Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

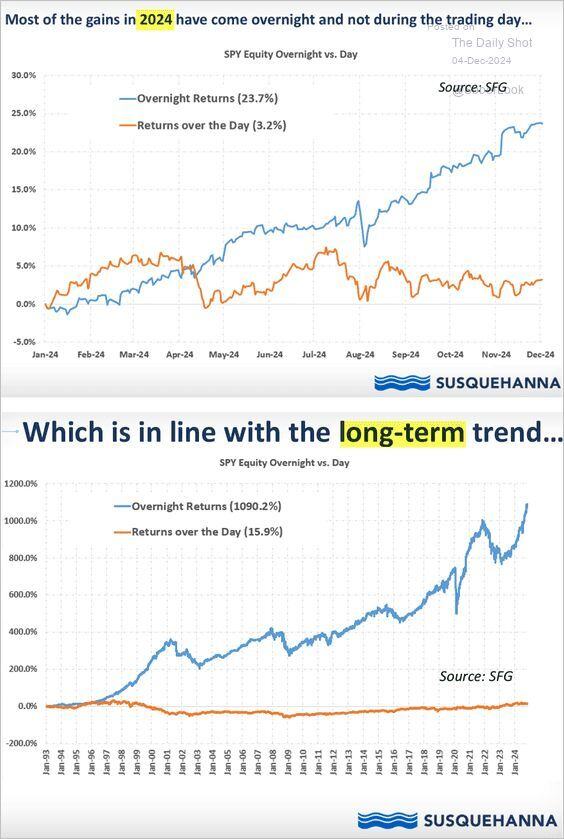

Overnight gains in US equities have massively outpaced intraday gains.

Source: Chris Murphy, Susquehanna International Group, The Daily Shot

As the old adage says... "Concentration makes you rich. Diversification keeps you rich".

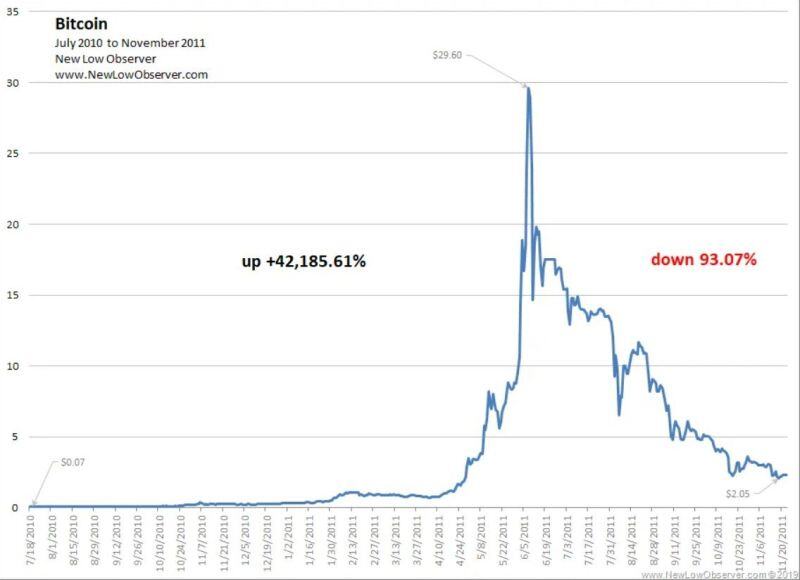

#BTC

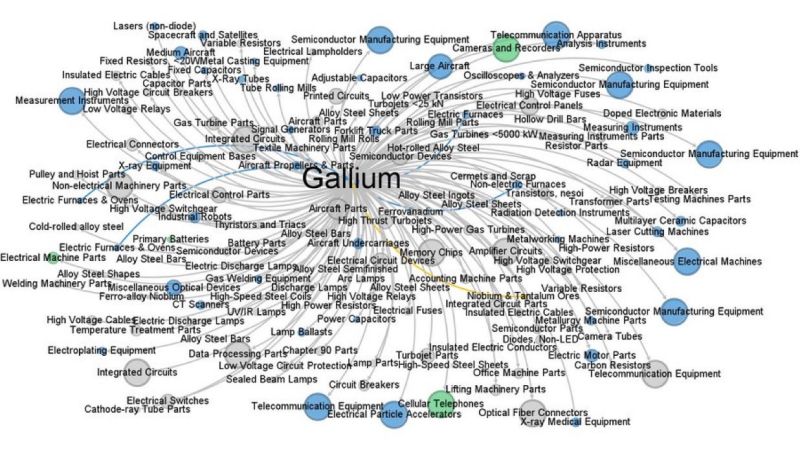

🚨China export bans Gallium & Germanium🚨

Why it matters: Gallium is central to countless downstream industries: semiconductors, aerospace, telecommunications, & more. This image shows how interconnected it is👇 Source: DeepBlueCrypto

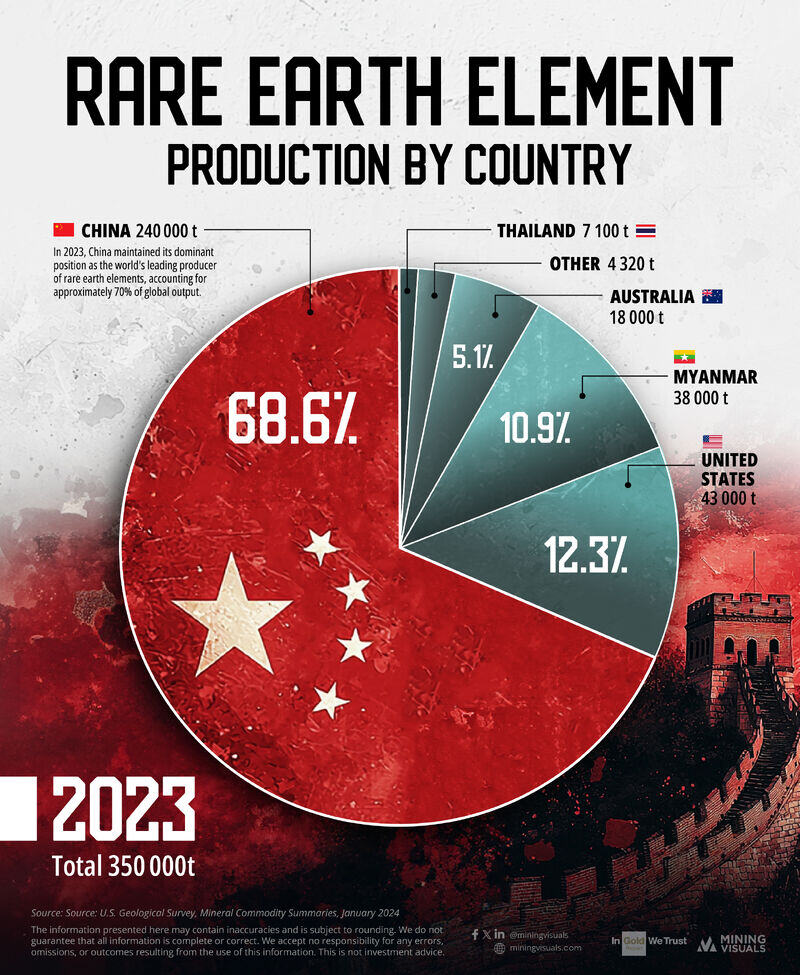

Rare earth element production by country

Source: Visual Capitalist

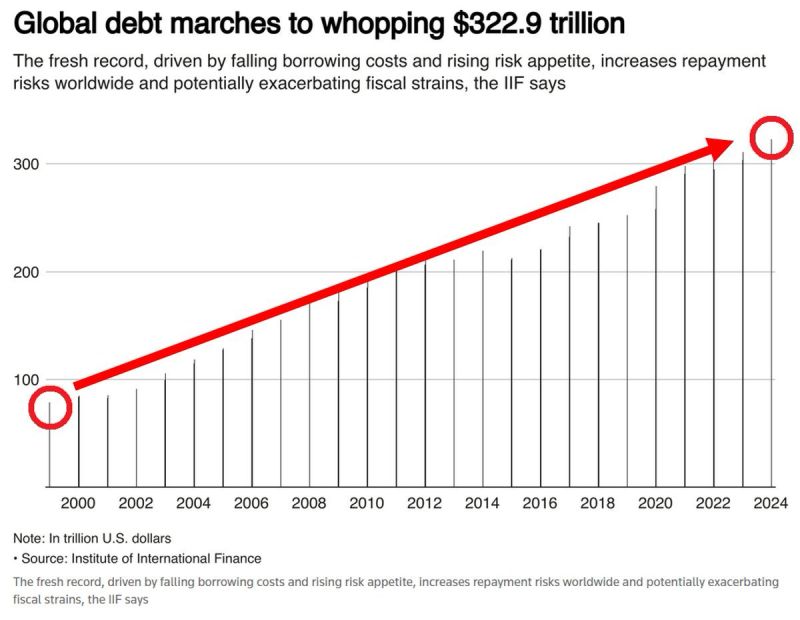

GLOBAL DEBT HIT A NEW RECORD

Global debt rose by over $12 trillion in Q1-Q3 and hit a MASSIVE $322.9 trillion, a new all-time high. Over the last 2 decades, world's debt has TRIPLED. Debt-to-GDP fell to 326%, ~30 percentage points below 2021 record but remains above 2019. Source: Global Markets Investor @GlobalMktObserv

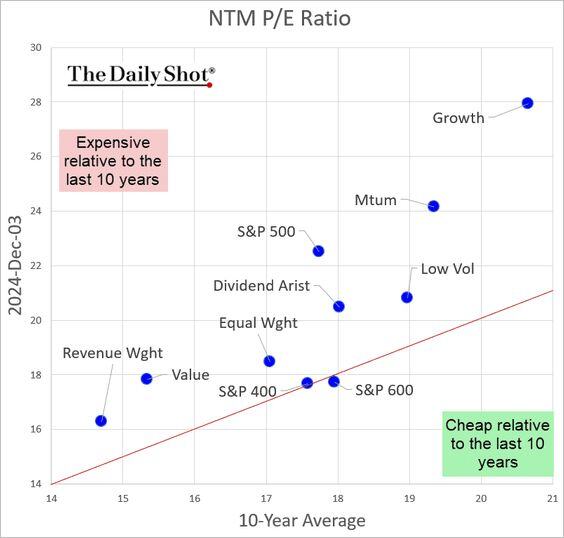

Only small caps are trading at multiples below their 10-year average.

Mike Zaccardi, CFA, CMT 🍖 @MikeZaccardi, The Daily Shot

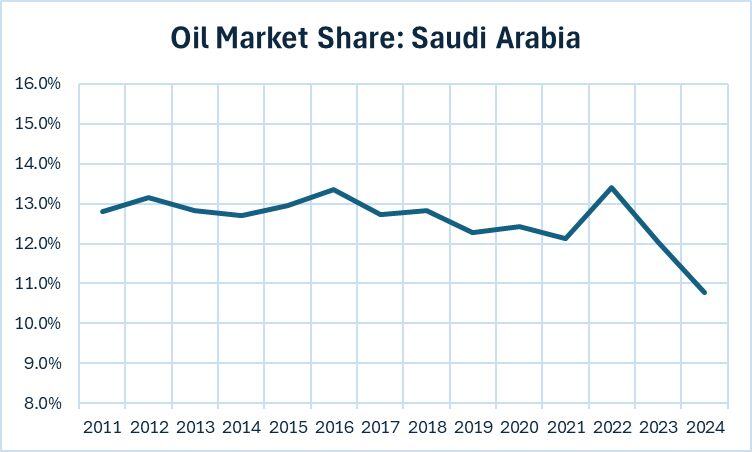

US shale oil production crossed 1 mil b/d in 2011.

Since then, Saudi's market share has been on slow but steady decline, punctuated only briefly by steep price drops in 2015-6 and 2020. How can Saudi regain market share? Either they maintain a $60+ price and see their market share continue to erode, or they increase production to reclaim market share, and see prices plummet. Either way, it's lower revenue in the short term. Should they pump more to decrease prices and regain market shares? Taking the market to <$40 again will be painful for them in the near-term, but they have the financial wherewithal to survive. Source: John Arnold on X

Investing with intelligence

Our latest research, commentary and market outlooks