Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

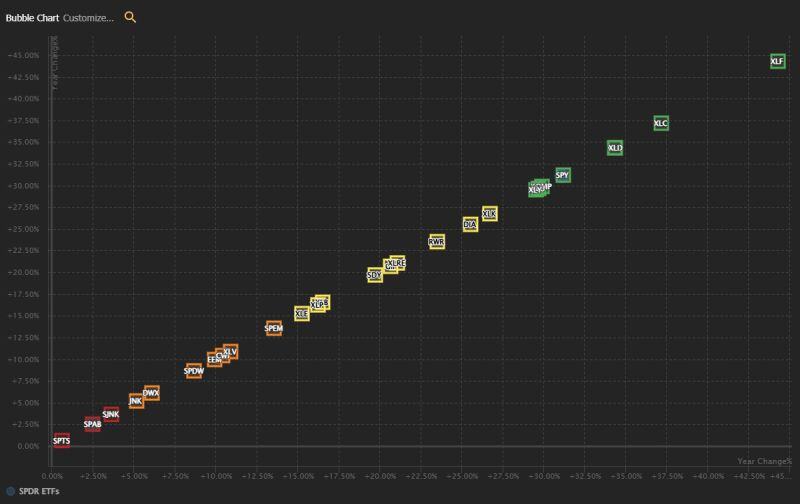

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

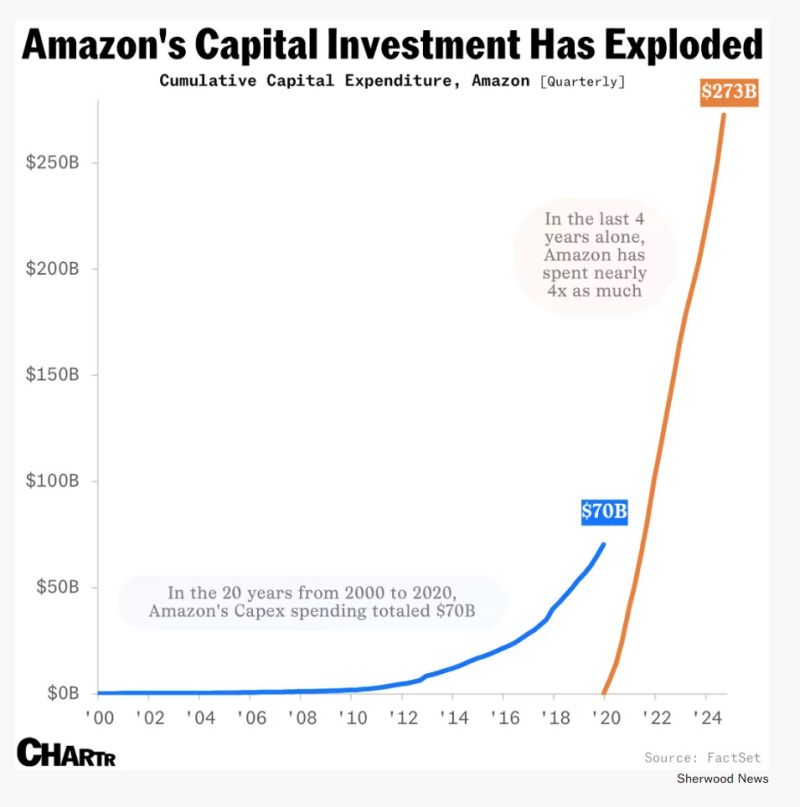

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

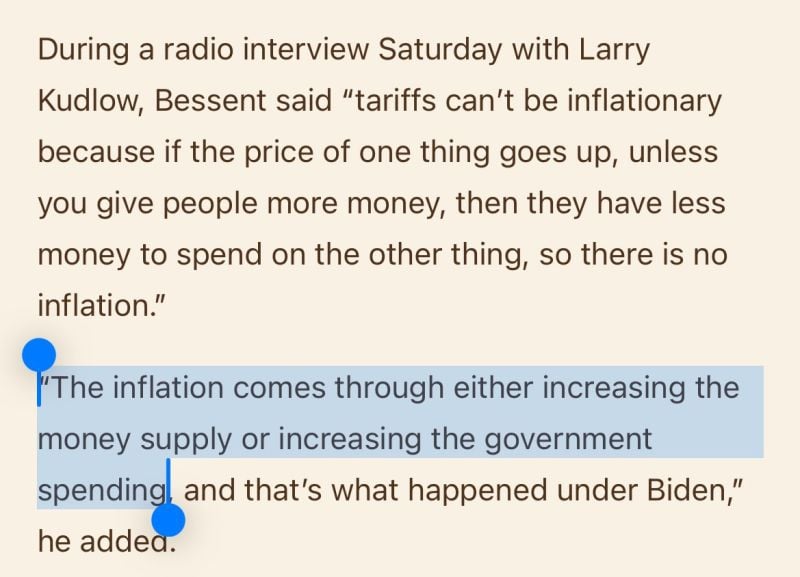

Scott Bessent on tariffs:

"Tariffs can’t be inflationary because if the price of one thing goes up, unless you give people more money, then they have less money to spend on other things, so there is no net inflation.” Source: Geiger Capital

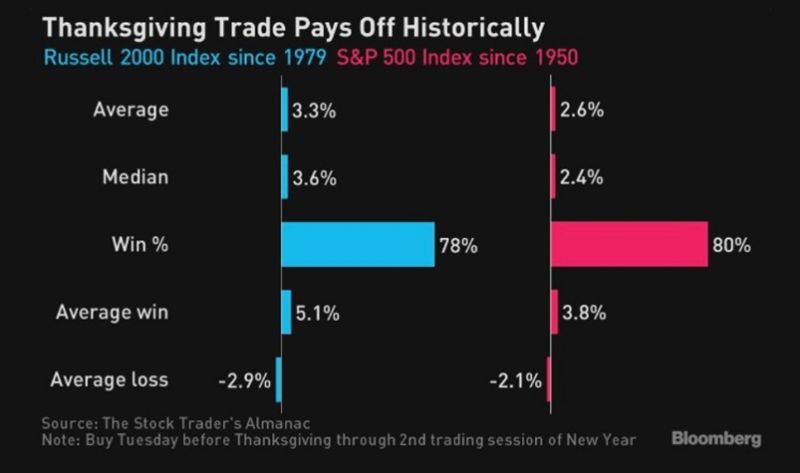

Strong seasonal pattern kicking off today through the second trading day of the New Year…

Source: Bloomberg

He did it again... Over $495,100,000 have been liquidated from the crypto markets within the last 24 hours.

This is the single largest Bitcoin liquidation event in history, just days after Jim Cramer told investors to buy and called $BTC a winner... More seriously some pullback / profit taking was long due... but the market is taking the habit of going short Jim Cramer's view Source: Jacob King

JUST IN: 'America elected the most pro-crypto Congress ever with almost 300 pro-crypto elected to the House and Senate - CNBC

Crypto execs, investors and evangelists saw the election as existential to an industry that spent the past four years simultaneously trying to grow up while being repeatedly beaten down. In total, crypto-related PACs and other groups tied to the industry reeled in over $245 million, according to Federal Election Commission data. Nearly 300 pro-crypto lawmakers will take seats in the House and Senate, according to Stand With Crypto, giving the sector unprecedented influence over the legislative agenda. Link to CNBC article >>> https://lnkd.in/euj8FDqN

Elon Musk, CEO of Tesla, praised India's election process for its speed.

Musk was responding to a post, highlighting how India counted 640 million votes in a single day.

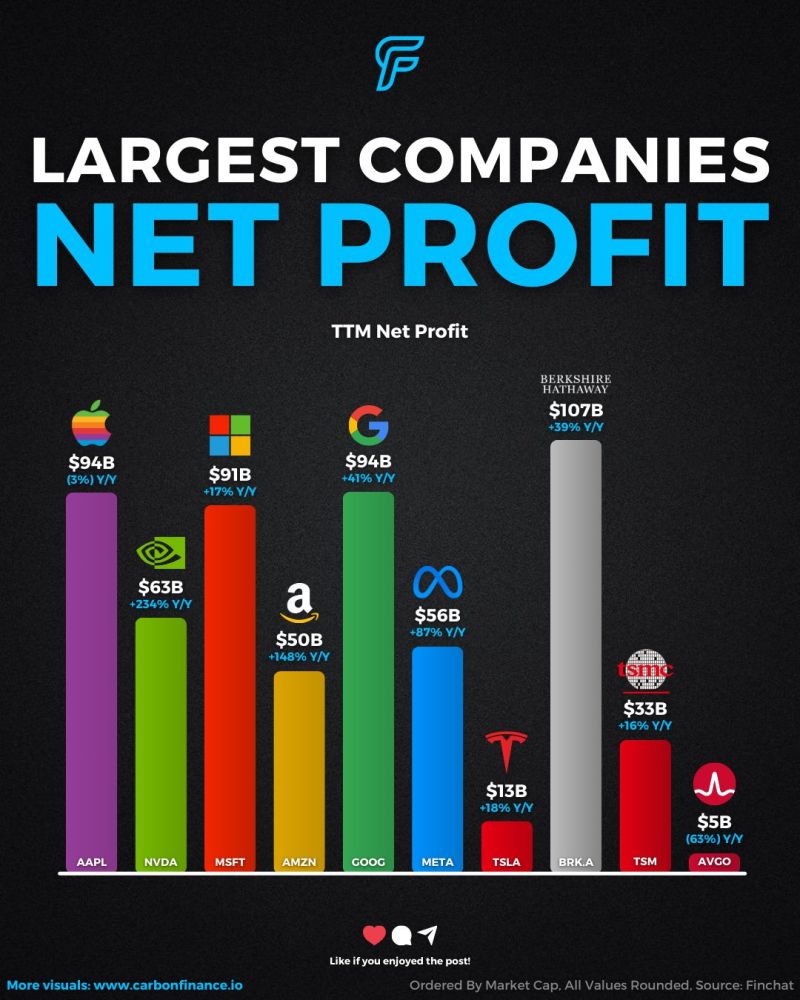

The giants of the U.S. economy are absolute cash machines.

Here’s their TTM (trailing-twelve-months) net income (and Y/Y growth): $AAPL: $94B (-3%) $NVDA: $63B (+234%) $MSFT: $91B (+17%) $AMZN: $50B (+148%) $GOOG: $94B (+41%) $META: $56B (+87%) $TSLA: $13B (+18%) $BRK.A: $107B (+39%)* $TSM: $33B (+16%) $AVGO: $5B (-63%) *Note: Berkshire's net income includes unrealized gains from its massive investment portfolio. These 10 alone earned $606B this year. Will they continue to grow their profit at similar rates moving forward?

Investing with intelligence

Our latest research, commentary and market outlooks