Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

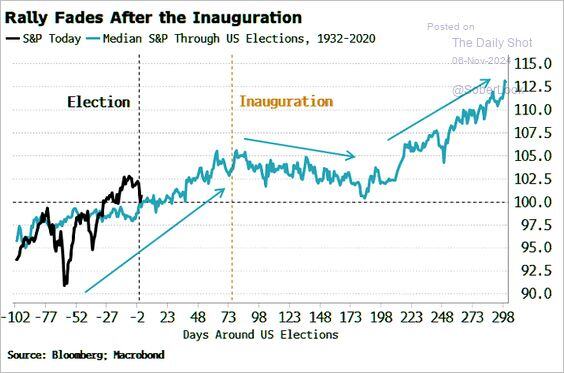

Following the election, the SP500 typically rallies through inauguration day before moderating.

Source: Bloomberg, Macrobond, Mike Zaccardi, CFA, CMT, MBA, The Daily Shot

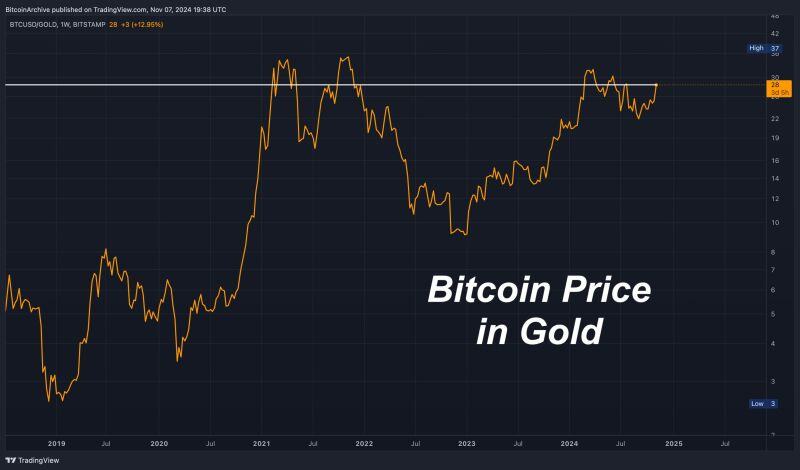

2 months before the bear-market bottom, the Wall Street Journal felt safe enough to kick Saylor with this WRONG headline.

There were ignorant calls on 𝕏 that MicroStrategy would be liquidated, even though there were no margin calls on the debt, which were mostly long duration 5-6 year terms. Source: Bitcoin Archive

Théo — the French Whale on Polymarket — will make $50m on his $30m bet on Trump.

A very interesting post by @TrungTPhan on X: WSJ interviewed him again after election and he explained the key polling data that gave him conviction for his bet: “neigbour polls”. ▫️Polls failed to account for the “shy Trump voter effect,” Théo said. Either Trump backers were reluctant to tell pollsters that they supported the former president, or they didn’t want to participate in polls, Théo wrote. To solve this problem, Théo argued that pollsters should use what are known as neighbor polls that ask respondents which candidates they expect their neighbors to support. The idea is that people might not want to reveal their own preferences, but will indirectly reveal them when asked to guess who their neighbors plan to vote for. Théo cited a handful of publicly released polls conducted in September using the neighbor method alongside the traditional method. These polls showed Harris’s support was several percentage points lower when respondents were asked who their neighbors would vote for, compared with the result that came from directly asking which candidate they supported.▫️ The former bank trader (Théo is fake name he gave WSJ, which confirmed his identity through other methods) said he made the bet purely from financial standpoint (not tryign to make political statement).

China on Friday announced a five-year package totaling 10 trillion yuan ($1.4 trillion) to tackle local government debt problems, while signaling more economic support would come next year.

The debt swap program, however, fell short of many investors’ expectations for more direct fiscal support. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks