Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

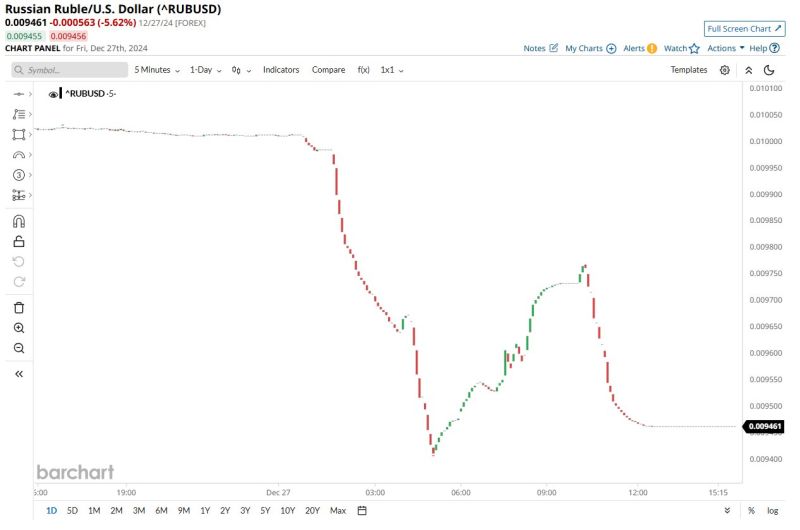

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

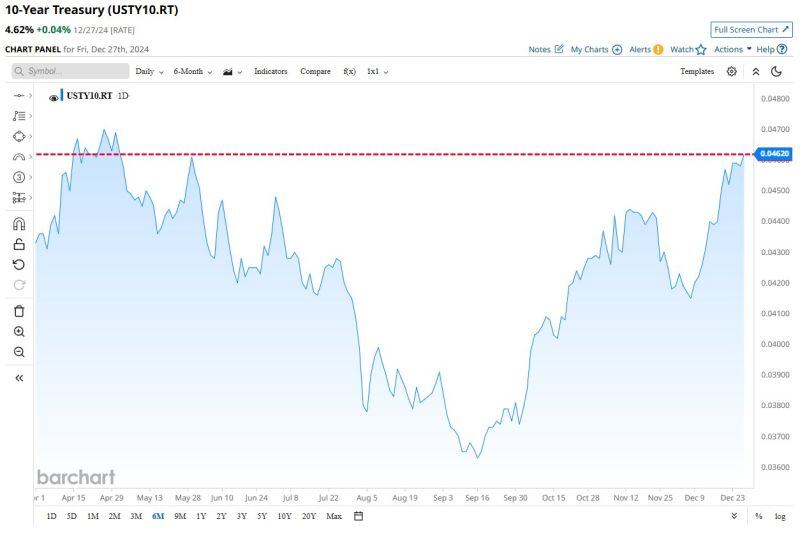

10-Year Treasury Yield closes at highest level in almost 8 months 🚨

Source. Barchart

With just 2 trading days left in 2024 here's a full heat map of the NASDAQ 100's $QQQ performance so far this year.

Source: Evan @StockMKTNewz

Bitcoin monthly candle closes soon...

Will the december monthly candle look like that? $BTC Source: Trend Spider

Yearly candles on the S&P 500. This looks like a multi-year breakout. 🐂 $SPX

Source: Trend Spider

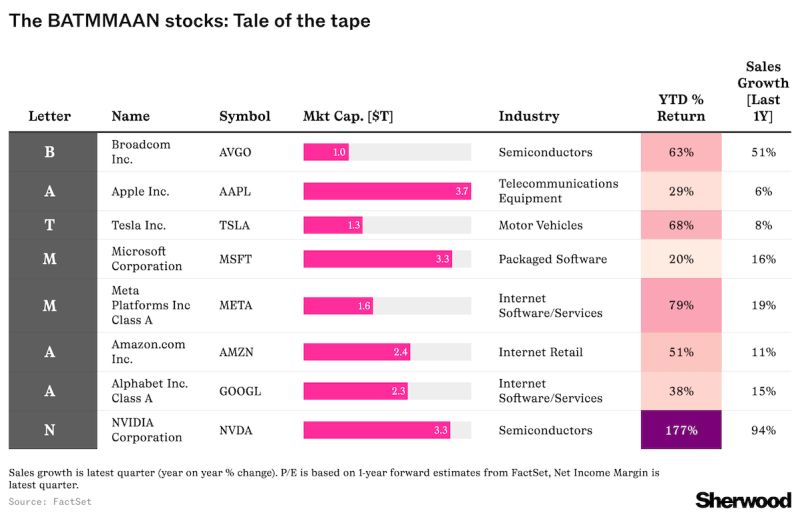

Not the Magnificent 7, but 2024 was the year of BATMMAAN! 🦇

BATMMAAN: +70% YTD Mag 7: +65% YTD S&P 500: +27% YTD Source: Wall St Engine,@wallstengine

🚨 The S&P 500 is down 1.0% in December but most of the sectors have been in a carnage:

Energy -10.7% Materials -9.9% Real Estate -8.9% Utilities -7.6% Industrial -7.0% Healthcare -5.3% Financials -4.6% Consumer Staples -4.0% 🚨 Tech holds this market. Source: Global Markets Investor, Bloomberg

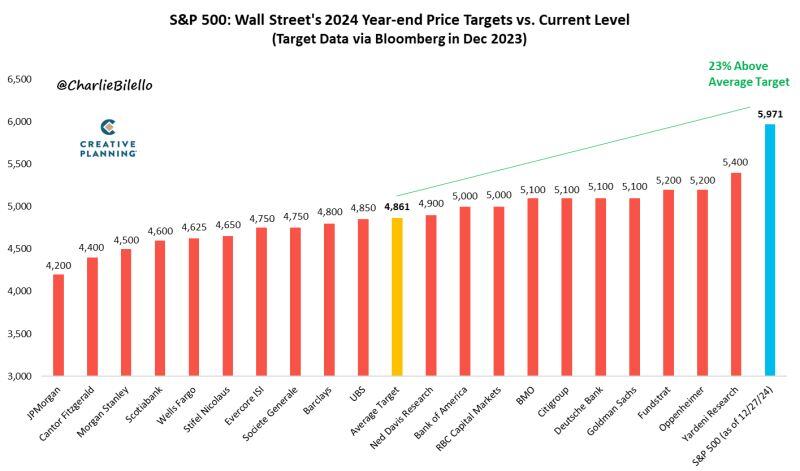

At 5,971, the S&P 500 is over 500 points above above the highest 2024 year-end price target from Wall Street strategists and 23% above the average target (4,861).

$SPX Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks