Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Canadian investor and “Shark Tank” star Kevin O’Leary said Thursday that he wants to help broker a deal with President-elect Donald Trump

that would create some sort of “economic union” between the US and Canada – declaring that at least half of his countrymen would support such a merger. "There's 41 million Canadians sitting on the world's largest amounts of all resources, including the most important, energy and water. Canadians over the holidays have been talking about this. They want to hear more. What this could be is the beginning of an economic union. Think about the power of combining the two economies and erasing the border between Canada and the United States. I like this idea and at least half of Canadians are interested. Nobody wants Trudeau to negotiate this deal. I don't want him doing it for me, so I'm going to go to Mar-a-Lago. I'll start the narrative".

THIS IS ONE OF THE MOST EXPENSIVE MARKETS IN HISTORY

Most valuation indicators are at or near the highest levels since the 2000 Dot-Com BUBBLE. Some of them exceeded these levels, such as the Buffett ratio. Some indicators imply negative returns over the next few years. Source: Global Markets Investor @GlobalMktObserv, Hubert Ratings

"Bad" newspaper headlines do not always translate into bad equity returns...

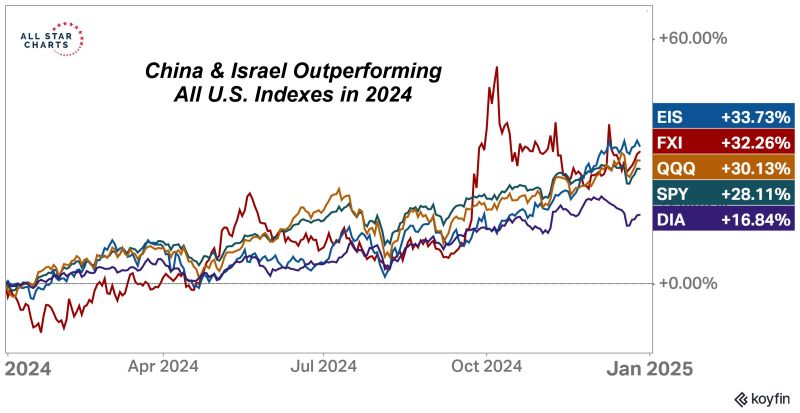

Believe it or not but both Israel and China outperformed all the major U.S. Indexes in 2024. Source: J-C Parets

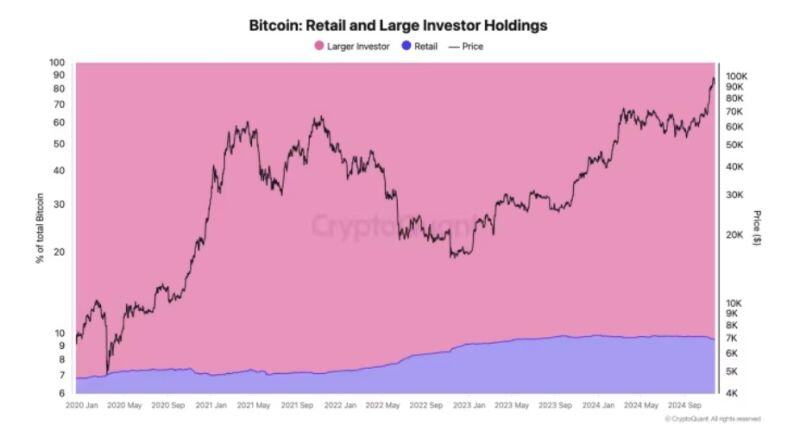

On-chain analytics reveal that retail investors (holding less than 1 BTC) own 9.5% of total bitcoin, while large investors control the remaining 90.5%.

Notably, retail ownership has grown significantly—from 6.8% in 2020 to a record high of 9.85% in December 2023. Quarterly reports from crypto exchange Coinbase provided data on transaction volume on its platform and broke down whether this volume came from institutions or consumers (retail). Although retail investor volume grew in 2024 compared with 2023, so did institutional volume — and at much higher levels. source : criptoquant

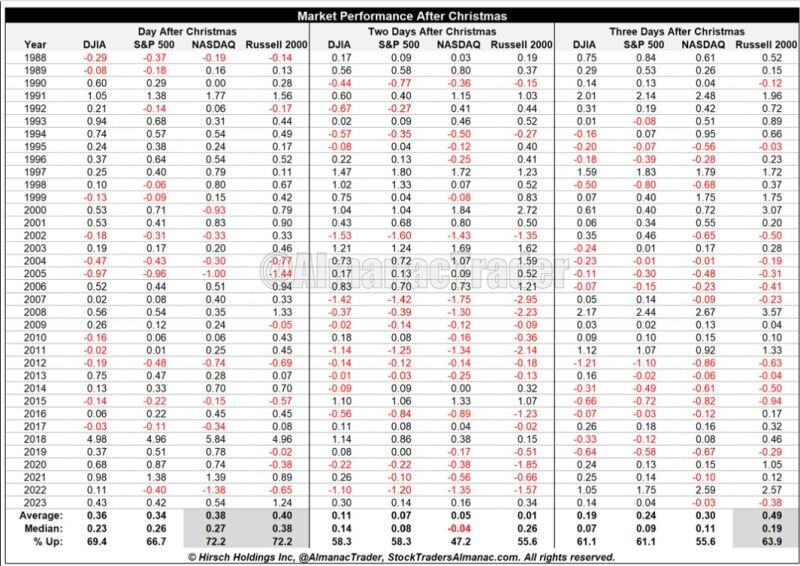

Market Performance After Christmas

Day after Christmas – NASDAQ & Russell 2000 Up 72.2% of time with average gains of 0.38% and 0.40% respectively. source : almanactrader

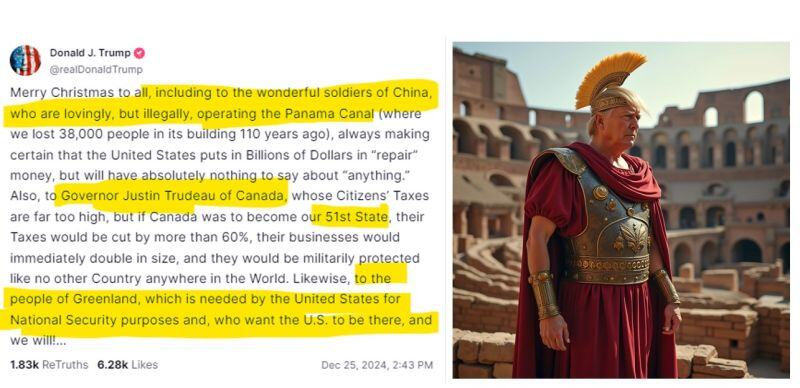

🚨TRUMP CHRISTMAS WISHES - A "MERRY CHRISTMAS" TO "EVERYONE"... WITH A MESSAGE TO THE WORLD

- On China and the Panama canal: “To the wonderful soldiers of China, who are lovingly, but illegally, operating the Panama Canal… the United States puts in Billions of Dollars in ‘repair’ money but will have absolutely nothing to say about ‘anything.’” - On Canada: “To Governor Justin Trudeau of Canada, whose Citizens’ Taxes are far too high, but if Canada was to become our 51st State, their Taxes would be cut by more than 60%, their businesses would immediately double in size, and they would be militarily protected like no other Country anywhere in the World.” - On Greenland: “To the people of Greenland, which is needed by the United States for National Security purposes and who want the U.S. to be there, and we will!” Closing Note: “We had the Greatest Election in the History of our Country… and, in 26 days, we will MAKE AMERICA GREAT AGAIN. MERRY CHRISTMAS!” Will US imperialism be one of the major theme of 2025??? Source: Truth Social, @mario nawfal on X

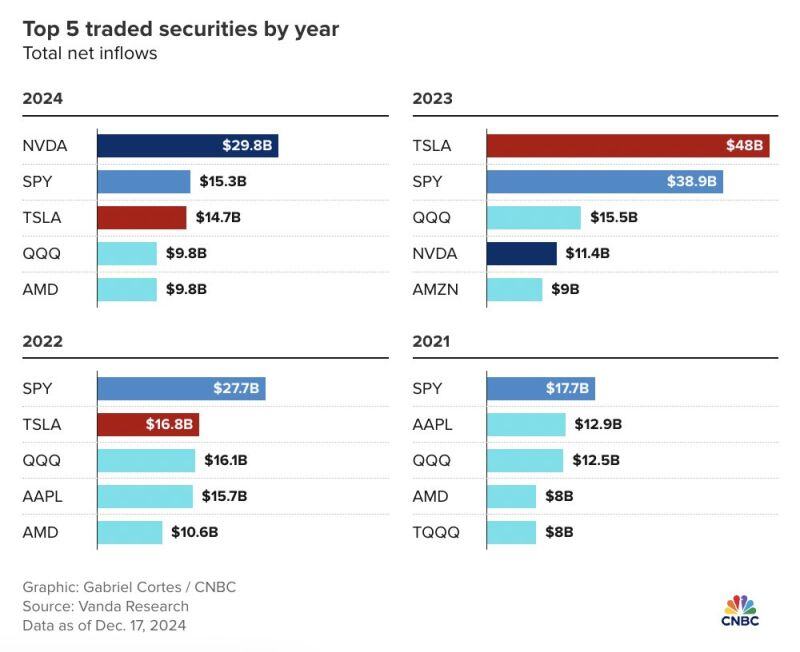

Nvidia $NVDA was the most-bought stock by retail traders on net in 2024

Source: CNBC, Evan on X

Investing with intelligence

Our latest research, commentary and market outlooks