Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

⚠️US QUITS RATE IS FALLING QUICKLY⚠️

The quits rate, the % of workers voluntarily exiting their jobs fell to 1.9% in September, the lowest since June 2020. Americans are increasingly depending on their current jobs as the hiring pace has declined. Data for October is due today. Source: Global Markets Investor

SPACEX SHOOTS FOR THE MOON WITH $350B VALUATION

Elon's rocket empire might be worth more than Portugal's entire GDP. SpaceX is floating a tender offer that would launch its valuation to a mind-bending $350 billion—up from last month's mere $255 billion price tag. This astronomical jump would make SpaceX not just the most valuable startup on Earth, but worth more than many Fortune 500 companies. For context, they were "only" worth $210 billion earlier this year. Source: Mario Nawfal Source: Bloomberg @SpaceX

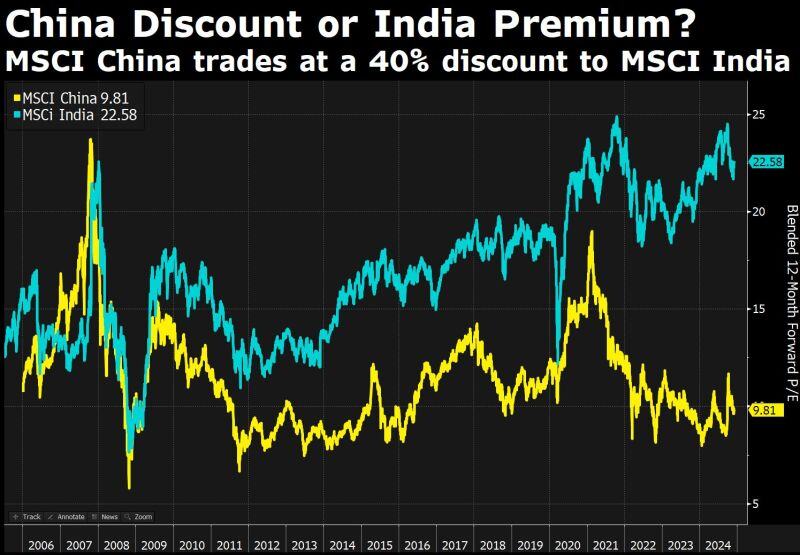

China trades at a 40% discount to India. Is this more a China discount or an Indian premium?

Source: Bloomberg, David Ingles

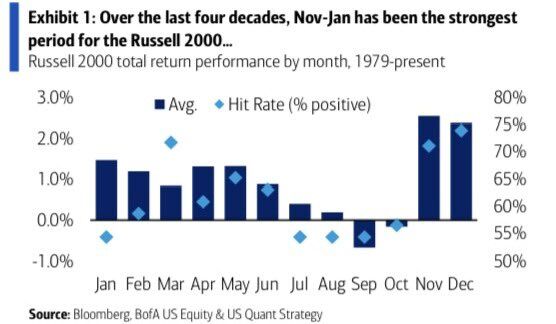

US small caps tend to heat up when the weather gets cold.

Historically, Nov-Jan is the strongest period for the Russell 2000. Source: David Marlin @Marlin_Capital, BofA

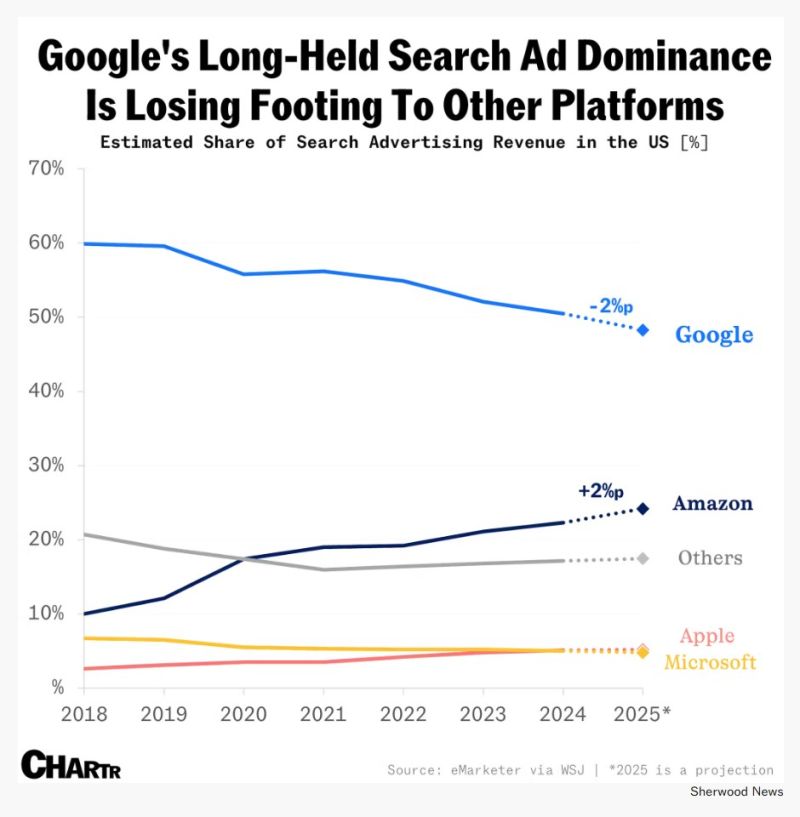

Google is slowly losing ground in search ads - by Chartr

While Google’s latest woes seem to center on the DOJ’s antitrust efforts, the search-engine giant may soon face another — perhaps even greater — threat to its moat: losing its dominance in search ads. In 2023, Google earned over $175 billion (or 57% of Alphabet’s total sales) solely from search advertising. However, Google is gradually losing ground in the $300 billion-strong global market for search ads, as both users and advertisers shift to competitors like Amazon and AI tools, The Wall Street Journal reports. According to data from eMarketer, Google’s share of the search-advertising market is forecast to drop below 50% next year for the first time since tracking began in 2008, with revenue growing at a modest 7.6% year over year. Meanwhile, Amazon’s search-ad revenue surged by 17.6% over the same period. Indeed, users are increasingly turning to platforms like Amazon or TikTok for their shopping searches and general queries, according to WSJ. The seemingly inevitable rise of AI is also playing a role: a survey from New Street Research found that nearly 60% of US consumers used a chatbot to help them decide on a purchase in the past 30 days. Source: Chartr, WSJ

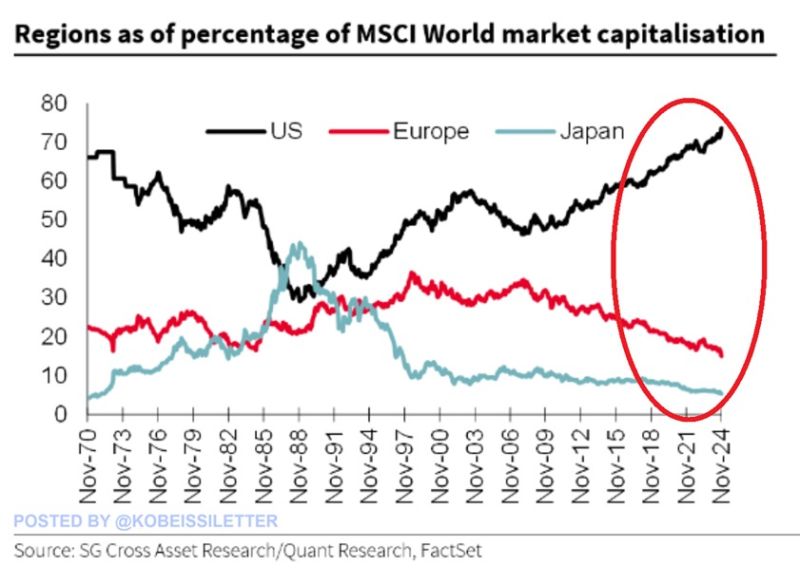

The US stock market is MASSIVE: US stock market capitalization accounts now for 74% of the MSCI World Index, a new all-time high.

Since the end of the 2008 Financial Crisis, this percentage has increased by ~25 points. By comparison, Europe and Japan’s share have dropped by ~15 and ~5 percentage points, respectively. As a result, the US' share of global market cap is now 4 TIMES larger than Europe and Japan COMBINED. This comes as the S&P 500 has rallied 450% over the last 15 years compared to a 70% and 310% gain of the Euro Stoxx 50 and Nikkei 225. The US stock market has never been larger. Source: The Kobeissi Letter, SG Cross Asset Research, Factset

Investing with intelligence

Our latest research, commentary and market outlooks