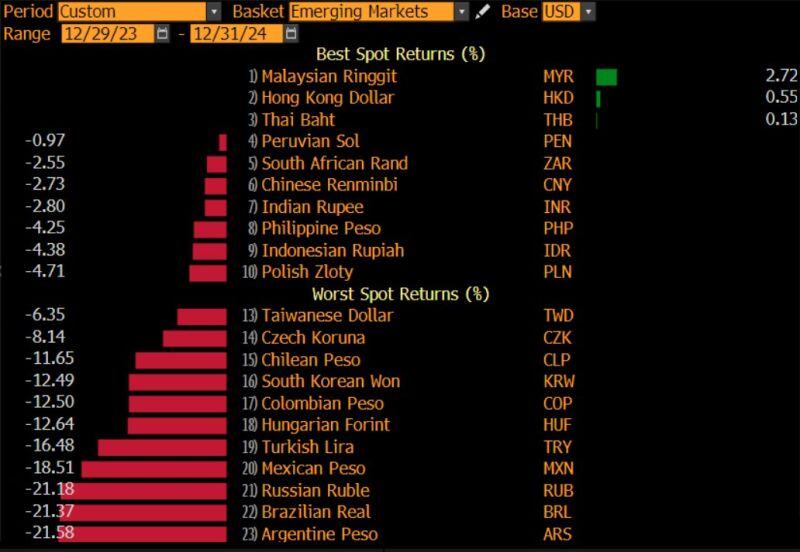

This is EM currency performance versus the Dollar in 2024. The 3 worst performers are: (i) Argentina's Peso; (ii) Brazil's Real; (iii) Russia's Ruble.

Source: Bloomberg, Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks