Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

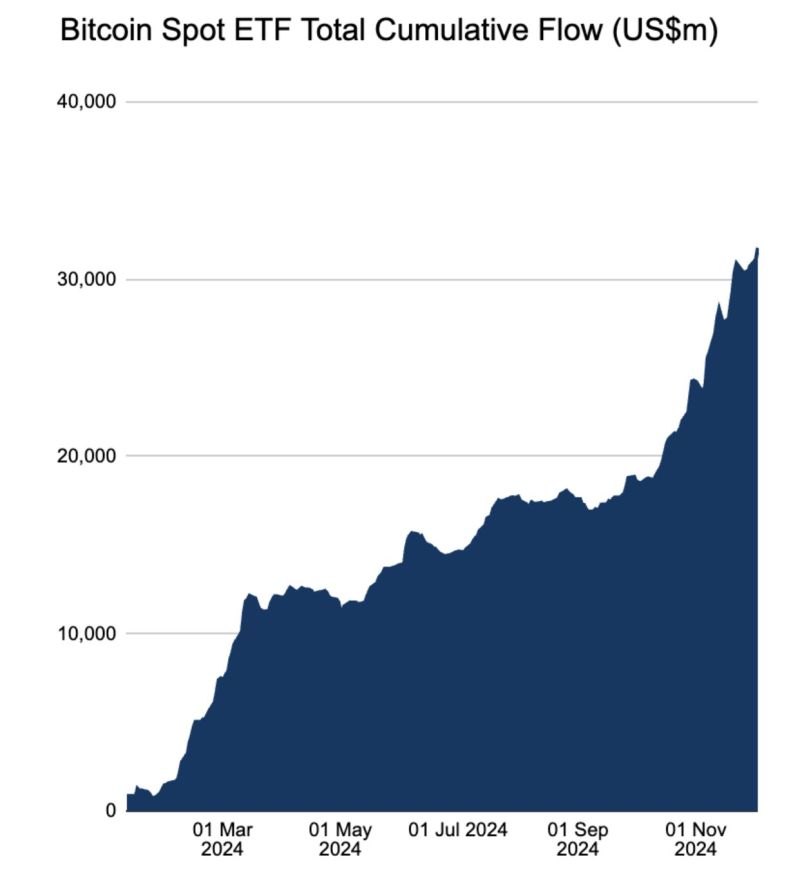

- bitcoin

- Asia

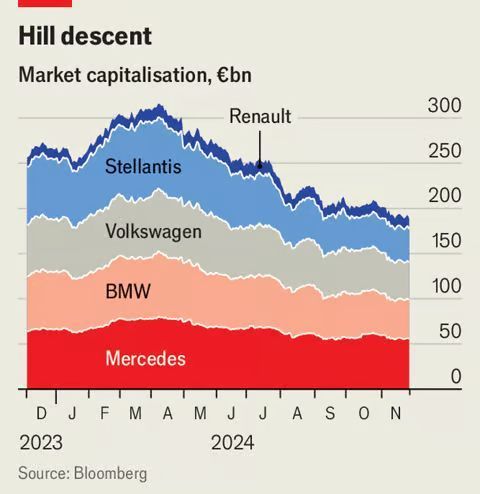

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

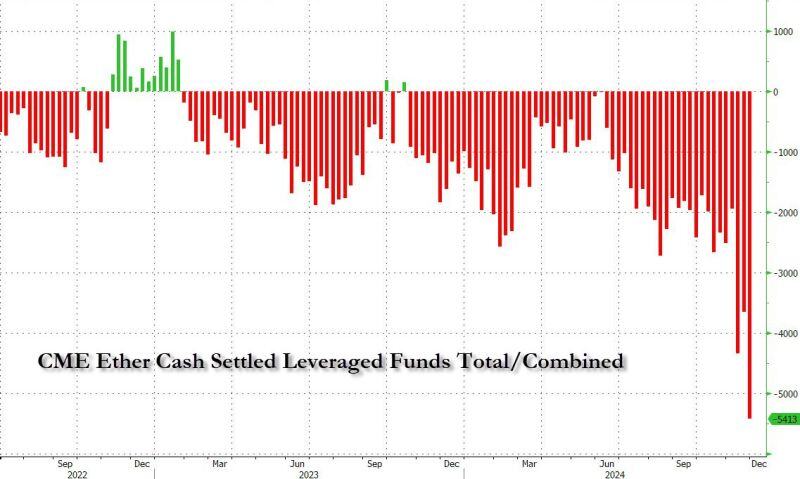

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

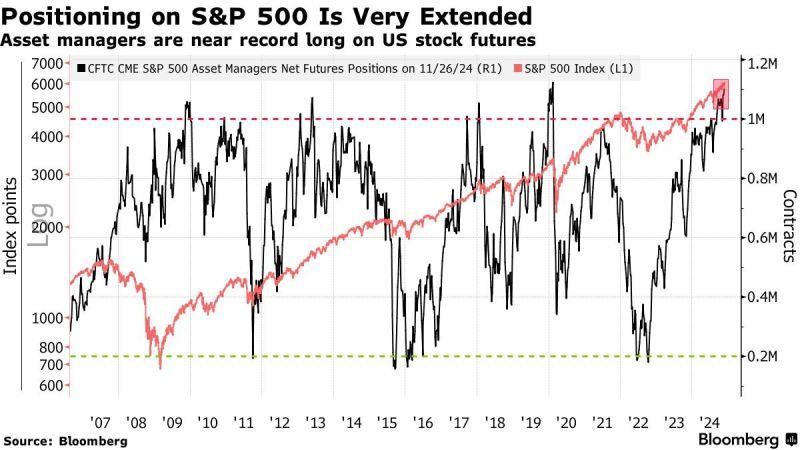

S&P 500 futures positioning is very extended. Nearing record long levels, according to Citi.

Source: Barchart, Bloomberg

GS: Chart of the Week

Global MAP (economic) Surprise Index Has Fallen Sharply, Driven by Weak Euro Area PMIs and a Plummet in US New Home Sales Source: Mike Zaccardi, CFA, CMT @MikeZaccardi, GS

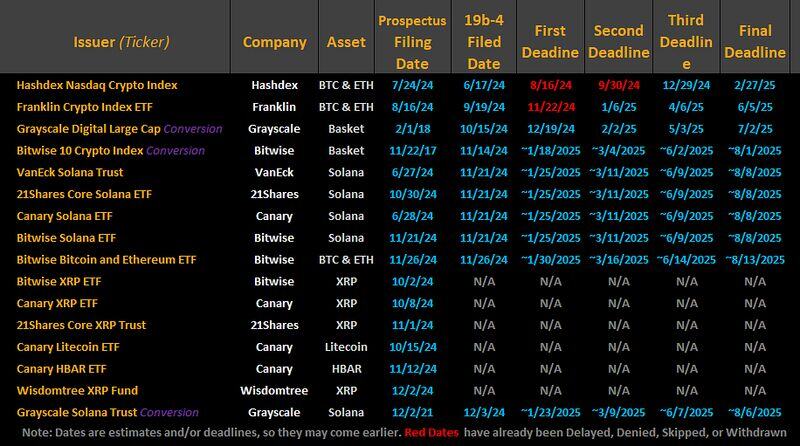

SOL ETF first approval deadline is 3 days after Gary Gensler leaves office and 3 days after Trump takes over

Source: gum on X, Bloomberg

BREAKING: Alex Mashinsky of Celsius Network pleads guilty to:

1. Inducing investor to sell their Bitcoin to Celsius with false statements about its EARN program. 2. Manipulating the price of CEL Sentencing is Tuesday, April 8, 2025 at 11:30 with a max sentence of 30 years. Source: Aaron Bennett @AaronDBennett on X

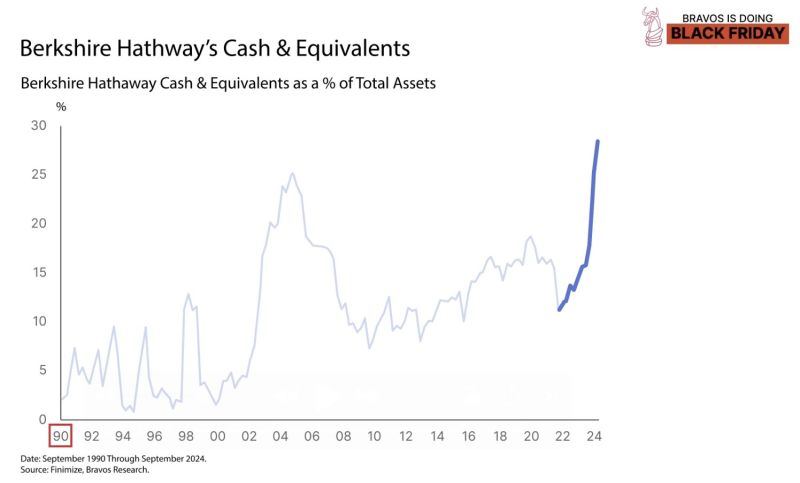

ALERT: Buffett’s cash allocation is at 30% of Berkshire Hathaway’s total assets Such an elevated cash position has NEVER been seen

Source: Bravos Research

European automotive sector is facing deep crisis

• Demand for cars in EU has stalled and may never return to pre-pandemic levels • Outlook for exports has darkened amid US tariff threats and low Chinese demand Source: Agathe Demarais on X, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks